DanyR1

@t_DanyR1

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

DanyR1

RNDR bottom

Final rndr fib touch on .786, should see -.27. seems like an extremely good opportunity to load up

DanyR1

BTC bottom and ATH

Multiple rejections of support and the FIb. We are primed for a big move in the right direction. Historically speaking we need to clear rejections of the fib for a higher probability to the extention.

DanyR1

Ether Long

Multiple Rejection of FIB, going to reach extension and hit 4500+

DanyR1

Sol FIB

Multiple Rejections of the Fibs. Strong chance well have a summer lul, in that case we could see $100 sol

DanyR1

DanyR1

Ether: Road to 5k

As we can see Ether is clearly rejecting the .786 FIB multiple times allowing us to developed confidence in this as a level of support. Target is -.27 at 5k.

DanyR1

Remember remember the 15th of November

Should see XRP break out the of the ascending triangle and reach for ATH before Nov 15th.

DanyR1

Bitcoin Market Top & Bottom Prediction

I believe that this market cycle is mirroring the 2013 cycle which could possibly bring up the question if there are two market cycles and it alternates. In 2013 we saw a local top followed by a summer lull to then continue the bull market. I believe we have put in the summer lull and we are on our way to reach the Market Cycle top. I also believe that we are seeing diminishing returns, otherwise, BTC would reach 300k this market cycle if it followed 2013 percentages and I don't think that is very likely. How I reached the Top : The 2011 peak to the top of the first local top brought us a 734% gain The 2017 peach to the top of the first local top brought us a 227% gain This is a reduction of about 30.9% From the local top to the 2013 ATH it was a 366% increase If we were to speculate a top ATH for this cycle with the same reduction ratio it would be an increase of 113.094% which would equate to a 138k Bitcoin . How I reached the bottom : I did notice that in 2013 the bottom of the bear market reached the top of the weekly Candle close of the first local top. In our case, it would fall to about 60k. This seems very reasonable to be the bottom for this cycle as it would only be a 60% retracement from the predicted top. It's important to note that from the first local top in 2013 to the bottom it was a 75% decrease and the from Market top it was an 87% decrease. Meaning the drop from the ATH in 2013 was 13.5% greater than the previous drop. So if we take the measured drop from the local top to the bottom in our current cycle we get a 55.37% decrease adding 13.5% to that gives us 62.84% which would be our assumed total drop for this upcoming bear market cycle meaning that Bitcoin would have a low of 53k give or take. You may ask you self well that isn't that much of a drop compared to the last cycles but we must account for the institutional investors that have joined us and are looking to hold and not sell out after a few months/years.Just to note at this I belive the top to be around 120-125k for BTC

DanyR1

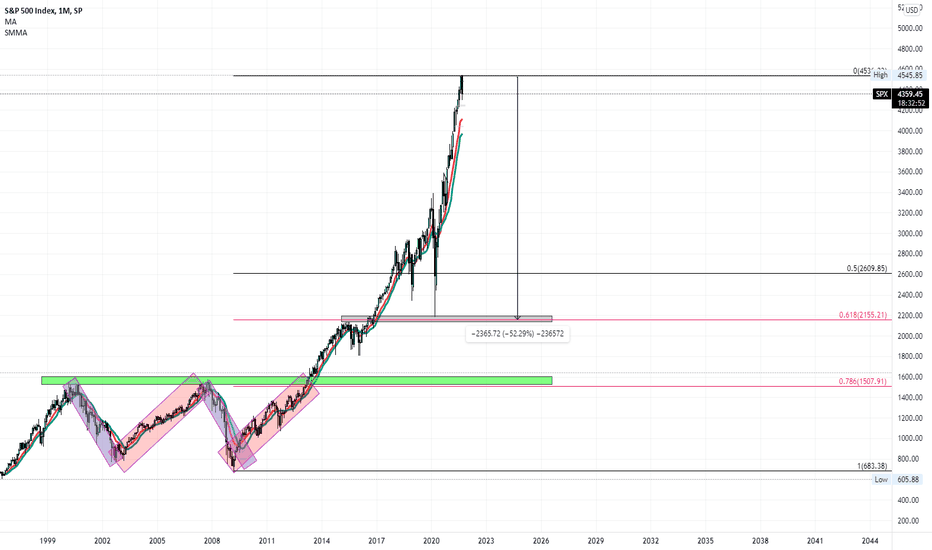

SPX Short targets

hmmmm..... Seems that these levels of support line up with some key Fib levels. This could easily be invalidated, but the way the market and current state of the world is gives this a higher proabability. I am loading up on SPXU.

DanyR1

Bitcoin Fibonacci extension

As we can see we have a text boom fib extension set up. The 2nd phase on the .618 was achieved indicating higher odds to reach our extension target. Invalidation to this set up will happen if a daily candle is placed through the .618 September is a bearish month which is worth noting as this is quite a bullish set up. If market moves sideways I will be looking to close this position.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.