CryptoSheykh

@t_CryptoSheykh

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

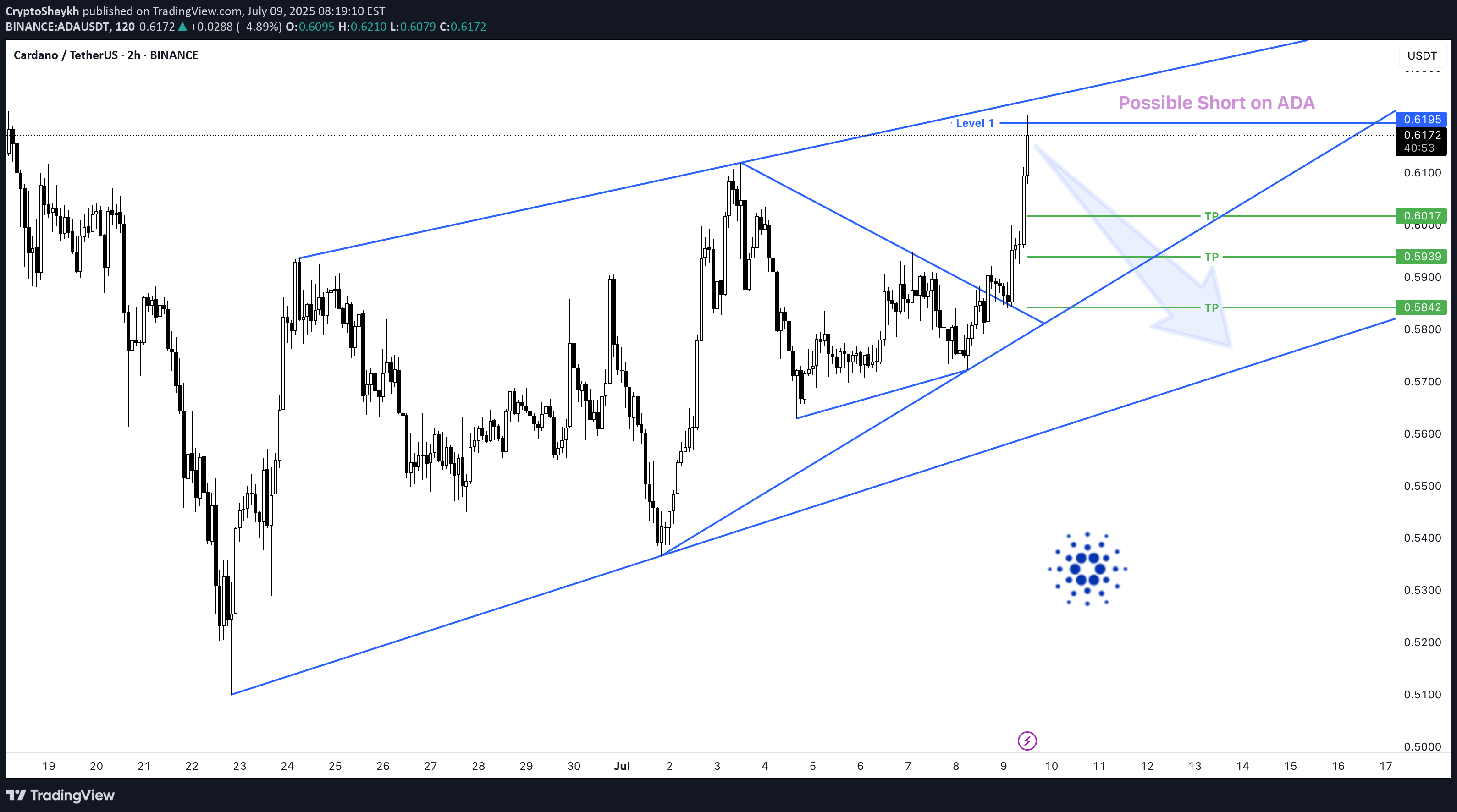

ADA/USDT – Possible Short

ADA/USDT – Bearish Reaction from Key Channel Resistance | Short OpportunityBias: Short Setup (Counter-Trend)Cardano (ADA) has reached a significant technical juncture following a strong bullish impulse. Price has tapped into a critical resistance zone marked by:The upper boundary of a broadening ascending channelA horizontal liquidity pocket at 0.6195, labeled as “Level 1”An extended impulsive move without consolidation, suggesting potential overextension📌 Key Price LevelsResistance (Short Entry Zone):Level 1: 0.6195 USDTBearish Targets (Take Profits):TP1: 0.6017 – Local support & minor demandTP2: 0.5939 – Mid-range value zoneTP3: 0.5842 – Confluence of wedge support & previous demandThe structure resembles a rising broadening wedge, typically a bearish reversal formation, especially after a sharp leg into resistance.The breakout from the smaller consolidation wedge has now run into major supply, where early short entries may begin to scale in.

LONG ADA/USDT | Bullish Reversal Setup

ADA/USDT | Bullish Reversal Setup📊 Market StructureContext: After a retest of April highs, ADA pulled back into a shallow down-sloping support line (blue).Implication: A series of higher-low tests into that line suggests buyers are defending this area.🔹 Demand Order BlockZone: 0.6350 – 0.6500 USDT (shaded blue)Key Entry Levels:0.6500 USDT 0.6436 USDT 0.6350 USDT ⚔️ Long Entry StrategiesAggressive: Scale into longs on a bounce off 0.6500 USDT with a strong bullish candle.🛑 Stop LossClose below Level: 0.6157 USDTPlaced just below the demand block to absorb noise yet protect capital.🎯 Profit TargetsTP10.6853TP20.7192TP30.7568🔧 Trade ManagementScale-Out: Take partial profit at each TP to lock in gains.Trail Stop: Move to breakeven once TP1 is reached.Invalidation: A daily close below 0.6157 USDT negates the setup—exit and reassess.

Short NEAR/USDT

🔥 #NEAR/USDT🔴 SHORT🎲 Entry Zone 1: 2.076🎲 Entry Zone 2: 2.097✅ Take Profit 1: 2.038✅ Take Profit 2: 1.987✅ Take Profit 3: 1.921✅ Take Profit 4: 1.850✅ Take Profit 5: 1.737(Extended if Momentum Persists)❌ Stop Loss: Above 2.190💱 Recommended Margin: 2.5% – 5%🧳 Recommended Leverage: 5X – 15X🧠 Narrative: NEAR is testing a supply zone at 2.076 – 2.097. A rejection here could spark downside toward the listed TP levels as sellers regain control.📈 Market Context: Keep an eye on overall crypto sentiment and BTC’s trend; a broad market rally could negate this short bias, while renewed weakness may accelerate the move.⚠️ Risk Management: Place stops above 2.190, size positions carefully, and stay alert for unexpected strength.⚠️ Take Care of Risk Management for Your Account

Short ALGO/USDT

🔥 #ALGO/USDT🔴 SHORT🎲 Entry Zone 1: 0.1870🎲 Entry Zone 2: 0.1890✅ Take Profit 1: 0.1838✅ Take Profit 2: 0.1775✅ Take Profit 3: 0.1667✅ Take Profit 4: 0.1551(Extended if Momentum Persists)❌ Stop Loss: Above 0.1985💱 Recommended Margin: 2.5% – 5%🧳 Recommended Leverage: 5X – 15X🧠 Narrative: ALGO is testing a supply zone at 0.1870 – 0.1890. A rejection here could trigger a move toward the lower support levels identified as TPs.📈 Market Context: Monitor overall crypto sentiment and BTC action; a broad rally may invalidate this short bias, while continued weakness could accelerate downside targets.⚠️ Risk Management: Place stops above 0.1985, size positions carefully, and be ready to adapt if price shows unexpected strength.⚠️ Take Care of Risk Management for Your Account

SHORT ADA/USDT

🔥 #ADA/USDT🔴 SHORT🎲 Entry Zone 1: 0.6310🎲 Entry Zone 2: 0.6340✅ Take Profit 1: 0.6205✅ Take Profit 2: 0.6063✅ Take Profit 3: 0.5926✅ Take Profit 4: 0.5784✅ Take Profit 5: 0.5587❌ Stop Loss: Above 0.6511💱 Recommended Margin: 2.5% - 5%🧳 Recommended Leverage: 5X - 15X🧠 Narrative: ADA/USDT is experiencing resistance in the 0.6310–0.6340 zone. Failure to break above this level could trigger a bearish move toward lower support zones.📈 Market Context: Monitor overall crypto sentiment and Bitcoin’s trend; a strong BTC rally may invalidate this short, while a broader pullback could accelerate the downside.⚠️ Risk Management: Place stops above 0.6511, size positions carefully, and remain flexible if price action shows unexpected strength.⚠️ Take Care of Risk Management for Your Account

SHORT XRP/USDT

🔥 #XRP/USDT🔴 SHORT🎲 Entry Zone: 2.1110✅ Take Profit 1: 2.0675✅ Take Profit 2: 2.0242✅ Take Profit 3: 1.9545✅ Take Profit 4: 1.8867(Extended if Momentum Persists)❌ Stop Loss: (A Strong Close Above 2.2100 Invalidates the Short Setup)💱 Recommended Margin: 2.5% - 5%🧳 Recommended Leverage: 5X - 15X⚠️ Take Care of Risk Management for Your Account

Short-Term Short Position DOT/USDT

🔴 DOT/USDT – Approaching Key Short ZonePolkadot (DOT) has formed a rising wedge after rebounding from local lows. Price is now facing a critical short zone near 3.897 – 3.985, where sellers may step in if DOT cannot sustain upward momentum.Chart Formation: The rising wedge often indicates potential bullish exhaustion; a break below wedge support confirms a bearish bias.Volume Consideration: Look for a surge in sell volume near entry levels to validate a short entry.🔴 Short Position DOT/USDT🎲 Entry LevelsEntry 1: 3.897Entry 2: 3.985✅ Take-Profit TargetsTP1: 3.798TP2: 3.648TP3: 3.472TP4: 3.256 (extended downside if momentum persists)❌ Invalidation Level: 4.131+(A strong close above 4.00+ invalidates the short setup.)🧠 Narrative: This wedge suggests a potential bearish retest if DOT fails to break higher. A rejection at 3.89 – 3.98 may send price to lower supports.Market Context: Overall market sentiment and Bitcoin’s trend can influence DOT’s movement; a strong BTC rally could negate this setup.⚠️ Risk Management: Place stops just above 4.131+, size positions carefully, and stay flexible if price action indicates continued strength above the wedge."Take Care of Risk Management for Your Account"

Short-Term Short Position UNI/USDT

🔥 UNI/USDT – Approaching Key Short ZoneUniswap (UNI) has formed a rising wedge structure after rebounding from local lows. Price is now nearing a critical short zone around 5.762 – 5.804, where sellers could potentially step in if UNI fails to break above with conviction.🟣 Zone to Watch“Possible Short Zone” (in purple) — a high-probability entry area for short trades given the overhead resistance and wedge convergence.🔴 Entry Points:Entry 1: ~5.762 (initial level)Entry 2: ~5.804 (upper boundary)📉 Momentum & SetupChart Formation: The rising wedge often suggests bullish exhaustion; a decisive break below wedge support can signal a bearish shift.Volume Consideration: Look for a sell-volume uptick or a clear rejection around 5.70 – 6.2 to confirm the short setup.🟢 Take-Profit Zones✅ TP1: ~5.549✅ TP2: ~5.315✅ TP3: ~4.957✅ TP4: ~4.244 (Extended downside if momentum persists)❌ Invalidation Level: 6.265+(A strong close above this level indicates a bullish breakout from the short window.)🧠 NarrativeThis setup highlights a possible bearish retest, as UNI’s rebound has propelled price into a narrowing wedge near major resistance. Should buyers fail to push beyond 5.70, aggressive sellers may anticipate a correction. A volume-backed rejection here could see UNI retrace to lower support levels.🎲 Market ContextMonitor broader crypto sentiment and Bitcoin’s performance; strong market momentum could negate the bearish bias, while a market-wide pullback may accelerate downside.📌 Risk ManagementPosition Sizing: Adjust to your risk tolerance and never overexpose.Stop-Loss: Place it above 6.265+ to avoid unexpected breakouts.Remain flexible and reevaluate if price action shows continued strength above the wedge.

Short-Term Short Position LTC/USDT

🔥 LTC/USDT – Approaching Key Short ZoneLitecoin (LTC) has formed a rising wedge structure after rebounding sharply from local lows. Price now faces a critical short zone near 81.62 - 84.16, where sellers could potentially step in if LTC fails to break above with conviction.🟣 Zone to Watch“Possible Short Zone” (in purple) — a high-probability entry area for short trades given the overhead resistance and wedge convergence.Entry Points:Entry 1: ~81.62 (initial level within the wedge)Entry 2: ~84.16 (upper boundary, near resistance)📉 Momentum & SetupChart Formation: The rising wedge implies potential exhaustion of bullish momentum if price fails to continue upward. A break below wedge support often signals a bearish turn.Volume Consideration: Look for a sell-volume uptick or a clear rejection around Entry 1 or 2 or within the short zone to confirm a likely reversal.🟢 Take-Profit Zones✅ TP1: ~79.25✅ TP2: ~75.08✅ TP3: ~69.55✅ TP4: ~63.53 (Extended downside if momentum persists.)❌ Invalidation Level: 87.30+(A strong close above this level indicates a breakout from the short window)🧠 NarrativeThis setup showcases a potential bearish retest, as LTC’s swift rebound has led price into a narrowing wedge. If buyers fail to push beyond 81.62 – 84.16Savvy traders may anticipate a correction. A volume-backed rejection in this zone could send LTC back toward its lower support levels.🎲 Market ContextMonitor broader market sentiment and Bitcoin’s performance; a strong BTC rally could invalidate downside expectations.📌 Risk ManagementPosition Sizing: Trade responsibly according to your risk tolerance.❌ Stop-Loss: Place it above the invalidation level (e.g., around 87.30+ to mitigate unforeseen breakouts.Reevaluate if the market shows signs of bullish continuation beyond the wedge.

Short Position FIL/USDT

🔥 FIL/USDT – Approaching Key Short ZoneFIL is currently consolidating within a tightening wedge structure, showing signs of bearish indecision as price grapples with a well-defined short zone. Price action has moved aggressively from local lows and is now testing multi-level resistance areas.🟣 Zone to Watch:“Possible Short Zone” highlighted in purple — this zone marks a high-probability entry area where sellers could step in.📍 Entry Point:🔴 Short Entry: 2.654 – Near the lower end of the resistance window.📉 Momentum & Setup:Chart Formation: The consolidation has created a rising/symmetrical wedge, indicative of a bearish retest scenario.Volume Consideration: Look for a spike in volume accompanying a bearish reversal near the upper band of the zone.🟢 Take-Profit Zones:✅ TP1: 2.518✅ TP2: 2.333✅ TP3: 2.125✅ TP4: 1.848 (Final zone)❌ Invalidation Level: 2.90+(A strong close above this level would signal a potential trend reversal and invalidate the bearish setup.)🧠 Narrative:This setup is a textbook example of a bearish retest where support converts to resistance. The rapid price climb has likely exhausted buyers, setting the stage for sellers to capitalize on the multi-level resistance. Smart money appears poised to offload positions at these levels before further downside expansion, potentially triggering a liquidity grab.🎲 Market Context:Keep an eye on overall crypto market sentiment.📌 Risk Management:As always, manage your position sizes and money management carefully. Consider setting a stop-loss just above the invalidation level (around 2.90) to protect against unexpected moves.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.