ChartsEmpire01

@t_ChartsEmpire01

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

ChartsEmpire01

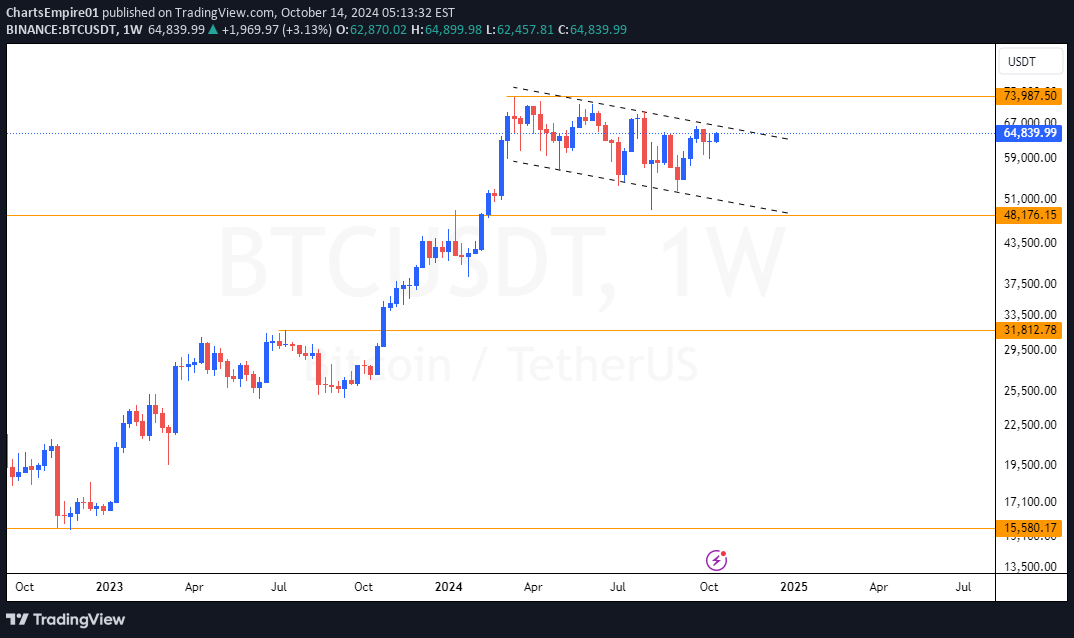

Is Bitcoin Preparing for 200k?

Bitcoin ha been ranging in a potential bullish flag for months. If the bulls ensures a strong bullish close above the $67,000 this week, this could interest more buyers to rally the price of Bitcoin on the continuation of a bullish swing which would eventually tag the price of $200k based on the MOBJ of the obvious bullish chart pattern detected on the weekly chart

ChartsEmpire01

Where To #XTZ/USDT?

Can #XTZ Bulls defend the 0.6500 psychological level? IMO: #XTZ/USDT could be the next interest for the bulls. Price crashed to a potential buy Liquidity zone. I am bullish

ChartsEmpire01

IOTXUSDT: HOW FAR CAN THE BULL MOVE?

Patiently waiting for liquidity to confirm the next swing

ChartsEmpire01

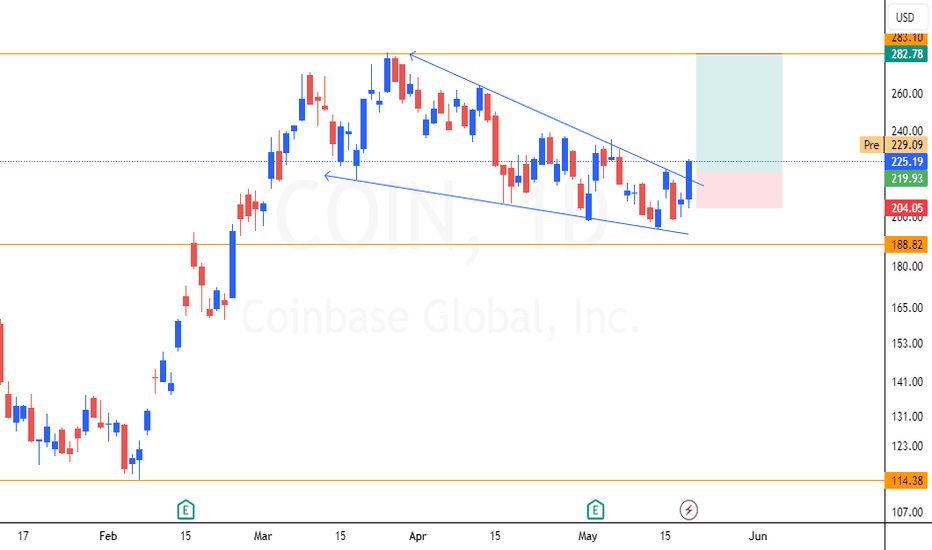

COINBASE POTENTIAL BULL SETUP SPOTTED

Bullish pennant bull breakout spotted on #COINBASE stocks. Expectation of higher bullish sentiment could arise this week.

ChartsEmpire01

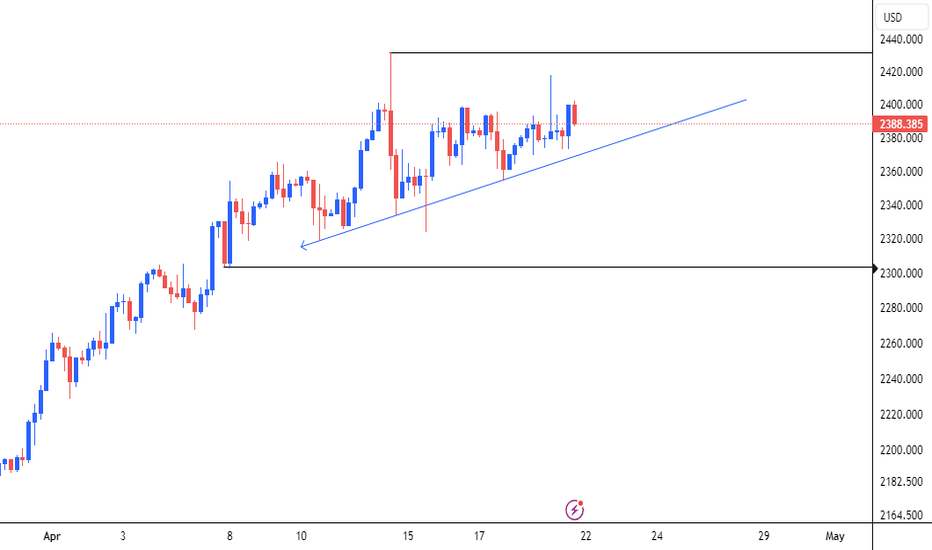

XAUUSD LATEST UPDATE

Bulls are gradually setting up to test the demand zone. Potential high expectation of bull breakout next week.

ChartsEmpire01

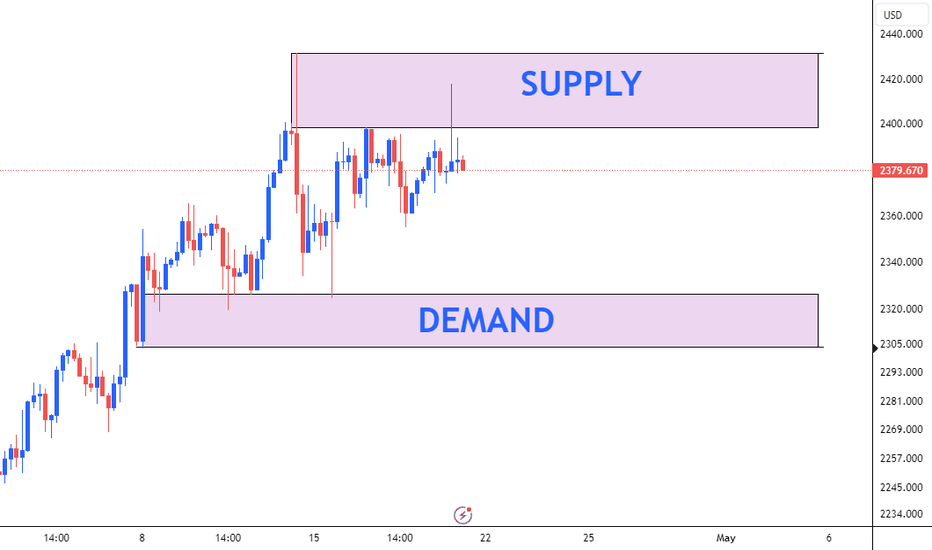

XAUUSD INTRA-DAY CHART OUTLOOK

Scalpers and Day traders should pay attention to the demand and supply zones on #XAUUSD 4HR chart. In summary its better to trade from demand to supply as a day trader or scalper. A strong daily bar bearish break below Demand could attract swing traders for aggressive short entry.

ChartsEmpire01

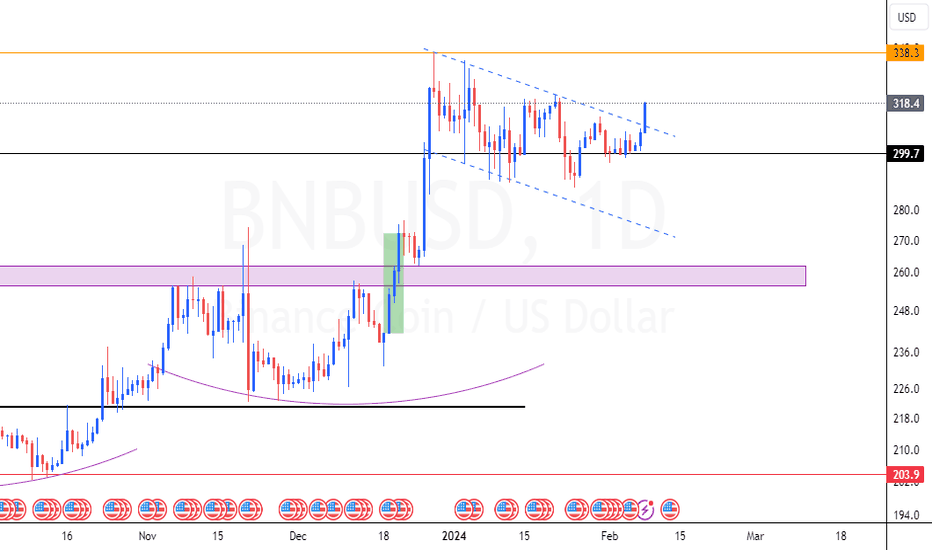

BNB Bull about to resume the uptrend?

A strong daily close above the upper band flag would suggest bullish interest.

ChartsEmpire01

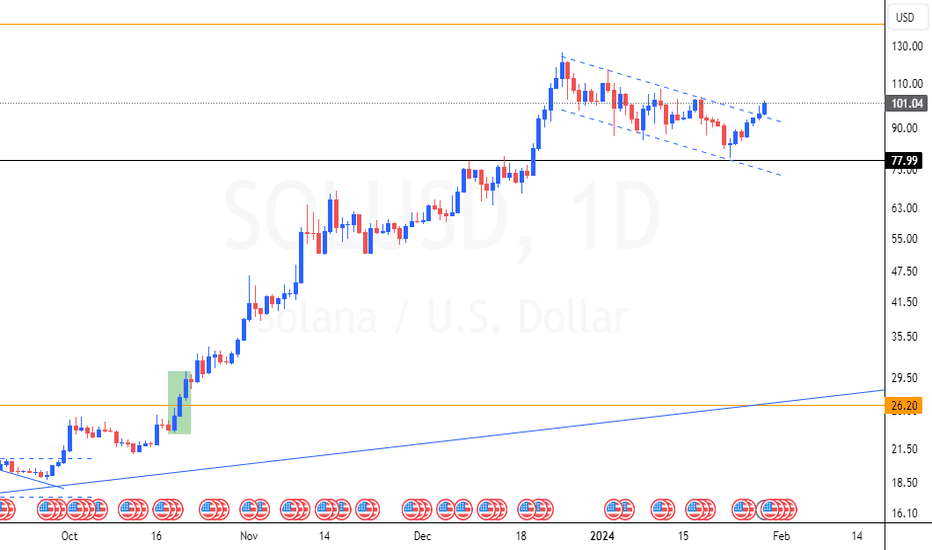

SOLANA BULL UPDATE

The bulls can do it again on Solana. More bulls are stepping in for more long orders.

ChartsEmpire01

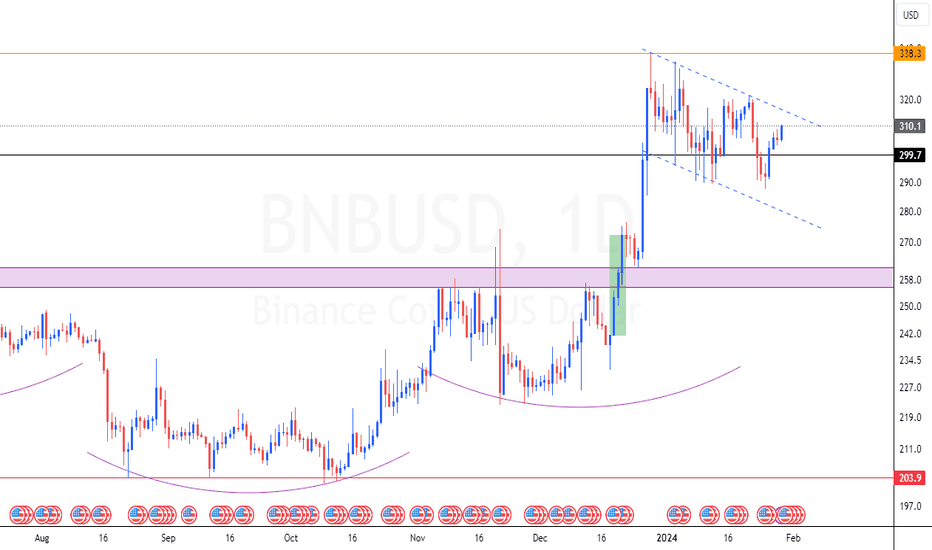

BNB UPDATE

Strong bullish sentiment still active on BNB. A strong day close above the bullish flag would interest more buyers to load more long orders.

ChartsEmpire01

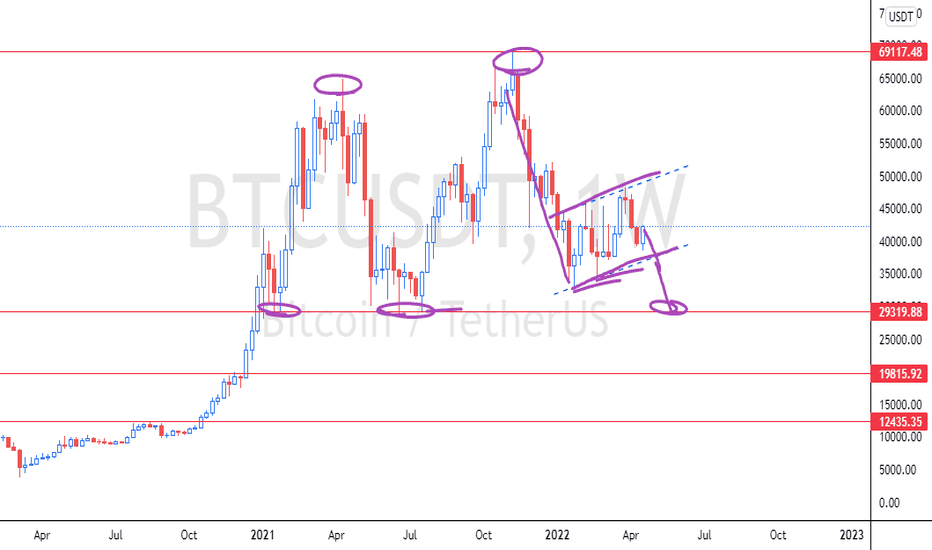

BTC WEEKLY CHART OUTLOOK

Here's a breakdown of BTC long-term analysis. The bearish flag confirmation may interest more sellers to pull down price to $29,319chart worked out as forecasted.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.