CaterinaGoldTrading

@t_CaterinaGoldTrading

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

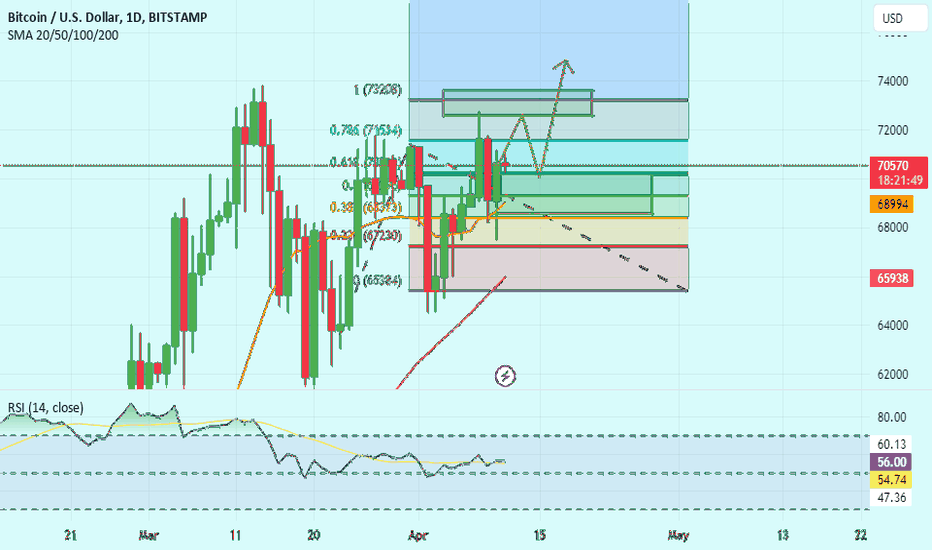

Market Analysis: Gold Holds Support at $68-69k

On the daily chart (D), the price closed with a bullish candlestick and retraced to the 0.618 Fibonacci level, indicating strong support. The bullish view remains intact, with potential for further upward movement if the $68-69k support area holds. On the hourly chart (H1), there is a reversal pattern forming, suggesting a potential uptrend. Traders may wait for the price to retrace to around $69.5k for a buying opportunity. The next resistance levels to watch are $72.7k and $73.5k. Altcoins are showing weaker buying pressure compared to BTC due to BTC's dominance in the market. Traders may focus more on BTC trades, while considering quick scalping strategies for Altcoins.

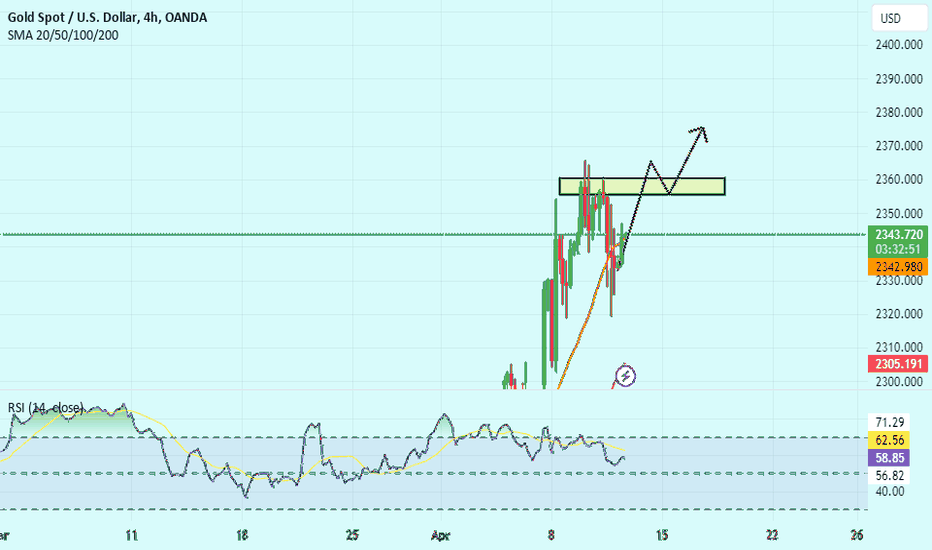

Gold Market Analysis: Trends and Insights

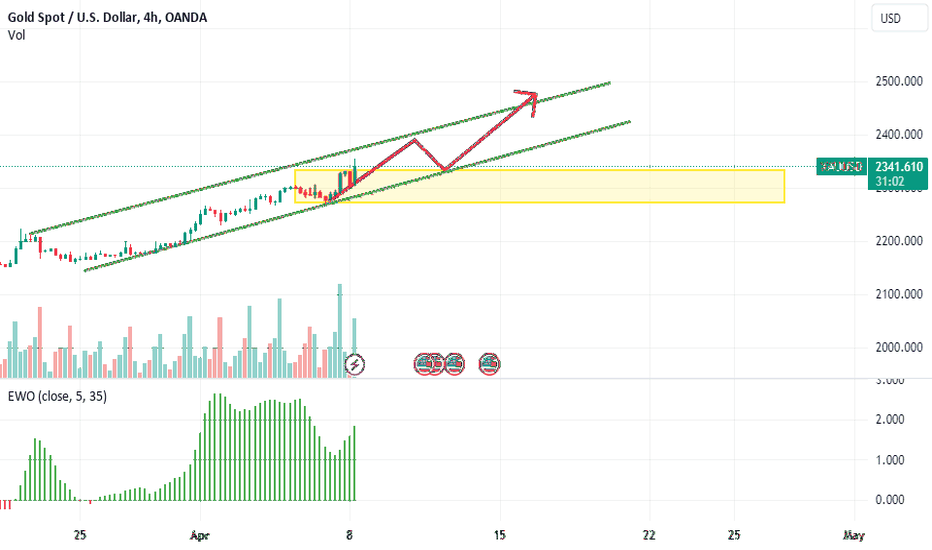

In Wednesday's US trading session, gold prices unexpectedly rebounded following previous volatility, possibly due to the increase in the US dollar and bond yields. This led to a reduction in expectations for the Federal Reserve to cut interest rates in the near future. On the 4-hour chart, the upward trend of gold remains clearly intact. The Simple Moving Average (SMA) continues to point strongly upwards, showing no signs of correction. Additionally, the Relative Strength Index (RSI) remains stable around the 60 level, indicating decreasing selling pressure. This suggests that gold prices may experience significant upward movement in the coming period.

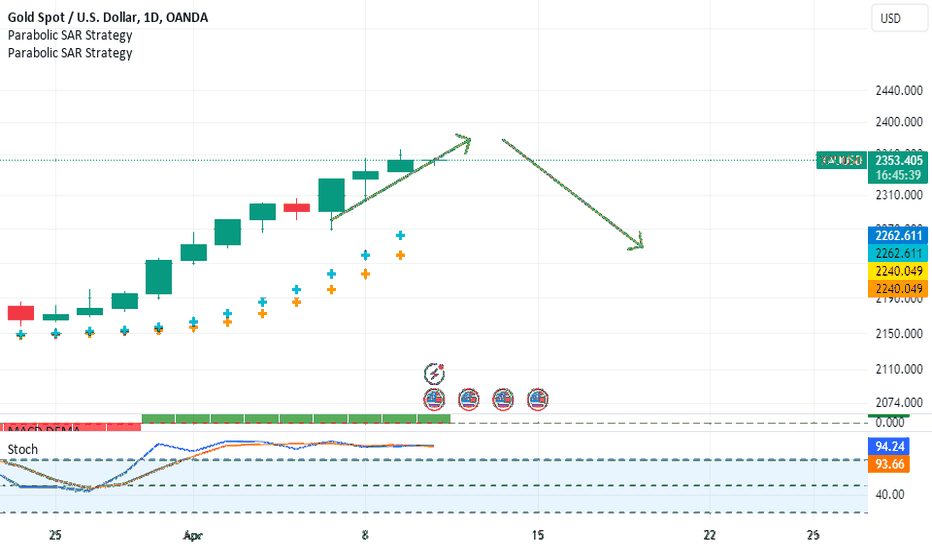

Gold Price Analysis: Technical Indicators and Trading Signals

One technical indicator that can help identify potential reversal points for a trend is the Parabolic SAR (Stop And Reversal). The Parabolic SAR places dots on the chart to indicate potential reversal points. From the above figure, you can see the dots change from being below the candlesticks in an uptrend to being above the candlesticks when the trend reverses to a downtrend.When the Stochastic rises above 80, it signals that the market is entering an overbought condition. When the Stochastic falls below 20, it signals that the market is entering an oversold condition.

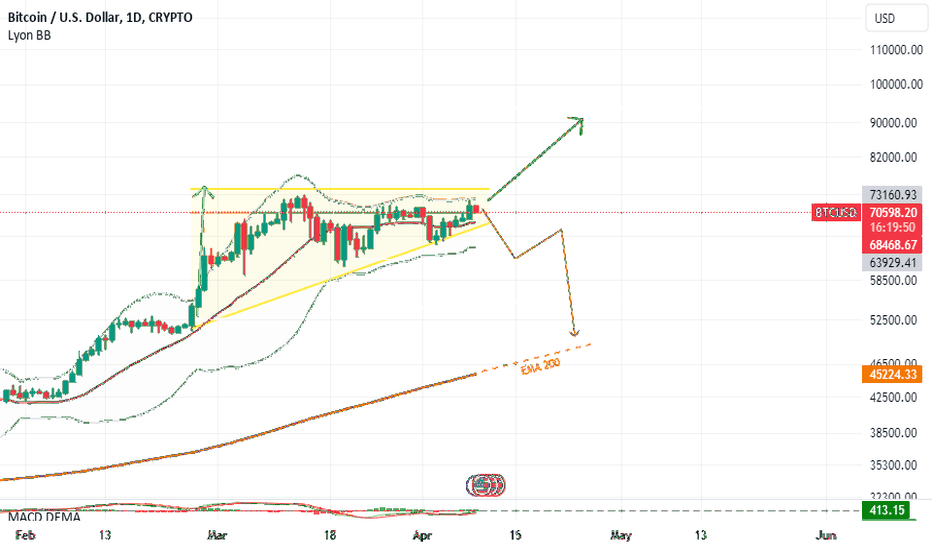

The BTC continues its upward trajectory

A correction is possible if the bottom of the triangle is breached. If there's a breakout to the upside, well, we continue buying. This analysis reflects only my personal perspective and is not financial advice. The BTC is showing strength as it continues its ascent towards higher levels. However, there's a possibility of a correction if the bottom of the triangle pattern is broken. In such a scenario, we might witness some profit-taking and a temporary pullback in price. On the other hand, if there's a breakout to the upside, indicating a bullish continuation pattern, it would signal further buying opportunities. It's important to remember that this analysis is based on personal observation and should not be construed as financial advice. Traders should conduct their own research and analysis before making any trading decisions.The two sides are struggling, I think the seller will dominate

Gold Continues to Rise Despite USD Cooling Off

Gold prices continued their upward trend today, reaching around $2347 USD per ounce, with a 0.261% growth for the day, even as the USD index showed signs of cooling off. However, after several consecutive sessions of gains, gold prices are facing profit-taking pressure. Nevertheless, the precious metal is believed to still receive significant support due to three main reasons driving its record-breaking surge: Firstly, political turmoil is driving investors towards gold. Conflicts in Ukraine and Gaza persist, with the risk of escalation to other nations lingering in the market. Investors and governments alike are wary of the consequences of these conflicts, and gold is seen as one of the most effective hedge assets against such concerns. Secondly, central banks continue to buy gold. Data from the World Gold Council shows that global central bank gold reserves increased by 19 tons in February. Thirdly, gold is considered a hedge against inflation. Gold often sees a resurgence when inflation tends to rise, thereby preserving the value of money. In terms of news, this week sees relatively few economic data releases. The highlights include the US Consumer Price Index (CPI) report for March, expected on Wednesday (April 10), followed by the Producer Price Index (PPI) and weekly initial jobless claims data from the US on Thursday (April 11).Gold price is on target

Gold Prices Soar Despite Positive US Employment Data

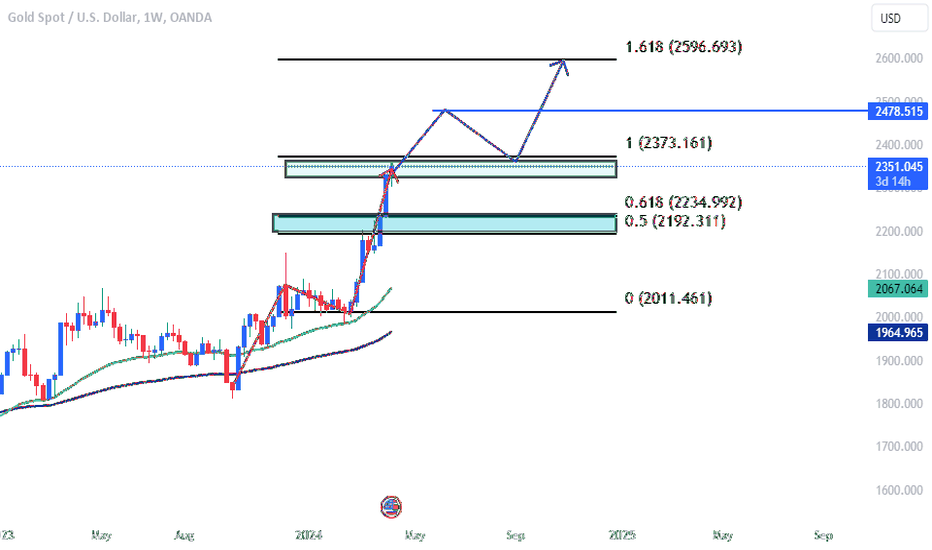

Despite the release of better-than-expected US employment figures, the global gold market has seen a significant surge, reaching new record highs during weekend trading sessions. This marks the third consecutive week of gains for the precious metal. Recent developments, including the robustness of the economy and inflation data, prompted Federal Reserve Chairman Jerome Powell to reiterate the stance that the US central bank has ample time to deliberate on the timing of its first interest rate cut. According to CME FedWatch, traders are currently indicating a 60% probability of a rate cut in June. In conclusion, I hold a strong optimistic outlook on the potential for gold prices to reach $2500 per ounce. With central banks continuing to bolster their gold reserves for diversification purposes, higher US bond yields or a stronger US dollar are unlikely to impede gold's upward trajectory.The ELLIOTT wave shows that the buying force is still strong, the price is still moving within the price channel. I think in the short term Gold will still maintain its price.Gold is going exactly as I predicted

BTC Breaks Bullish Flag

BTC has successfully broken out of the bullish flag pattern, as indicated on the chart. Following the breakout, a period of consolidation is expected, which is crucial for sustaining the trend. The ultimate target remains at 74804, with two potential scenarios outlined on the chartComment:Comment: Bitcoin (BTC) prices have witnessed a significant uptrend recently, fueled by a combination of factors including increased institutional adoption, growing mainstream acceptance, and a favorable macroeconomic environment. Institutional investors, hedge funds, and corporations have increasingly embraced Bitcoin as a store of value and an inflation hedge, allocating portions of their portfolios to the digital asset. Moreover, the ongoing global economic uncertainty and unprecedented monetary stimulus measures by central banks have spurred interest in Bitcoin as a decentralized alternative to traditional fiat currencies. As a result, Bitcoin prices have surged, attracting both institutional and retail investors seeking exposure to the potential upside of the cryptocurrency market.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.