Captainobvious5454

@t_Captainobvious5454

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Captainobvious5454

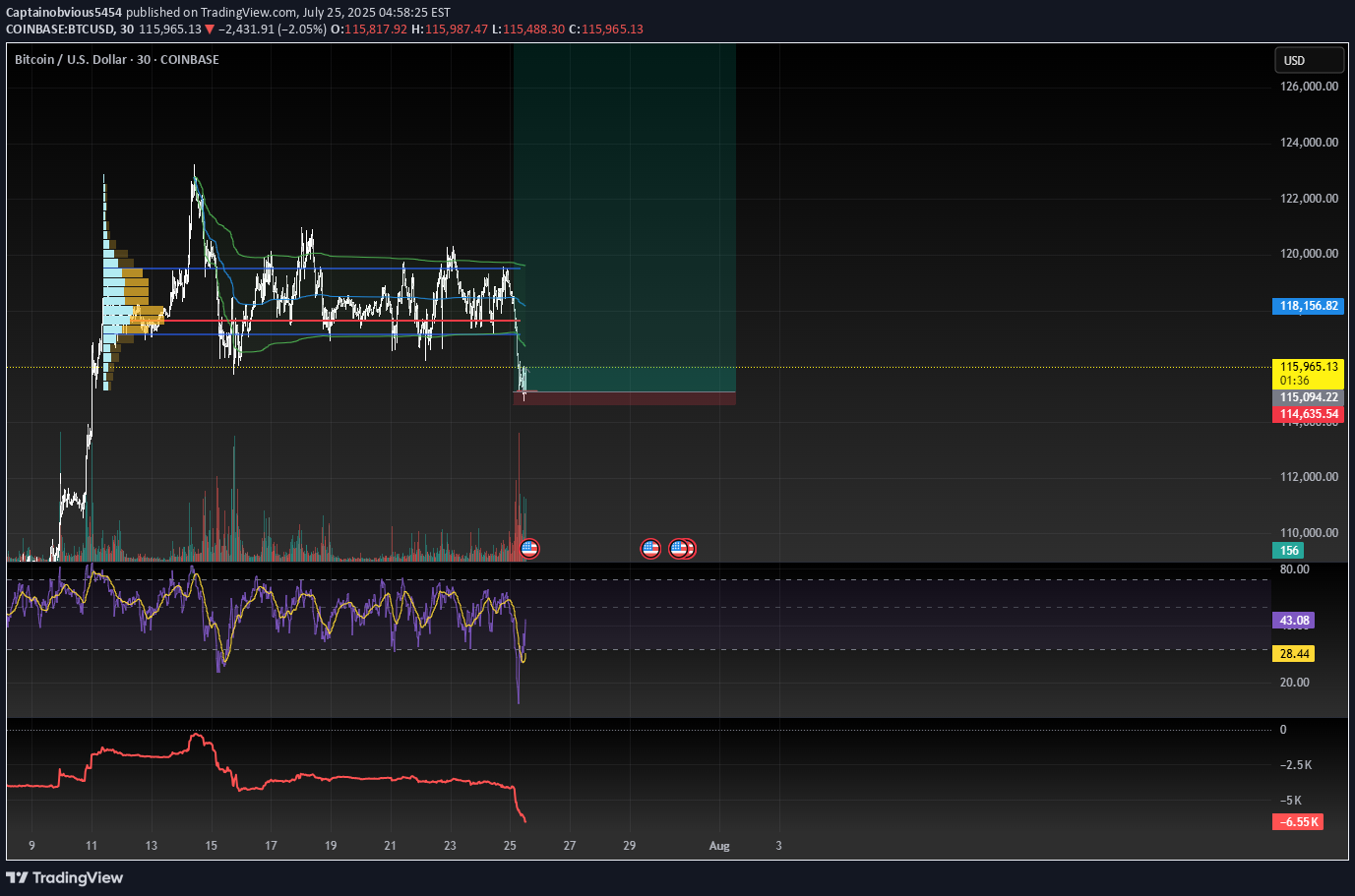

key area for bulls

if bulls cant hold this we're going to test previous range VAH which is 110k holding this will need to reclaim VAL if it rejects Range VAL as a bearish retest we may lose this area. if VAH (which is a CME gapfill) wont hold (imo if we go this far down it will nuke) theres a likelyhood to 103k Im bullish i think we reclaim here but thought is not edge. for now we have decent oscilator data. SP will be king here, if it will pump btc will pump also. i longed here

Captainobvious5454

sellers are getting absorbed

in this chart you can see the CVD decreasing while price is increasing. we also made a tridant structure although these are all bead lows, that i would like to be swept absorption is happening and money is flowing in. so im prepared in case it wants to make a sweep on CME market open. but its an obvious long

Captainobvious5454

Captainobvious5454

its just sample size

The high at 4 a.m swept all the weekend bad highs (higher than the rest) on CME theres only 1 candle (to rule them all) and a gap down of ETH (electronic trading hours) in my experience gaps that form on weekends and gap on ETH get filled even more likely than the ones who are formed on ETH and shown on RTH (regular trading hours) i like that this high is higher than the range and is back in the previous range it aligns with liquidity concepts. also, on this range we can observe that the RSI is going down slightly while price remains the same. that indicates a momentoum slowdown and CVD is making higher highs while price stays in the same range which indicates aggressive buyers are actually not making a lot of progress. I have a short now because i like this structure and my odds. we can easily have one last sweep of liquidity twards 106 but for now im enjoying my short probabilities. my first target is 98k where i will attempt a long if the data looks good (hidden bullish divergence, structure, swing fail pattern etc) the long and short are there to hedge themselves. if 97 is broken, tho.. we will break the trendline. bearish retest of this trendline will cascade us into the stoploss domino pieces falling.. i will not stand in the way of this cheos and wait like a good boy around 82k 74k and 69k all while my short is still active. im bullish for 2025.i did not stoploss but actually added on my short. for me this is just a reasonswing fail on a 4 hour 3 drive structure with a nice RSI bearish divergence. if it bullish retests support and continue pumping i will probably stoplossjust a quick update TP 1 i took aggressive take of 40% close yesterday my stoploss is already in profit and i might get stopped out today but idc if it hits it hits if no then noimagine this, trade is so automated i only have to inform you guys the day after. i made some $ on TP 1 :)

Captainobvious5454

The easy long is

72k and 73k but i dont think it will hold because its that textbook resistance turns into support and its that easy making millions is not supposed to be easy so i think lower. so a slightly stronger dip can occur in my honest opinion i'd look at some previous range stuff. 64k and 67k i think if this wont hold POC wont hold and we actually test below previous range value area low for a quick dip of 59k and a fakeout of losing 60k. so 59k and all these other levels are my goals. call me crazy but im actually nice here, usually on cycles bitcoin losses 60-90% of its value thats at least 40k to 30k so im actually bullish calling for 70 to 58k range ofc anything 60k and 59k as a fakeout. 58k that i marked right there is a bad low sweep area

Captainobvious5454

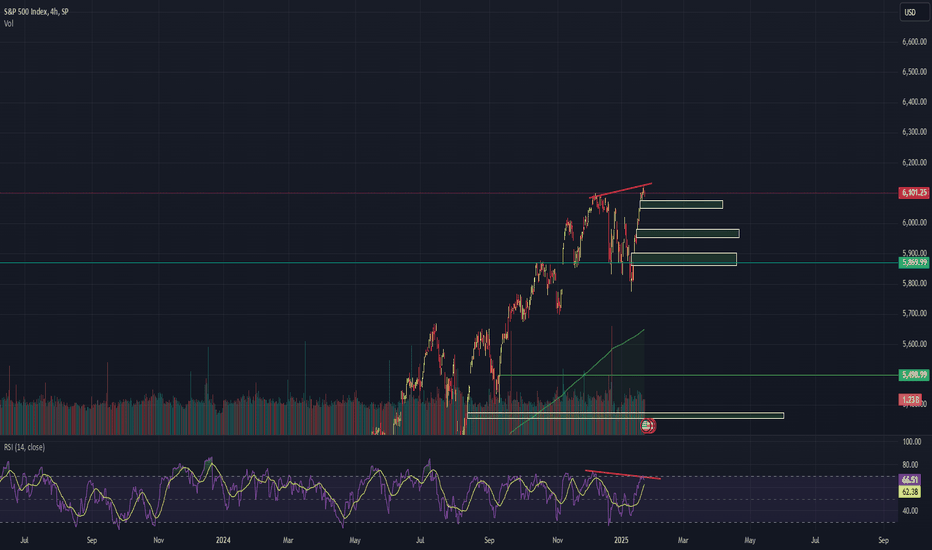

time to rotate back to value

pff too many gaps anyways and we have a 4 hourly rsi bear div and declining volume and a swing fail pattern on our latest ATH along with an RTH (regular trading hours) CVD ( cumulative volume delta) bearish divergence and all of you are way too bullish anyways its bear time

Captainobvious5454

7k usd profit hit today im still holding to see this HS play out

Can someone explain to me why gold is still going down? ArmanShabanTrading 3 hours ago TheSecondGambler, Gold is currently under pressure due to a combination of factors: Strengthening USD: A stronger dollar often weighs on gold since it makes the metal more expensive for foreign buyers. Reduced Demand for Safe Havens: With increased market optimism and a shift toward risk assets, the demand for gold as a safe haven has decreased. Interest Rate Expectations: Market speculation around delayed Fed rate cuts or even rate hikes is reducing the appeal of non-yielding assets like gold. These combined factors are driving the bearish momentum in gold prices. Let me know if you’d like further clarification! Captainobvious5454 in 11 minutes ArmanShabanTrading, dont forget btc becoming an inflationary asset that rivals gold once trump assumes office and allows banks to hold btc! so we can see gold decreasing in market cap while btc market is going up literally investors already reallocating thier money.ArmanShabanTradinggold attempting to breakdown from the neckline even though its 7% down is showing how much pressure the asset is experiencing bears showing their heads up

Captainobvious5454

who even is shorting gold right now? welp thats me.

Gold surge is mostly because of war concerns, trump assuming office will provide us peace in the long run.. we have a structural edge with 2 sizes 1 is already confirmed and the 2nd one is theorized. now that we break and lose levels below the neckline we will visit the larger structure pattern for the right shoulder. a bearmarket rally to the right should should provide the test and confirmation for a larger distribution on a larger scale. my home run is on 2400 area but i will take profit on any major levels and keep my position running and hedge ofc against it. GL to all traders and investors.first hedge area reached profits are juicy <3

Captainobvious5454

BTC double bottom!

OH SNAP THIS IS ACTUALLY INVERTEDThere's also that BULLFLAG OOPS PARDON i mean BEARFLAG as a bearish retest interesting to see we had that bearish retest last year as well (check ugly circle)we have a weakening support (48k) a bad low at that level and a tripple bottom I MEAN TRIPPLE TOP PARDON ME in the lower timeframe at the 71kTheres also an RSI bear div on the weekly timeframe and guess what else a DEATHCROSSpermabulls will not be convinced but data is data.we might actually be approaching one of the nastiest btc corrections.This wont neceserily happen but i've seen too many calls for a cup and handle pattern i got annoyedi've got 2 sayings for people who are mega bullish:1.Believe only half you see because the other half is an illusion.2. professionals have the worst case scenerio in their head ALWAYSbonus3. 90% of people are not profitable traders if you're not a pro when you think right>go left

Captainobvious5454

BTC is BULLISH NOT BEARISH a wyckoff analysis

after this wykoff accomulation phase made by the big money the path of least resistance is UP and UP onlymost BTC to be absorbed by retailers has been absorbed by professionals and investorsafter multiple testsshakeswe have made the final effort with a dovish speach from powellthis is basically a pricing in of the fed interest cuts.Lets dive in to the analysis and price action.so first of selling climax:the lows of the selling climax back on monday did not look bullish. and it is possible we will still sweep them in the future perhaps thats a level to look on if we fail to rise above 70k or it is a level to look at on the next bear market cycle.the interest to keep selling at these levels is the reason why we had to multipley test these levels "weakening" the area.What gave me the first bullish bias is the sign of strength from the upthrust action.the fact we held and didnt drop far showed a lot of buyers willing to abosrb the drop.smart money concepts would dictate that liquidity sweeps are likely. so there were many bad lows to sweep liquidity from and we did grabbed it made a really good low and for me that was one of the final edges to understand we are going up.and i was looking to long from the higher low after we had this rising wedge pattern i absorbed it with the professionals and longed from there.ever since that long we had another drop with big selling volume ever since there were less and less sellers because stock was absorbed and accomulation completed.cup and handle pattern2 shake tests to get weak hands out of the market before we go upand like you can see on net volume there were not any sellers left on these levels.Right now we have a bullflag and we are making mega bullish action on btc. i will not change my bias before we have a long enough distribution phase.this accomulation campaign took 21 days to complete.distribution would likely be roughly the same time if not longer.What i can say for sure right now is that the majority of btc stock is in the hands of professionals and they will decide whats gonna happen next.DONT TRADE WHAT YOU THINK OR FEELIT IS ALWAYS BIASED YOUR THOUGHTS AND PSYCHOLOGY ARE IN THE WAY OF SUCCESSTRADE WHAT YOU SEE NOT WHAT YOU FEEL

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.