Captain-MAO

@t_Captain-MAO

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Captain-MAO

MANATA/USDT - Macro Bottom

MANATA/USDT appears to have established a macro bottom, where downside risk is increasingly limited and upside potential is expanding. This is typically the zone where long-term positions are built, not chased.

Captain-MAO

BTC/USDT — Final Shakeout Zone 75-77k

BTC/USDT is approaching a highly critical macro inflection zone. From a market-cycle perspective, patience is required as Bitcoin may still need one final corrective leg to complete the broader reset before resuming its primary uptrend. The 75,000–77,000 zone stands out as a key area where the market could form its final bottom. Historically, Bitcoin tends to perform a last shakeout to remove late longs and weak hands before transitioning into a new bullish phase—often triggering short-term fear across the entire crypto market.

Captain-MAO

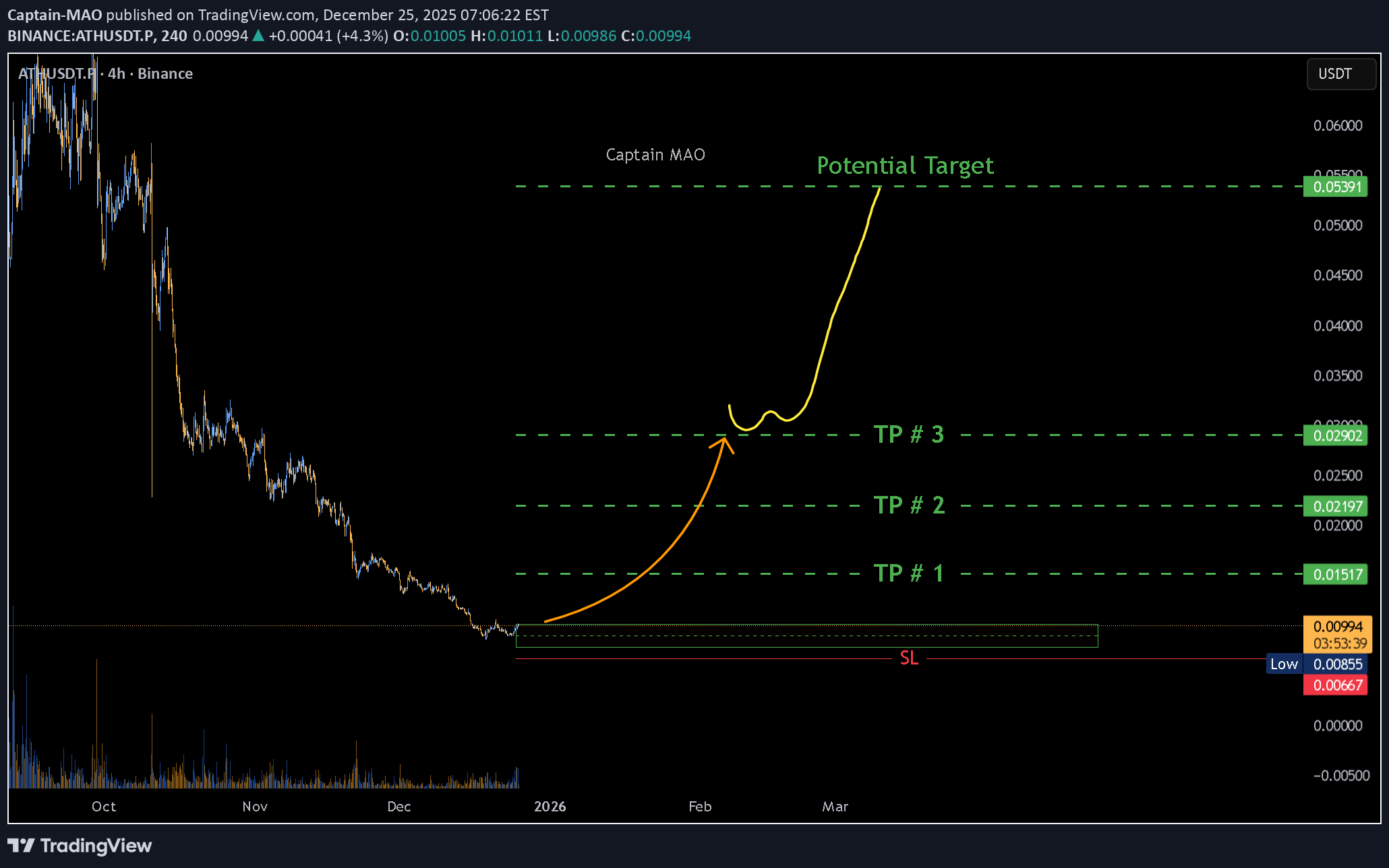

ATH/USDT 200%!!

ATH/USDT has spent sufficient time building a strong and well-defined base, indicating that selling pressure has been absorbed. Extended consolidation at low levels often reflects accumulation rather than weakness, especially after a prolonged corrective phase.

Captain-MAO

LAYER/USDT-Ready

LAYER/USDT appears to have completed the final stage of a liquidity sweep, where weak hands were shaken out below key support. This behavior is commonly seen at the end of corrective cycles, setting the stage for a strong directional move.

Captain-MAO

الگو W در BIO/USDT: آیا بازیابی قدرتمند پس از صعود 500 درصدی آغاز میشود؟

Captain-MAO

APT/USDT +150%

Aptos (APT) has spent a significant portion of 2024 and 2025 in a brutal downtrend, recently testing "generational lows" near the $1.42 – $1.60 zone. However, the tide is shifting. With the Baby Raptr and Velociraptr upgrades halving block times to 50ms and massive institutional backing from the likes of BlackRock (BUIDL Fund), APT is fundamentally one of the most undervalued Layer-1 assets in the market.

Captain-MAO

آیا ارز XVG آماده جهش 200 درصدی است؟ تحلیل الگو و زمان دقیق چرخش بازار

Over 323days formed huge classic box text book pattern indicating strong zone we can see final shakeout its time for reversal targeting 200% for this structure

Captain-MAO

SUI/USDT - upmove100%

Over the past 20 days, SUI/USDT has shown clear signs of strong buyer participation, aggressively defending the 1.30–1.40 demand zone

Captain-MAO

سقوط 11 درصدی طلا از اوج تاریخی: کجاست نقطه حساس سرنوشتساز XAU/USD؟

Been asked to analysis GOLD on current market structure On October 20, 2025, Gold (XAU/USD) recorded a new all-time high at $4,383, marking a historic peak in the current macro cycle. Since then, the metal has retraced sharply by nearly 11%, bringing price action back into a critical decision zone — a true make-or-break level. This area will define the next major directional leg. A strong bounce from current support could revalidate the long-term bullish structure and initiate another run toward ATH, while a breakdown below this zone may confirm a deeper correction before the next accumulation phase.as planned GOLD take action in mentioned zone as of now price at critical zone in case price drop and stblize below green box best zone to buy belowuptrend has startedfinally managed to come back to bullish zone same target

Captain-MAO

ورود شگفتانگیز XVG/USDT: شکست رنج با قدرت خرید بالا!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.