CHOWTRADE

@t_CHOWTRADE

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

CHOWTRADE

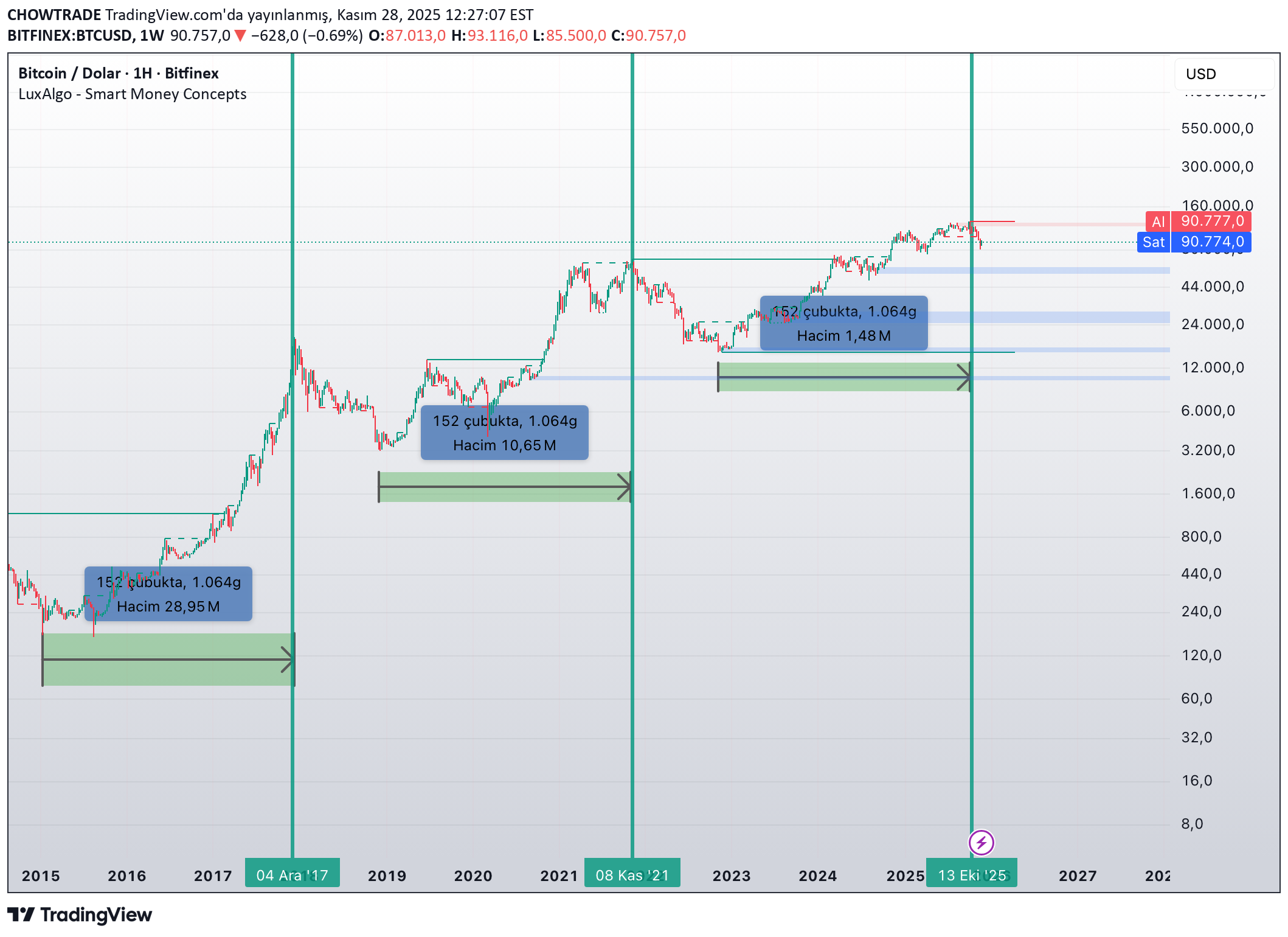

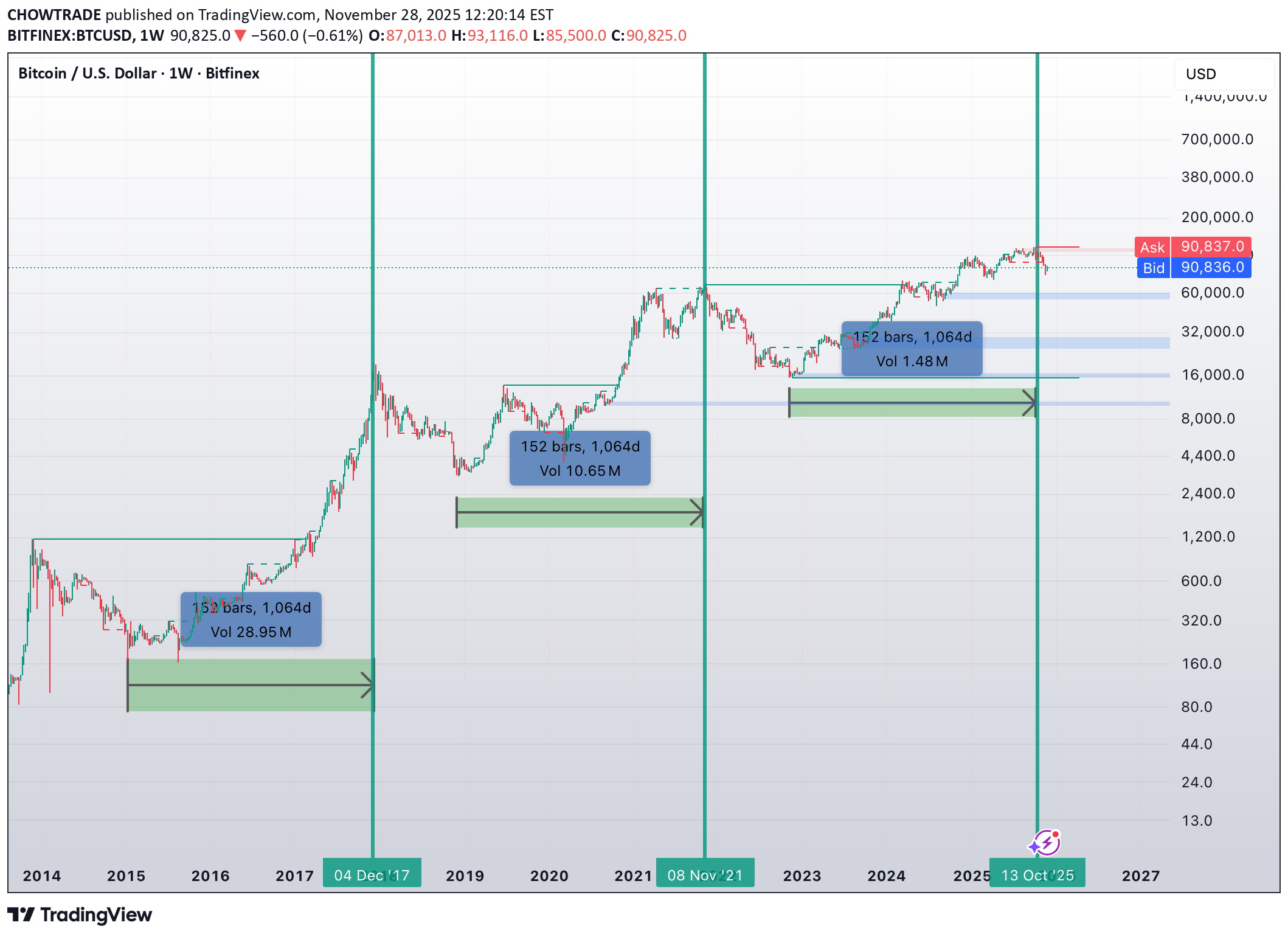

آیا چرخههای بیت کوین تکرار میشوند؟ تحلیل زمانبندی رازآلود چرخه ۱۰۶۴ روزه BTC!

Grafikte üç BTC döngüsü işaretlendi: 2017 → 2021 → 2025. Her biri yaklaşık 1064 gün sürüyor (tepe → tepe). Bu yapı iki kez gerçekleşti ve mevcut döngü aynı zaman aralığına denk geliyor. 🔍 Grafik verileri: 2017 döngüsü bitti → düzeltme + birikim. 2021 döngüsü benzer şekilde sonuçlandı. Güncel döngü yeni ATH’e ulaştı (~126K) → tarihsel döngü sonu ile uyumlu. BTC şu anda geçmişte güçlü tepki ve taban oluşumlarının görüldüğü bölgede. Buradan sonraki hareket büyük ihtimalle düzeltme dalgaları şeklinde, trend devamı değil. Geçmiş döngülerde zirveden sonra birkaç sert yükseliş görülmüştü. Altcoinler Alt sezonu hâlâ mümkün ancak BTC’ye bağlı. Destek üzerinde tutunma = pozitif senaryo. Kırılım = risk artışı. Özet BTC döngü uzunluğu ≈ 1064 gün. Şu anki döngü zaman olarak tepe bölgesine ulaştı. Devam eden süreç düzeltme yapısına daha yakın. Alt rallisi için BTC istikrarı şart. Piyasa duygusal değil matematiksel. Döngüler garanti değil, ama görmezden gelmek de strateji sayılmaz.

CHOWTRADE

تناظر چرخههای بیت کوین: راز زمانبندی تکرار سقف و کف قیمت!

The chart highlights three major BTC cycles: 2017 → 2021 → 2025. Each spans roughly 1064 days from peak to peak. This pattern has repeated twice, and the current cycle aligns within the same time window. 🔍 Key observations: The 2017 cycle ended → correction + long accumulation. The 2021 cycle mirrored the structure. The current cycle reached a new ATH (~126K), aligning with historical cycle endpoints. BTC is now trading inside a zone where previous cycles showed strong pullbacks and base formation. Further movement may develop as corrective waves rather than trend continuation. Historically BTC offered solid bounces after topping out. Altcoins Upside still exists, but it depends on BTC holding support. Stability above key levels = potential alt impulse. Breakdown = elevated risk for alts. Summary BTC cycles ≈ 1064 days each. Current outlook fits the end-cycle window. Likely corrective structure with bounce scenarios. Alts need BTC stability to shine. The market isn’t emotional it’s geometric. Cycles aren’t guarantees, but they’re signals worth respecting.

CHOWTRADE

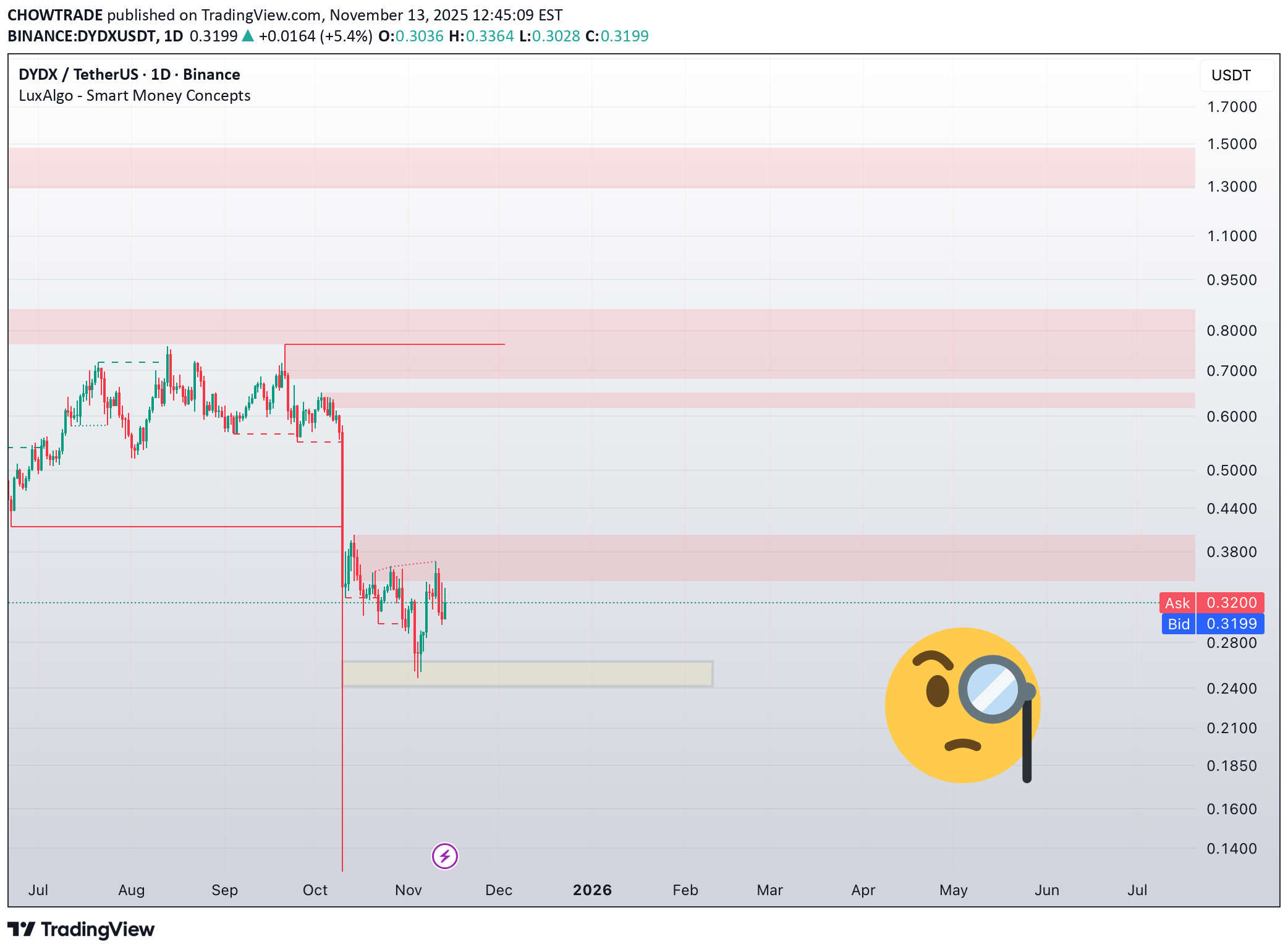

تصمیم بزرگ dYdX: افزایش ۷۵ درصدی بازخرید توکن، اما آیا قیمت بالا میرود؟

dYdX topluluğu, protokol ücretlerinin %25’inden %75’ine kadar token geri alımını artırma yönünde oy kullandı — karar hemen yürürlüğe girdi. Kulağa boğa gibi geliyor ama grafik farklı söylüyor: $1.3’ten düşüşten sonra DYDX hâlâ $0.35–0.38 arz bölgesinin üzerine tutunamıyor. Bu bölgenin altındayken “to the moon” yok, sadece gürültü var. 🧠 Olası senaryo: $0.25–0.27 likidite yakalanabilir. $0.33+ tamamen duygusal giriş. 📊 Görüşüm: Temel: $0.25–0.38 aralığı Boğa: $0.40 üzerinde kırılım → $0.6 hedefi Ayı: $0.25 altı → $0.18 testi Her zamanki gibi: haberler gürültü, seviyeler hareket içindir.

CHOWTRADE

تصمیم بزرگ dYdX: افزایش 3 برابری بازخرید توکن! (آیا قیمت بالا میرود؟)

🧩 DYDX / USDT The dYdX community voted to increase token buybacks from 25% to 75% of protocol fees, effective immediately. Sounds bullish, but the chart disagrees after dumping from $1.3, DYDX still can’t hold above the $0.35 0.38 supply zone. As long as we’re under it it’s not “to the moon”, it’s just noise. 🧠 Possible play: $0.25–0.27 where liquidity can be caught. $0.33+ pure emotion, not entry. 📊 My take: Base: range $0.25–0.38 Bullish: breakout above $0.40 → run to $0.6 Bearish: drop below $0.25 → test $0.18 As always news for the hype, levels for the moves.

CHOWTRADE

سولانا در آستانه سقوط به منطقه بحرانی؛ آیا 100 دلار کف حمایتی اصلی است؟

Bu seviye kırılırsa, bir sonraki güçlü alım bölgesi $120–100 aralığında kanalın alt sınırı ve ana likidite burada. Piyasa zayıf görünüyor düşen bıçağı yakalamaya gerek yok. %6 düşüşten sonra aceleyle almak mantıklı değil. $150’den tepki gelirse giriş fırsatı olabilir, ama asıl alım bölgesi daha aşağıda, $100 civarında. 📉 Temel senaryo: $150 kırılır → $120 testi → muhtemelen $100. 📈 Alternatif: $150’den sıçrama → $170 üzerine çıkış → kanal içine dönüş. Bu piyasada kazanan, duygularını değil soğukkanlılığını koruyandır.

CHOWTRADE

سولانا در آستانه سقوط؟ صبر کنید تا این سطوح کلیدی شکسته شوند!

If this level breaks, the next strong buy zone is $120–100, where the lower channel boundary and main liquidity sit. The market still looks weak no point catching a falling knife. No need to buy after a -6% drop. If we see a clear reaction from $150 fine, there’s a setup. But the best accumulation zone is still lower, closer to $100. 📉 Base scenario: break $150 → test $120 → possibly $100. 📈 Bullish case: bounce from $150 → reclaim $170 → back inside the channel. Stay calm. The market rewards patience, not emotions.

CHOWTRADE

بیداری زِکَش: فریب هیجان نخورید، منطقه خرید واقعی اینجاست!

Piyasa yine “gizlilik” anlatısıyla hareketleniyor, herkes yeni 1000x arıyor. Ama bana göre bu sadece başka bir hikaye. Bunu defalarca gördük: AI, L2, GameFi, RWA… şimdi Privacy. Her seferinde aynı döngü: hype → inanç → pump → dump. Evet, gizlilik önemli. Ama piyasa fikirleri değil, likiditeyi ve aktiviteyi ödüllendirir. ZEC büyük cüzdanlar tarafından pompalanırsa hareket görebilir, ama temelde bu sadece döngünün bir aşaması: 📉 kapitülasyon → 🗣 anlatı → 📈 pump → 😶 sessizlik. Gerçek alım bölgesi 200–220$ civarında. Şu anda zirvelerden almak gereksiz risk olur. 🧊 Hype soğusun, sonra hareket et.

CHOWTRADE

بیداری زیکش (Zcash): صبر کنید؛ قیمت واقعی کجا پایین میآید؟

Once again, the market is chasing the “privacy narrative”, looking for the next 1000x coin. But to me, it feels like just another storyline — the same pattern we’ve seen dozens of times: AI, L2s, GameFi, RWA… now Privacy. Every time it’s the same: hype → belief → pump → dump. Yes, privacy matters. But the market doesn’t pay for ideas it pays for liquidity, activity, and community. ZEC can still make a move if big wallets start pushing it, but fundamentally, this is just another stage of the cycle: 📉 capitulation → 🗣 narrative → 📈 pump → 😶 silence. Technically, the next real buy zone sits around $200–220. Buying high now makes no sense patience will pay off. 🧊 Wait for the hype to fade then act.

CHOWTRADE

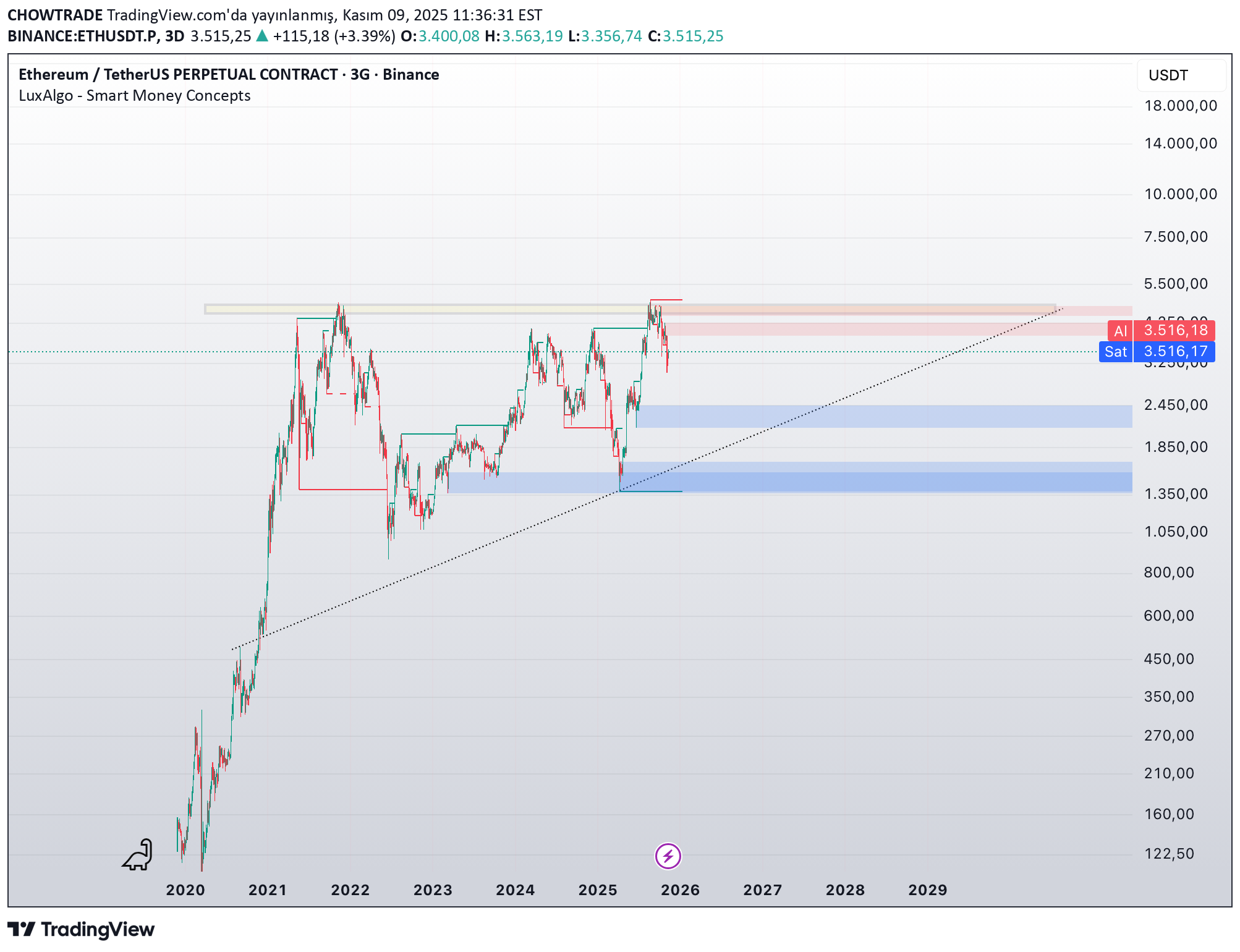

اتریوم در آستانه انفجار یا سقوط: آیا قیمت ۳۸۰۰ دلار شکسته میشود؟

Ethereum, uzun vadeli yükselen trend çizgisini koruyarak sağlıklı bir piyasa yapısını sürdürüyor. Ancak fiyat şu anda daha önce satıcıların güçlü olduğu $3,500–$3,800 aralığındaki kritik direnç bölgesine yeniden yaklaşmış durumda. Şu anda ETH için karar verme bölgesindeyiz: 🔹 $3,800’ün üzerindeki bir kırılım, fiyatı $4,500–$4,800 seviyelerine taşıyabilir ve yükseliş trendinin devamını teyit eder. 🔹 Bu bölgeden bir reddedilme ise fiyatı $2,550–$1,950 bölgesine kadar geri çekebilir; bu alan trend çizgisiyle örtüşüyor ve likiditenin yoğunlaştığı nokta. Genel eğilim hâlâ yükseliş yönünde, ancak momentum zayıflamaya başlıyor. Bana göre ETH, yukarı yönlü kalıcı bir kırılım öncesi konsolidasyon aşamasına ihtiyaç duyuyor. Uzun vadeli yapı sağlam, ancak kısa vadede sabır gerekiyor.

CHOWTRADE

اتریوم در آستانه نبرد بزرگ: مقاومت حیاتی ۳۸۰۰ دلار چه سرنوشتی برای قیمت رقم میزند؟

Ethereum continues to respect the long-term ascending trendline, maintaining a healthy market structure. However, the price has once again approached the critical resistance zone between $3,500–$3,800, where sellers historically dominated. This area remains a key decision point for ETH: 🔹 A confirmed breakout above $3,800 could open the way to $4,500–$4,800, continuing the macro uptrend. 🔹 A rejection here, however, might trigger a deeper pullback toward $2,550–$1,950, aligning with the ascending trendline and liquidity zones below. The weekly trend still favors buyers, but momentum shows signs of exhaustion. In my view, ETH needs a period of consolidation before any sustainable breakout. Long-term structure intact but short-term patience is key.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.