Bullboys8

@t_Bullboys8

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Trendline Breakout Alert

REZ/USDT has been under a descending trendline for a long time. Now the price has finally tested & broken out 🔥 🔑 Trading Plan: ✅ DCA zone already tapped (perfect accumulation entry). ✅ If price holds above breakout → first target 0.034 (20% book). ✅ Next target 0.065 (30% book). 🎯 Final upside zone: 0.17 – 0.186 📊 Risk Management: Stoploss below 0.0069 = setup invalid. Always stick to DCA strategy & take partial profits on the way up. ⚡️ This trade requires patience & discipline. If the breakout sustains → strong upside potential in the coming months.

BTC/USDT 4H Analysis

Bitcoin currently consolidating around the $110k region, sitting just above a major demand zone. Market structure is showing two possible scenarios: 🔹 Bullish Case: Price holds above the grey demand zone (RL) and pushes toward the mid-level ($118k). A clean break here could open the path toward $124k–$126k (RH). 🔹 Bearish Case: If the $110k–$109k support fails, BTC may revisit the blue demand zone around $102k–$100k before any recovery. Key Levels to Watch: Resistance: $118k / $124k Support: $110k / $100k ⚠️ This is not financial advice. Always use proper risk management. 💬 What’s your outlook on BTC this week – bullish continuation or deeper correction?

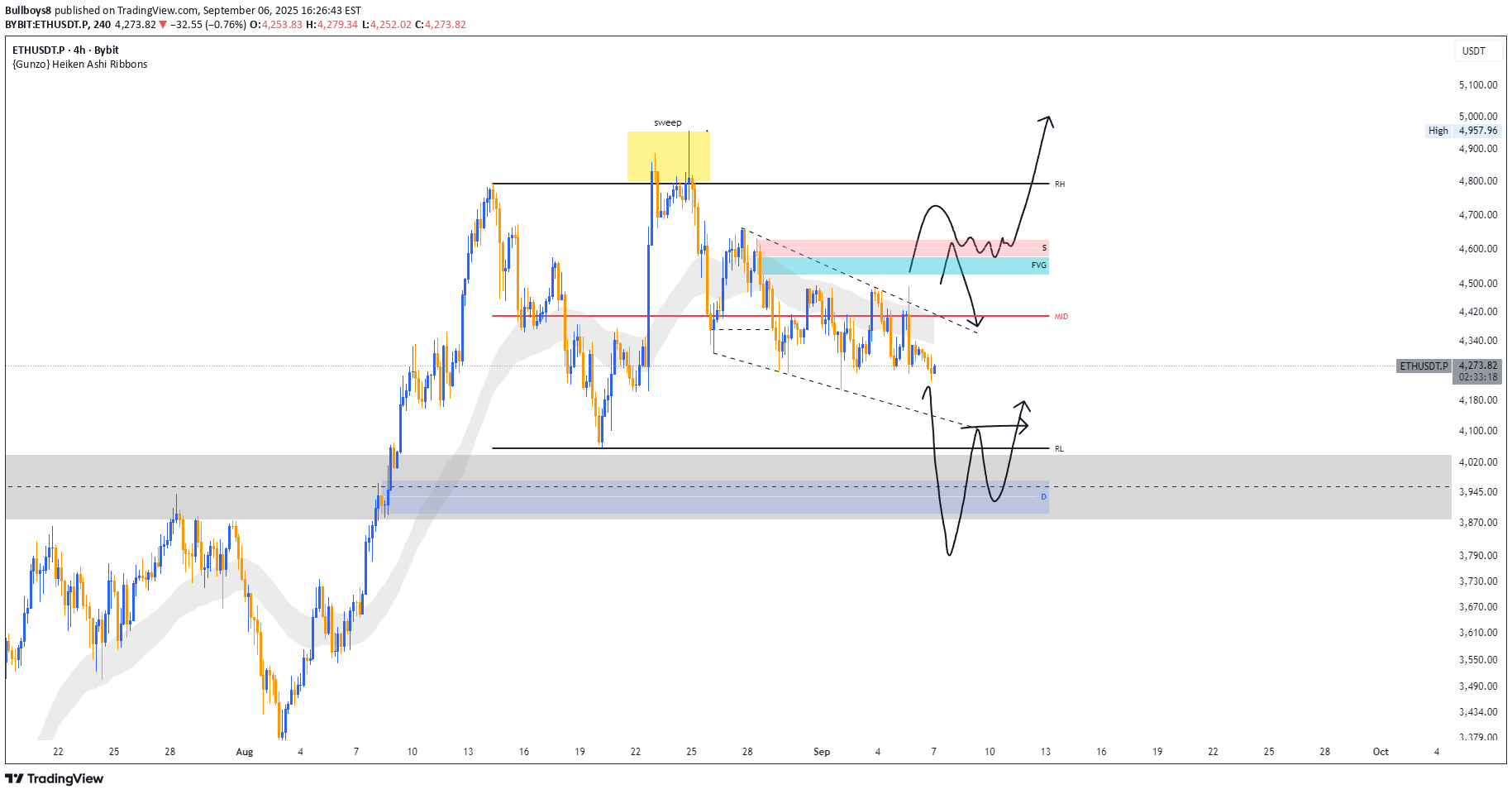

ETH/USDT 4H Analysis

Ethereum is consolidating after a recent liquidity sweep near $4,950. Price is currently ranging between mid-level resistance ($4,420) and the demand zone around $3,950–$4,000. Two possible scenarios in play: 🔹 Bullish Case: If ETH holds above $4,200 and clears the FVG + supply zone ($4,600–$4,700), we could see a strong continuation toward $5,000 psychological level. 🔹 Bearish Case: If current support fails, ETH may retest the grey demand zone ($3,900–$3,950) before any bullish recovery. Key Levels to Watch: Resistance: $4,420 / $4,700 / $5,000 Support: $4,200 / $3,950 ⚠️ This analysis is for educational purposes only, not financial advice. Always trade with proper risk management. 💬 Do you think ETH will reclaim $5k next, or will we see a deeper correction first?

Ethereum Weekly Analysis

📊 Ethereum Weekly Analysis This week, I have analyzed the ETH/USDT chart focusing on key support & resistance levels, market structure, and potential trading zones. The breakdown includes: 🔹 Weekly trend direction 🔹 Major support & resistance zones 🔹 Key liquidity levels & possible reversal points 🔹 Short & long opportunities based on structure This analysis is purely educational and based on my personal trading experience. Always manage risk properly and do your own research before trading

XAU Buy Setup

Buy Setup For Next Weak XAU its High Probly chance To Restest 2999 lvl

BTCUSD ...

BTCUSD … Simple just watch yellow box when price enter just wait for clear 2H OR 4h MSB,CHOCH and trade … If we close above Gray line and consolidate and IF We consolidate and came below gray line and msb,choch for bearish Down, For conformation down break trend linedone read what i say and what happend for more follow me

BETAUSDT

Betausdt .. good for buying now range low sweep price break internal market structure also a good support lvl here big good fundamentals coming soon

DYDXUSDT

Dydx buying setup here... holding strong support here last 2 weak also a strong breaker here

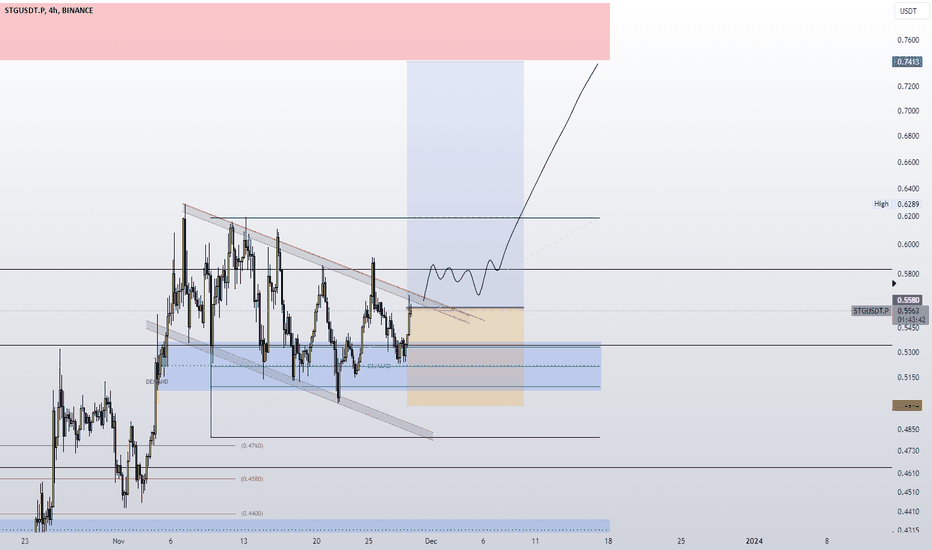

STGUSDT Setup

STGUSDT Setup STGUSDT Setup .. bullish flag pattern with SMC .. breakout then enter in trade also a good pattren in STGBTC CHART

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.