Blueberry

@t_Blueberry

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Blueberry

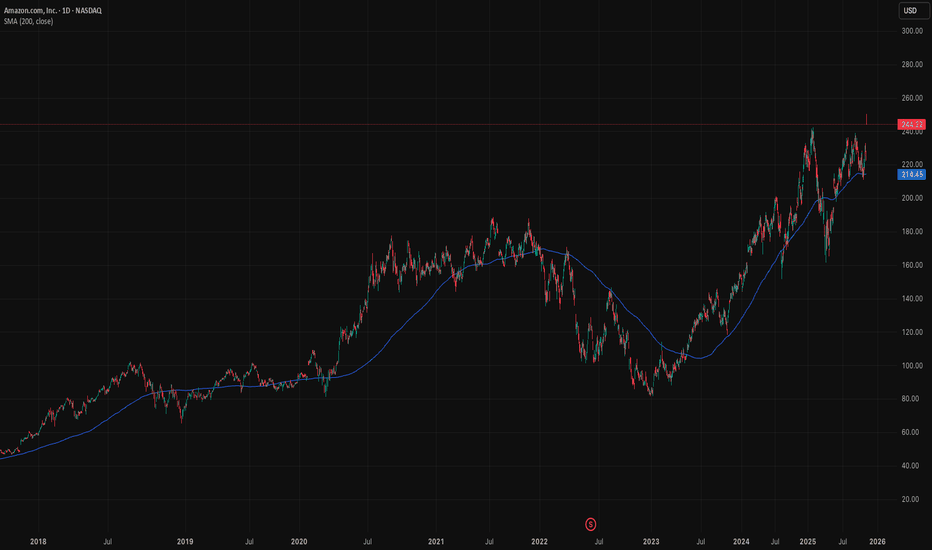

اخراجهای آمازون: پایان یک دوران یا آغاز جهش بزرگ در عصر هوش مصنوعی؟

Amazon’s recent job cuts aren’t a sign of weakness, they’re a strategic recalibration. The company is shifting from broad expansion to focused execution. In the AI era, scale isn’t just about size, it’s about precision. Amazon has trimmed roles across Alexa, devices, and some corporate functions. These are legacy bets, not core growth engines. At the same time, it’s doubling down on AI infrastructure, robotics, and cloud innovation. This is not belt-tightening for survival, it’s reallocation for higher returns. The broader theme is operating leverage. Amazon is reshaping its cost structure to match a new kind of growth, leaner, smarter, more profitable. AI tools aren’t just powering customer-facing products, they’re cutting fulfillment times, optimising logistics, and automating warehouses. Fewer people, more output. These cuts also signal cultural focus. Amazon is pushing resources into areas where it sees outsized opportunity. AI chips, ad tech, fulfillment innovation. All of these carry higher margins and more defensible moats than traditional retail or hardware. To be clear, the job cuts matter. They’re part of the margin expansion story. But they must be seen in context. Amazon is not retreating, it’s refining. And for long-term investors, that distinction makes all the difference. The stock is now sitting comfortably above its 200-day moving average. The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Blueberry

زدکش (Zcash): گنجینهای پنهان برای حفظ حریم خصوصی در چرخه بعدی کریپتو؟

Crypto isn’t new anymore. We’re past the toddler years. Total crypto market cap has surged past $3 trillion again, and maturity is following price. Each cycle brings innovation. The next one will be about infrastructure, scalability, compliance, privacy. Zcash fits that last bucket. We must saw from the outset that crypto is different to other asset classes in that it is very much sentiment driven. The network grows and becomes self-fulfilling. It's a sentiment asset class, based on utility, confidence, and durability. Liquidity drives interest, interest builds trust, trust scales networks. Zero-knowledge proofs aren’t theory, they’re live. Zcash lets you send fully encrypted transactions. No blockchain breadcrumb trail. That’s a big deal in a world that’s getting more watched. Regulators are moving. The EU’s MiCA framework is here. The US Treasury wants more visibility over crypto flows. Even stablecoins are facing surveillance. But there’s a line, privacy isn’t crime. Legitimate financial privacy will be demanded by users who value security, not secrecy. Zcash is one of the few projects positioned for this. Its tech is peer-reviewed, its encryption is compelling. As crypto grows, so will scrutiny. And with that, demand for tools that offer privacy without leaving the system. With a market cap of $3.8 billion, Zcash is a fraction of Bitcoin’s $1.2 trillion or Ethereum’s $450 billion (as of October 2025). Yet, it outshines competitors like Monero, whose $3.2 billion market cap lags despite similar privacy goals, thanks to Zcash’s superior zero-knowledge tech and transparent framework that regulators can trust. While privacy coins face scrutiny, Monero was delisted from major exchanges like Binance in 2024, Zcash’s design mitigates these risks, balancing user privacy with regulatory accountability. Add to your watch list and accept this will have a lot of volatility in the coming months. The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Blueberry

Gold price advanced for the third consecutive day and reached a new record high of $3,674, before retreating somewhat as a jump in US Treasury yields boosted appetite for the Greenback. The revision of job figures in the US further cemented the case for a cut by the Federal Reserve, though traders are also attentive to coming inflation prints. Gold price uptrend stalled after hitting an all-time high (ATH) of $3,674, before retreating below $3,650. If XAU/USD ends negatively on the day, a test of $3,600 is on the cards. On further weakness, the next stop would be the April 22 high of $3,500. The RSI is currently overbought but has not yet reached the critical threshold of 80, suggesting that the bullish trend in Gold remains intact. If Gold clears $3,674, up next would be the $3,700 figure, followed by $3,750, and $3,800. The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Blueberry

Gold prices advanced during the North American session as market participants increasingly speculate that the Federal Reserve (Fed) may initiate rate cuts at its upcoming September meeting. Bullion has been in recovery mode since last Friday, after the July Nonfarm Payrolls (NFP) report revealed significant downward revisions to May and June figures. The labor market surprise led investors to begin pricing in a 25 basis point rate cut, reviving demand for non yielding assets like gold. Adding to the dovish narrative, Tuesday’s ISM Services PMI showed a deceleration in business activity, falling short of economists’ expectations. Meanwhile, June’s trade deficit narrowed, according to data from the Commerce Department, pointing to mixed signals from the US economy. Political uncertainty at the Fed is also in focus. The resignation of Governor Adriana Kugler has opened the door for President Donald Trump to appoint a successor. Importantly, the vacancy also paves the way for Trump to potentially nominate a new Fed Chair. On the trade front, new tariffs set to take effect on August 7 are expected to range between 10% and 41%, according to recent announcements. Research from Yale’s Budget Lab shows the average US tariff rate has risen to 18.3%, marking the highest level since 1934, further fueling concerns about inflation and global growth. Technically, gold appears poised to challenge the $3,400 level, supported by safe haven demand and softer macro data. However, the rebound in US Treasury yields and strengthening of the US dollar could limit further upside, especially after bullion touched an eight day high of $3,390. Looking ahead, markets will closely monitor upcoming US Jobless Claims, Consumer Sentiment figures, and comments from Fed speakers, all of which could provide further insight into the central bank’s next policy move. The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Blueberry

Tesla is a global innovator that is changing the world. As a general rule, many investors have a saying: Never bet against Elon. They're not wrong. Elon delivers. But the short term is messy. The stock is hovering around its 200-day moving average, a critical test. Break lower and we could see $290, maybe $260. That’s not panic, it's just price catching up to reality. The auto business is deep in a downcycle. Q2 deliveries fell 14%, with revenue down 12%. Profits squeezed. Classic cyclical move. Nothing new here. But it’s weighing on momentum. The upside isn’t about cars, it's autonomy, robotaxis, AI (Grok in cars). That’s where Tesla becomes a $2 trillion company. Musk knows it and is building for the future (100,000 GPU super cluster). He’s already shifting the story. But that future is 6–12 months out, maybe longer. In the meantime, we sit in the waiting room. Auto volumes need to stabilise. Robotaxi needs scale. Optimus requires proof and some definitive timeframes to get the market excited. That creates a 3–6 month narrative gap. Markets hate gaps. Earnings last week were among the softest (though expected). EPS fell 23%. Free cash flow almost vanished. No real catalysts until next quarter. If the broader market sells off, which looks likely, Tesla takes more heat. But let’s not lose the plot. Tesla is still Tesla. Long-term vision remains. Musk’s execution record is unmatched. Bet against him and you lose, eventually. Short term, expect weakness. Patience required. If the stock breaks $315 with conviction, we’d expect further weakness before the real upside re-emerges. Wait, watch, then pounce. The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Blueberry

Bitcoin is up around 26% this year. A strong gain. But it’s not alone. The higher Bitcoin rises, the less the gains become in percentage terms. It's now in a different league, so a $1,000 or $10,000 move its necessarily what it used to be. Meanwhile, Gold, silver and copper have also pushed higher in 2025. The Nasdaq 100 is up too. All signs point to a weakening US dollar. When risk assets and commodities rally together, it's a signal. Investors are shifting. Not out of fear, but to diversify away from the dollar. This is a theme that’s building strength. Gold is up nearly over 25% YTD. Silver even more. Copper, the industrial bellwether, has joined the rally. These aren’t just trades. They’re strategic moves. A hedge against dollar debasement, inflation, and long-term fiscal risks in the US. The Nasdaq’s rise tells a similar story. Tech stocks benefit when yields fall and the dollar softens. Big tech also has global revenue exposure. A weaker dollar inflates their earnings in foreign currencies. What ties all this together? Loss of confidence in the dollar as the sole reserve hedge. Too much debt, too much printing. Central banks know it. They’ve been buying gold for years. Now, retail and institutional investors are catching on. Bitcoin, the digital alternative to gold, gets the headlines. But it’s part of a broader move. The USD remains the world’s most important currency. That’s not changing tomorrow. But its dominance is being questioned in ways we haven’t seen in decades. This isn’t just a crypto rally. It’s a dollar diversification play. And it’s gaining momentum. The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Blueberry

Gold prices surged to nearly a two month high on Friday driven by escalating geopolitical tensions in the Middle East. Spot gold rose 1.3% to $3,427.36 per ounce. This marks a gain of over 3.5% for the week. The rally was fueled by Israel's preemptive strike on Iran's military and nuclear facilities, intensifying regional instability. The conflict has shifted investor focus from trade negotiations to safer assets like gold. Additionally, weaker U.S. economic data, including jobless claims at an eight month high and subdued inflation, have increased expectations of a Federal Reserve interest rate cut, further boosting gold's appeal. Technically, gold has established a subsequent move towards challenging the all time peak, around $3,500 psychological mark. Top end of the falling flag channel at $3,300.00 provided a strong support and reversal as the price continues its short term bullish trending channel. On the contrary, some follow-through selling below the $3,385 region, however, should pave the way for additional losses towards the $3,355 intermediate support. "The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice."

Blueberry

Gold prices advanced during the Asian trading hours, touching a fresh daily high around the $3,317 mark. The move comes amid a combination of factors boosting demand for the yellow metal, notably dovish signals from the Federal Reserve and escalating geopolitical tensions. The US Dollar weakened following Friday's softer-than-expected inflation data, which has strengthened market expectations for a potential Fed rate cut in the second half of 2025. Investors are now positioning for looser monetary policy, which typically enhances the appeal of non-yielding assets like gold. In parallel, geopolitical risks continue to dominate market sentiment. Ongoing conflicts in Ukraine and the Middle East, coupled with renewed US-China trade tensions, have weighed on risk appetite and fueled safe-haven inflows into gold. From a technical standpoint, XAU/USD faces immediate resistance in the $3,355–$3,375 supply zone. A sustained move above this area could open the door to further gains. Conversely, any near-term pullback might find initial support near the $3,300 psychological level, with stronger buying interest expected around the $3,280–$3,278 region.

Blueberry

The Gold price rally has halted, as “double-top” candle chart appears to be soon confirmed, which in reverse could send XAU/USD prices toward the $3,000 figure and beyond. Momentum shows that buyers' strength is fading and that sellers are stepping in following a softer-than-expected US inflation report and weaker global outlook as market awaits further confirmation on US-China trade deal. For a reversal of trend double-top confirmation, sellers must clear the May 1 low of $3,202. Once cleared, the next stop would be $3,100 and $3,000 respectively. However, in the interim, short term support level of $3,250 is holding well with a provisional level of both, natural support and 50% fibonacci level adding an additional cluster zone within that last major range. Conversely, break above $3,300 will most like add another level of conviction for buyers to face the next resistance at $3,350. If surpassed, the next ceiling level would be an all time high of $3,501 and beyond. However, for gold to appreciate and continue its long term uptrend, new macro catalyst would need to emerge, as markets anticipate and turns to this Thursdays Retail sales and Jerome Powell's Fed speech.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.