BitcoinMacro

@t_BitcoinMacro

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BitcoinMacro

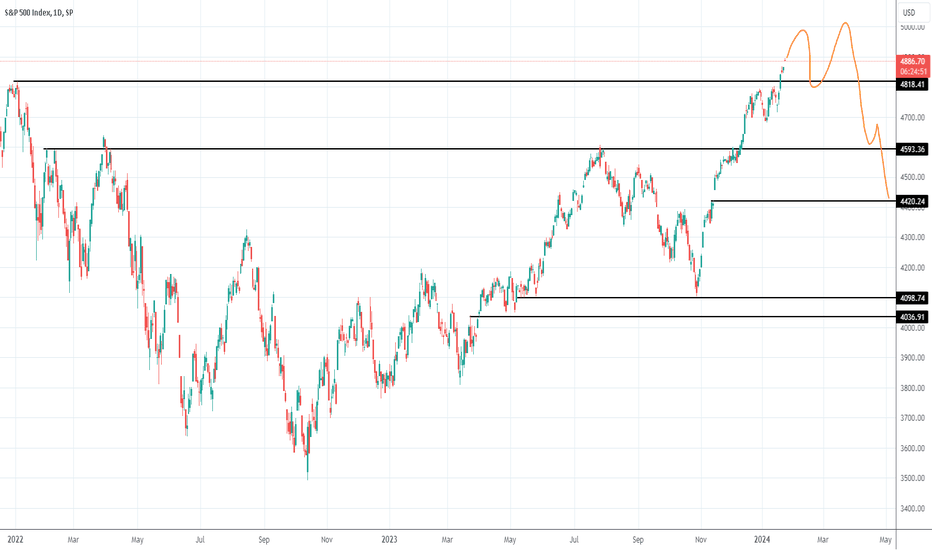

The financial system is in a continuous state of evolution, with the roles of Central Banks and governments also undergoing significant changes. Since the events of 2008 and the Covid pandemic, Central Banks have taken a more active role in providing liquidity as needed. Presently, they have various programs at their disposal for deployment if necessary. From our perspective, Quantitative Easing (QE) is somewhat negative, as it injects superfluous reserves into the system, whereas Quantitative Tightening (QT) returns useful collateral to banks. Over time, the fact that Mortgage-Backed Securities (MBS) became guaranteed by the government, coupled with programs like the BTFP, has effectively rendered several assets similar to money. Thus, if the Fed decides to either discontinue the BTFP or alter its terms rather than renew it – given that currently it’s supporting stressed banks while also essentially handing free money through a spread trade, and if QT is resumed once the RRP is fully utilized, we foresee a tightening of liquidity conditions. As the US and other governments persist in their printing and stimulating efforts when debt loads are high, paradoxically, higher interest rates can be stimulating to an extent. The additional income for bondholders, along with government injections of funds, are cancelling the impact of higher interest rates to an extent. Despite potential challenges for the private sector in securing bank financing, as many refinanced at much lower rates than the current rates, the effects of higher interest rates have remained even more muted. However, that doesn’t mean that higher rates won’t eventually have an effect, and we believe that this year their effect will be felt and that’s why inflation will remain lower than expected by many. Consequently, if the Fed begins to cut rates, resumes QE and paused the BTFP, it could mean reduced financial flows to the private sector. A critical factor here will also be the Treasury's approach to debt issuance, particularly whether it opts for T-bills or long duration Treasuries. As the Fed and the Treasury have taken numerous steps to enhance liquidity and support markets, and given that it's an election year, with the Fed’s likely preference to avoid Trump's re-election, they may not aggressively target inflation reduction. Although Inflation ended the previous year at 3.4%, significantly above the Fed’s target of 2%, we don’t think that the Fed will really try to push the economy off a cliff in an election year to push inflation down by 1.4%. Based on how things currently look, there is the potential for inflation to drop to 3% or lower in the next month, which still allows for the Fed to cut rates in March. While we do anticipate a future spike in inflation, we don't see it happening soon very soon, nor do we believe the current fiscal policy is so lax as to cause a rapid inflationary surge. Based on market trends and positioning, it appears commodities might experience a final leg down before rallying again. Geopolitical tensions and climate change also contribute to inflationary pressures, and these will probably keep playing a more and more important role over time. If inflation driven by shortages re-emerges, it could adversely affect stocks and liquidity, as it will be different from monetary inflation due to monetary debasement. As pushing the economy into a recession will not resolve wars or issues in agricultural production, and the lagging effects of interest rate hikes are just starting to be felt, along with the fact that we are in an election year, we think it’s more likely that both the Treasury and the Fed could do whatever it takes to support markets. That’s why at least for now, I believe we'll see several some cuts in 2024, resumption of QE, more T-bill issuance, and resumption of the BTFP. Here we’d like to emphasize, that although we do think there's a political element to all that, it’s not all just political, and they might not have the anticipated impact everyone is expecting. Not only that, but the fear of inflation and the fear of the Fed/Treasury seeming like they are acting too political when the stock market is at ATHs and inflation above their target, might force them to be less accommodative than the market expects them to be. The truth of the matter is that once the RRP is depleted, the government may face challenges in funding itself if banks don't buy bonds, or if the Fed doesn't step in. Deflation/a recession are also risks, considering the rapid and intense shift in rates globally, while the world economy is visibly in bad shape, despite how strong the US economy has been. Let’s not forget that the M2 money supply in the US has gone down for 2 years in a row, while real rates are at +2%. Although a massive recession seems unlikely, based on everything we have mentioned, as well as with stocks at all-time highs, it’s possible that we might see a rise in unemployment, along with a rise in inflation at some point in Q2-Q3 in 2024. To close things up, regarding the stock market, it seems to be rallying due to rising liquidity and anticipating additional rises in liquidity. Previously, we thought stocks might peak slightly above their 2021 all-time highs, but now there appears to be room for a higher rally before reaching a top. We are not forecasting a final peak, but rather a significant correction 2-3% higher from here. As the market seems to be factoring in a lot of positive outcomes, like the ones we have mentioned before, and it might prove to be right, it is possible that this could be derailed by unforeseen event, or due to overly bullish sentiment as the market is getting way too far ahead of itself. Last week, sentiment was a lot less bullish than two weeks ago, and that’s what has allowed it to rally further with ease, but there is no guarantee this can last much longer. Let’s not forget that markets tend to top when the best news come out, and nothing looks like could make it go down. Therefore, we do see a potential top in Q1, either next week around the Fed and Treasury announcements, or in March, when the Fed really either cuts or doesn’t cut, whether it really resumes or doesn’t resume the BTFP, and what it decides to do with QE/QT once the RRP is drained.

BitcoinMacro

In recent times, Bitcoin's correlation with stocks has gone down, despite the fact that the crypto market has been rising along with stocks, metals, and bonds. Despite this alignment, leading cryptocurrencies Bitcoin and Ethereum have struggled with key resistance levels. The market's current state indicates a potential overextension, hinting at an imminent major correction. Bitcoin, in particular, has been stagnant, with investors long on BTC experiencing slight losses over the past month. Ethereum, while looking technically a lot cleaner than Bitcoin versus the USD, ETHBTC is still below its 200 WMA. Although it has swept its lows across all platforms, it hasn’t been able to have a major breakout. Bitcoin's recent sideways movement hints at a potential significant price shift. Several indicators point towards an overheated market, suggesting that Bitcoin and Ethereum might be entering a bearish phase or distribution cycle. Nonetheless, there's still room for an interim rally, potentially seeing a 10-20% increase in Bitcoin and Ethereum's value. In the short term, Bitcoin prices could soar to between $49,000 and $53,000, primarily driven by the anticipated ETF approval. Following this surge, a correction seems probable, with Bitcoin's price potentially declining to the $31,000 to $33,000 range in the subsequent months. In contrast, altcoins have been outperforming Bitcoin, signaling a shift in market dynamics. The anticipation of the Bitcoin halving and the ETF, along with the excitement around Bitcoin Ordinals, initially pushed altcoins down relative to BTC until late October 2023. Their situation had started improving with the win of XRP, the win of Grayscale, the potential for an ETH ETF, the potential for a Coinbase win vs. the SEC, the Binance settlements with the DoJ and CFTC, and finally all the wins of Tether because of its collaboration with the FBI and Treasury. At the same time, as the halving and the ETF are somewhat priced in (in the short term), Ordinals moved on other chains and, as usual, extremely high fees on Bitcoin boosted the price of many other protocols. (Bitcoin dominance - Stablecoins excluded) This altcoin breakout against Bitcoin is attributed to increased mainstream adoption and strength in sectors such as AI, computing, memes, and gaming. Despite appearing bullish, top altcoins like Ethereum have recently underperformed. However, pairs like ETHBTC and BNBBTC are showing signs of bottoming out, with SOLBTC notably breaking out. This trend suggests that altcoins may continue to rise over the short term. The resilience of major altcoins, deviating from previous market cycles at a similar juncture, indicates a new market dynamic. This change is bolstered by the first-time legitimate adoption of crypto projects, backed by significantly more mature technology than was available three years ago. While the performance across various crypto sectors is uneven, many smaller altcoins have outperformed, leading to what appears to be a mini alt season with the total market cap of coins excluding BTC, ETH, XRP, BNB, and stablecoins more than doubling. However, we have to be aware that a lot of the price appreciation has also occurred due to excess speculation. Bitcoin and Ethereum options open interest being at all-time highs while their price is a lot lower than their all-time highs is a sign that investors are really betting on something big. The extremely high open interest in crypto assets excluding Ethereum, whose Open Interest is larger than that of Bitcoin, despite their market cap being a lot smaller than that of Bitcoin. Funding rates in the market have also skyrocketed and are indicating excess speculation. Positioning on CME futures also indicates that retail traders are really going long into the ETF announcements. The Bitcoin ETF discussion is another critical aspect of the market. The ETF's potential impact remains uncertain, with a decision expected within the next 10 days. In our opinion, the ETF news is being front-run significantly, although there is still some doubt on whether the ETF will be approved or not. Funds and investors have been buying stuff like Microstrategy, Coinbase, funds, miners, ETFs, and ETPs, and have gotten exposure in all sorts of ways. What we think is certain is that we will see massive outflows from these products and a rush into the ETFs, something that could create an initial spike in the price of Bitcoin, as the overall impact on the market will be neutral. All the Bitcoin-related companies that have a premium will lose it post-ETF, and this could initially help the Bitcoin price rally. Analysts estimate 50B moving into the Bitcoin ETF in the first year, but the products we mentioned already give an exposure of about 50-100B. Finally, as GBTC still has a discount and we don’t know when it will convert into an ETF, we might not see as much buying pressure as everyone is estimating. In the end, liquidity, risk appetite and other catalysts like the US government selling its Bitcoin after the ETF launch could be more important than the ETF at this point. What’s interesting is that the launch of an ETF, could lead to a more significant impact on altcoins than on Bitcoin. Why? Well, so far, we haven’t had a full-fledged alt season, and for that to be triggered we’d need to see some key developments: 1.Approval of Bitcoin ETFs – Buy the rumor (bitcoin), buy the news (alts on ETF approval). Sell Bitcoin to buy alts. 2.Progression beyond the Bitcoin halving event (another buy the Bitcoin and then sell for alts). 3.Speculation on likely approval of Ethereum ETFs. 4.Coinbase's potential victory in its legal battle with the SEC, signifying a major win for crypto assets. 5.Resolution of all issues between all US agencies and Binance 6.Bitcoin reaching a milestone value of $100,000, potentially redirecting investment into altcoins as Bitcoin investors secure profits and everyone is talking about crypto 7.ETHBTC hitting 0.04 8.The distribution of funds from bankrupt entities like Mt.Gox and FTX to their creditors. 9.The SEC providing clear regulatory guidelines for the cryptocurrency sector. In summary, while Bitcoin and the broader crypto market appear poised for potential interim rallies driven by anticipated regulatory approval of Bitcoin ETFs, the market also shows signs of overextension indicating an imminent correction. Key catalysts like the Bitcoin halving and ETF news seem largely priced in already. Ultimately, the crypto market outlook remains uncertain and volatile in the near term. However, growing mainstream adoption could drive a legitimate altcoin breakout, potentially triggering a mini alt season, especially if essential catalysts like SEC regulatory clarity transpire. Nonetheless, investors would be prudent to temper expectations and maintain cautious optimism given excess speculation and mixed signals across Bitcoin, Ethereum and altcoins.

BitcoinMacro

Greetings everyone! I hope you all are doing well. I have recently updated many of my previous ideas about the markets, including bitcoin, crypto, and traditional markets. I was bullish several months ago, and I remain bullish. The market currently looks extremely explosive for reasons I will explain. First, as I mentioned previously, a Bitcoin ETF is on the horizon. Given Grayscale's legal victory and actions by several ETF providers, the probability of an ETF being approved is around 90-95%. However, this is not the only catalyst boosting Bitcoin's price. Bitcoin underperformed relative to other coins in 2020-2021. Now many of those coins have capitulated as regulatory pressure mounts. Concurrently, we are gaining clarity on regulations. The SEC is losing more cases, and the world (Hong Kong, UK, Singapore, UAE) is embracing crypto. The technology is much more mature, and the market has largely purged fraud. Some risks remain, but for now, Bitcoin's price seems free to rally until an ETF approval. I expect a significant Bitcoin correction once approved, with capital rotating into altcoins. The macro environment is tricky as bonds and stocks collapse while gold, silver, and crypto rally. In my view, Bitcoin's underperformance this year has likely ended as capital rotates in. As Paul Tudor Jones and Larry Fink noted, Bitcoin can be a safe haven as bonds blow up. Current geopolitical tensions reinforce Bitcoin's perception as digital gold. It was created for this moment - decentralized and transactional during sanctions. No central bank holds Bitcoin to dump like bonds or gold. Bitcoin remains useful when inflation rages and bonds crater over massive government spending. This chart below shows that a few months ago, Bitcoin became extremely oversold when it suddenly crashed. Based on some of my metrics, it was one of the most extreme crashes ever, given its magnitude and how the market was trading just days prior. Although Bitcoin is now overbought after repeatedly testing $30k, I expect it to rally higher soon. Being overbought does not necessarily mean the market will reverse imminently. Given previous rallies, this one appears to be just getting started. Although it's true that Bitcoin's rally does not seem entirely 'healthy,' since it has left some gaps and double/triple bottoms below 29K , extending down to $19k. However, the market need not revisit these untested levels just because they exist. As we've seen in major bull runs and bear markets, the market can leave such levels unfilled for long periods, possibly indefinitely, especially with a major catalyst like an ETF on the horizon. One positive that some overlook while focused on these levels is that in perpetual swaps, the market did sweep the $24.9k low during the crash. Perpetual prices dropped much further than spot, meaning there may not be as much untapped liquidity below as some assume, since most action occurred in derivatives. USDT currently has a small but significant premium over the dollar. This demonstrates demand for cash and too much cash on the sidelines. The stablecoin supply seems to have bottomed, as it has held above $123B for months now, while showing signs of recovery as more cash enters the market. Meanwhile, funding on perpetual swaps remains quite negative and open interest is relatively high, indicating potential for a significant short squeeze. Grayscale has filled a major gap and retested key resistance, so the premium may not close as quickly as usual. It would be reasonable for someone to close out a long GBTC trade, since it has already rallied 90% relative to BTC after the discount hit -50%. Technically GBTC still looks very bullish, as does Bitcoin, so buying GBTC instead of BTC for an extra 10% gain seems decent for those willing to take on some extra risk. However, this carries some risk if the SEC further delays or rejects the ETF. Ethereum also looks extremely bullish, as does ETHE. In my view, an Ethereum ETF will also eventually get approved, albeit potentially taking longer. ETHUSD seems to have filled a major inefficiency/FVG in perpetuals but not yet in spot. Currently, the market appears bottomed, despite having several key areas remaining to test lower, like some obvious double bottoms. ETHE looks very bullish now, poised for a major rally. Meanwhile, ETHBTC looks less great, seeming headed for 0.04 eventually, yet also finding support around current levels that could spur a significant bounce. Coinbase is also looking very strong. The company is thriving with a lot going for it. The chart shows textbook accumulation. I also believe Coinbase will prevail against the SEC, making it 3-0 versus the SEC after Bitcoin, Ripple, and Coinbase wins. These victories would massively boost crypto overall.

BitcoinMacro

Hello everyone. A few weeks ago, I shared a few successful ideas about Coinbase, Grayscale, and the possibility of an ETF being approved. I also shared several interesting plays that have been doing very well, so I would like to dig deeper into them and check their progress. This idea will be a comprehensive look at crypto's evolving landscape. An in-depth analysis of current trends, fundamentals, and data, where I will explain why I remain bullish on crypto and Bitcoin in particular. There is also a decent chance that an alt season has begun. We will explore why the future looks bright while examining any potential issues and going through the current price action. So pour yourself a nice drink, and let's get into it!1) Coinbase has been doing incredibly well. Why? A few reasons... a) multiple ETFs have been filled and are waiting for approval by the SEC, most of which have Coinbase as their main exchange/partner. b) The SEC was expected to sue Coinbase, so it was a sell the rumor - buy the news event. Once the SEC sued Coinbase, the stock capitulated and bounced immediately. However, the SEC's case looks weak, and Coinbase could win. c) Most other exchanges in the US have been suffering, with Bittrex shutting down and BinanceUS potentially shutting down too. d) Coinbase has launched a derivatives platform both in the US and abroad and its own Layer 2 protocol. Therefore more potential profits will come to the exchange.2) Microstrategy is also doing great. Like Coinbase, the stock went through a lot of FUD, and many thought it would be forced to sell some of its coins if Bitcoin's price fell below a certain level. Now this is all in the past. Microstrategy's business is booming, and they keep buying lots of bitcoins. Not only are they buying, but they even repaid their loan to Silvergate at a 30% discount. Coinbase also repaid part of its loans at a steep discount because interest rates are so much higher and crypto so much lower.Both stocks fell more than 90% from their ATHs and went sideways for nearly 14 months. They both bottomed in May along with the Terra collapse and had a secondary low that was essentially an SFP, as they follow US tech companies as they were capitulating. Now both are also being heavily bid by players in the traditional space (TradFi), as these players don't have easy access to crypto until an ETF gets launched; hence they are looking for proxy trades. MSTR seems to be doing better as it is essentially a leveraged bet on Bitcoin due to the fact that it has taken massive loans to buy Bitcoin at low-interest rates and isn't exposed to altcoins like Coinbase is. Finally, MSTR's price partially filled the gap that opened in 2020 since the time it announced it bought Bitcoin.3) GBTC's discount is closing. As I had said multiple times before, Grayscale's Bitcoin Trust would outperform Bitcoin. I had been saying that buying GBTC at a 40-50% discount is a good idea, and those that bought GBTC are now beating BTC by 40-50% and could gain another 30-40% as the discount closes even further. The main reason behind this idea was that the SEC would probably lose against Grayscale. The SEC hasn't been able to explain why it hasn't approved an ETF, and its case has many holes. The same holds for many of their actions and failures to protect retail investors. Approving an ETF before the elections would help them cleanse all their past mistakes.The massive discount that GBTC had hurt millions of investors directly and indirectly, and the only way to properly restore balance would be to approve an ETF. Once Blackrock decided to step in, it was game over. Why? Because BlackRock has an incredible track record of having its ETFs approved (575-1). If one ETF is approved, all ETFs have to be approved, which means that, finally, GBTC will be converted to an ETF. GBTC could easily rally, fill the gap at 24, pause there for a while, and then continue higher.4) BITO was the futures ETF the SEC approved in October 2021, and it was yet another awful product. It was horrible for investors, as it has underperformed Bitcoin by more than 30%. The only real usefulness of that ETF has been to help me trade Bitcoin better. How? Because of its gaps. The CME futures, the BITO ETF, and GBTC have been forming/creating special patterns which could give an edge to someone based on the types of gaps on the chart.As BITO slowly becomes irrelevant, CME futures and all the spot ETFs will play a more important role in price action, so tracking their gaps could be a handy tool for those that actively trade. What BITO indicates at the moment is that Bitcoin could have another dip toward 28800 and then go higher because of the major gap it has lower. Overall, there are many more gaps to the upside than the downside; hence, I expect prices to go higher soon, as these gaps act like little magnets.5) As the traditional market is closed tomorrow, it will be interesting to see what the crypto market does as it trades 24/7. The CME futures will probably trade tomorrow, as they've also been trading today. Usually, the market opens for a few hours on July 3rd and is closed on July 4th, but futures tend to be open pretty much on all holidays. Bitcoin is trading near its May-June 2022 local tops and looks super strong. Based on my analysis, the most immediate targets are 35300 and 37500, as indicated by the CME gaps. However, I think that the fair value of Bitcoin is closer to 37-40k, and with an ETF, it could easily shoot up toward 50k. As seen in the spot chart, many FVGs are waiting to be filled to the upside, and it's unlikely that any will be filled to the downside. The capitulation at 15.5k last November was quite intense, and the market has essentially formed a massive inverse Head and Shoulders pattern, with a target near 49-50k. The current uptrend is very clean and technically perfect. It first swept the Nov 2020 low that led to the big breakout, then tested 20k during the USDC-SVB crisis (bottomed right at the 2017 ATHs), and finally tested the 25k breakout zone during the SEC lawsuits. Currently testing the 30-31.5k resistance, and it will most likely eventually break above it. It also closed Q2 above 30k, which was a very strong close!6) Finally, I want to talk broadly about Ethereum, Bitcoin's Dominance, and my view on crypto assets. Ethereum has filled its CME gap and paused there. It was normal for the price to dip slightly today in USD and BTC terms. Overall, ETHUSD isn't as clean as BTCUSD. I wouldn't say I like that it has too many FVGs (gaps/inefficiencies) open and so many double bottoms. Essentially there is much-untapped liquidity, which makes it look a bit unhealthy. However, ETHBTC seems to have bottomed. I waited months to see the FVG at 0.0608 filled, and once it did so, the market almost immediately bounced. It has now reclaimed support and looks fairly strong.If ETHBTC has bottomed, then potentially, crypto broadly has bottomed vs BTC. Ethereum is the leader of the rest and is also in a powerful position. Bitcoin might lead the ETF race, but an Ethereum ETF will eventually emerge. So far, Ethereum has many advantages over Bitcoin, like fee burning, lower inflation, more adoption, and staking. As more and more investors stake, then there will be less selling pressure on the market. Ethereum could be seen as green tech by many investors, which will also give it an extra boost. What remains to be seen is whether the SEC will deem staking and Ethereum as securities, which means that an Ethereum ETF might take longer.At the moment, many ALTBTC pairs look quite bullish and bottomed out. However, ETHBTC has gotten rejected at resistance, and Bitcoin's dominance remains in a strong uptrend. The current BTCD (BTC.D) pullback doesn't look sufficient to conclude whether we are in an alt season. So far, it's been positive that many crypto assets are dipping or rallying along with Bitcoin, as the worst for them to be dipping when BTC is rallying. In my opinion, there is a decent chance altcoins capitulated, as the selling from many bankrupt firms or crypto delistings has already occurred. For example selling from Voyager, Celsius, Bakkt, Revolut, and Robinhood are either priced in or has occurred. These customers have gotten or will get BTC, ETH, or USD back, which can convert into other crypto assets.To start wrapping things up, I want to mention the many crucial events to look out for. a) The return of FTX, b) the legal court cases between the SEC and all the crypto firms, c) bankruptcies, and d) the distribution of BTC from Mt Gox and the US government. The return of FTX would be very bullish for crypto and Bitcoin in particular, as FTX mostly has smaller coins and cash. The SEC will probably lose some cases against Ripple, Coinbase, and Grayscale, which will shape the future of crypto. Remember that a lot of the bearish news is already priced in to a large extent, and very few events can truly shake crypto (not Bitcoin). As these policies and bankruptcies have disproportionally hurt smaller crypto assets, they could be the ones that benefit the most once the tide turns.Bitcoin investors and traders should be most aware that Mt Gox will return about 140k BTC and 500m in cash, and the US government has about 90k BTC to sell and 120k BTC to return to Bitfinex. GBTC has 635k BTC, which will come back to the market through the ETF conversion (so far, they've been locked out of the market). BlockOne has 164k BTC, which was raised during the ICO period and might eventually distribute to EOS holders. All these events might be short-term bearish for Bitcoin, but long term, we think they will sort out imbalances in the market. At the same time, these events will probably push capital and liquidity into altcoins, so rather than panicking and selling, it's better to look for opportunities in the rest of the crypto market.In conclusion, this market will provide multiple opportunities to the bulls, even though it will be a bumpy ride. I don't want to say with certainty that the SEC will lose all its cases, as I think many crypto assets, if not the majority, are securities. However, the crypto space isn't going away, especially as multiple jurisdictions like the UAE, UK, Singapore, and Hong Kong have taken a good approach to crypto regulations. At the same time, I don't want to tell anyone to speculate too much on smaller crypto assets, as the pool of liquidity that is about to enter primarily into Bitcoin is much larger than anything that currently exists in crypto, which means that BTC could outperform crypto assets over the next 6-12 months.Thanks a lot for reading, and I hope you learned a lot from my analysis. Good luck! :)

BitcoinMacro

Pendle has been the best performer during the bear and early bull markets. TVL has grown and gained much traction as it offers an interesting product. However, is the current valuation reasonable? Its current Mcap is at 112M, and the circulating supply is about 42%.At its recent peak, PENDLE was up 5000% from its ATL and still hasn't surpassed its ATH. Don't be fooled by the prices shown here on Tradivingview, as its actual ATH was closer to 2.5$, and the 1.4-2.5$ region was the area it first started trading in May 2021.Usually, most listings on Binance tend to fall sharply, but will Pendle fall? What makes a listing top once listed on it? Well, usually, whales find the opportunity to offload their assets once a token gets on the platform, as that provides enough liquidity for them to exit.In bull markets, listings create excitement and fuel the price higher, while in bear markets, they tend to do nothing. If we are in a bull market, then it's possible that the listing won't mark the top, especially because we are in an early bull market.Binance isn't as strong as it once was, and there is a lot of FUD around the exchange; however, it remains the largest and most important. What's more important for Pendle is that it has almost reached its previous ATHs in USD terms and new ATHs in BTC terms. That means that it is fairly expensive, despite the adoption it has seen. Personally, I wouldn't short here, but I wouldn't immediately buy either. I would wait for the market to cool down a little bit and then step in. As you can see below, the first relatively large exchange that listed it and that is also available on TradingviewPendle was MEXC. The listing came in Sep 2021, and the market surpassed those highs but is now back below them.Since its most recent breakout, the market rallied more than 150%, and before that breakout, I wanted to talk about it but totally forgot about it. Today the market spiked and is already down 30%, yet it's still above the level from which trading opened today. The current price action looks like a blow-off top, and that's why there is no reason to chase anything here. I expect some consolidation here, and the market might have another leg up once the consolidation is over. Usually, when an asset goes back near its ATHs in USD and BTC so early in the bull market, it tends to go much higher. This momentum is hard to stop, but that doesn't mean the rally will come immediately after such a volatile day. In my opinion, 0.95-1.05$ are good levels to add longs and aim at least for the ATHs around 2.2-2.5$ as the next target.

BitcoinMacro

Injective has been rallying for months and has defied the bear market, which has drained most other crypto assets. Due to its super bullish fundamentals, it has stolen the limelight and will probably continue to do so.Its uptrend has been very healthy so far, and we can see that through INJBTC. INJ has been doing very well relative to BTC, and both INJUSD and INJBTC look clean. What I mean is that technically they look solid, as they have had several corrections and consolidations. Therefore the current trend looks sustainable.The two key areas I think INJUSD is targeting next are 10.3$ and 14.5$. Those two areas have a lot of liquidity, given that triple/quadruple tops have formed there. I expect the market to hit those targets in the next few months. Taking profits in those zones makes sense only in the short term, simply to add more in case the market corrects once it gets there.

BitcoinMacro

Not much to say here. The project has been in strong accumulation both in USD and BTC for about a year. Although most NFTs have taken a big hit, this has shown great strength. AGLDUSD had a low in June 2022, swept it in November 2022, and now going up strong. AGLD is extremely strong and shows clear signs of steady accumulation.NFTs might have had their capitulation moment over the last week, which means NFT-related tokens might be a buy.

BitcoinMacro

Not much to talk about here. The case is very simple. This coin didn't experience a proper bear market, which is a massive sign of strength. Over the last few years, it slowly got more listings and is now listed on Coinbase, which means it could have the potential necessary liquidity to push it higher.Unfortunately, its chart on Tradingview isn't the best because even the average price, as shown by Tradingview, includes price action of just the last year or so; hence it doesn't show the whole picture. Based on my holistic analysis, it looks solid and could have a rally higher at any moment. The downside is somewhat capped, and the upside is almost unlimited. The first target is near 22$, but I expect higher prices after a correction. Essentially the first 2x is easy, and anything after that is a gift.On the chart, which is an extraordinary chart, I have added some potential paths for the price action. I always like to pay attention and trade coins that differ from the rest, as these coins provide the best opportunities. Depending on how you look at it, this multi-year consolidation could lead to a substantial expansionary move. Overall, I think 6.5$ is the lowest the price could so I would put my stop below it, but I find it unlikely that the 10$ support will break soon. If it does break, either buy lower or wait for the reclaim and then step in.

BitcoinMacro

As I made a case for FTT and have made a case for COIN and GBTC before, I want to keep sharing some unique charts and cases. Again, my FTT idea was banned (from a little mistake), so I just reposted it and want to continue with more special cases. By special cases, I mean stuff that looks weird, infeasible, or tricky, where sentiment is leaning against my case, while there could be a significant catalyst that helps the trade.In my previous ideas, I went deep on some of those, and in the idea below, I shared some extra ones, like LEO. For example, FTT had people very negative about FTX being bankrupt, yet FTX might be revived, boosting the token's price. COIN had everyone bearish due to the SEC lawsuit, yet it's pumping hard, as most of the news was priced in, and Coinbase might win against the SEC. GBTC had a massive discount as everyone was bearish and worried, yet an ETF is coming. So what about LEO?LEO is a token created by Bitfinex, an exchange token with some 'special' rights. Those rights are that if Bitfinex gets the 2016 hacked coins back, it will distribute 80% to LEO holders. The FBI caught the hackers 1-1.5 years ago and is sitting on those coins. I assume that it will eventually give Bitfinex the coins back. If they don't, LEO will crash, but if they do, LEO could easily do a 2-3x from here.As you can see in the chart above, if the price of LEOBTC goes up to the highs it reached when the FBI caught the hackers, that's a 150% increase. Is it reasonable? The current market cap of LEO, in BTC terms, is 120k BTC. The hacked coins were 120k BTC. 80% of that is 96k BTC will go into buying back LEO tokens, and the rest to the Bitfinex team and shareholders. I expect that Bitfinex will get a big boost from this. As Binance is in a bad state, Bitfinex could capitalize on this opportunity. They have been making tremendous progress on many fronts, and I believe that this could be a significant catalyst. Giving 3B back to LEO holders and Shareholders is massive. The publicity will be huge too.The main issue against my idea is that LEO is the second biggest exchange token, yet Bitfinex isn't in the top exchanges by real volume. That means that, to a large extent, LEO has the return of the coins priced in because its price would otherwise not be so high.In my opinion, there is a chance that they will give the coins back to Bitfinex holders, potentially before the launch of the ETF, to cause selling pressure on the Bitcoin price. As BTC faces selling pressure from several 'sides' (Mt.Gox, US gov, Bitfinex, Bankrupt companies), prominent players/whales may use that opportunity to scoop cheap coins before the ETF launch.

BitcoinMacro

Hey guys, my idea on FTT got banned. This is a repost of the idea without the part that got it banned. I initially shared the idea when FTT was at 1.32$, and it's now at 2$. In case they unban it, this is the idea. That's the link to my ideaMy only other proof is the screenshots I shared, but that's the only thing I could do. I am quite upset because it was a perfect idea right before the announcement that efforts to revive the exchange were official and the process was on. I tried to contact the moderators here, but they insist that because I shared a link, my idea had to be banned. My idea got banned because I mentioned the account of a coalition of some FTX creditors who have been trying to resurrect the exchange for months. Again, I don't get that policy, especially as Tradingview allows people to share links on these ideas, but these are the rules. All I have to say, is if you are sharing any ideas, make sure you don't share links from outside sources.The idea 'Buying FTT with the expectation that FTX 2.0 will be launched. Some major players in the crypto space are pushing for the relaunch of the exchange, and this account is from a coalition of FTX traders that want to revive the exchange.I believe that the exchange can be relaunched. Why? What would be the benefit? It would be a clean slate. No issues with regulators and a huge customer base. If the FTT token remains, then it wouldn't be a security.Relaunching the exchange when other exchanges are under pressure and the SEC is cornered is the best time to do it. It's one of the ways to give money back to customers slowly and have people trade on it. Allowing creditors to trade their claims, distributing illiquid holdings rather than selling them for nothing, and having a solid community that wants to see the exchange succeed would greatly benefit everyone involved.As I mentioned in my recent ideas, the SEC is cornered; they will try to do anything they can to regain trust and stability. For example, they 'postponed' a fine on BlockFi to help their customers get more money back. With many new traditional firms wanting to enter the game, it would be easy to sell FTX and have it relaunched. The SEC has done a lot to damage ordinary crypto users with all of its mistakes and aggressive policies, and it is now at a point where it will be forced to soften its tone.Maybe FTT goes to 0 if the token becomes useless either because the exchange isn't relaunched or if it's relaunched, it's relaunched without the use of FTT. However, if it is used for anything, if the exchange relaunches, it could rally hard from here. Under new management, it could even trade back to where it was before the collapse. Overall, FTT is a potential 5-10x from here, as it's trading on most exchanges outside the US, isn't trading on US exchanges (won't be delisted), and probably won't be deemed a security by the SEC.To close things up, FTTUSD is in a range. It first took out its high at 3$ and then its low at 0.8$. Therefore the next move from here is going to be higher. FTTBTC is showing massive bullish divergence and is slowly trying to reverse its bearish trend. Putting a small amount in FTT and forgetting about it, like a mini investment or long-term call option, is probably a good idea.Closing the trade manually because my idea has been unbanned. The moderators saw my case, and they removed the ban. I'd like to thank them and the whole Tradingview team as a whole. They've been doing incredible work over the years. When I said the rules are the rules, I meant it. It was my mistake to add a Twitter account like that, as it could be any account for any reason, so the moderators have to limit any potential abuse.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.