BearKingdomTrading

@t_BearKingdomTrading

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

BearKingdomTrading

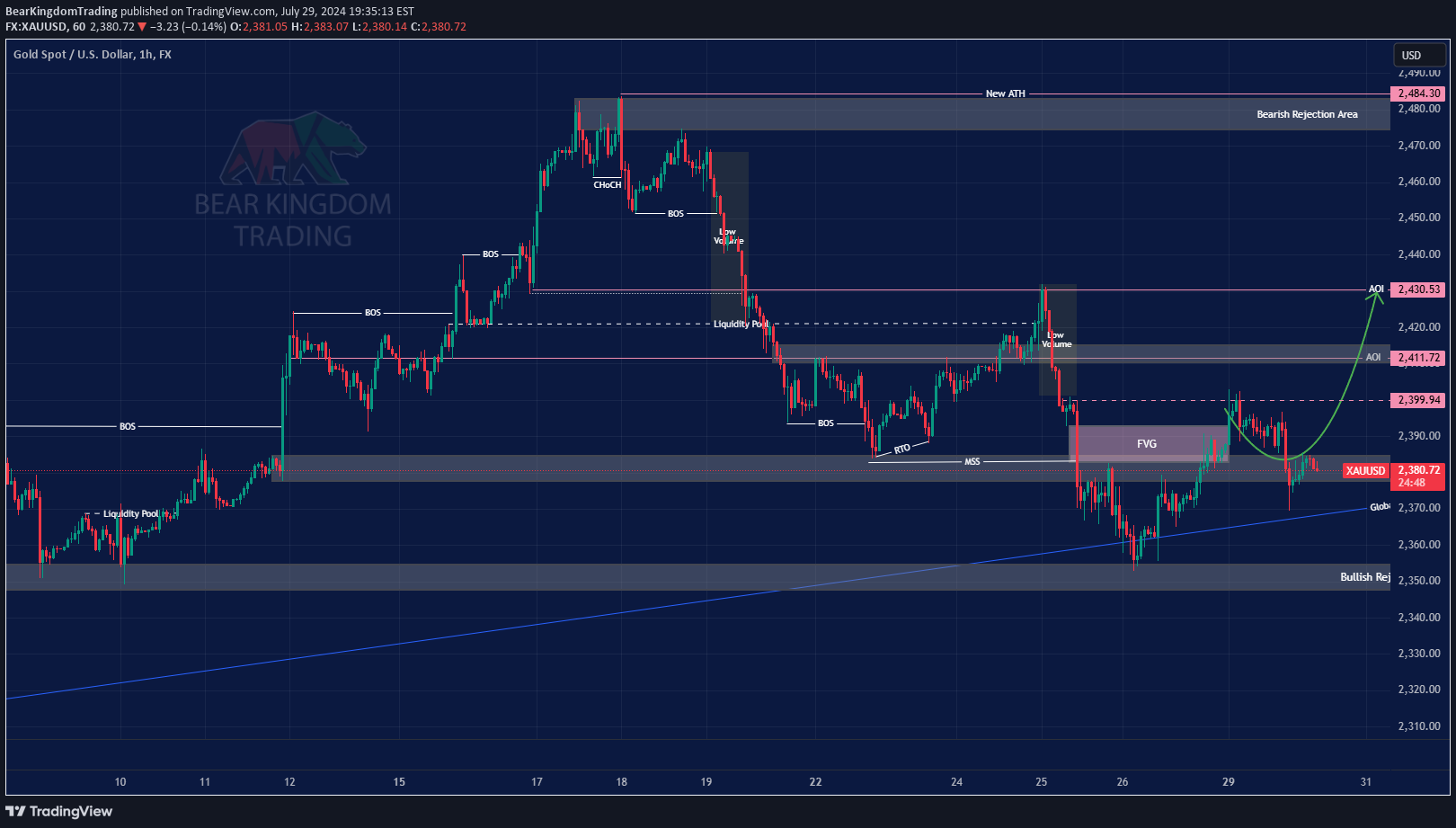

🪙 #XAUUSD (GOLD / U.S. Dollar) 🕓 Time Frame : 1H 🔼 Status : Bullish 🌐 Important 📆 30/07/2024 Current Market Situation: Gold has been strengthening since the session opened and is currently testing the 2400 zone. The market sentiment is turning bullish again, although it is approaching a strong resistance level at 2400. The key focus is on the 2393.0 level. Market Dynamics: No Significant News: Today, there is no major news affecting the market, and the overall situation remains stable. US Deflation: Markets are awaiting confirmation of US deflation progression, which could hint at the soon reduction of interest rates. This scenario is generally favorable for gold. Technical Outlook: Key Level: The focus is on the 2393 edge of the range. If the price consolidates above this area, it could influence further growth. Descending Resistance: It is important to monitor the descending resistance as it may be difficult to break this area on the first attempt. Resistance Levels: 2400 2430 Support Levels: 2393 2384 2377 Conclusion: The technical and fundamental outlook for gold is quite positive. We should expect a retest of resistance with potential subsequent growth. However, before entering an active recovery phase, there might be a retest of support levels such as 2387, 2382, or 2377.

BearKingdomTrading

💡#XRPUSDT 🕓 Time Frame : 1D 🔼 Status : Bullish 🌐 Important 📆 26/07/2024 Current Market Situation: XRP is currently the strongest performer in the market. While ETH and BTC are experiencing declines, Ripple is holding steady as traders anticipate growth amid ongoing rumors. Key Observations: Market Sentiment: Traders are showing increased confidence in XRP, driven by rumors of a positive resolution to Ripple's legal issues with the SEC. CEO's Statement: Ripple's CEO has expressed optimism, suggesting a legal resolution with the SEC is expected "very soon." Speculation: There is speculation that the SEC's closed-door meeting to finalize the case against Ripple might occur today, July 25. Market Dynamics: Trading Volume: Trading volumes for XRP are rising. Price Movement: The price is hitting local highs, and whales are accumulating XRP. Technical Levels: Resistance Levels: 0.6378, 0.7440 Support Levels: 0.5712, 0.5100 Technical Outlook: Resistance Break: Attention should be focused on the 0.6378 - 0.5712 range. If XRP fails to break the resistance at 0.6378, the price may test liquidity below the support level before any subsequent growth. Potential Impact: Legal Resolution: A positive resolution in the trial will likely provide a significant boost to XRP, potentially giving it a "second life." New Path: Breaking the resistance at 0.6378 will open a new path for XRP, possibly leading to further gains. Conclusion: XRP is showing strong resilience and potential for growth, driven by speculation of a favorable legal outcome. Traders should watch the key resistance and support levels closely, as a break above 0.6378 could signal a significant upward movement.

BearKingdomTrading

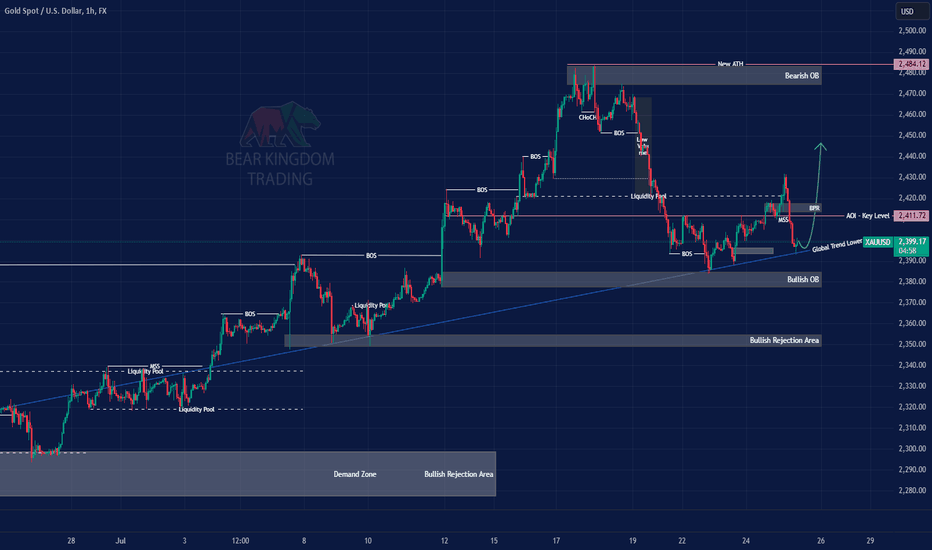

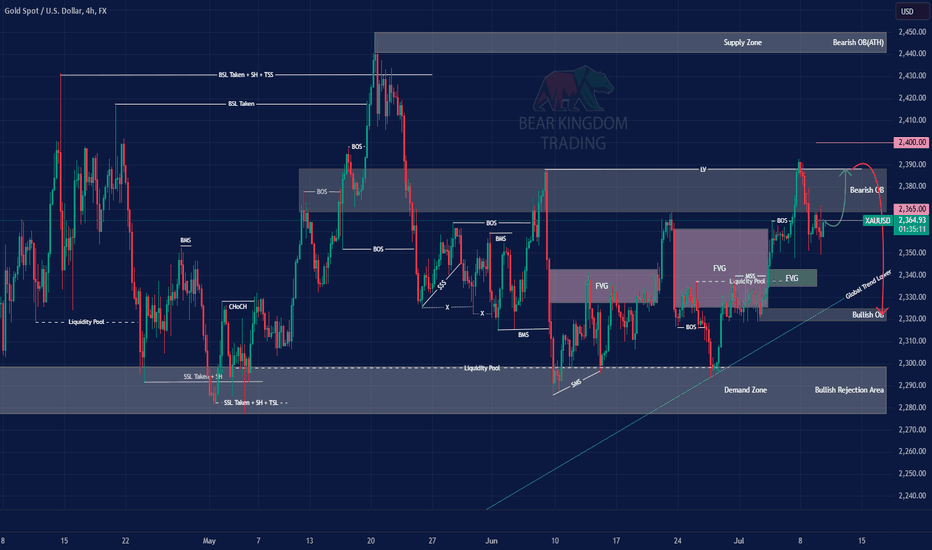

👑#XAUUSD (GOLD / U.S. Dollar) 🕓 Time Frame : 1H 🔼 Status : Bullish 🌐 Important 📆 26/07/2024 Analysis : After retesting the 2430 level, gold (XAUUSD) experienced a selloff. There is currently no significant pressure on the price of gold, likely due to profit-taking amidst the stock market selloff and anticipation of upcoming economic data from the US. Key Observations: Profit Taking: Gold fell after retesting 2430, likely due to traders taking profits. Economic Data: Traders are awaiting key US economic data, including GDP and Initial Jobless Claims, set to be released at 12:30 GMT. This data could have a medium-term impact on the market. Focus on PCE: The main focus is on the Personal Consumption Expenditures (PCE) data, which will be released on Friday. This data is crucial as investors are anticipating a potential Fed rate cut in September. Lower interest rates tend to increase gold's appeal. Technical Analysis: Correction Forming: A correction is forming with strong support areas at 2370 and 2350, which can prevent further declines. Resistance Levels: 2377, 2392 Support Levels: 2370, 2355, 2350 Potential Scenarios: Rebound Potential: If the price stabilizes in the 2370-2377 zone, it could set the stage for a rebound. Consolidation Above 2377: If gold consolidates above 2377, it may enter a recovery phase. Testing Lower Support: If the price fails to consolidate, traders might test the liquidity in the 2355-2350 range before any further growth. Conclusion: Gold is currently in a correction phase with key support levels at 2370 and 2350. The upcoming economic data, especially the PCE, will be crucial in determining the next move. A consolidation above 2377 could signal a recovery, while failure to hold this level might lead to a test of lower supports.

BearKingdomTrading

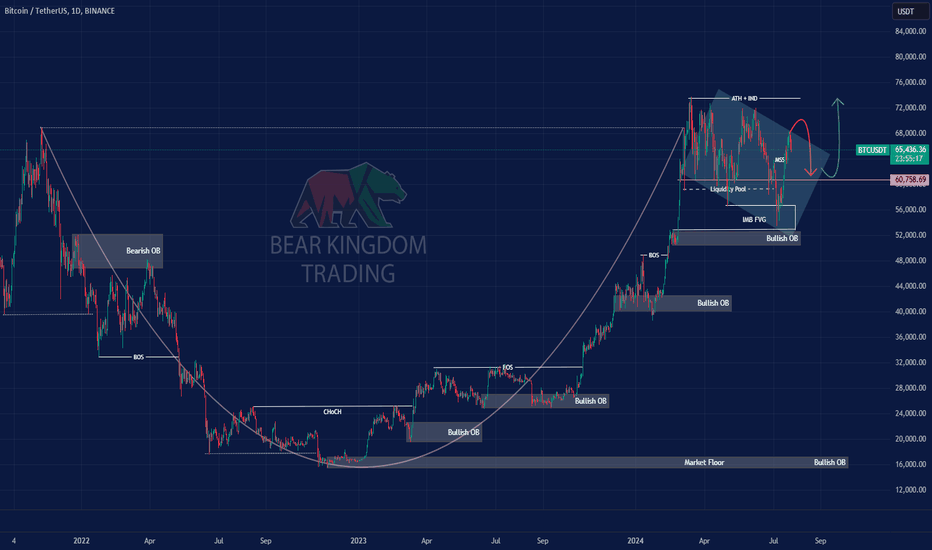

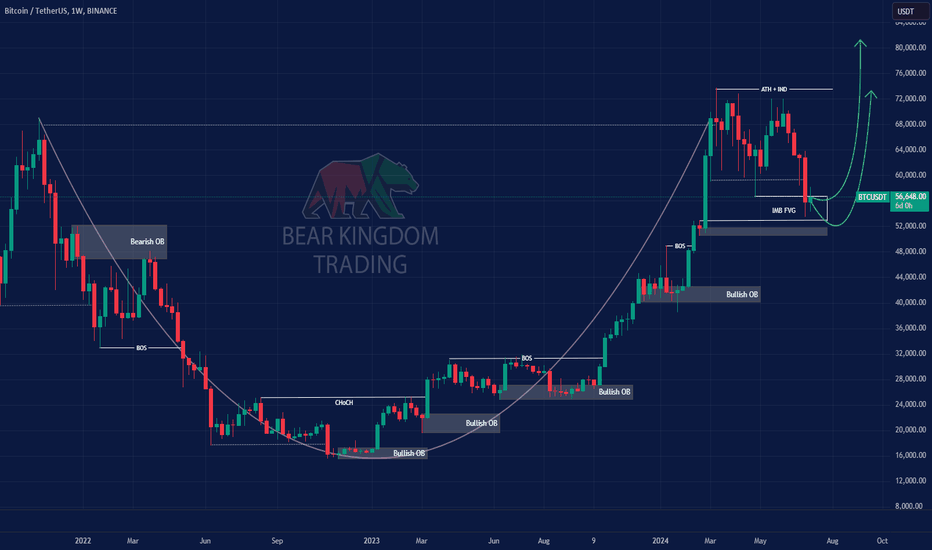

👨🦳 #BTCUSD (Bitcoin) 🕓 Time Frame: Daily/Weekly 🔼 Status: Bullish (short then long) 📆 25/07/2024 Current Market Situation: Overall, Bitcoin (BTCUSD) looks promising but is currently moving slowly due to some market expectations. Key Observations: Psychological Pause: There may be a psychological stop following the introduction of the ETH-ETF. Historically, when the BTC-ETF was introduced, the market initially fell before rallying. Awaiting News: The market might be on hold before significant news. On July 27, there will be a cryptocurrency conference featuring speeches by Trump and Harris. Market Dynamics: Fundamental Factors: The fundamental aspects are currently driving the market, creating an energized environment. Technical Factors: The technical outlook is less clear, with mixed signals being observed by major market participants like MMs and Whales. Technical Outlook: Resistance Zone: A strong resistance zone lies ahead and will be tested soon. This zone could impact the price in various ways. Current Status: Bitcoin is currently bullish with no bearish preconditions. Scenarios : Scenario 1: If the resistance zone is breached, Bitcoin could rally further. Scenario 2: If the resistance holds, a pullback could occur. Conclusion : Given the mixed signals and pending key events, it is difficult to make a precise prediction at this moment. The resistance zone will be crucial in determining Bitcoin's next move. For now, Bitcoin remains bullish with no clear bearish signals.

BearKingdomTrading

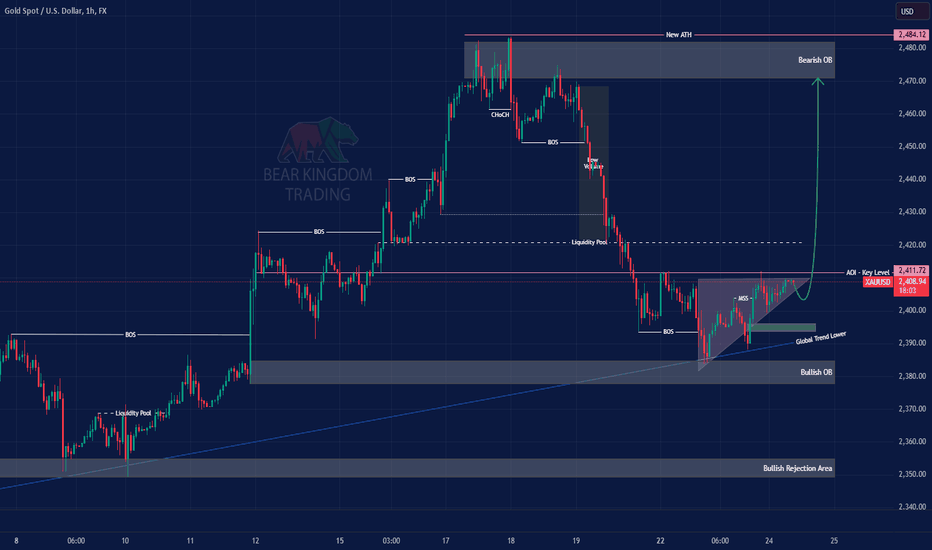

👑 Ideas For XAUUSD / GOLD 🕓 Time Frame: 1hr 🔼 Status: Cautiously Bullish 📆 25/07/2024 Overview : Gold has reacted perfectly to the 2390-2400 area, forming a false breakdown followed by growth to 2420. However, the current extremely low volatility is concerning, suggesting a potential major move could be imminent. Key Observations: False Breakdown: Gold formed a false breakdown in the 2390-2400 area before rising to 2420. Low Volatility: The current market exhibits very low volatility, often a precursor to a significant move. Bullish on D1: The daily timeframe (D1) remains bullish for gold. Dollar Index: The dollar index is showing signs of potential decline in the medium term. Economic Data to Watch: S&P PMI: Scheduled for 13:45 GMT. New Home Sales: Scheduled for 14:00 GMT. These data releases could provide the necessary momentum to revitalize the market, depending on the actual numbers. Technical Analysis: Resistance Levels: 2420, 2430, 2450 Support Levels: 2405, 2400, 2392 Potential Scenarios: Bullish Continuation: If the bulls hold above 2400-2405, we could see a continuation of the upward trend towards 2430-2450. Retest of Liquidity Area: A possible retest of the liquidity area before a subsequent bull run. Bearish Impulse: Although there are no current preconditions, a break in structure could result in a strong downward impulse to 2370. Conclusion : Gold's price is gradually updating the highs and forming clear support zones. While the potential for a bullish continuation exists if the bulls defend the 2400-2405 area, traders should be cautious of the low volatility, which could lead to a significant movement in either direction.

BearKingdomTrading

👑 #XAUUSD (GOLD / U.S. Dollar) 🕓 Time Frame : 1H 🔼 Status : Bullish 📆 24/07/2024 📈 False Break of Bullish Range Support Analysis: Gold (XAUUSD) is currently forming a false breakdown of the previously mentioned range between 2390 and 2400. A return to the buying zone is developing, suggesting that buyers might push the price up to 2450. Key Observations: False Breakdown: Gold is experiencing a false breakdown of the support range between 2390 and 2400. Reversal Swing Pattern: A reversal swing pattern is forming around the support level, indicating strong buyer activity. Fundamental Background: The market remains unstable due to factors like the Fed's actions, the US presidential race, and geopolitical tensions in the Middle East and Eastern Europe. However, these factors are relatively stable today, allowing technical analysis to guide predictions. Technical Outlook: Support: The bulls need to defend the 2400-2405 range to maintain the potential for an upward movement. Medium-Term Target: If the bulls hold this level, an upward move towards local liquidity zones and the upper boundary of the range is expected. Resistance Levels: 2405 2412 2420 Support Levels: 2400 2392 Conclusion: The current market confirms the presence of the range. While a downward move is not entirely ruled out, the bulls' active defense of the lower boundary suggests a bullish outlook for the short and medium term.

BearKingdomTrading

👨🦳 #BTCUSD (Bitcoin) 🕓 Time Frame: Weekly (Logarithmic) 🔼 Status: Bullish 📆 22/07/2024 Analysis: As anticipated, Bitcoin (#BTCUSD) has successfully reached its next target of $67,700! This analysis has provided returns of over 25% so far. The upcoming targets are $72,000, $73,777, and $77,000. Key Observations: Current Price Achievement: Bitcoin has hit the target of $67,700. Overall Returns: The analysis has yielded over 25% returns. Future Targets: $72,000: Immediate next target. $73,777: Subsequent target. $77,000: Long-term bullish target. Conclusion: Bitcoin continues to show strong bullish momentum with significant price targets ahead. The upcoming levels to watch are $72,000, $73,777, and $77,000, suggesting further potential gains.

BearKingdomTrading

👑 Ideas for XAUUSD / GOLD 📈 GOLD Correction after the rally: Bears still dominate 📈 The fight for 2365. Can we get to 2400? 🔽 Status: Bearish 📆 11/07/2024 Analysis: Gold (XAUUSD) is currently testing the $2350 level, gathering liquidity below this zone. Bulls are actively defending this key area, and the overall outlook appears promising. However, market dynamics remain uncertain due to Federal Reserve Chairman Jerome Powell's upcoming speech, ahead of the Consumer Price Index (CPI) and Producer Price Index (PPI) releases. Key Observations: Bullish Defense: Bulls are holding the price above $2350, showing bullish dynamics. Consolidation: Gold is consolidating above the key level of $2365 and testing the liquidity area between $2375 and $2380. Potential Breakout : A breakout and consolidation above this area could further strengthen the price, with targets at $2387 and potentially reaching $2400. Resistance Levels: 2373 2380 Support Levels: 2365 2355 2350 Conclusion: While a short-term bounce to the downside is possible, consolidation above the key zones could form an interim bottom for the bulls. The market's reaction to Powell's comments and upcoming economic data will be crucial in determining the next direction for gold prices.

BearKingdomTrading

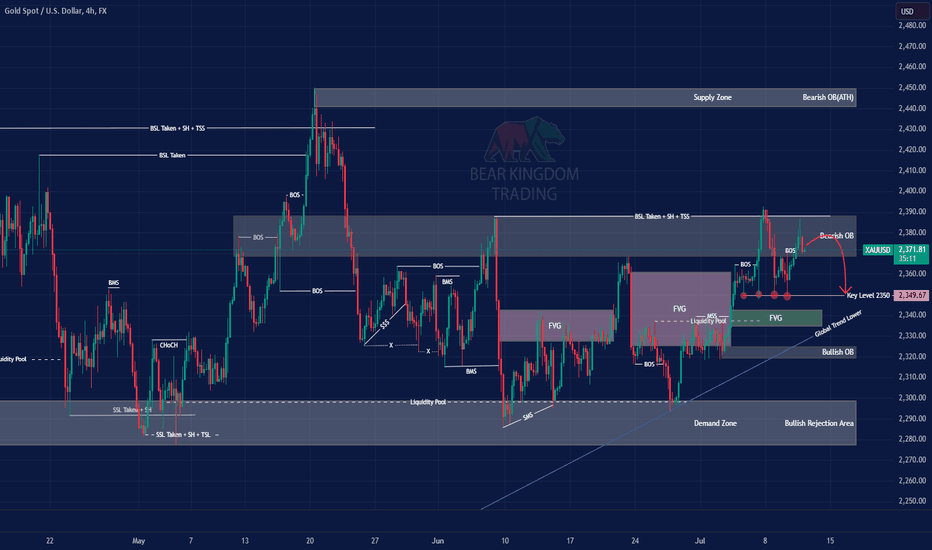

👑 Ideas For XAUUSD / GOLD 🕓 Time Frame : 4hr 🔼 Status : Neutral/Bullish 📆 10.07.2024 Gold is currently trading within an ascending channel, but traders are actively selling off all of Friday's bullish momentum. The key level to watch is the resistance at 2365, where bears are currently holding the market. Market Context: Dollar Movement: The dollar has stabilized amid anticipated comments from Fed Chair Jerome Powell, as well as upcoming CPI and PPI data releases on Thursday and Friday. Fundamental Background: Currently neutral, leading gold to enter a correction phase, testing the liquidity area around 2350. Key Levels: Resistance: 2365, 2387 Support : 2358, 2350, 2341 Scenarios: Bearish Scenario: If sellers maintain control at 2365 and prevent the price from rising above this level, a decline to 2350 and 2341 is likely. Further downside could see the price reaching 2325. Bullish Scenario: If buyers can form a consolidation above 2365, it will open up a channel towards the upper boundary at 2387. This could lead to a move up to 2375-2385. Strategy Given the current market instability and the battle between bullish and bearish participants at the key resistance level, two scenarios are possible. Prioritize a small bounce from 2365, a resistance retest, and a potential breakout with bullish momentum towards 2375-2385. Summary Focus on the 2365 level. The outcome of the struggle at this resistance will dictate the next significant move for gold. Watch for Powell's comments and the CPI and PPI data, which could heavily influence market sentiment and direction.Target reached on the bullish move to the 2390 area. Gold bounced immediately. watch for more bearish pressure.

BearKingdomTrading

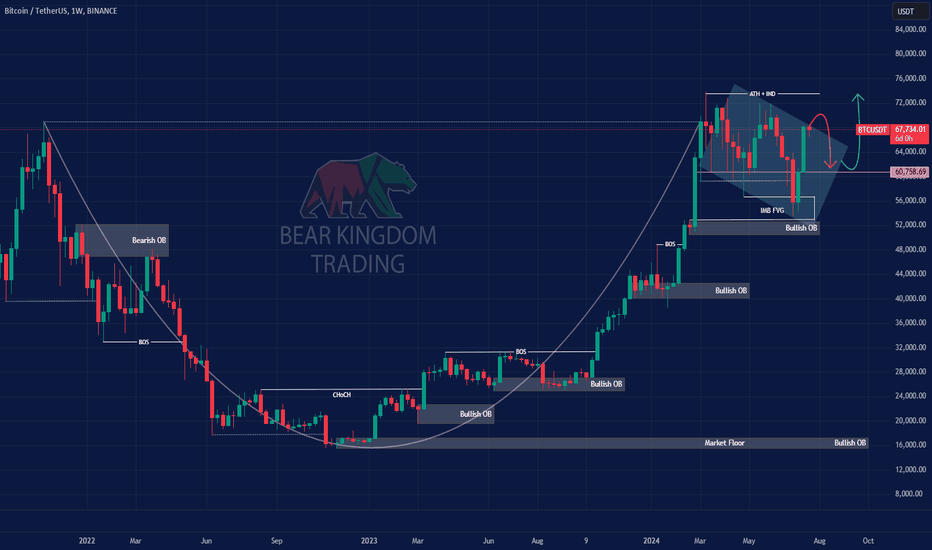

👨🦳 #BTCUSD (BITCOIN) 🕓 Time Frame: Weekly (Log) 🔼 Status: Bullish 📆 09.07.2024 Bitcoin's Weekly Chart: FVG Filled, Potential for Further Growth if Support Holds Upon analyzing the #Bitcoin chart on the weekly timeframe, we observe that after two months, this cryptocurrency finally experienced a drop to fill its old Fair Value Gap (FVG). Interestingly, following this fill, the price managed to rise by 10%, moving from $53,500 to $58,300. Currently, Bitcoin is trading around $57,200. If it can hold above the support level of $50,500 to $53,500, further growth in price can be expected. Previous assumptions from the analysis remain valid. Keep an eye on these levels to gauge Bitcoin's next movements and potential bullish continuation.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.