BKEXFutures

@t_BKEXFutures

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BKEXFutures

BKEX Interpretation of cryptocurrency market on May 18, 2023

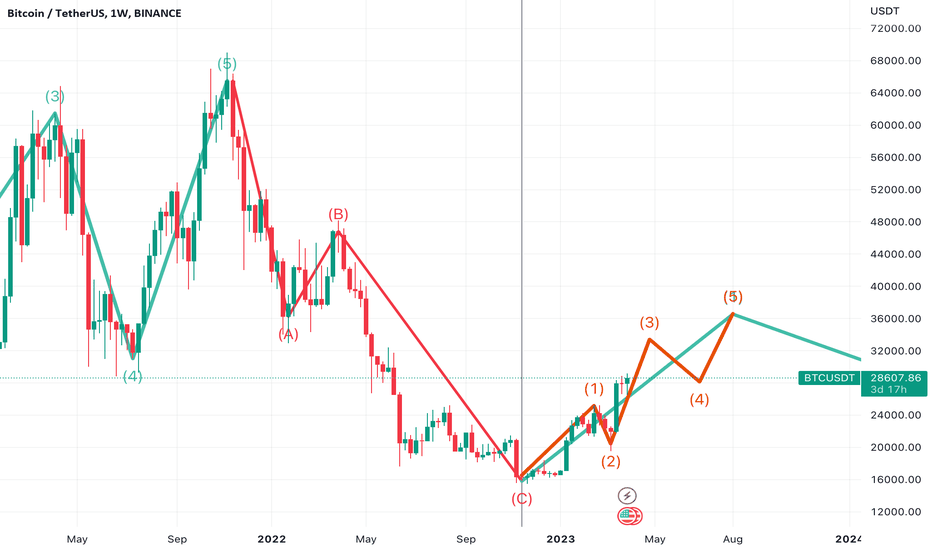

BKEX Interpretation of cryptocurrency market on May 18, 2023 According to the plan, LDO has reached the position of 2.4 to reduce positions. Conservative investors can continue to reduce their positions for each subsequent 10% rise. At 2.7 or above, all positions will be reduced. Aggressive investors can appropriately retain positions to play the new high market. Other altcoins that have not yet performed can wait patiently for rotation. Altcoins index is still hovering at a low level. The exchange rate repair market still needs to be in full swing. The varieties that have yet to rise significantly are worth looking forward to. The net inflow of ETH pledges has exceeded 1 million pieces. The market is starting to remove the previous valuation of extreme risks. Combined with the probability that the Federal Reserve will stop raising interest rates next month, the overall picture remains positive. This rise is defined as the last rise of a bullish wave, and it is inappropriate to chase the high entry. Please preserve your capital during the rise according to your risk appetite. While it is possible to miss a period of more significant profits in the FOMO by reducing your position too early, the risk will increase as the rally progresses. Under the premise that the market is not particularly bullish in the second half of the year, it is necessary to reduce positions out of the market in batches.

BKEXFutures

Interpretation of cryptocurrency market on May 12th, 2023

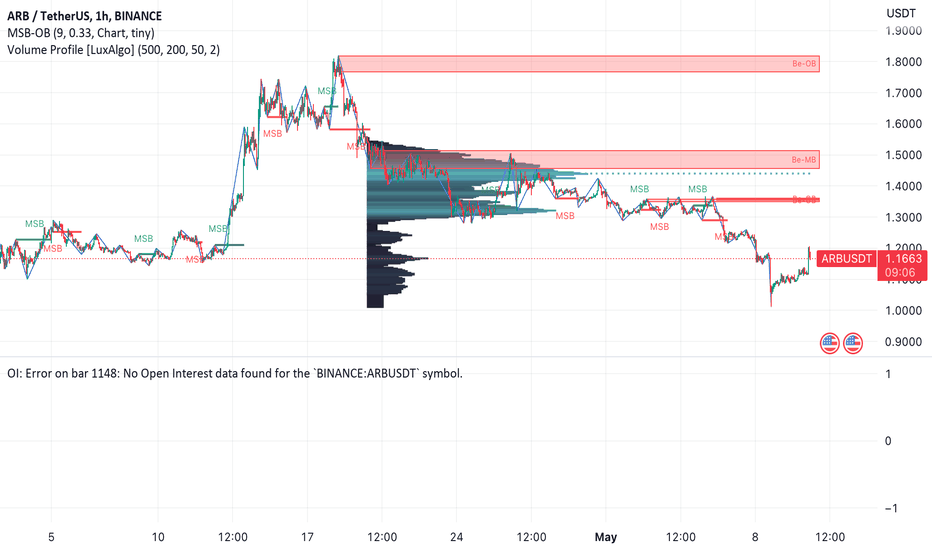

Interpretation of cryptocurrency market on May 12th, 2023 Mainstream coins continued to trade sideways yesterday as altcoins bottomed out. ETH pledges continued to rise at an accelerating rate. Since the Shanghai upgrade, there has been a net inflow of over 100,000 coins. With Memecoins continuing to heat up, the rise in gas fees has also seen a significant increase in pledge earnings. Favorable for ETH and the pledging circuit, but the market is still not speculating on this. The pressure and washout can also be seen yesterday in LDO's extreme move. After a quick breakdown to smash out the panic market, it rallied back to the weekend price. ARB spot low was slightly larger than 1USDT, but the contract pins smashed through 1 USDT. This also means that users who stopped out and blew their positions at the derivatives round number mark have been cleared. You can tell that the adjustment in altcoins is in place. The issue of exchange rates was also mentioned earlier. High-value altcoins have now reached the bottom range, both technically and fundamentally. Unless systemic risks bring down the overall valuation, the subsequent sustained rise is a probable event. And all that needs to be added to start this leg of the market is an opportunity. It could be a specific message or a significant rise in one of the leading tokens. But the follow-up, whether it's an exchange rate fix or favorable cashing in, is still seen as the last leg of the year's rally. The position reduction should still be done in batches during the rally.

BKEXFutures

Interpretation of cryptocurrency market on May 10th, 2023

Interpretation of cryptocurrency market on May 10th, 2023 Mainstream tokens continued to trade sideways yesterday as altcoins bottomed out. ETH pledges continued to rise at an accelerating rate. Since the Shanghai upgrade, there has been a net inflow of over 100,000 tokens. With Memecoins continuing to heat up, the rise in gas fees has also seen a significant surge in pledge earnings. Favorable for ETH and the pledging circuit, but the market is still not speculating on this. The pressure and washout can also be seen yesterday in LDO's extreme trend. After a quick breakdown to smash out the panic market, it rallied back to the weekend price. ARB was slightly larger than 1 USDT, but the derivatives pins smashed through 1 USDT. This also means that users who stopped out and blew their positions at the derivatives round number mark have been cleared. We can tell that the adjustment in altcoins is in place. The issue of exchange rates was also mentioned earlier. High-value altcoins have now reached the bottom range, both technically and fundamentally. Unless systemic risks bring down the overall valuation, the subsequent sustained rise is a probable event. And all that needs to be added to start this leg of the market is an opportunity. It could be a specific message or a significant rise in one of the leading tokens. But the follow-up, whether it's an exchange rate fix or favorable cashing in, is still seen as the last leg of the year's rally. The position reduction should still be done in batches during the rally.

BKEXFutures

Interpretation of cryptocurrency market on May 4th, 2023

Interpretation of cryptocurrency market on May 4th, 2023 During the holiday period, the market generally remained on a shaking trend. The 25 basis point rate hike had long been priced into the market and did not bring about a trend selection. Powell then revealed several messages in his speech. Firstly, this rate hike is mainly sure to be the last. Secondly, the market had begun to expect a 100 basis point rate cut by the end of this year, a view that Powell refuted. But then went on to predict that the economy would grow at a moderate pace, not a recession. This statement can be interpreted to mean that a recession is still a possibility for the economy. But after a downturn occurs, the Fed will step in to save it. In addition, the view that the debt ceiling must be raised as soon as possible to avoid a default and that the banking sector remains sound was also mentioned. Overall, the situation is under control. A severe crisis (a default on US debt) will not happen. The impact of a bank crash and collapse is also within manageable limits. Any panic about systemic risk can be interpreted as an opportunity to undercut for the time being. The recession probability is high, but a recession will mainly affect US stocks, not crypto. Even the recession has a more positive component for crypto. During the holiday season, many cottage coins are traded lightly. This situation is prone to pinning and means that the choice of direction is getting closer. Just continue to be optimistic. Rate cut expectations, and a pick up in ETH pledges are still likely to be speculative themes.

BKEXFutures

Interpretation of cryptocurrency market on April 19, 2023

The market was still largely shaky yesterday. The ETH pledge rate started to pick up. The chain is also seeing accelerated growth in continuous operations for pledged vouchers. The market is still up, and the current position is unlikely to be the highest of the year.This hedging behavior will create a lot of liquidity in the short term and drive the market higher. However, because of the overlay of leverage, it is a stampede to liquidation once the game is over. At the moment, this play is just raising its head, and if it can be followed up on a larger scale, the final rise, top, and fall of the current round will be accompanied by a faster pace.As previously judged for the second half of the market, a sizable market should surge higher on FOMO sentiment and end abruptly. On the contrary, the current market sentiment still needs to be hotter.

BKEXFutures

Interpretation of cryptocurrency market on April 18th, 2023

Yesterday's market maintained a high level of oscillation. The main point of concern this month can already be shifted from economic data to the change in ETH pledge rate, ETH unpledged withdrawals have now declined after a significant increase on the 15th, and 16th.From the withdrawal data, profit withdrawals account for the vast majority of withdrawals, and there are fewer cases where all withdrawals are canceled for verifier status. Moreover, the market has remained stable or even rebounded under the huge selling pressure. Although the subsequent selling pressure will always exist, the point of maximum pressure has already passed. The market will not wait for the selling pressure to be completely digested before it takes off, and the rise will appear earlier than most people expect.In addition to this, the pledging track is fragile except for RPL, but the significant growth in pledging volume is real again. The market is always anti-human nature, also as during the WEB3 conference in Hong Kong, the cottage continued to be in the doldrums. When investors abandoned the altcoins to hold BTC, the cottage's markets came, so don't blindly change the weak varieties to solid varieties.The research institute's operating strategy also involves this, it will only sell the strong varieties to replace the weak varieties and will not operate in reverse, at present is even more so since the Shanghai upgrade landing, the Layers2 plate has been a small performance, after the break, the follow-up may still rotate, while the direct benefit of the pledge track is very quiet, there is also a greater probability that will be in the investors can not resist replacing varieties after the pull-up.In general, at present still have to hold patiently, have pulled up before considering reducing the position to leave, and because the risk of doing more is currently rising, reduce the position out of the funds, for the time being, no longer do input, if the subsequent market appears unexpectedly down, this part of the funds will only work.

BKEXFutures

Interpretation of cryptocurrency market on April 3rd, 2023

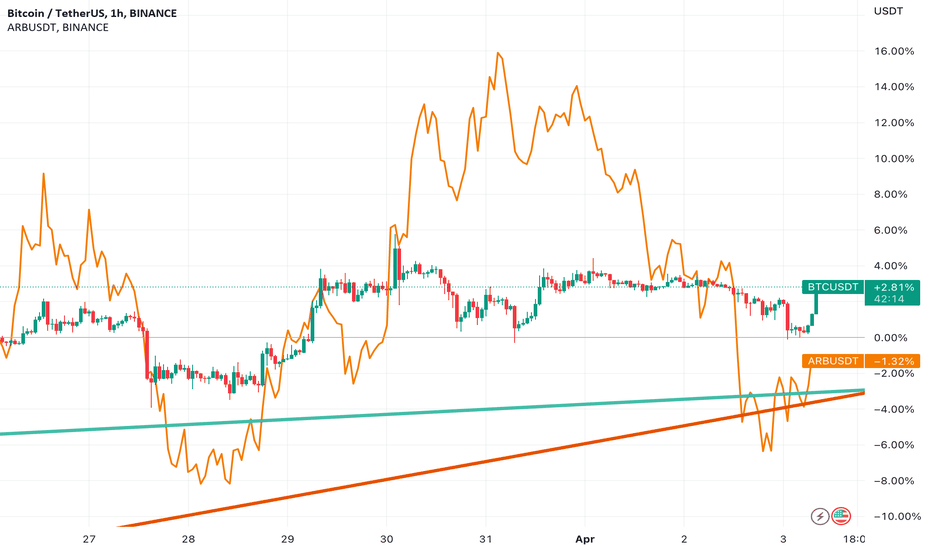

The market was relatively stable over the weekend. The ARB team's actions caused their tokens to crash and somewhat shocked the market.The incident stemmed from the first community governance (AIP-1) vote on a proposal to transfer 750 million ARBs from the Arbitrum Foundation after the ARB token offering. However, users discovered that the Foundation had already transferred this token amount before the vote. The Arbitrum Foundation said that the proposal was only a request for community approval of the Foundation's proposal, not a recommendation. So far, the proposal has been voted down by over 70% of users.The impact of this is that if holding governance tokens does not effectively govern the project, the value of governance tokens will be questionable. Most altcoins are governance tokens, so ARB has also dropped several altcoins.The story has now entered a new phase. Arbitrum Foundation has been under pressure from the community to re-initiate a bespoke voting scheme, splitting AIP-1 into more granular matters. The split into multiple, more granular matters for voting explains some of the misunderstandings among investors. For example, the token allocation pie chart was not classified in detail.April remains a bullish month. In addition to a new round of macro data, which was limitedly positive, the positive pulled straight up. There is also the Shanghai upgrade and the Hong Kong conference, and other opportunities within the industry can speculate on the heat. Just continue to be optimistic. Waiting for the realization of the market appeared.

BKEXFutures

Interpretation of cryptocurrency market on March 30, 2023

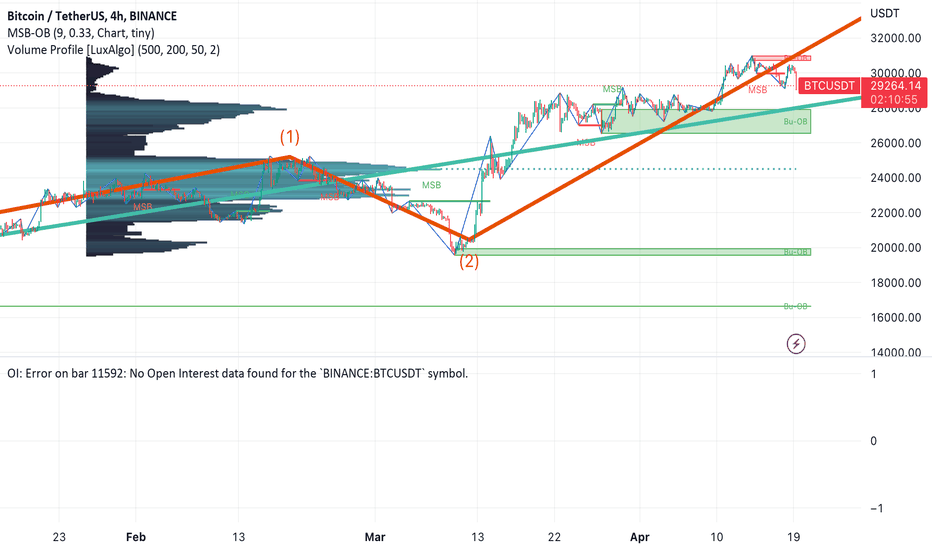

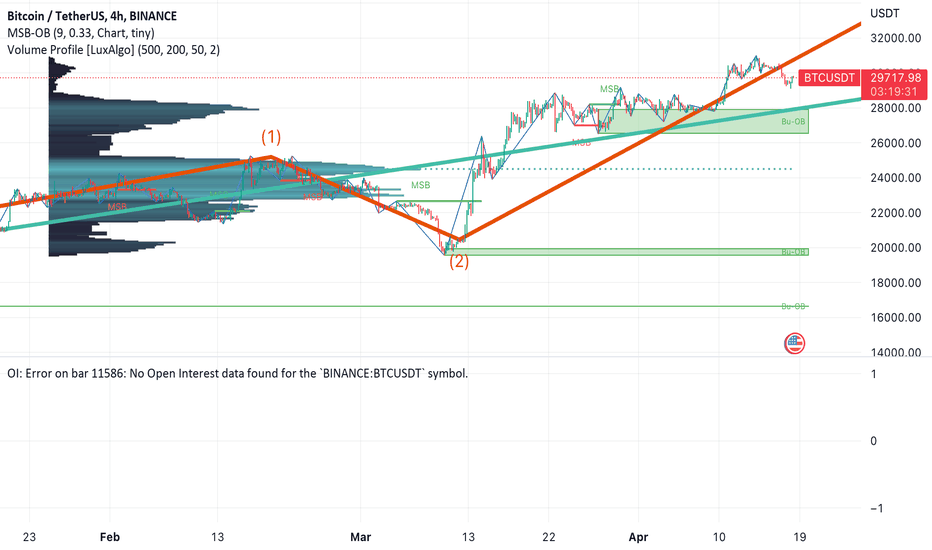

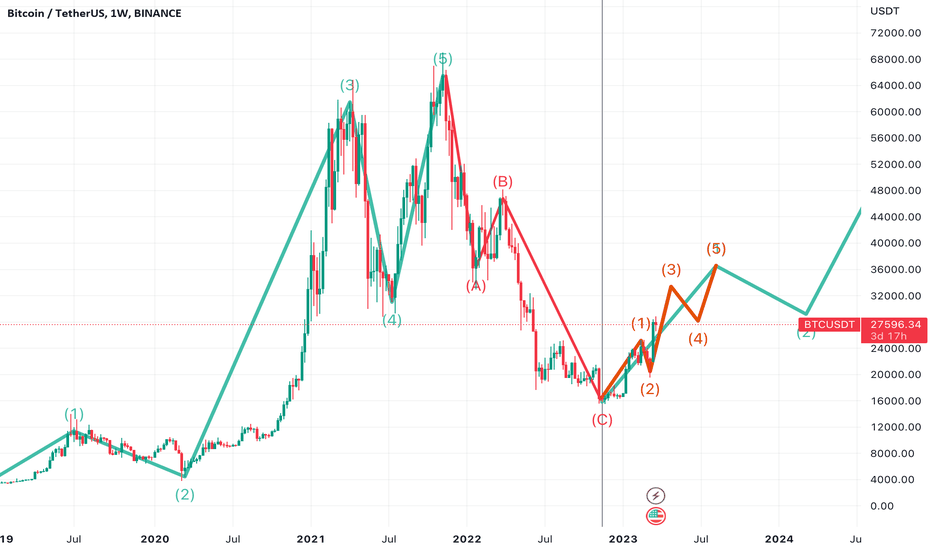

Yesterday Powell mentioned in a private meeting with US lawmakers that he expects to raise interest rates again this year. As we have analyzed this before, it makes little difference whether the interest rate pole is 5% or 5.25%. Whether the rate hike stops in May or June and whether the second half of the year or next year starts with a rate cut. Apart from the difference in timing, there will be no other variables.The following economic data will have less impact than what has come before. Tonight's unemployment benefits and tomorrow night's PCE data will only require short-term traders to properly hedge against the unusual volatility that may arise around 8:30. Because there is no rate resolution in April, the impact of the data will be even weaker. And the main weakness is the impact of the positive.The bearishness will not bring about a more significant rate hike. Still, the good (unemployment rising, inflation falling more than expected as good) may make the last rate hike expected to disappear as well as open the rate cut faster, allowing the rise to come earlier.This judgment on the April market is event-driven by the Shanghai upgrade. Like ETH 2.0 last year, ETH drove a general rise in cottage coins. It also aligns with the rotation market that should occur after BTC leads and the altcoins index is highly depressed. The a specific need to pay attention to the landing of the Shanghai upgrade. If it is delayed, it is okay. What is destined to happen, and there is a possibility of overlaying the halt in interest rate hikes. Under the stimulation of the double good, the pull-up will only be more robust.

BKEXFutures

Interpretation of cryptocurrency market on March 29, 2023

The market rallied yesterday, with the vast majority recovering from the decline caused by Binance' negative trend. The market is still stable, and worrying too much is unnecessary.Unemployment data and PCE data follow this week. Although the impact of the economic data has been reduced against the backdrop of the banking crisis, it may still bring short-term volatility. Short-term operation friends can pay due attention to avoid these periods and hold a long period of the position directly ignored. The only thing to do is wait patiently to realize medium and long-term positions.

BKEXFutures

Interpretation of cryptocurrency market on March 23, 2023

This morning, the Federal Reserve raised interest rates by 0.25%. In a subsequent speech, Powell mentioned that he would not consider lowering interest rates this year and continued to maintain the 2% inflation target and other hawkish remarks. But he also released positive signals. For example, it no longer mentions continued rate hikes are appropriate for this matter but changed to "some additional tightening policy may be appropriate." The market was also interpreted as a hint of a pause in interest rate hikes in May. This result has been expected, and the market is also according to the optimistic interpretation. The Nasdaq was rallying during Will's speech. The overall performance of crypto was oscillating.But then it fell, and bank stocks led the decline. Former Fed Chair Yellen caused the drop. Yellen said the Treasury was not considering or proceeding to expand deposit insurance unilaterally. Likely, the current banking crisis is not as severe as it seems, so there is no need. However, the market interpreted it as positive, and the Nasdaq and crypto turned it down.In contrast, the Federal Reserve's policy makes more sense because the banking crisis will also ease with the cessation of interest rate hikes and rate cuts. The premise is that if the problem does not continue to worsen for the time being, it is also premature to carry out too much policy assistance. The cessation of interest rate hikes and rate cuts is destined to happen, and last night also deepened this market judgment.Does the interest rate curve stop rising at 5% or 5.25%? Precisely at what month it starts to twist downward is no longer particularly important as long as the eventual trend can be broadly consistent with the chart, not so high as to appear to go sideways for six months. Or continues to remain up such an exaggerated error, the established judgment does not need to change - still bullish on the market.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.