BITRAF_CRYPTO

@t_BITRAF_CRYPTO

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BITRAF_CRYPTO

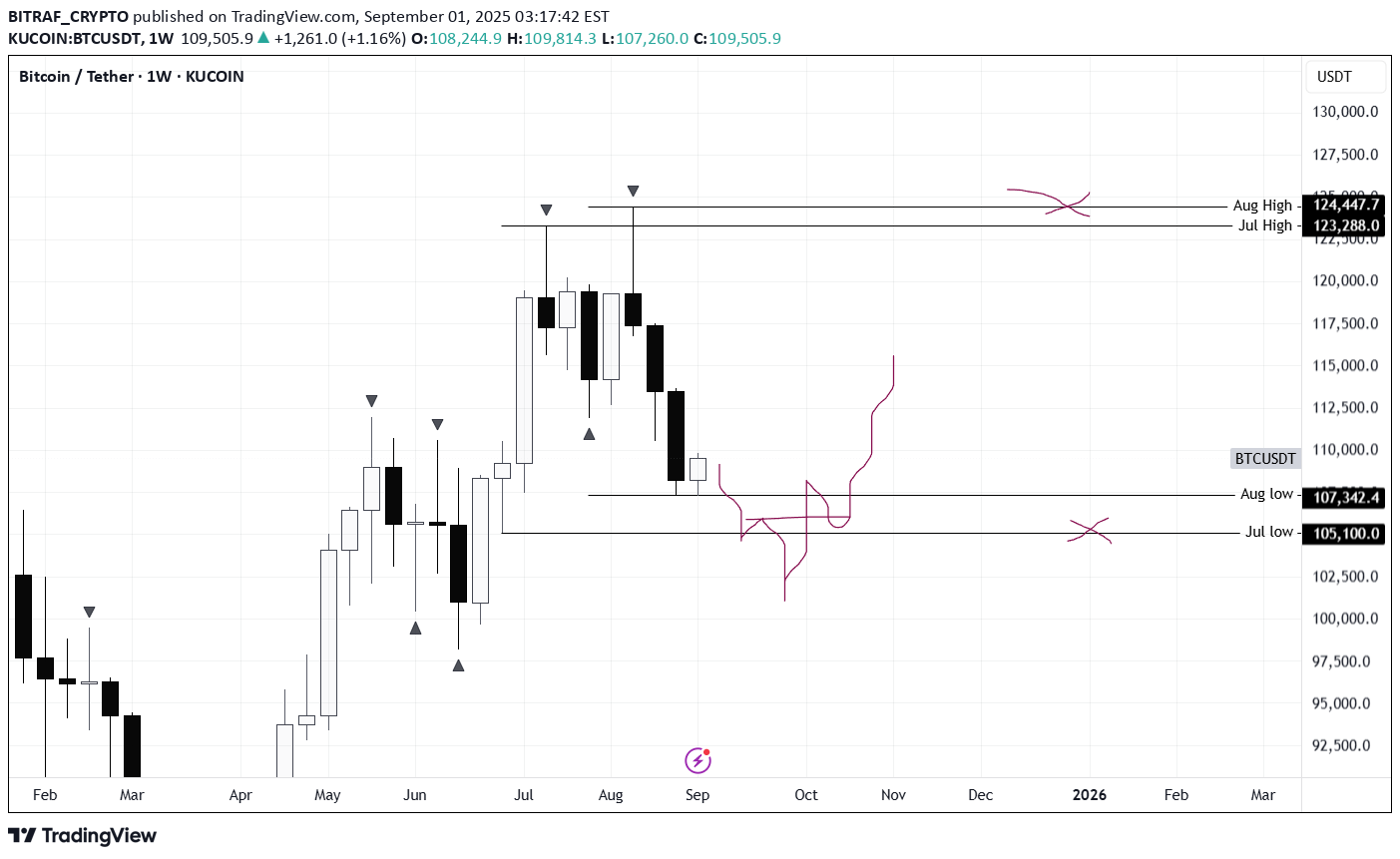

فرصت طلایی خرید بیت کوین در این ناحیه: سیگنال ورود بلندمدت BTC/USDT

Following the OTE pullback, price has corrected into the discount zone. If the market provides proper confirmation signals, this area may offer valid long opportunities.

BITRAF_CRYPTO

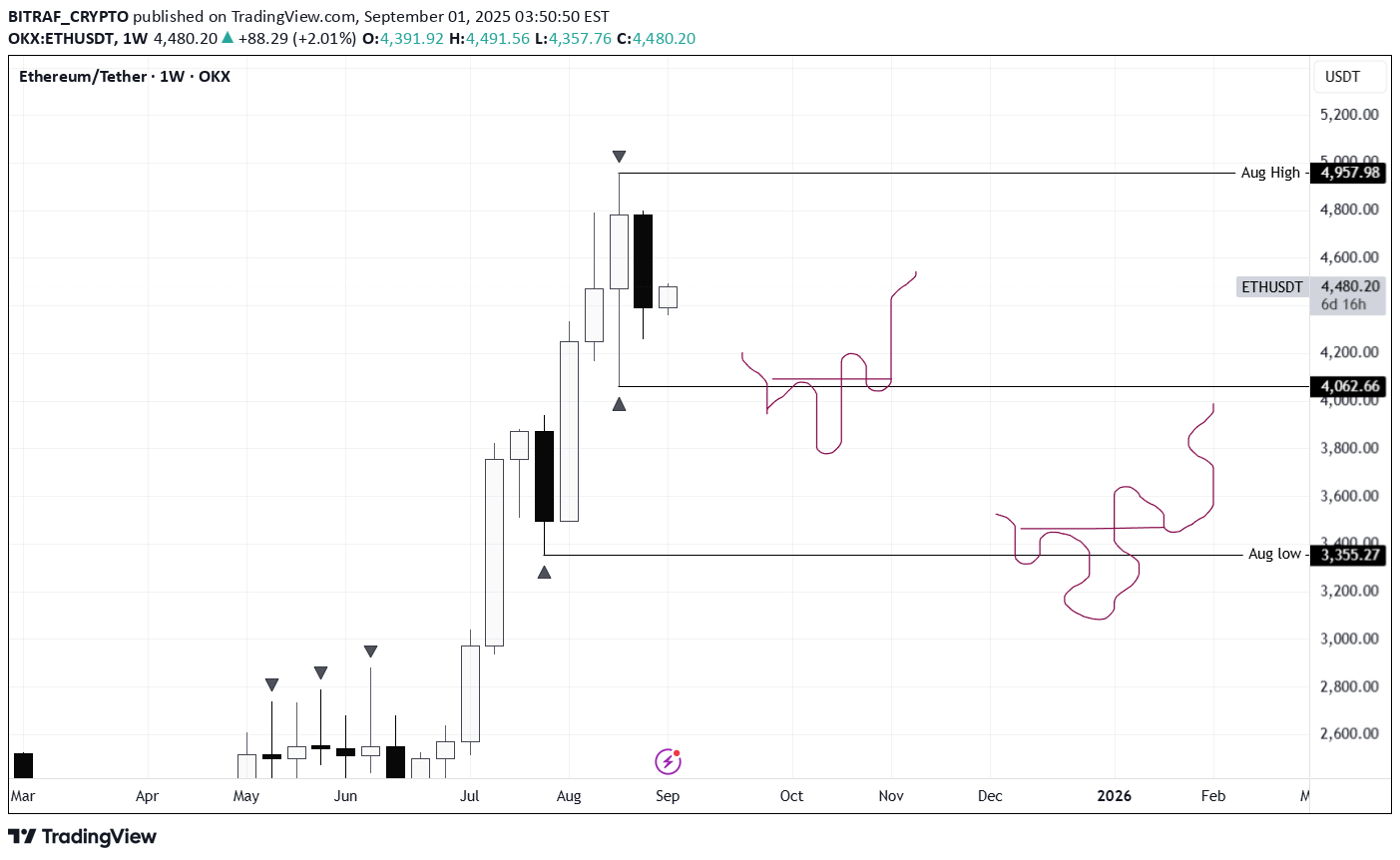

تحلیل تکنیکال اتریوم (ETH/USDT): فرصت خرید زیر مرز حیاتی؛ منتظر تأیید نهایی!

ETH remains in a broad consolidation phase. Price has now reached the lower boundary of the range, bringing the market into a potential long setup zone — but only if proper confirmation signals are present. As always, patience and validation of conditions are key before considering any long entries.

BITRAF_CRYPTO

تحلیل تکنیکال اتریوم (ETH/USDT): منتظر شکست کدام محدوده برای استراتژی بعدی؟

BITRAF_CRYPTO

بیت کوین در آستانه فتح قله ۱۲۶ هزار دلار: آیا روند صعودی ادامه مییابد؟

The global trend remains bullish, while price action is currently consolidating locally. A break and sustained hold above the 126K ATH would confirm a potential continuation of the uptrend, but only if supported by favorable market conditions.

BITRAF_CRYPTO

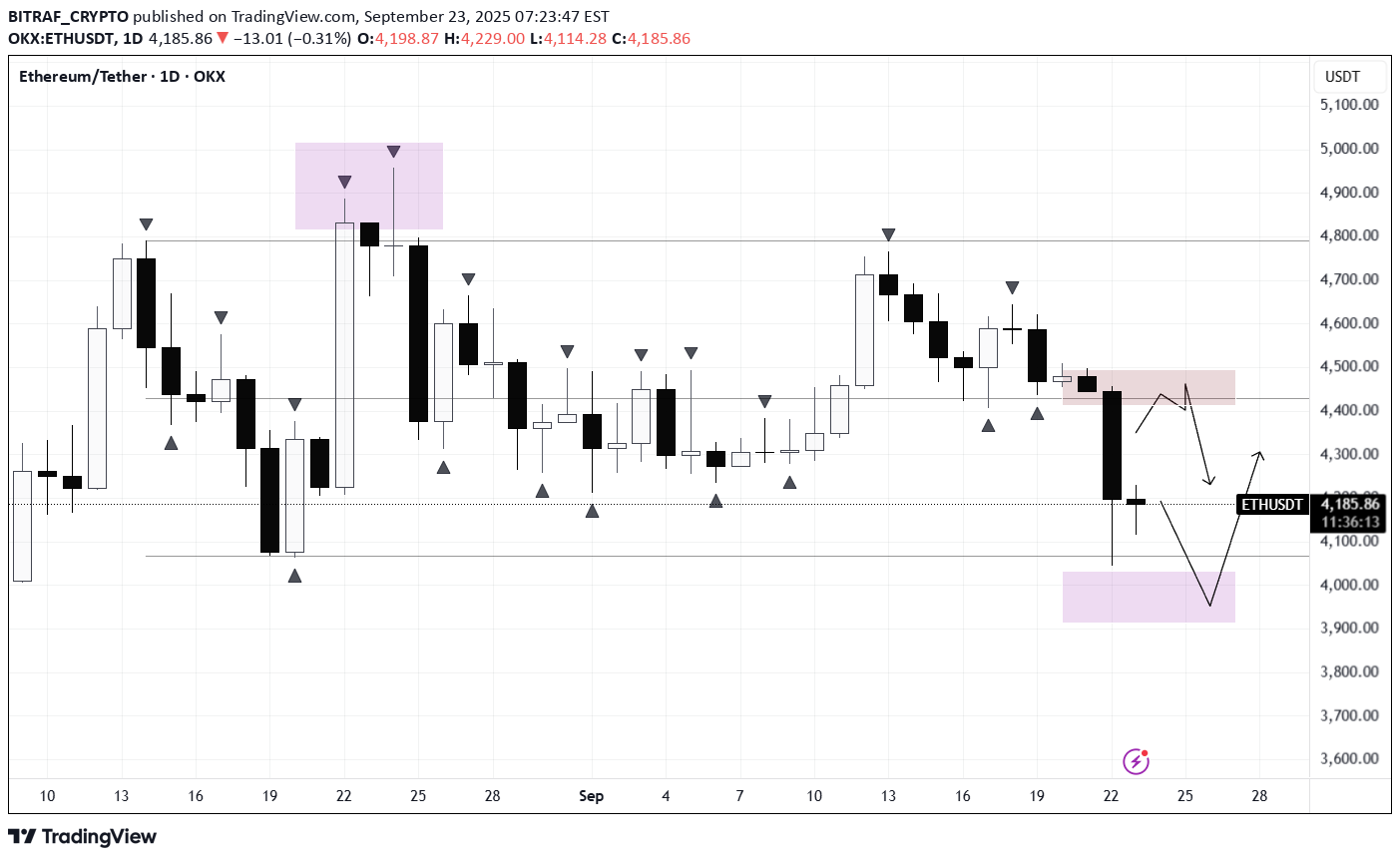

ETH/USDT

Currently trading in a local consolidation, moving within its range expansion. After a deviation below the range low, long setups can be considered — but only if confirmation conditions are met. Potential short opportunities may appear in the 4400–4500 zone, again only with proper confirmations.

BITRAF_CRYPTO

ETH/USDT

I’m watching for a potential correction into the 4300–4400 zone. 📈 Bullish Scenario (Preferred): If price corrects into 4300–4400, I’ll look for confirmation signals to enter long. Upside targets: 5000–5200. ✅ Plan: No longs without confirmation.

BITRAF_CRYPTO

AVAX/USDT

AVAX is currently consolidating, and I’m keeping an eye on a potential correction into the 25–28 range. 📈 Bullish Scenario (Preferred): If price taps into one of the highlighted zones (25–28), I’ll look for confirmation signals to enter long. Target zones to the upside: 35–45. ⚠️ Alternative Scenario: Price may continue its rally directly toward 35–45 without a deep correction. ✅ Plan: Wait for confirmation before taking any long positions.

BITRAF_CRYPTO

ETH/USDT

Similar to BTC, September isn’t historically the strongest month. For further upside, we’d like to see liquidity taken in the 4000–3355 zone. Long setups only after clear confirmation.

BITRAF_CRYPTO

BTC/USDT

Historically, September tends to be a “red” month for Bitcoin. We’ve already seen liquidity taken from the July high, and the August low has also been swept. For further upside, a clean sweep of the July low would be ideal. Long setups only after clear confirmation.

BITRAF_CRYPTO

AVAX/USDT

AVAX remains in consolidation both locally and on the higher timeframe. A weekly FVG has been marked as a potential reaction zone, which would also align with a deviation below the range. Entries only after confirmation on lower timeframes.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.