AbInvestments

@t_AbInvestments

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

AbInvestments

*Updated XRP 30m Analysis 06/12

Analysis: To start this analysis off lets make it clear, XRP WILL long term reach $1000+, I am extremely confident that the use case and real world utility outweigh how undervalued the currency right now. Following on from yesterdays analysis. We could be seeing some consolidation within this zone which I have marked. Firstly taking a deeper look into internal structure, We can see that price appears to be creating HL and HH which indicate a iBOS and also potentially iCHoCH. The confluences I'm looking for next would be a HL once again, followed by a HH. However taking into account the overall short term trend, we are bearish as this is just a correction for price and If it was to come down to the M30 Swing low or even better the Supply zone I've marked I will be looking to add more long positions at this level. To consider: INTERNAL Break of Structure If price creates LL below M30 Low If price creates HL internal structure FOMO and Paper hands

AbInvestments

XRP 30m Analysis 06/12

Analysis: This is just a correction!!! Don't sell XRP under $5. Currently we can see that price has pulled back and has changed character into a temporary downtrend. I would assume this is due to people selling their XRP and securing profits due to lack of knowledge or confidence within XRP. It appears internally to be creating LL and LH. The current swing high and low are indicating the potential next moves: HH - If the next move is a HH we will be waiting for a HL confirmation before taking out $3+ LL - If the next move is a LL we will be looking for long positions within our Supply zone around the $2 area. As always XRP is the best crypto available to invest in and whilst its as cheap as it is now it will not be this price forever. To consider: Pullback FOMO News and Speculation

AbInvestments

ETH 30m 06/12

Analysis: Following on from yesterdays analysis we can see that price has respected our 3 zones, if you scale into the 5m chart you'll see more info for the one big candle you can see which is covering the entire swings high and low. Lets look at the three areas of interest and break it down further: Respected Supply Zone - We can see that price came perfectly into this zone which we identified would indicate a good opportunity for long positions. Sweet Spot - Price wicked into the Supply zone which is now respected and even closed above this zone, absolute pin point entry. FVG - Price closed within this zone which means this is also a great area to take long positions. We have not yet had a close below this zone. I would expect to see price either consolidate between the FVG and the Swing High however if not I would expect it to jump past M30 Swing High in very few candles. To consider: Currently within ATH range Bull run Cycle Crypto news and speculation FOMOAs predicted, we can see that price has flew past the M30 Swing High in few candles. Price reacted as described, consolidating a little before taking off!

AbInvestments

100K+ BTC 30m ANALYSIS 06/12

Analysis: Historical day for BTC, smashing the 100k. I strongly believe all of December we will see BTC fly to $110K+. In the analysis I've identified a great potential long position I will be looking to take if price comes back into my supply zone , respects and closes inside or above the SR . This is a great 1:6RR and even in the event price does create a LL below M30 Swing Low I will be looking for more long positions with the same target of M30 Swing High . If the move is successful I would suggest it will tap our supply zone and should fill the entire position within very few candles. To consider: $100K+ FOMO M30 Swing is LL Trump and News Speculation

AbInvestments

ETH 30m ANALYSIS 04/12

Analysis: ETH is looking extremely bullish and will continue pushing. We are expecting a pullback and I think it will come back towards the supply zone which I have labelled. If price respects the FVG I will be looking for long positions at both FVG and also supply. I even think the sweet spot could be a great opportunity to grab a long position. To consider: Bull Run ATH + Still pushing Crypto Regulation near Pullback imminent

AbInvestments

BTC 30m ANALYSIS 04/12

Analysis: Inside of the M30 Swing highs and lows we have noticed an internal change of character. Price was creating LH + LL. Now we can see its broken out of this pattern and is creating HH + HL, keep in mind this is still LH in relation to the M30 swing High. This could just be a correction. Overall I think this would be a great opportunity to Buy because as we are approaching $100K fomo will set in and crypto speculation and regulation nearing will set this off the charts. I think long term we can expect to see BTC $250k+ before 2030. I've used the potential area of resistance as TP1 and secured partial profits however now I'm closely watching to see if we will break out of this uptrend and potentially see a LL. To consider: Almost $100K FOMO Crypto Regulation Near Pullback or Bearish trend?

AbInvestments

XRP ANALYSIS 04/12

Analysis: I've identified the M15 Swings, both high and low and this can help us see the general range we're currently trading in. For a quick scalp I would be looking to target the M15 High. I will be looking for an entry either in the area of support if we see another touch, however if we continue further towards the M15 Low I will look to gain an even better position. Long term, I will always be bullish so I would never look for sells IMO as this can moon anytime. To consider: FOMO Real World Utility Jan 20th Speculation (Bye Bye Gary) Price consolidating

AbInvestments

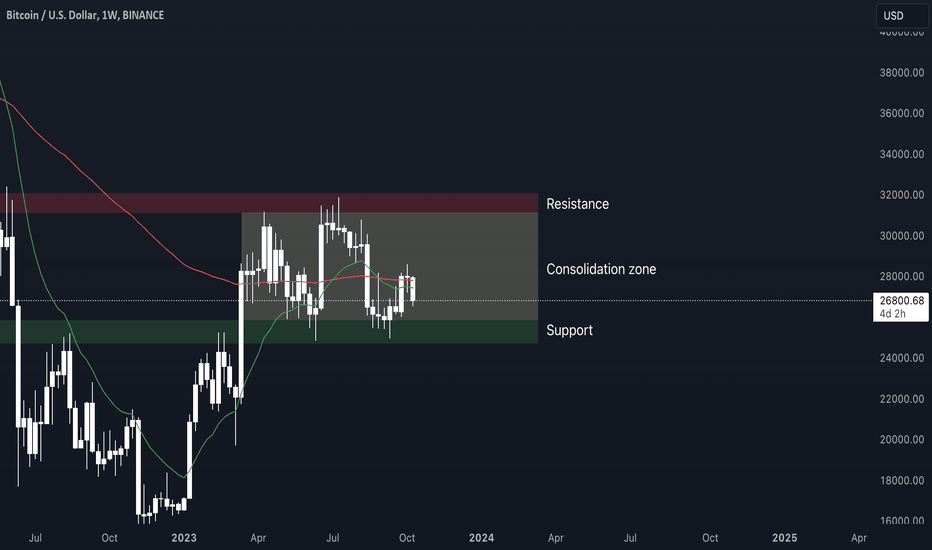

BTC WEEKLY ANALYSIS 11/10

Analysis: Looking at the weekly chart, I would say it's too early to find an entry whilst price is still consolidating. Once we can see price breaking out of zone we can look for a retest confirmation. To consider: Overall history is very bullish. Currently in bear market. Crypto regulation nearing. SMA crossing but no clear indication.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.