Technical analysis by Strateg_ about Symbol ETH: Buy recommendation (12/24/2025)

Strateg_

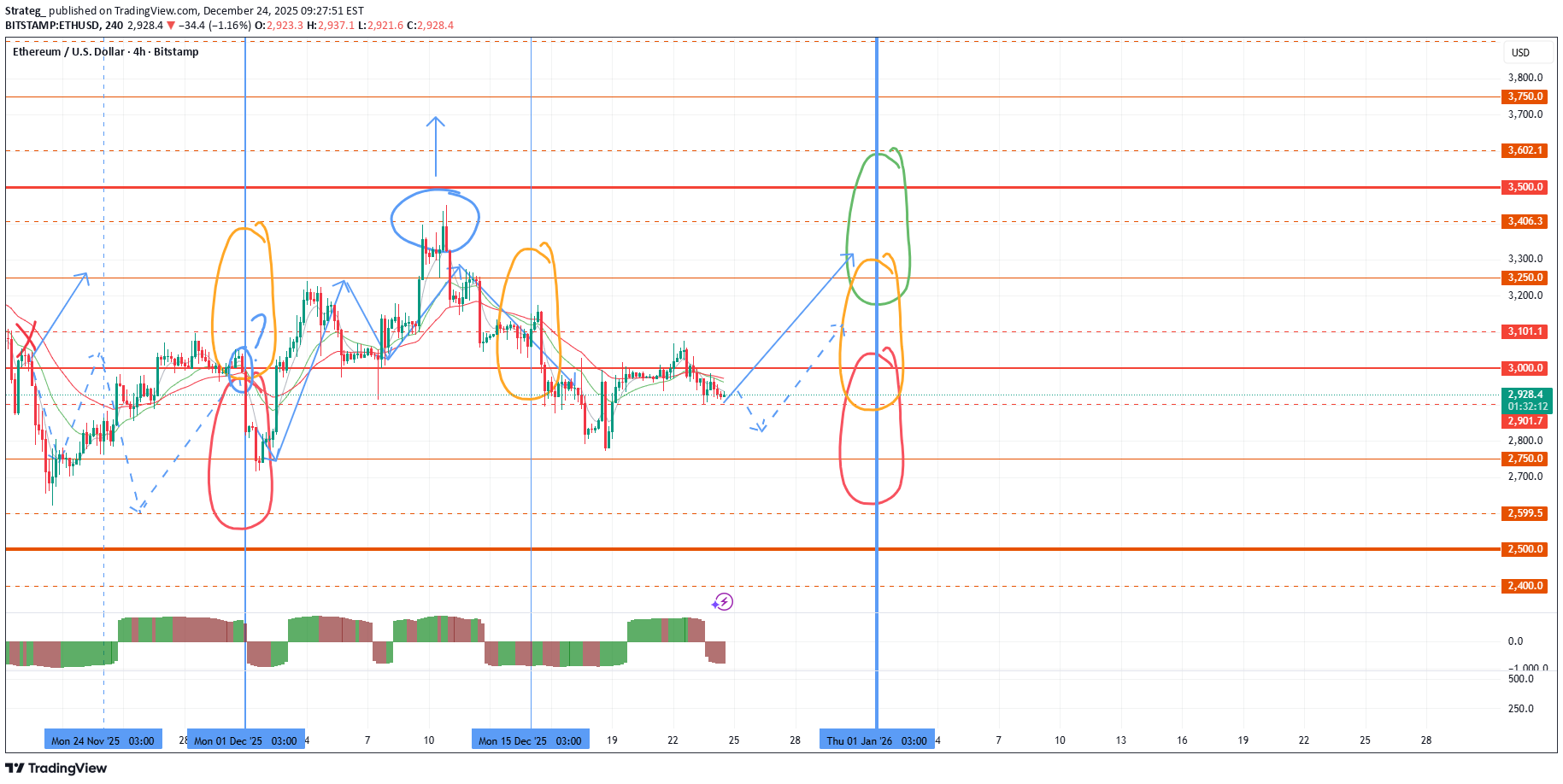

Maintaining purchases at the turn of the year

The market has perfectly worked out the scenario outlined in the last review, and buyer activity is growing. We are approaching the end of the year, and we will consider the near-term prospects. On average, the market consolidated in anticipation of determining the opening level of a new annual candle for ETH and BTC. As I expected, ETH opened the second half of the month in the neutral zone, which smooths out sales. There is also a strong bullish signal for a retest of 3500. BTC has reached strong medium-term support around 85k, from which the probability of a rollback to a retest of 100k prevails, which I described in the last review. We have already seen one pullback, but there is still a possibility of an attempt to break through 100k after the opening of a new annual candle. Against the background of preparations for a new wave of purchases at the beginning of the year and the struggle for the closing level of the year, the probability of a new test of the range of 3100-3500 ETH prevails. A pullback in brent with consolidation above $ 60 also inspires optimism among buyers. If the year opens above this level, a very rapid reaction of the cryptocurrency market with a large wave of purchases is likely. However, most of the market, especially large-cap coins, still retains the potential for a turnaround to a clear bull run, which may linger until the next seasonal bullish period in February. With this picture, it is worth carefully weighing the growth potential before additional purchases today and giving preference to heavily oversold assets with high technical goals for retest and slow issuance. Today, I still prefer TURTLE NFP HOOK NTRN VIC MITO ENSO BMT SHELL, for which the growth potential is higher than the rest of the altcoin market, which may contribute to growth similar to RESOLV or STO in the near future. Among the coins with the tag monitoring for work, I consider only CHESS, which has high technical signals for retest up to 0.10-15. Against the background of the annual rollback in CHZ, the probability of a bullying in fan tokens is also increasing. ATM ACM CITY JUV looks especially interesting. However, the dynamics of CHZ in the second half of the year is quite negative, I recommend working with fan tokens in a small volume and not increasing turnover if there are older unclosed positions.I want to make comments on the coins showing activity in recent days. These growth waves are more like exit pumps. For ZBT and DOLO, there is a fairly aggressive increase in the number of coins in circulation ahead, which is likely to push the price down. However, these false impulses are a signal for purchases on recent binance listings. Similar growth waves can be expected for the coins that I recommended for work, but with a stable trend. The growth impulses of PORTAL and BIFI are also more of an exit pump before delisting, but they give a signal for the growth of coins with the monitoring tag. Against this background, there is a possibility of large impulses, in particular for CHESS up to 0.10-15.Against the background of the growth of FARM and D, there is a probability of growth up to 50-70% according to COS ACA UTK DATA QUICK FIO BEL, however, the monitoring tag may be assigned to the 20-22 tools at the beginning of the new year, and therefore I recommend working with these assets in a small volume.