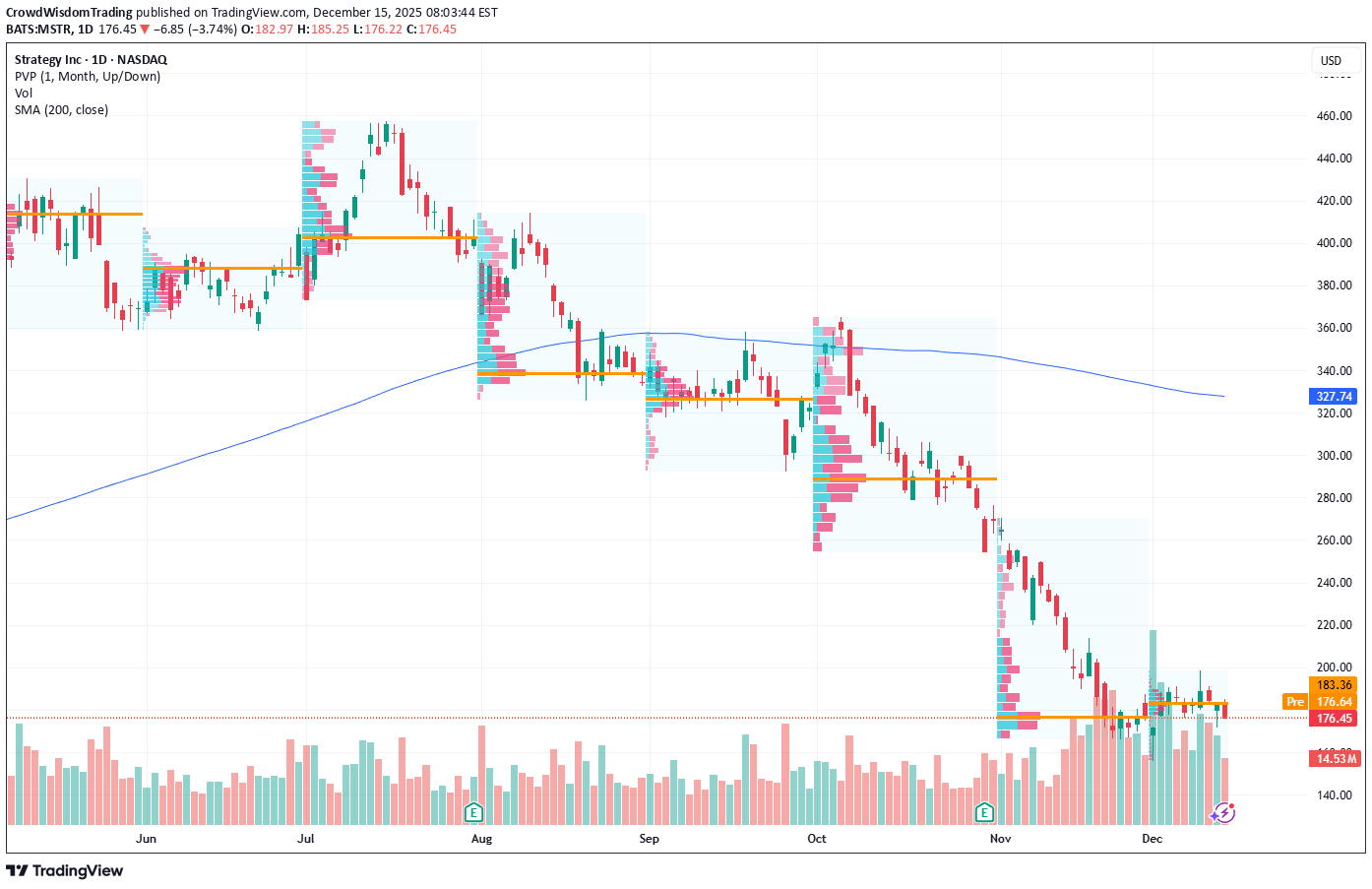

Technical analysis by CrowdWisdomTrading about Symbol MSTRX: Sell recommendation (12/15/2025)

MicroStrategy breakdown setup points to near-term downside risk

Current Price: $176.45 Direction: SHORT Confidence Level: 68% (Multiple professional traders express bearish bias tied to heavy Bitcoin exposure near resistance and key technical levels) Targets: - T1 = $172.00 - T2 = $168.00 Stop Levels: - S1 = $182.00 - S2 = $185.00 **Wisdom of Professional Traders:** Several professional traders I follow are pointing to MicroStrategy’s vulnerability at current levels, with price slipping from recent highs and failing to clear resistance around $182-$185. The collective wisdom is emphasizing how closely MSTR’s intraday momentum is tied to Bitcoin’s swings, and the fact that the stock is hovering near resistance makes downside setups more attractive this week. **Key Insights:** Here’s what's driving my view: many traders are flagging that MSTR has been under pressure despite last week’s broader market strength. The heavy reliance on Bitcoin holdings means any pullback in BTC, even moderate, is quickly echoed in the equity price. While some traders are bullish longer-term on MSTR’s BTC strategy, the near-term consensus I’m seeing is that risk is skewed to the downside unless BTC breaks decisively higher. The real story here is the repeated failure to hold above $182-$185, which aligns with the 20-day SMA and near-term swing highs. Multiple traders called this resistance out, and recent attempts to push past $185 have been met with selling. At the same time, support levels at $170-$172 are being watched closely as short targets, with bearish sentiment stronger among those tracking speculative asset weakness in December. **Recent Performance:** In the last two weeks, MSTR fell from an early December high near $191 down to $176, sliding in tandem with Bitcoin retreating from $30k. The stock briefly tested $182 multiple times but failed to close above it, cementing that zone as a sell trigger for many short-bias traders. Volume spikes on down days suggest distribution rather than accumulation. **Expert Analysis:** Multiple professional traders are shorting or recommending caution, highlighting MSTR’s decline from $457 to under $180 over the past three months. They point out the unsustainable nature of using Bitcoin as the primary corporate treasury asset during a volatile macro environment. Technical setups like head-and-shoulders patterns and downward channels are in focus, with preferred short entries in the $182-$185 zone aiming for the $168-$172 range. **News Impact:** Recent news about MicroStrategy buying an additional 10,000 BTC was met with skepticism rather than enthusiasm. While it showcases the company’s commitment to its Bitcoin-centric strategy, traders note that such moves increase volatility exposure. A few bearish tweets cite the debt load as another overhang, and this acts as a headwind whenever Bitcoin softens. News flow over the last week tied to BTC price dips has reinforced the short case for MSTR. **Trading Recommendation:** Putting it all together, I’d take a short bias if MSTR remains below $182, targeting $172 as the first leg and $168 on a stronger breakdown. Stop levels at $182 and $185 protect against unexpected bullish surges tied to a Bitcoin rally. This setup offers a reasonable risk-reward given the high beta and recent rejection at resistance. I’m keeping position size tight due to the volatility, but the preponderance of professional trader sentiment suggests the next move is lower.