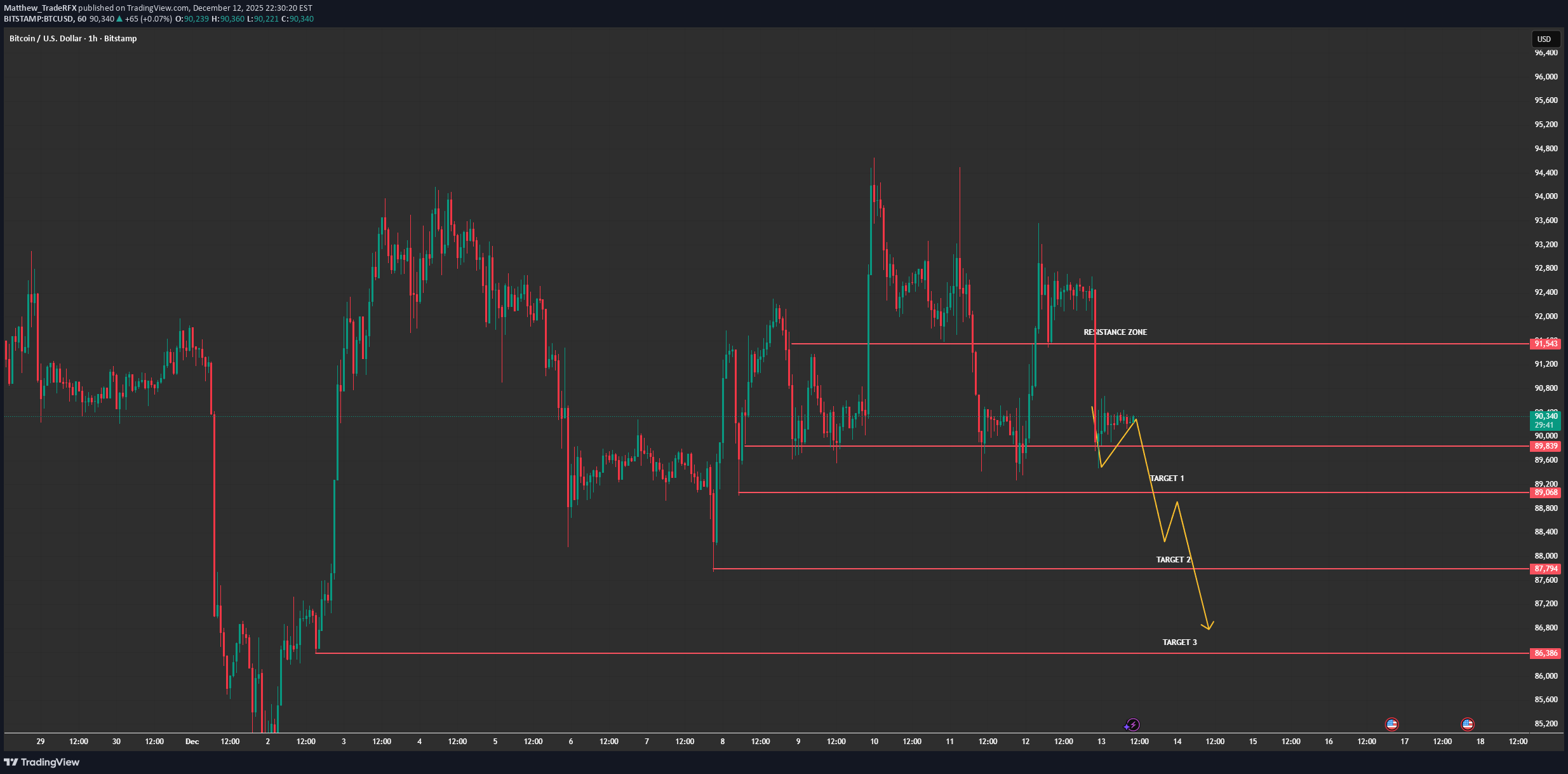

Technical analysis by Matthew_TradeRFX about Symbol BTC: Sell recommendation (12/13/2025)

بیت کوین سقوط کرد: تایید روند نزولی و اهداف جدید قیمت زیر ۹۱,۵۶۳ دلار

As per the updated analysis, BTCUSD has reversed its previous bullish momentum and is now poised for a downtrend toward lower targets. The chart shows a well-defined resistance zone at 91,563, where price has started to recoil and move lower. 🔹 Market State: Bearish Reversal Confirmed BTCUSD has now entered a consolidation phase below the resistance zone, with price rejecting the higher levels around 91,563. The market is setting up for a downside continuation with clear price action signals. The move lower has already begun, and targets are positioned around 89,200 (Target 1), 88,000 (Target 2), and 86,386 (Target 3). 🔹 Macro Factors Driving the Decline: 1. Risk-Off Sentiment Prevails Yesterday's decline can be attributed to the broad market risk-off sentiment. Concerns about global economic uncertainty, geopolitical tensions, and weaker-than-expected economic data are pressuring risk assets like Bitcoin. 2. Strong USD and Profit-Taking The US dollar’s strength has been a key factor in BTC's retreat. As the dollar rises, investors typically retreat to more secure assets, causing Bitcoin and other risk assets to experience declines. Profit-taking after Bitcoin's recent surge also contributed to the market's downward movement. 3. Fed Rate Expectations Fed's hawkish stance (with interest rates possibly staying higher for longer) is placing further pressure on risk assets, making them less attractive to investors. This also increases the capital inflow into USD and dampens demand for Bitcoin. 4. Macro Data Weakness Poor economic indicators such as reduced job growth or disappointing inflation figures could contribute to the broader market decline. The weak economic data creates more uncertainty, prompting liquidation of higher-risk assets. 🔹 Price Expectations and Targets: Resistance Zone: 91,563 (Key Rejection Point) Target 1: 89,200 Target 2: 88,000 Target 3: 86,386 As long as price remains below 91,563, the bearish continuation setup is intact, and the market is expected to decline towards Target 1, then Target 2 and Target 3.BTCUSD Update — Target 2 Achieved, New Upside Scenario in Play Congratulations to all traders — Target 2 has been completed exactly as planned. Price reacted cleanly from the demand zone, confirming that the prior sell-off was a liquidity sweep rather than a structural breakdown. With downside objectives fulfilled, the market has now shifted into a recovery and re-accumulation phase. Outlook: The preferred scenario is short-term consolidation, formation of a higher low, then a push toward Target 1 → Target 2 → Target 3. A breakout above 91,500 with volume would open upside toward 93,000–94,000. The bullish setup remains valid unless price breaks and holds below 87,700. Macro Support: Risk-off pressure is fading, Fed expectations remain dovish, ETF demand continues to absorb supply, and there is no strong macro catalyst favoring further downside.Bitcoin (BTC/USD) — Market Update: Consolidation Phase Before the Next Break Bitcoin has moved differently from the earlier projection, with price extending lower instead of following the initial sideways path. However, this deviation does not invalidate the broader market thesis. What we are seeing now is a liquidity-driven reset, after which BTC is transitioning into a consolidation and accumulation phase rather than a sustained bearish trend. From a macro perspective, the crypto market remains highly sensitive to global liquidity conditions. Ongoing uncertainty around the timing of Fed rate cuts, fluctuations in U.S. Treasury yields, and short-term USD strength have pressured risk assets, triggering forced liquidations across crypto markets. At the same time, institutional participation via spot BTC ETFs continues to absorb supply on sharp dips, preventing deeper structural breakdowns. This dynamic typically results in range-bound price action as the market digests macro signals. Technically, Bitcoin is stabilizing near a well-defined support area after an aggressive sell-off. Selling momentum has slowed, volatility is compressing, and price action is beginning to overlap—classic characteristics of accumulation after liquidation. In this environment, false breakouts are common, and patience becomes a strategic advantage. Looking ahead, the most probable scenario is sideways movement with gradual accumulation, as both buyers and sellers wait for a clear macro catalyst. A decisive breakout either through renewed risk-on sentiment or confirmation of easier financial conditions—will be needed to unlock the next impulsive move. Until that catalyst emerges, traders should avoid overtrading, respect range boundaries, and remain patient while the market builds the foundation for its next expansion.