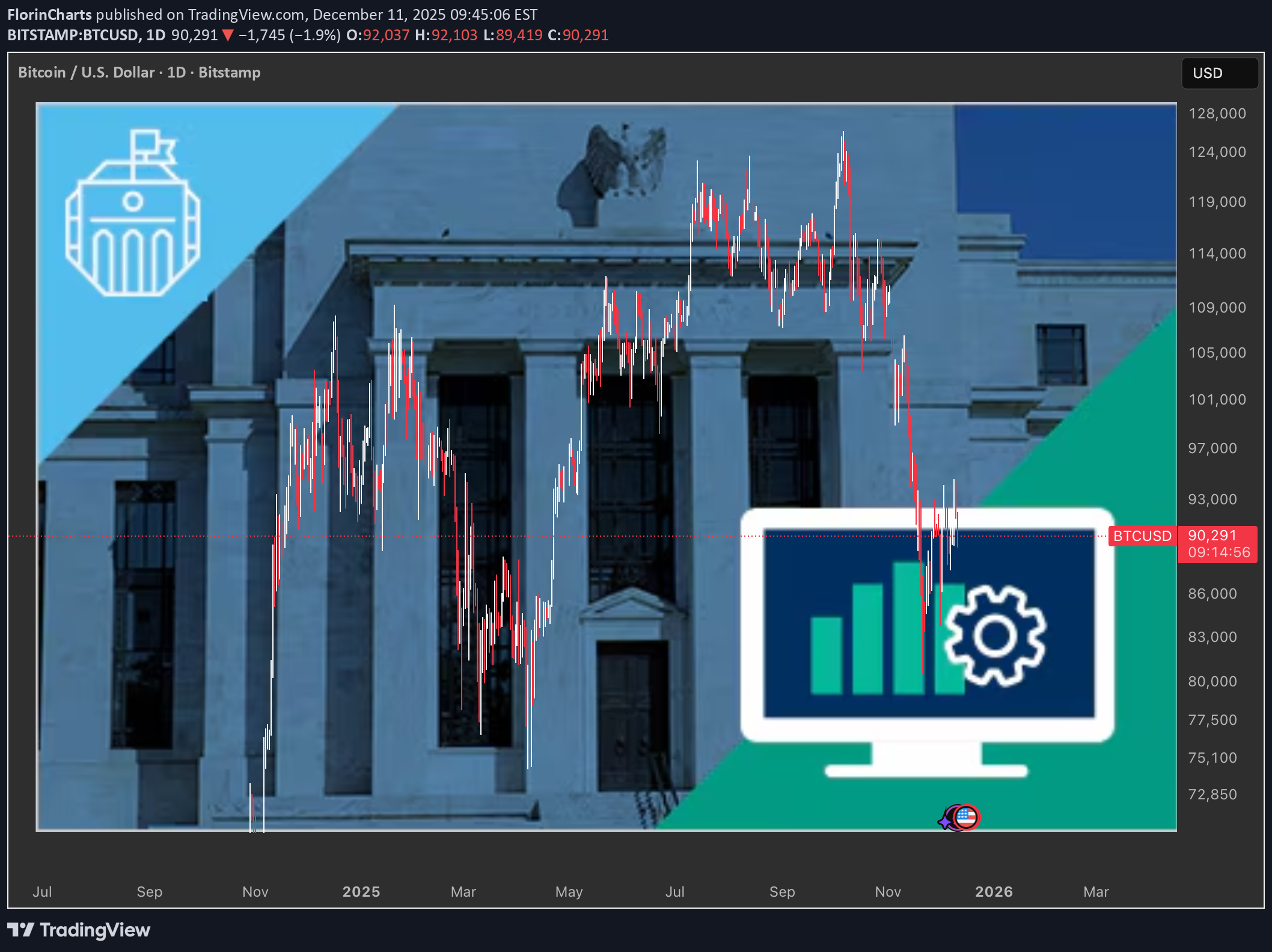

Technical analysis by FlorinCharts about Symbol BTC on 12/11/2025

کاهش نرخ بهره فدرال رزرو: جرقه رالی بزرگ در بازار سهام و رمزارزها!

Fed move and backdrop 📉➡️📈 The Fed just cut rates by 25 bps. Markets now have slightly easier policy but still “careful” Fed messaging. Yield curve and small caps 🏦📊 Short‑term rates are lower, but longer‑term yields can stay higher because of how the Fed manages its bond portfolio. That steeper curve helps banks lend more and is usually good for small‑cap and cyclical stocks. QT, QE and liquidity 💧 QT is ending, so the Fed is no longer shrinking its balance sheet. For crypto traders, that feels like “QE‑lite” because liquidity is no longer being drained from the system. Easier policy plus steady liquidity tends to support risk assets like tech and crypto. ISM, Bitcoin and the cycle 🪙📈 The ISM production index is back above 50, which signals economic expansion. Bitcoin has often made big upside moves when ISM turns up and policy is easing. What’s next for traders ⚔️ - Stocks: Better setup for small caps as banks can lend more and the curve steepens. - Crypto: Macro is shifting to “risk‑on,” so Bitcoin and Ethereum could challenge or make new highs earlier than a strict four‑year cycle would suggest.