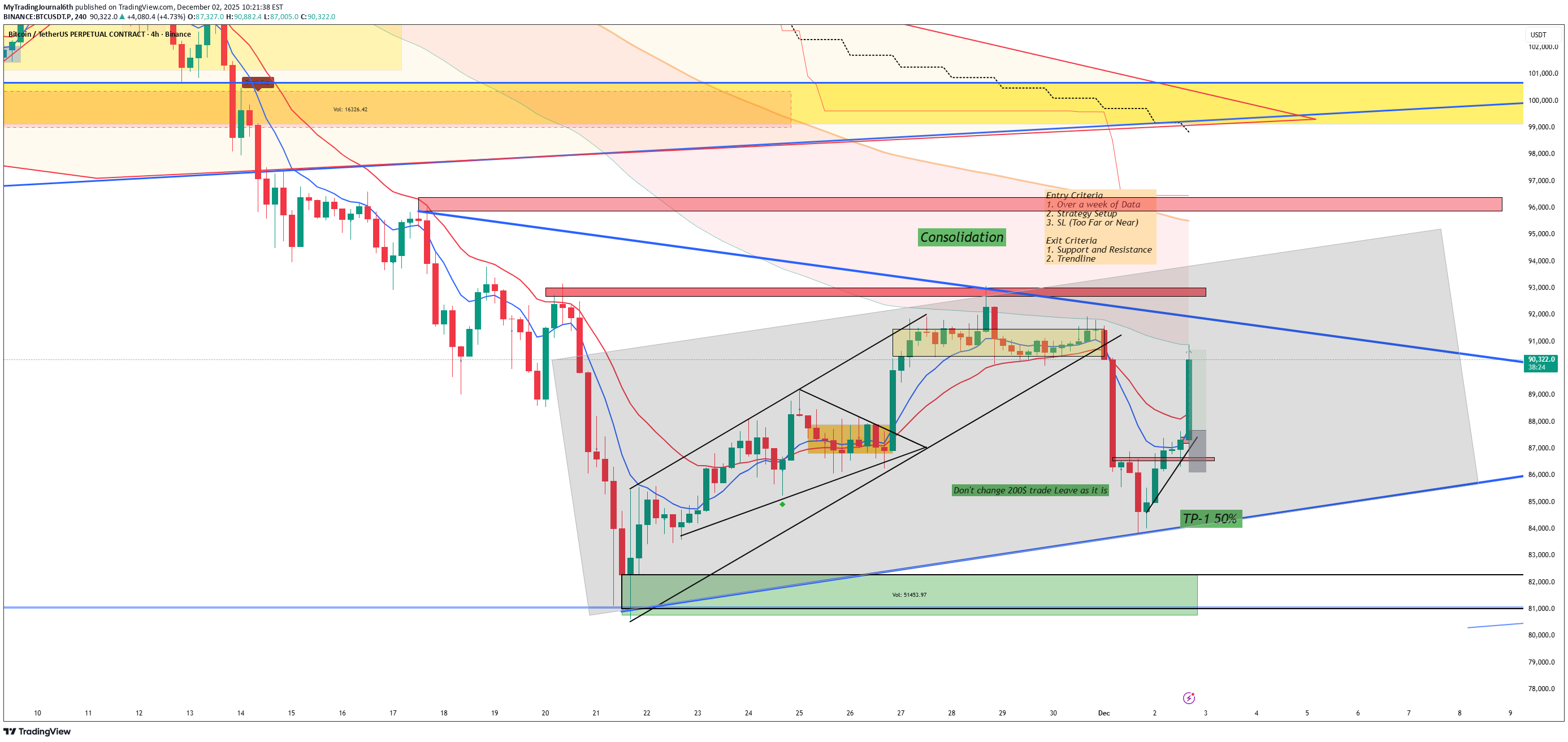

Technical analysis by MyTradingJournal6th about Symbol BTC: Sell recommendation (12/2/2025)

MyTradingJournal6th

رمزگشایی بازار خرسی: استراتژیهای سرمایهگذاری در بحران اقتصادی ۲۰۲۵

Understanding the Current Bear Market The markets are currently in a bear phase, defined by a decline of 20% or more from recent highs. Recent news shows Bitcoin and broader equities facing renewed selling pressure, influenced by market risk-off sentiment and liquidity tightening. Crypto assets like Bitcoin have fallen significantly, reflecting cautious investor behavior amid economic uncertainties and volatility spikes as we enter December 2025. Long-Term Bear Market Strategy Stay Calm and Balanced: Avoid panic selling; maintain a diversified portfolio to spread risk across asset classes including bonds and defensive stocks. Dollar-Cost Averaging: Invest gradually in discounted quality assets to reduce average purchase cost during market dips. Focus on Strong Companies: Prefer large-cap, well-established firms and essential sectors such as food and healthcare. Prepare for Recovery: Bear markets are temporary. Position yourself to benefit when markets rebound by holding quality investments and investing strategically during declines. Final Thoughts While the bear market brings challenges, it also offers opportunities for disciplined investors. By understanding the current market dynamics, managing risk, and adopting a patient long-term view, investors can navigate volatility and position themselves for future gains. This post synthesizes the latest news on market conditions and practical investment advice for weathering a bear market effectively.