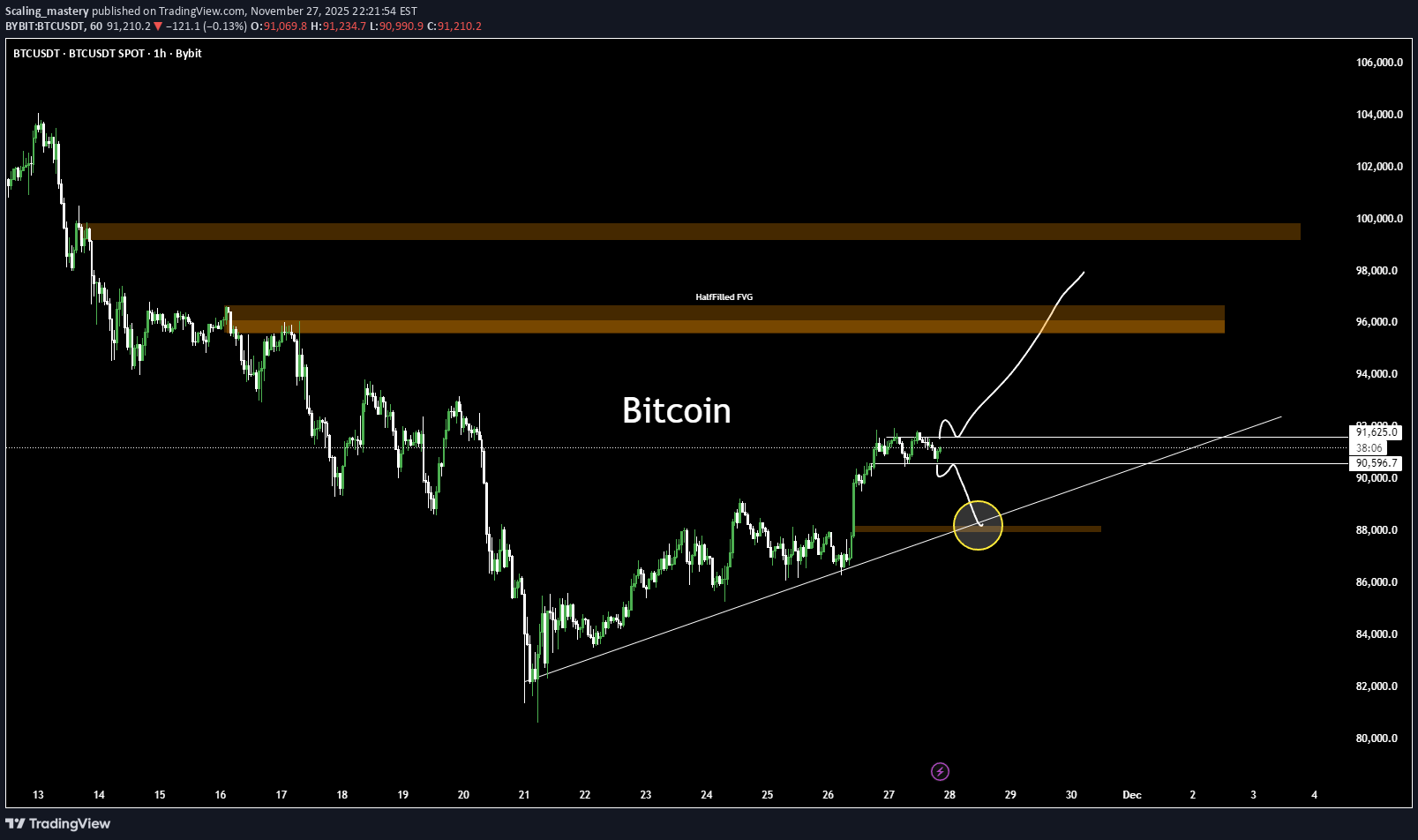

Technical analysis by Scaling_mastery about Symbol BTC on 11/28/2025

بیت کوین بر سر دوراهی: آیا خط روند میشکند یا سقوط میکند؟ (تحلیل کلیدی سطوح حمایتی و مقاومت)

BTC is approaching a key structural decision point, and the next move will determine whether we see continuation upward or a corrective sweep to lower liquidity levels. This idea outlines both scenarios with clear targets and educational structure analysis. Key Structural Areas 1️⃣ Rising Trendline Support BTC continues to respect a clean ascending trendline. This line has been a major pivot for the past several days. Price is currently hovering just above it, and the yellow circle marks the confluence of: Rising trendline support A local demand block Prior liquidity sweep zone This is the most important area to watch for reaction. 2️⃣ Short-Term Rejection Scenario (White Path) Before breaking upward, BTC may show short-term downside rejection, targeting: ➡️ Short-Term Target: $88,180 This level aligns with: Demand block retest Trendline kiss Local inefficiencies needing fill A rejection into 88,180 would be normal and healthy before a potential bullish continuation. 3️⃣ Bullish Reclaim Scenario If price taps the rejection zone and reclaims the trendline, upside targets remain: $95,800 – $96,500 → Half-filled FVG + structural supply $99,500 – $100,200 → Major FVG + macro resistance zone These zones are where we expect strong reaction and profit-taking. 4️⃣ Breakdown Scenario If BTC fails the trendline with a full candle close below, expect: Breakdown of structure Full sweep of demand Deeper correction into mid-range levels Not my primary bias, but it's critical to acknowledge the possibility. Summary BTC is sitting on an important trendline. A quick rejection into 88,180 could be the liquidity grab needed before upside continuation. Reclaiming the trendline = bullish continuation toward FVGs. Breaking below = deeper corrective move. 📘 Disclaimer This analysis is for educational purposes only. It represents personal opinion and not financial advice. Always do your own research and manage your own risk.