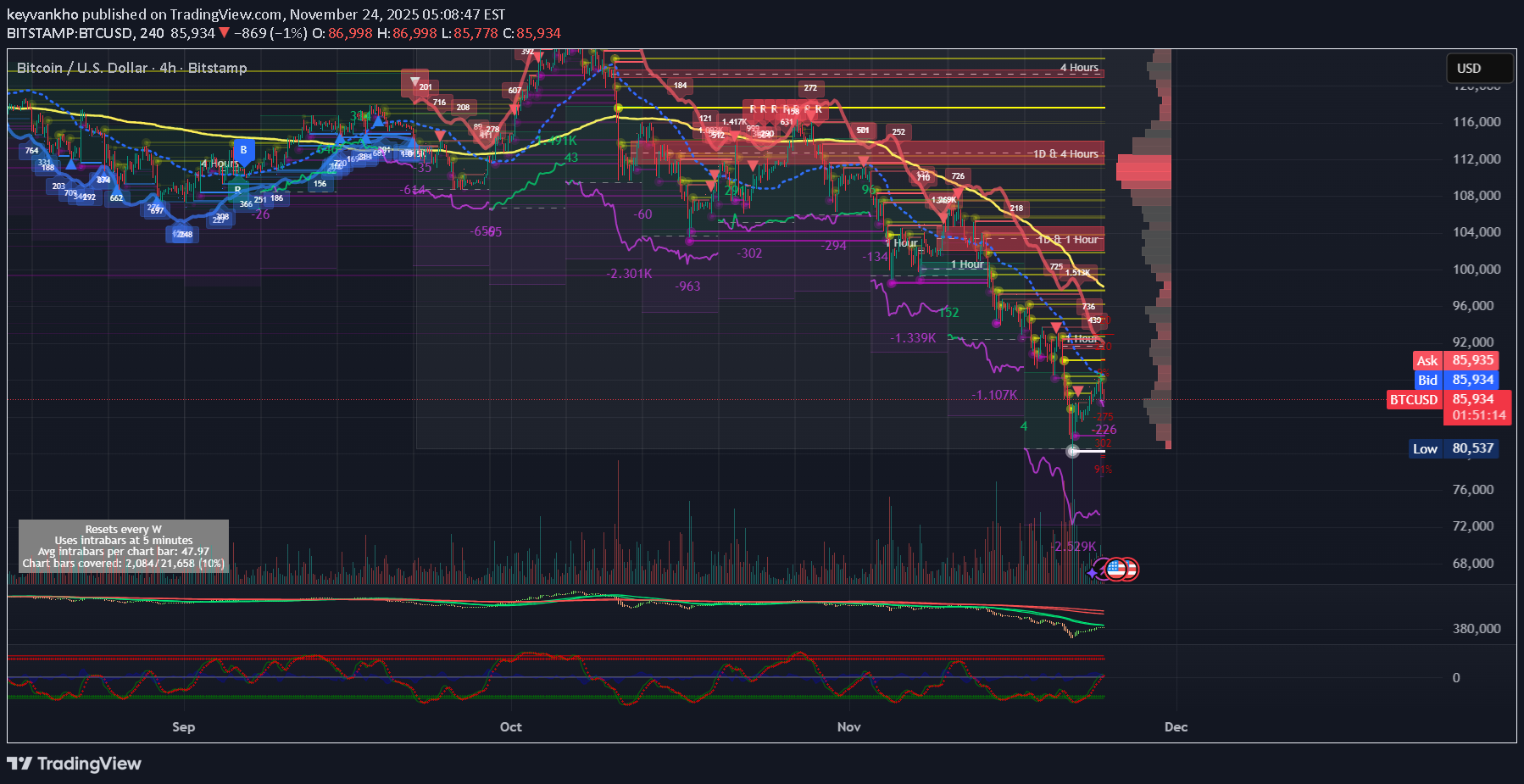

Technical analysis by keyvankho about Symbol BTC: Sell recommendation (11/24/2025)

keyvankho

بیت کوین: جهش پس از ریزش یا دام نهایی؟ سطوح حیاتی برای تماشا!

Bitcoin BTCUSD has completed a violent capitulation move into 80,537, clearing multiple liquidity shelves and wiping out late leverage. We are now seeing a corrective bounce inside a larger bearish structure, and the next move depends entirely on how BTC behaves between 88k resistance and 82k support. BTCUSDT BTCUSDC Bearish Scenario (Still the Base Case) As long as BTC trades below 88–90k, the bounce remains corrective and price is expected to rotate lower into 82–80k for a retest of the demand zone. A high-volume breakdown below 80k opens the door to the next liquidity pocket at 74k, where large bids and unfilled resting liquidity sit. Bullish Scenario (Needs Real Confirmation) If BTC forms a 4H higher low above 82k and then breaks 90k with: rising OBV, a bullish MACD cross, WaveTrend continuation, and a 4H close above the cloud, then the downside structure is invalidated and BTC can squeeze into the heavy resistance cluster at 92–95k. A clean reclaim of 95k flips the entire trend back to bullish and opens the path toward 100–103k. 📌 Key Levels Major Support: 82,000 – 80,000 Breakdown Target: 74,000 Local Resistance: 88,000 – 90,000 Macro Reclaim Level: 92,000 – 95,000 Bull Continuation Zone: 100,000 – 103,000 Summary BTC is in a post-capitulation recovery but not yet a confirmed reversal. The chart favors a range between 80k and 90k, with the next major move triggered by a break of either boundary. Momentum indicators (WaveTrend, MACD, OBV) show early stabilization, but trend structure and liquidity heatmaps still point to heavy supply overhead. Until 90k breaks, expect sideways-to-down, with 80k acting as the key battlefield. #Bitcoin #BTC #Crypto #Trading #TechnicalAnalysis #Liquidity #Stratify #WaveTrend #OBV #Capitulation If you find this analysis useful, please drop a like and share your thoughts in the comments — I always appreciate your feedback and perspectivesBTC Update – Price Has Hit the EXACT Decision Zone (91.5k–92.5k) Continuation or Dead-Cat? The next hours will decide. Bitcoin has now climbed into the exact resistance zone highlighted in my previous idea — the 91,500–92,500 band. This is the level I marked as the Decision Zone, and price is reacting exactly as expected. Right now, BTC is showing early signs of exhaustion, but also holding short-term bullish structure… which means we are sitting right at the turning point. Let me break it down clearly: 🔵 Scenario 1 – Bullish Breakout (Needs Confirmation) Bulls must break and close above 92,500 to flip this bounce into a real trend reversal. For a clean breakout, I’m watching for: A 1H or 4H candle close above 92.5k A breakout through the 4H Ichimoku Cloud CVD turning positive (currently flat/weak) OBV breaking the local down-trend RSI Games flipping from H-Bear → H-Bull Strong volume inflow No Shooting Star / upper-wick rejections If all of this aligns, then the next targets open up quickly: 94,500 → 97,000 → 100,000+ This is still possible — but it requires real strength. 🔴 Scenario 2 – Rejection (Currently More Likely) This bounce resembles a Wave-5 exhaustion inside a larger downtrend, and the indicators are showing weakness: Clear bearish CVD divergence RSI Games firing H-Bear signals QQE momentum flattening Volume not supporting the move VPVR showing heavy supply above 4H trend still bearish Multiple “R” algorithmic rejections at this exact level Price hitting the liquidity ceiling from the heatmap If rejection confirms here, the retrace levels remain exactly the same as in the original idea: 89,000 → 86,000 → 82,500 → 80,000 This is the classic post-capitulation bounce → distribution zone behaviour. 🟩 Big Picture BTC is now precisely at the zone I outlined in the original idea. This zone decides: Breakout → Trend Reversal Rejection → Dead-Cat Bounce and Lower Levels Nothing has invalidated the bearish scenario, but the bullish path is still open if buyers show strength above 92.5k. The next 24 hours are crucial. 💬 Your Feedback Helps More Than You Think If this update helped you, please let me know what you think with your likes and comments. Your support motivates me to keep posting detailed BTC insights every day.