Technical analysis by Pepperstone about Symbol BTC on 11/24/2025

Pepperstone

بیت کوین در کف ترس؛ آیا قیمت هم به همین اندازه سقوط کرده است؟

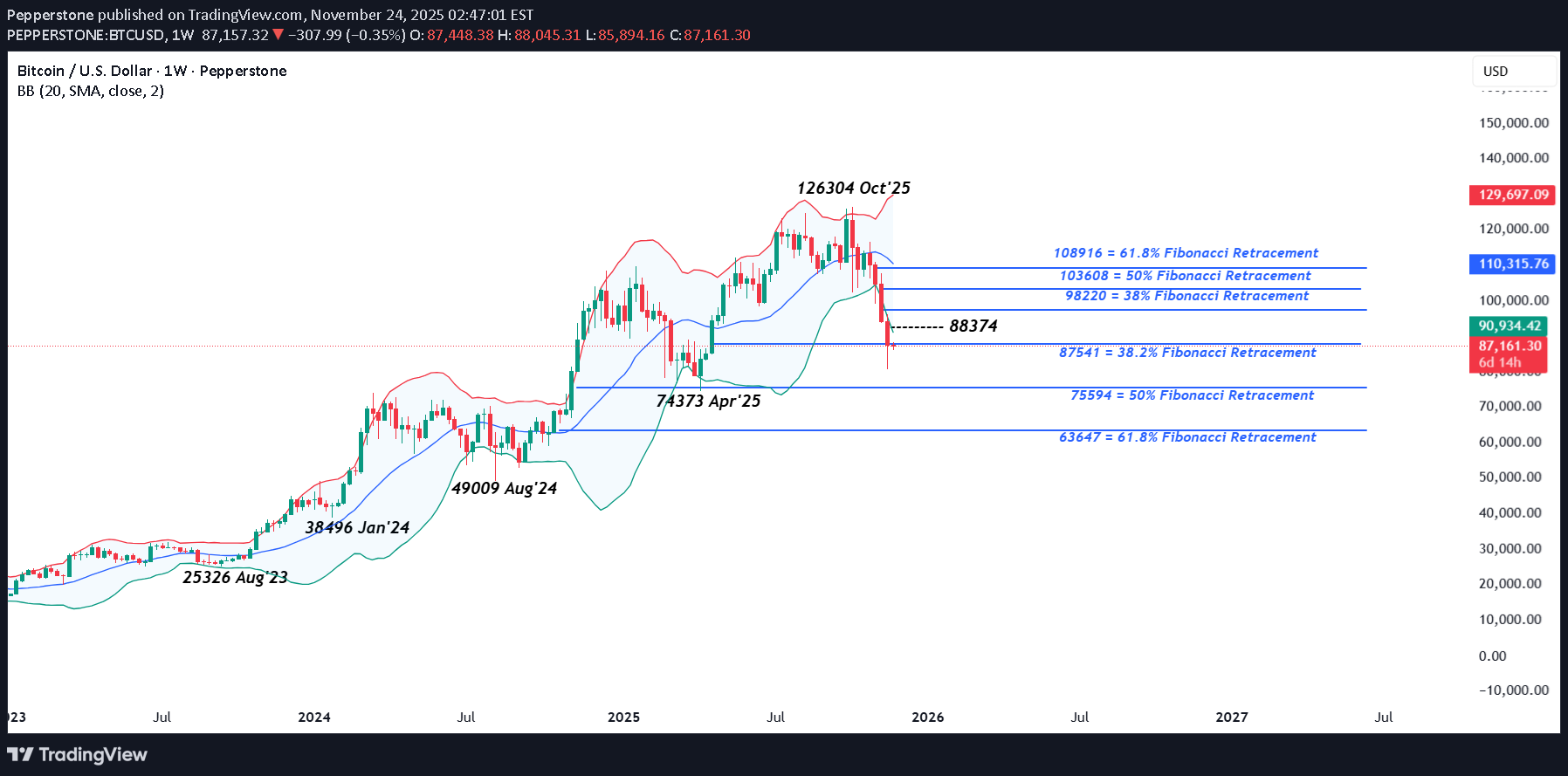

Bitcoin slumped to 80498 on Friday, its lowest trade since late April and a fall of 27% from its opening level of around 110000 at the start of November. However, the negativity hasn’t just been contained to Bitcoin, the crypto currency market has lost over $1 trillion in value during the same period, a move which has sent CoinMarketCap’s fear and greed index into extreme fear territory with a reading of 10 out of 100. Something which is perhaps unsurprising given how quickly the move has happened. Market observers have struggled to point to one single reason for the large drop but it could be linked to profit taking on popular leveraged trades across several asset classes that have produced strong gains in 2025. For example, in October Gold fell 11% from a record high of 4381 to 3886, and in the AI space, during November Palantir Technologies slumped 33% 221.75 to 147.50. Bitcoin’s shift into the mainstream could also be important. Institutional investors are not afraid to cut underperforming positions during periods of risk aversion, and it has been noted that billions have been taken out of Bitcoin exchange traded funds (ETFs) during November. This rush by investors to get out at the same time can reduce liquidity and extend moves to more extreme levels. Over the weekend, Bitcoin prices, which trade 24 hours a day 7 days per week unlike traditional financial markets, stabilised in the short-term trading back above 86000 early on Monday morning. The question now is ‘what comes next?’ To answer this, traders may be looking towards the charts to identify potentially important levels that could indicate the next directional moves for Bitcoin. Technical Update: Retracement Support Levels in Focus: Break Lower or Hold? Bitcoin has dropped 36% from its October all‑time high of 126304, marking a sharp correction in price. Historically such volatility has been typical within crypto markets and traders could now be weighing whether this decline may extend further or is a temporary pullback before price recovery, as has proved to be the case in the recent past. As the chart above highlights, a concern for Bitcoin bulls may well be that support at 87541, the 38.2% Fibonacci retracement, has been broken on a closing basis. Normally this level might be anticipated to limit declines, even encourage upside resumption, but the current risks are this failure to do so in the last week may lead to potential for further weakness. Possible Support Levels: A close below the 38.2% Fibonacci retracement support could be viewed as opening scope for further downside moves. Whether this proves true for Bitcoin in the week ahead remains uncertain, but the break below 87541 does raise the possibility for tests of lower support levels. If this plays out, traders may turn their attention to the 50% Fibonacci retracement at 75594, which links with the April 2025 low of 74373. Should closing breaks below these levels occur, then downside potential may extend toward 63647, which marks the deeper 62% retracement. Potential Resistance Levels: After such a sharp decline, a short‑term recovery is possible to help unwind overextended conditions. However, for this to evolve into a more sustained rebound, closes above 88374 (half of last week’s range) may be necessary. While not an outright positive signal, closes above 88374 may lead to tests of 98220, a level equal to the 38% retracement of the October/November declines. Should closing breaks above 98220 be achieved, this could in turn pave the way for further strength toward 103608, the 50% retracement level. The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.