Technical analysis by alirezak about Symbol ETH: Sell recommendation (11/23/2025)

alirezak

نقشه راه اتریوم: آیا حمایت حیاتی ۲۰۰۰ دلاری نگه میدارد؟ (تحلیل کامل)

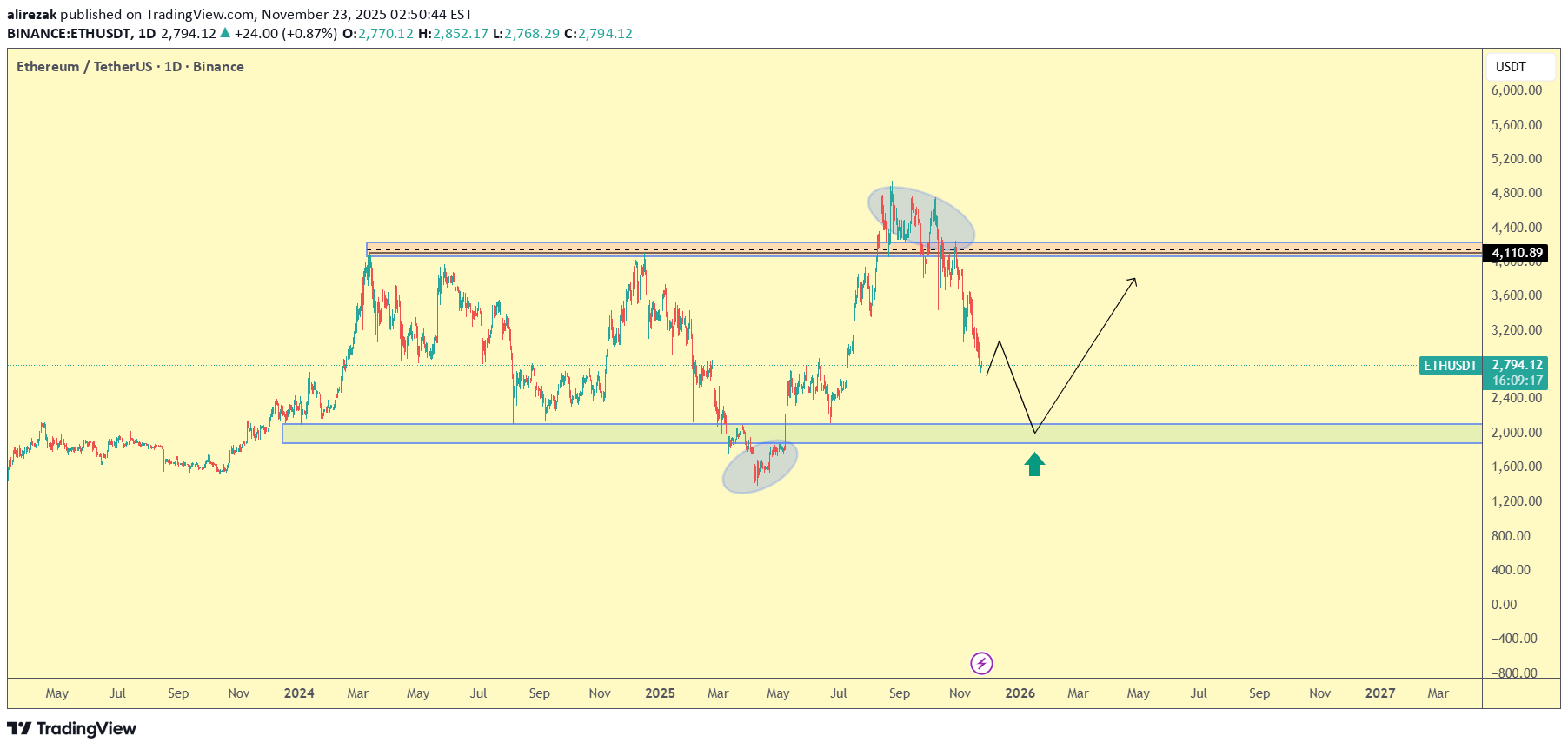

Dear Traders, Ethereum is currently in a corrective phase after a significant rally and repeated rejections from major resistance levels. The structure suggests price is approaching a critical zone that could determine ETH’s medium- to long-term direction. Below is a full technical + fundamental + scenario-based analysis based on your chart. 🟦 1. Technical Analysis 🔹 Market Structure In the daily timeframe, Ethereum has rejected the major resistance area at $3,950 – $4,200, which previously acted as a local top. After failing to break above it twice, the market shifted into correction mode. Price is now heading toward a major support zone around $1,890 – $2,150, which includes: A strong historical demand zone A previous accumulation area A key horizontal support level The region that initiated the previous uptrend This is a macro support, tested multiple times. 🔹 Repeated Tops (Distribution Zones) ETH formed two distribution structures around $4,100, indicating strong sell pressure. Your marked ellipses correctly highlight areas where large players likely distributed positions. 🔹 Likely Path of Price The chart structure suggests a high-probability scenario: Retracement into $1,890–$2,150 Reaction or short-term bounce Retest of broken structure or mid-range resistance Potential start of a new upward leg This follows the classic pattern: correction → accumulation → impulse. 🔹 Bullish Scenario If Ethereum finds support and confirms reversal signals such as: Bullish engulfing candles Higher lows Bullish BOS (Break of Structure) RSI divergence then a strong rally is likely. Targets: Target 1: $2,800 – $3,000 Target 2: ~$3,500 Target 3 (mid-term): $4,100 – $4,300 Breaking above $4,300 could open the door for a new long-term bullish cycle. 🔹 Bearish Scenario (Low Probability but Important) If ETH loses the major support at $1,890 with strong volume: Next support: $1,650 Deep correction target: $1,450 This scenario becomes more likely if Bitcoin enters a heavy sell-off or if macroeconomic risk increases. 🟦 2. Fundamental Analysis Ethereum remains one of the strongest assets fundamentally, supported by real-world usage, developer activity, and network economics. 🔹 Network Upgrades (Ethereum Roadmap) After the full transition to Proof-of-Stake and subsequent upgrades, Ethereum benefits from: Lower issuance (near-deflationary supply) Lower energy consumption Higher performance Better scalability Upcoming improvements focus on data availability and rollup efficiency, which reduces gas fees and boosts ecosystem growth. 🔹 Growth of Layer 2 Networks L2 ecosystems like: Arbitrum Optimism Base zkSync Starknet are driving massive transaction volume into Ethereum. More L2 usage → more ETH burned → stronger long-term value. 🔹 Dominance in DeFi Ethereum still leads the DeFi sector: Highest TVL (Total Value Locked) Most active protocols Largest developer community This creates continuous, organic demand for ETH in: Transactions Staking Collateral Smart contract execution 🔹 Staking Demand Over 25% of Ethereum’s total supply is staked. This reduces circulating supply, lowers sell pressure, and supports long-term price appreciation. Institutional interest in staking continues to grow, further strengthening fundamentals. 🔹 Key Risks Despite strong fundamentals, ETH faces these challenges: Regulatory pressure on staking services Correlation with Bitcoin in macro downtrends Competition from fast L1 networks (Solana, Avalanche, Sui, etc.) Still, Ethereum remains ahead in ecosystem maturity and security. 🟦 3. Final Summary Ethereum is approaching one of its most important supports in the last two years. If buyers defend the $1,890–$2,150 region, a multi-month bullish wave could begin. 🔥 Key Points ETH is correcting into major support Technical structure is still bullish in the bigger picture Fundamentals remain extremely strong L2 growth, staking, and DeFi support long-term appreciation The main scenario is: correction → accumulation → upward continuation Targets remain $3,000 → $3,500 → $4,300 if the support holds.