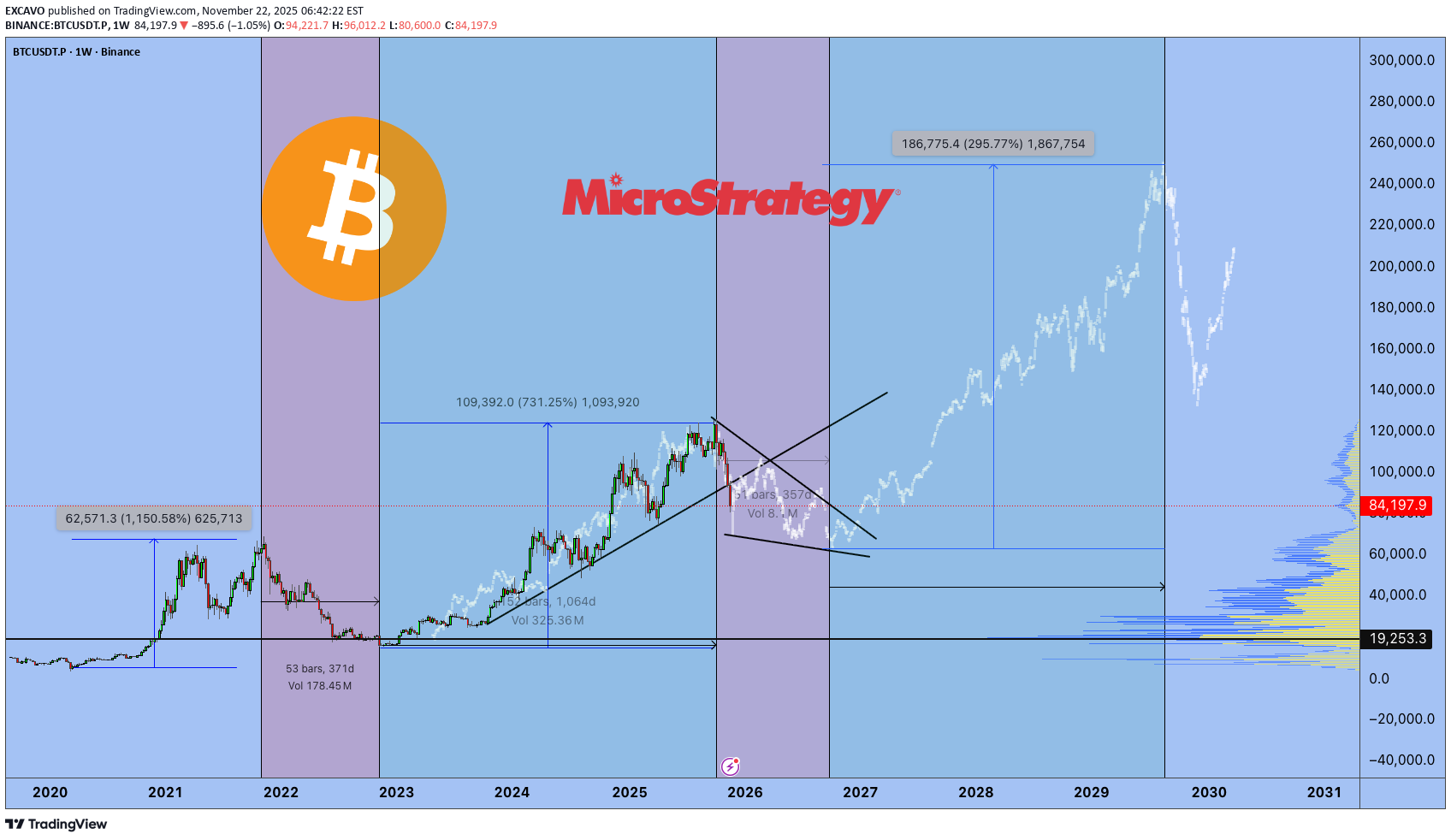

Technical analysis by EXCAVO about Symbol BTC on 11/22/2025

EXCAVO

سقوط بزرگ در انتظار مایکرواستراتژی؟ برنامه سایبر در معرض خطر حذف از شاخصها!

MSCI May Exclude Crypto-Heavy Companies: What It Means for MicroStrategy and the Market MSCI recently published a proposal that could dramatically reshape how global indices treat companies with large crypto exposure. According to the framework, companies holding more than 50% of their market capitalization in digital assets may be excluded from national and international indices. This sounds technical - but the consequences are huge. What This Means in Practice If the rule is implemented, companies like MicroStrategy, Bitfarms, Marathon, Hut8, Coinbase, or any firm holding a large percentage of crypto on their balance sheet, may: be excluded from major indices, lose exposure to institutional investors, be off-limits for pension funds, insurers and conservative hedge funds, face reduced liquidity and forced selling. This is not a small development. This is a structural shift. 🧩 Why MicroStrategy Is the Most Exposed MicroStrategy’s business model has been extremely straightforward: issue new shares raise debt (including convertible notes) use the proceeds to buy Bitcoin rising BTC → rising MSTR rising MSTR → more borrowing capacity A perpetual loop. But if MSTR gets excluded from key indices, the loop breaks: passive funds must sell institutional investors face compliance risk liquidity dries up volatility increases borrowing costs rise And remember: MicroStrategy currently trades below the fair value of its Bitcoin holdings. A forced outflow amplifies the structural imbalance. ⚠️ Why Institutions Bought MicroStrategy Instead of Bitcoin Many funds legally cannot buy Bitcoin. They also cannot buy high-risk crypto exchange stocks like Coinbase. But they can buy: reputable corporate debt convertible notes equity from a listed U.S. corporation Michael Saylor gave them a regulatory loophole: “Want Bitcoin exposure? Buy my convertible debt. If BTC rises, convert the notes into shares.” This workaround is now cracking. Convertible Debt Holders Are in a Tough Spot If MSTR is excluded from indices: index funds sell → share price drops falling price → convertible notes lose value institutions holding the debt face losses the balance sheet risk increases This is why regulatory decisions matter so much. Insider Selling: VP of Bitcoin at MicroStrategy Sells ~$19.7M Worth of Stock The timing is… interesting. Started selling on September 18 Sold options-based shares in multiple lots Continued selling until November 14 Total realized profit: ~$19.69M Selling into regulatory uncertainty is not random behavior. It’s a signal. Key Takeaways 1. MSCI’s proposal changes the rules: companies with >50% crypto exposure may become “non-indexable”. 2. MicroStrategy’s core model—borrowing to buy BTC—depends on institutional inflows. Index exclusion disrupts it. 3. Convertible note investors may face severe pressure. 4. Insider selling suggests internal awareness of structural risk. 5. If MSTR is removed from indices, forced selling could create significant downside pressure. 📉 Conclusion MicroStrategy has long been a “Bitcoin ETF before ETFs existed”. Institutions bought MSTR because they couldn’t buy BTC directly. But now: Bitcoin ETFs exist, regulations are tightening, index providers are updating risk frameworks. MicroStrategy may become a victim of its own success strategy. Best regards EXCAVO