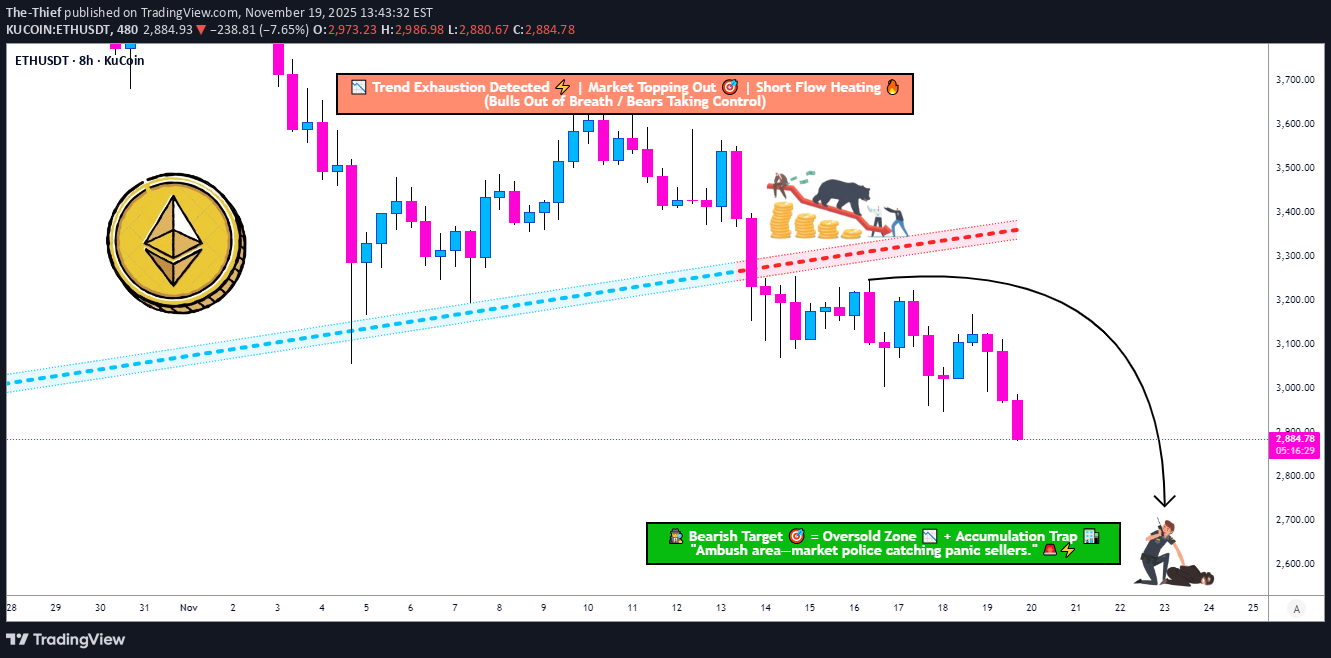

Technical analysis by The-Thief about Symbol ETH: Sell recommendation (11/19/2025)

The-Thief

نقشه راه نزولی اتریوم: شکست ساختار و میانگین متحرک (بهترین نقاط فروش)

Asset: ETH/USDT — “Ethereum vs Tether” Market Context: Crypto Market | Swing Trade | Bearish Profit Pathway Setup 📉 Market Outlook: Bearish Plan Confirmed Ethereum is displaying a bearish continuation structure, with price breaking below the Triangular Moving Average zone, signaling shifting momentum from buyers to sellers. Market structure is weakening, liquidity is building above the recent highs, and major supports remain untested below. This creates a clean swing-trade opportunity for disciplined traders. 🎯 Trade Plan: Thief Layered Entry Strategy The plan uses a layered sell-limit approach to capture premium retracement entries. 🧩 Sell-Limit Layers (Short Entry Zones): 1st Layer: 3200 2nd Layer: 3100 3rd Layer: 3000 (Traders may add additional layers depending on preference, liquidity, and volatility.) Layering helps reduce emotional entry pressure and allows scaling into premium short zones rather than rushing into the move. 🛑 Stop-Loss: Structural SL @ 3300 This is the Thief SL reference level at 3300, positioned above structural liquidity. Ladies & Gentlemen (Thief OG’s): adjust SL according to your own risk tolerance, capital, and strategy framework. Risk is personal — protect your account. 🏆 Target Zone: 2700 The downside objective aligns with: Strong support retest Oversold region confluence Trap-pattern breakdown Correlation pressures across major crypto pairs Ladies & Gentlemen (Thief OG’s): this is a community target reference — take profit based on your own comfort and risk appetite. Profit is profit. 🔍 Related Pairs to Watch (Correlation Insights) 1️⃣ BTC/USDT ( BTC ) Bitcoin leads crypto directional momentum. ETH generally mirrors BTC swings with slightly slower volatility. If BTC struggles to reclaim resistance zones, ETH downside probability strengthens. 2️⃣ ETH/BTC ( ETHBTC ) Key ratio indicating Ethereum’s strength vs Bitcoin. ETHBTC downtrend continues → ETHUSD bearish continuation becomes more reliable. 3️⃣ SOL/USDT ( SOL ) Strong competitor in Layer-1 ecosystem. SOL weakness often reflects broader market appetite decreasing → ETH follows. 4️⃣ TOTAL2 (Altcoin Market Cap) Tracks overall strength of altcoins excluding BTC. Breakdown in TOTAL2 = bearish environment = supports ETH downside targets. Monitoring these pairs provides confirmation of: Trend alignment Market-wide weakness Strength of bearish momentum Liquidity flows across majors ✅ Final Notes This setup is built for traders who prefer structured entries, disciplined layers, clear SL zones, and realistic targets. Trade smart, manage risk, and follow your own strategy refinement.