Technical analysis by ThetaNomad about Symbol BTC: Buy recommendation (11/16/2025)

ThetaNomad

بیت کوین در آستانه انفجار؟ سطوح کلیدی و شواهد قوی برای برگشت قیمت

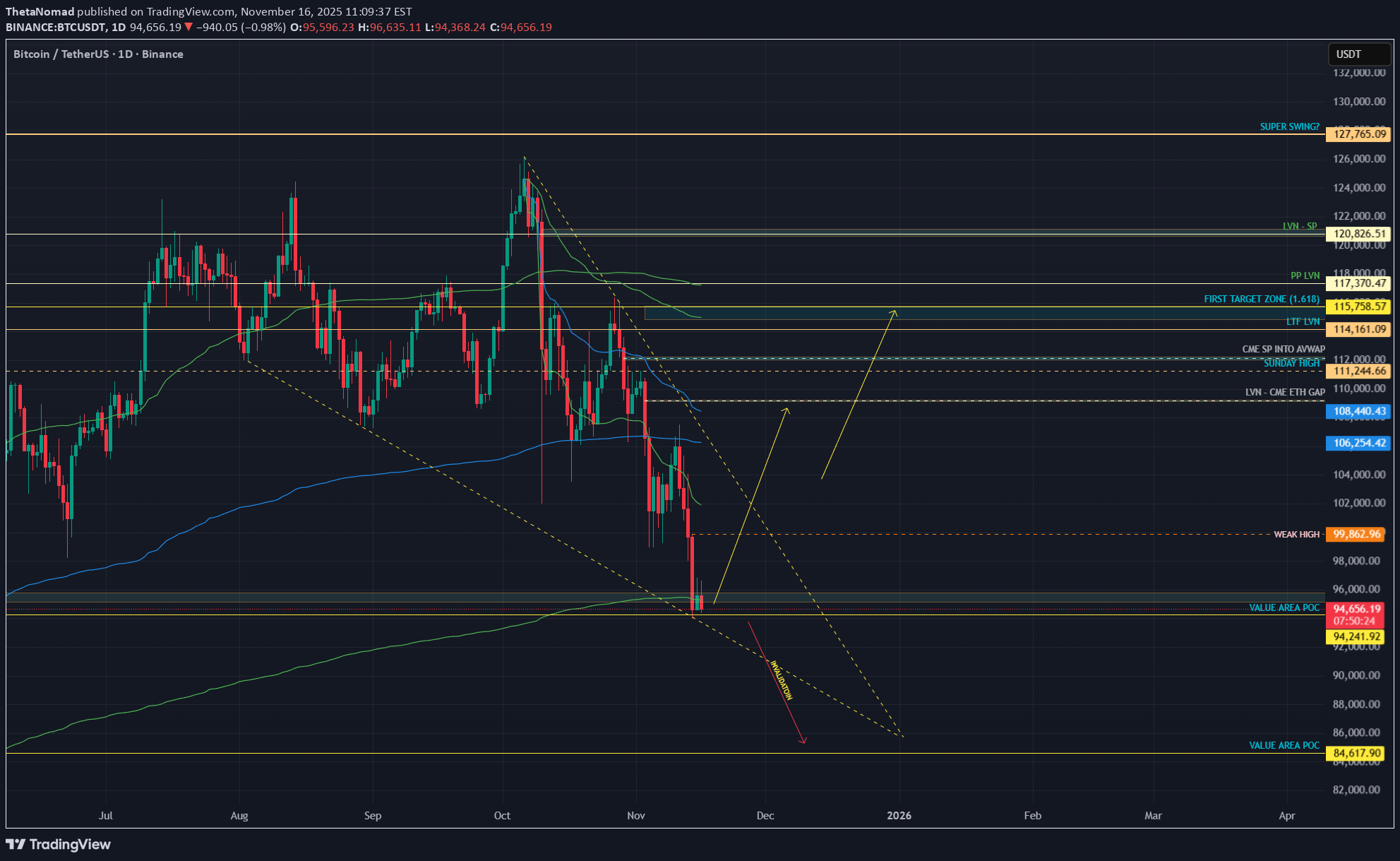

Traders, Bitcoin is now sitting inside a large falling wedge structure on the daily chart. Wedges of this type often form during trend exhaustion and can precede significant reversals when the lower boundary is reached. This pattern sets the stage for everything that follows in this analysis. Below is the full breakdown of why I believe Bitcoin is positioned for a potential reaction and where the most important levels are located. Recap of the Previous Bitcoin Analysis In the previous BITCOIN analysis I mentioned two scenarios. Scenario one outlined the following sequence: • Price pushes into 107k to 108k • That move sweeps the weak high and taps the AVWAP anchor • If spot CVD slows or perps shift into net selling, a rejection becomes likely • That rejection sends price back toward the mid range and possibly into 101k to 102k • Continuation into the higher timeframe LVN at 98k becomes possible Every single step unfolded almost perfectly. Current State of Bitcoin Bitcoin is now sitting directly on the lower band of the AVWAP anchored from 7 April 2025. What this means AVWAP stands for Anchored Volume Weighted Average Price. It calculates the average position of market participants beginning from the chosen anchor point. The April low marked a major shift in trend structure. When price reaches the lower band of an AVWAP anchored to such a significant low, it often acts as dynamic support. This is because it reflects the average entry of early cycle buyers. If price holds and begins reclaiming from this area, it signals that the strongest hands are defending their positions. If it fails, the market risks a deeper flush into lower demand clusters. Value Zone Analysis with Fixed Range Volume Profile To determine whether Bitcoin is inside a significant value region, we use a Fixed Range Volume Profile (FRVP). The range is anchored from the April low to the October high. Zooming into the profile on the left, price has now re-entered the core value area of this entire swing. The red horizontal line marks the Point of Control, which is the level with the highest traded volume in the entire range. The current low sits almost exactly on this level. Pixel perfect confluence. Why this matters When price returns to the value area after a distribution phase, two possible outcomes appear: 1. Reversal Buyers defend value and price rotates back toward high volume nodes above. 2. Continuation breakdown Price accepts below value, meaning even previous buyers are unwilling to re accumulate here. This opens the door to the next low volume pocket and lower demand zones. Right now, the reaction at this level is critical because we have perfect alignment between the lower AVWAP band and the FRVP Point of Control. Mathematical Levels and Fibonacci Structure Now we collect the mathematical evidence. We are sitting at a core AVWAP level and a core FRVP level. Now we check if the market is stretched mathematically. Bitcoin at the 1.618 Extension On the four hour spot chart, I apply a Trend Based Fibonacci Extension from A to B and project it from C. The placement rule Ask yourself: What was the last meaningful swing high that ended the previous trend and started the current reversal? That swing becomes A to B. The first corrective lower high after that becomes C. Using this structure, Bitcoin has now extended perfectly into the 1.618 level. The 1.618 Fibonacci extension is historically associated with exhaustion. Sharp downlegs often pause, take liquidity, or reverse at this point. TOTAL at the 2.0 Extension To confirm that this move is not isolated to Bitcoin, we check the TOTAL crypto market. TOTAL reflects the entire crypto market and shows equilibrium conditions. When Bitcoin and TOTAL stretch at the same time, reaction probability increases. Start with a retracement from A to B: Price nearly hit the fifty percent mark but not entirely. Then reverse the tool from B to A. Doing so reveals the extension levels below. Price is now sitting exactly at the 2.0 extension. Why the 50 percent connects to the 2.0 If a move retraces halfway, the remaining distance becomes the basis of the flipped extension. Doubling that distance gives the 2.0 level. Because TOTAL did not fully reach the fifty percent retracement, there is a small missing portion. To visualise this, I draw a box between the actual retracement and the fifty percent level. Then I duplicate the box under the 2.0 extension. The duplicated box lands perfectly on the current low, showing mathematical symmetry. Additional Mathematical Check I also check the structure that began after the 10 October crash. By extending from B to A, the downside projections appear. Price tagged the 1.618 level perfectly. Full symmetry Bitcoin at the 1.618 TOTAL at the 2.0 Internal structure at the 1.618 When all three align, the move has reached market wide symmetry. These zones commonly produce strong reactions or reversals. Summary so far We now have confluence in four categories: • AVWAP support • FRVP Point of Control support • Fibonacci extensions on BTC and TOTAL • Mathematical symmetry across multiple swings Next, we check the internal fuel of the move: order flow. Order Flow Analysis Spot CVD Divergence On both the one hour and thirty minute charts, Spot CVD continues making lower lows while price holds steady. This means aggressive sellers are pushing market sell but price refuses to break down. This can only occur when passive limit buyers absorb the flow. This is hidden absorption. Coin Margined Futures CVD Coin margined CVD shows the same pattern: lower lows while price stays flat. This indicates aggressive shorting with no continuation. Why coin margined matters Coin margined futures use BTC as collateral. When price declines, the collateral loses value. When price rises, shorts lose even more because both their collateral and their position move against them. Coin margined shorts get squeezed harder and faster. Open Interest • Stablecoin margined OI: holding steady. Traders continue to open or maintain positions during sell pressure. • Coin margined OI: compressed during the dump and is now flat. This means shorts are sitting in the market and can be forced out. Summary Price stable CVD falling OI steady This is absorption combined with short build-up. This often leads to a sharp reversal when price begins to lift. Volume Analysis Chart: Accumulation and Distribution (A D Indicator) The A D indicator shows whether volume flows into candles or out of them. On the one hour chart, the A/D is trending up while price stays flat. This means buyers are stepping in during down-wicks and absorbing sell pressure. Price is not showing this strength yet, which is typical for accumulation phases. On Balance Volume (OBV) OBV measures directional volume flow. On the last wick down, OBV actually moved up. This means buyers absorbed the move rather than sellers pushing price down. This is the classic bullish volume divergence after a liquidity sweep. Both Spot and Perps Confirm These divergences appear on both spot and perpetual futures. Spot confirmation is the strongest form of validation because it represents real buying without leverage distortion. The combination of A/D rising, OBV diverging, Spot CVD falling, and Futures CVD falling strongly supports that the sell pressure is being absorbed. What Happens Next Based on everything above, I expect Bitcoin to start by taking the weak local high at 99,862. Weak highs form when the wick structure is sloppy and no real sellers defended the level. On fine tick data, this high looks even weaker. Taking that high breaks the current local structure and potentially triggers a short squeeze. If Bitcoin begins closing four hour candles above 106,200, the next important level is 108,500. Main Thesis Bitcoin pushes into the first target zone and performs a Swing Failure Pattern around 115,700. With strong momentum, the move could extend into the 17,300 to 18,000 region. Invalidation and Downside If Bitcoin loses support and spends meaningful time below 93,000, the next major support is 84,617. This is the next Point of Control from the AVWAP auction and an extremely important level to watch. All relevant levels are marked on the charts. Trade safe and manage risk. From the depths of the sands, ThetaNomad ------------------- If you like my analysis, give it a like and leave a comment so more people can see real analysis without the noise.#Bitcoin #LINK We’ve reached the levels of interest — here’s what I’m watching: -> CME ETH gap closed -> Price nearing the HTF AVWAP (04 Aug ’24) inside a HTF gap -> HTF AB=CD completed -> A lot of fresh shorts chasing the move down For a long I want: -> Structure confluence -> CVD confluence -> Volume shift -> OI confluence — ideally OI drops Why OI drop? Because a drop means shorts are closing → move is losing fuel → good conditions for a reversal. Exception: If we get hidden bull div (absorption) — CVD making a higher low while price makes a lower low — then high OI can actually be bullish. That means aggressive sellers are being absorbed and shorts are getting trapped. I won’t instantly enter — first I want to see how OI, CVD and volume behave at the level.Patiently waiting for $88,888 — expecting one more local low. The current one looks weak and fragile. There’s an LVN sitting right on $88,888, formed around the weekly FVG. For a long setup, I want to see price wick and slip into that LVN, with CVD turning red and OI increasing — a push that traps fresh shorts before wicking back up.Need to re-assess the market. Keep a close eye at the next target I targeted: 85k~.