Technical analysis by ELDORADOFX about Symbol PAXG: Sell recommendation (11/5/2025)

پیشبینی طلا (XAUUSD): نوسانات بازار آسیا و سطوح حیاتی حمایت و مقاومت

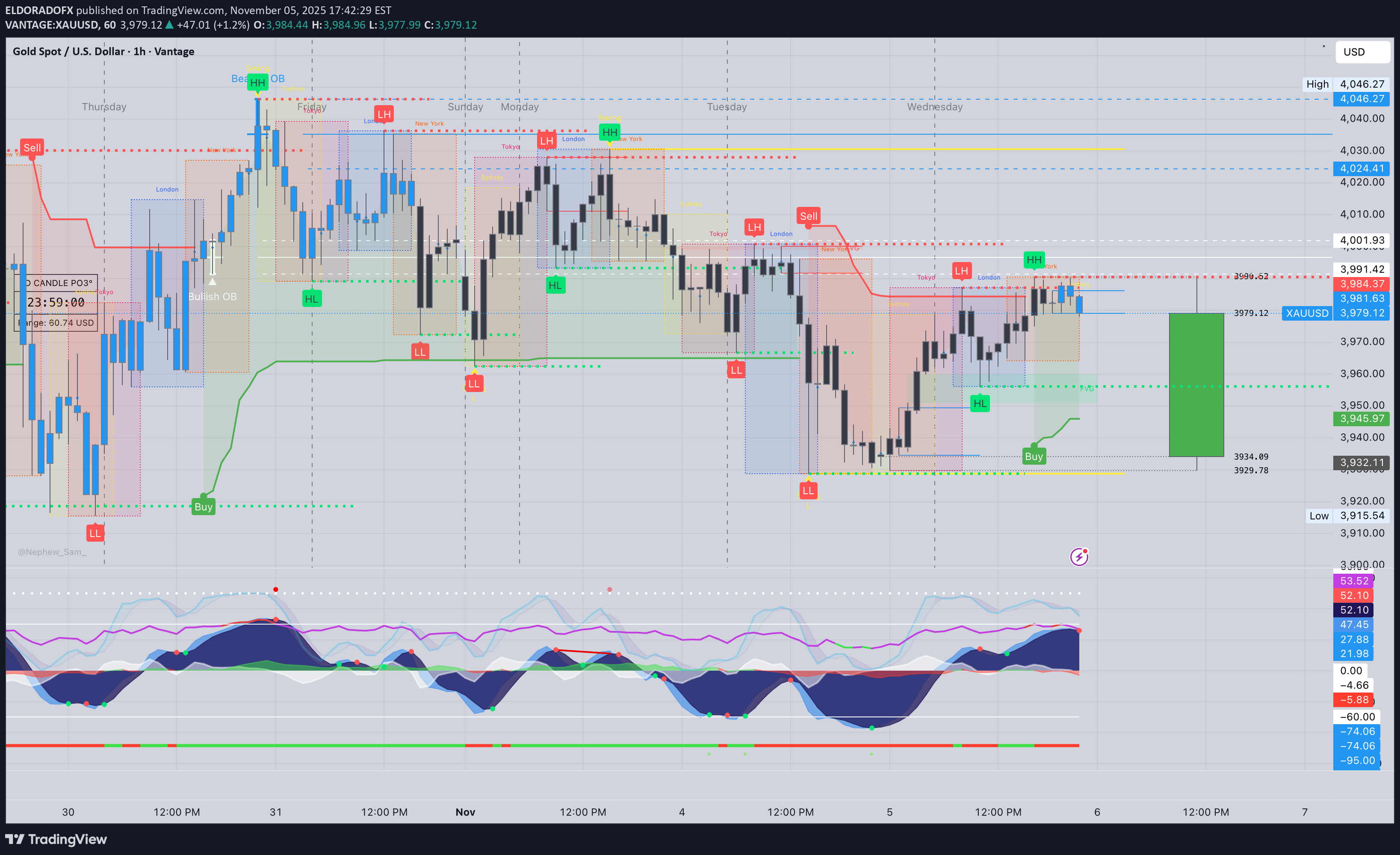

1️⃣ Market Overview Gold begins the Asia session around $3,979, showing mild weakness after repeated rejections from the $3,985–$3,990 supply zone. The metal remains trapped within a descending channel formed from the $4,046 swing high, but buyers are still defending the ascending trendline from $3,928. This setup suggests the market is coiling ahead of a potential breakout, likely during the Asia–London overlap. ⸻ 2️⃣ Technical Breakdown 🔹 Daily (D1) Gold maintains a neutral stance, holding above the 100 EMA ($3,870) but still below the 10 EMA ($3,995). RSI sits near 49, showing equilibrium between buyers and sellers. A daily close above $3,990 could reignite bullish pressure toward $4,015–$4,046, while a drop under $3,955 would open downside continuation toward $3,930–$3,915. 🔹 1H Chart The 1H structure remains bearish-to-neutral, with lower highs under the descending trendline. MACD momentum is flattening, while RSI near 46 signals loss of bullish drive. Intraday support aligns at $3,973–$3,960, with resistance between $3,985–$3,990. 🔹 15M–5M The short-term structure shows a minor BOS (Break of Structure) below trendline support. Repeated wicks around $3,978–$3,975 indicate growing selling pressure. MACD turning red and RSI rolling over from 55 confirm the fading momentum before Asia volatility pickup. ⸻ 3️⃣ Fibonacci Analysis (Last swing: 3,928 → 3,990) •38.2% = 3,966 •50.0% = 3,959 •61.8% = 3,952 🎯 Golden Zone: 3,966 – 3,952 This is a potential intraday demand zone for countertrend bounces if confirmed with volume. ⸻ 4️⃣ High-Probability Trade Scenarios 📈 BUY SCENARIO (Countertrend Rebound) •Entry Zone: 3,966 – 3,952 (Fibonacci Golden Zone) •Targets: 3,975 → 3,985 → 3,990 → 4,010 •Stop Loss: Below 3,947 •Confirmation: Bullish CHoCH or engulfing pattern on 5M–15M within zone. 📉 SELL SCENARIO (Main Bias) •Entry Zone: 3,985 – 3,990 (Supply + trendline resistance) •Targets: 3,975 → 3,960 → 3,940 •Stop Loss: Above 4,000 •Confirmation: Rejection candle or RSI divergence >65. 💥 Breakout SELL Setup •Trigger: Break & close below 3,970 •Retest Zone: 3,973–3,975 •Targets: 3,955 → 3,940 → 3,915 •Stop Loss: Above 3,985 ⸻ 5️⃣ Fundamental Watch •Asian session: Low liquidity, but early positioning ahead of US Jobless Claims may start to build. •DXY holding above 106 maintains short-term downside pressure on gold. •Fed members’ comments later today could inject volatility into metals. ⸻ 6️⃣ Key Technical Levels •Resistance: 3,985 / 3,990 / 4,010 / 4,026 •Support: 3,973 / 3,960 / 3,952 / 3,940 •Golden Zone: 3,966 – 3,952 •Break Sell Trigger: < 3,970 •Break Buy Trigger: > 4,000 ⸻ 7️⃣ Analyst Summary Gold is consolidating inside a tight compression wedge, with bears defending the 3,985–3,990 area. As long as 3,970 holds, price remains in equilibrium. However, a confirmed breakdown below 3,970 could accelerate bearish continuation toward 3,955–3,940. Conversely, only a clean break above 4,000 would confirm short-term bullish reversal. ⸻ 8️⃣ Final Bias Summary 📉 Primary Bias: Bearish below 3,985 → targeting 3,960 – 3,940. 📈 Alternative Bias: Bullish breakout above 4,000 → targeting 4,015 – 4,046. ⸻ 🥇 ElDoradoFx PREMIUM 3.0 – PERFORMANCE 05/11/2025 🥇 📊 Flawless precision | GOLD & BTC domination. ━━━━━━━━━━━━━━━ 🪙 XAU/USD (GOLD) 🔻 SELL +40 PIPS 🟢 BUY LIMIT +20 PIPS 🟢 BUY LIMIT +60 PIPS 🔻 SELL +60 PIPS 🟢 BUY +40 PIPS 🟢 BUY +260 PIPS 🔻 SELL +80 PIPS 🟢 BUY +110 PIPS 💰 GOLD TOTAL: +670 PIPS ━━━━━━━━━━━━━━━ 📱 BTC/USD TRADES 🚀 SELL +900 PIPS 💸 BTC TOTAL: +900 PIPS ━━━━━━━━━━━━━━━ 📊 COMBINED DAILY PROFIT: +1,570 PIPS ✅ 9 Trades → 9 Wins | 0 SL | 0 BE 🎯 Accuracy: 100% ━━━━━━━━━━━━━━━ 🔥 Both GOLD and BTC delivered textbook setups today — high accuracy, clear structure, and strong risk control. 👏 Congratulations if you profited! ✅✅✅🚀🚀🚀