Technical analysis by Crypto_robotics about Symbol BTC: Sell recommendation (11/3/2025)

Crypto_robotics

تحلیل بیت کوین: پیشبینی حرکت بعدی و مناطق حساس خرید و فروش (با جزئیات کلیدی)

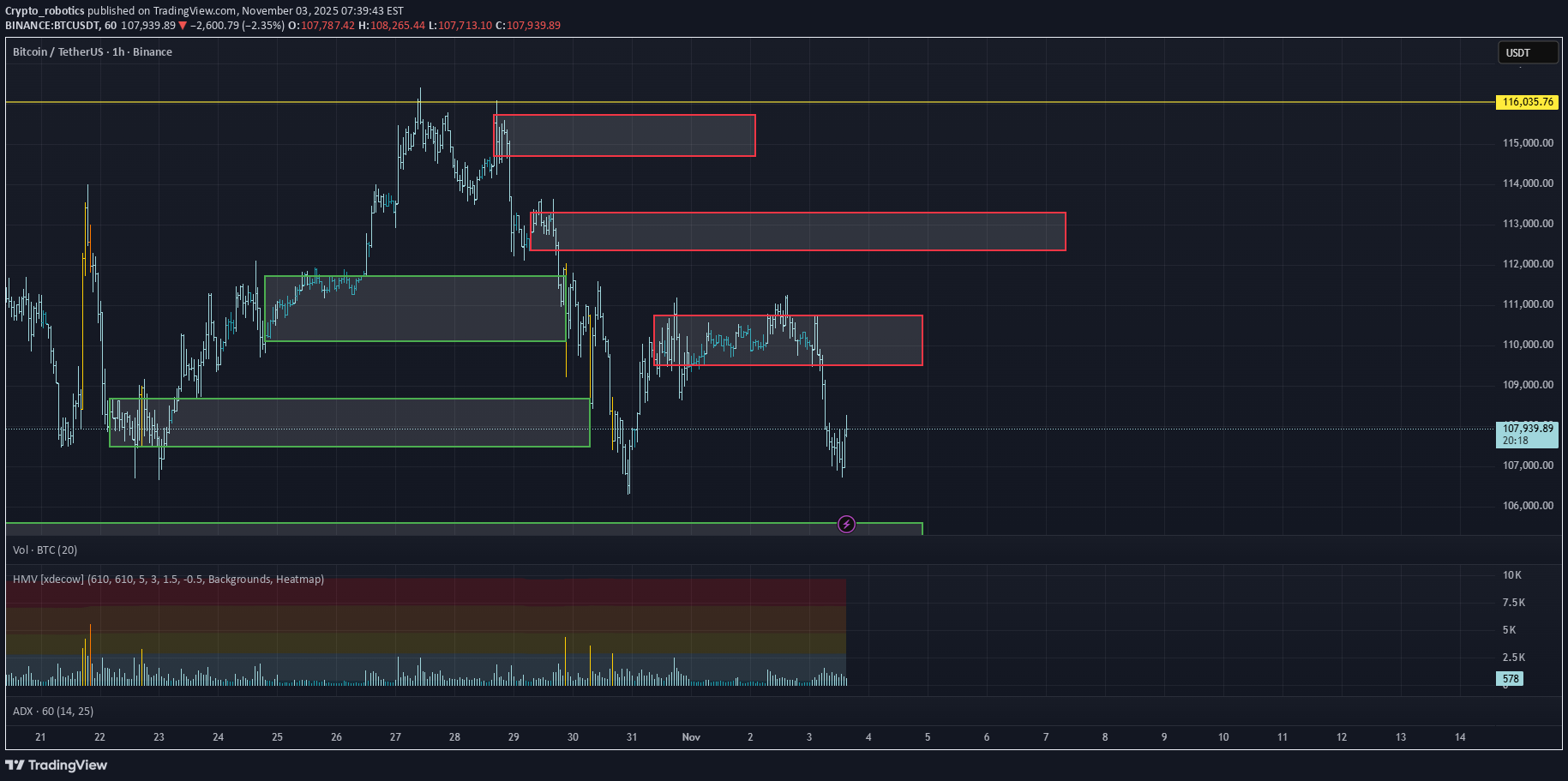

📈 WHAT HAPPENED? At the beginning of last week, Bitcoin tested the key level of $116,000, forming an abnormal cluster of buys below this mark. We expected a supporting force to emerge during the retest of this anomaly. However, the movement turned out to be a seller's trap, leading to a downward price reversal. On Tuesday, we highlighted this fact in our daily TradingView post and adjusted our analysis. Bitcoin continued to decline, tested important volume zones below, and only slightly slowed down its fall. On the global timeframe, there is a clear sideways pattern in the range of $102,000-$116,000, within which we’re currently trading. 💼 WHAT WILL HAPPEN: OR NOT? The priority for movement is towards the nearest selling zone. If there is no reaction from this zone, the priority is towards the lower boundary of the designated sideways pattern. We’re not considering global and positional buys yet. The initiative is still on the seller's side, and we should wait for a clearer picture. When the lower limit of the flat is reached, the probability of returning to the range is minimal, as the volumes within the range are distributed closer to the upper limit. In this scenario, we’ll consider more global buy zones below the current level. Buy Zones: • $105,600–$104,500 (volume anomalies) • $97,000–$93,000 (volume zone) Sell Zones: • $109,500–$110,700 (accumulated volumes) • $112,400–$113,300 (accumulated volumes) • $114,700–$115,700 (accumulated volumes) • $120,900–$124,000 (volume zone) 📰 IMPORTANT DATES This week, we are following these macroeconomic events: • November 3, Monday, 14:45 (UTC) - publication of the US Manufacturing PMI for October; • November 3, Monday, 15:00 (UTC) - publication of the US Manufacturing PMI for October by ISM; • November 4, Tuesday, 15:00 (UTC) - publication of the US Job Openings and Labor Turnover (JOLTS) for September; • November 5, Wednesday, 13:15 (UTC) — publication of the change in the number of employed in the non-agricultural sector of the United States for October; • November 5, Wednesday, 14:00 (UTC) — publication of the supply management index for the non-manufacturing sector of the United States for October; • November 5, Wednesday, 14:45 (UTC) — publication of the business activity index for the services sector of the United States for October; • November 6, Thursday, 12:00 (UTC) — announcement of the UK interest rate decision for November; • November 6, Thursday, 13:30 (UTC) — publication of the number of initial unemployment claims in the United States. *This post is not a financial recommendation. Make decisions based on your own experience. #analytics