Technical analysis by MR_gold2 about Symbol BTC: Buy recommendation (11/2/2025)

MR_gold2

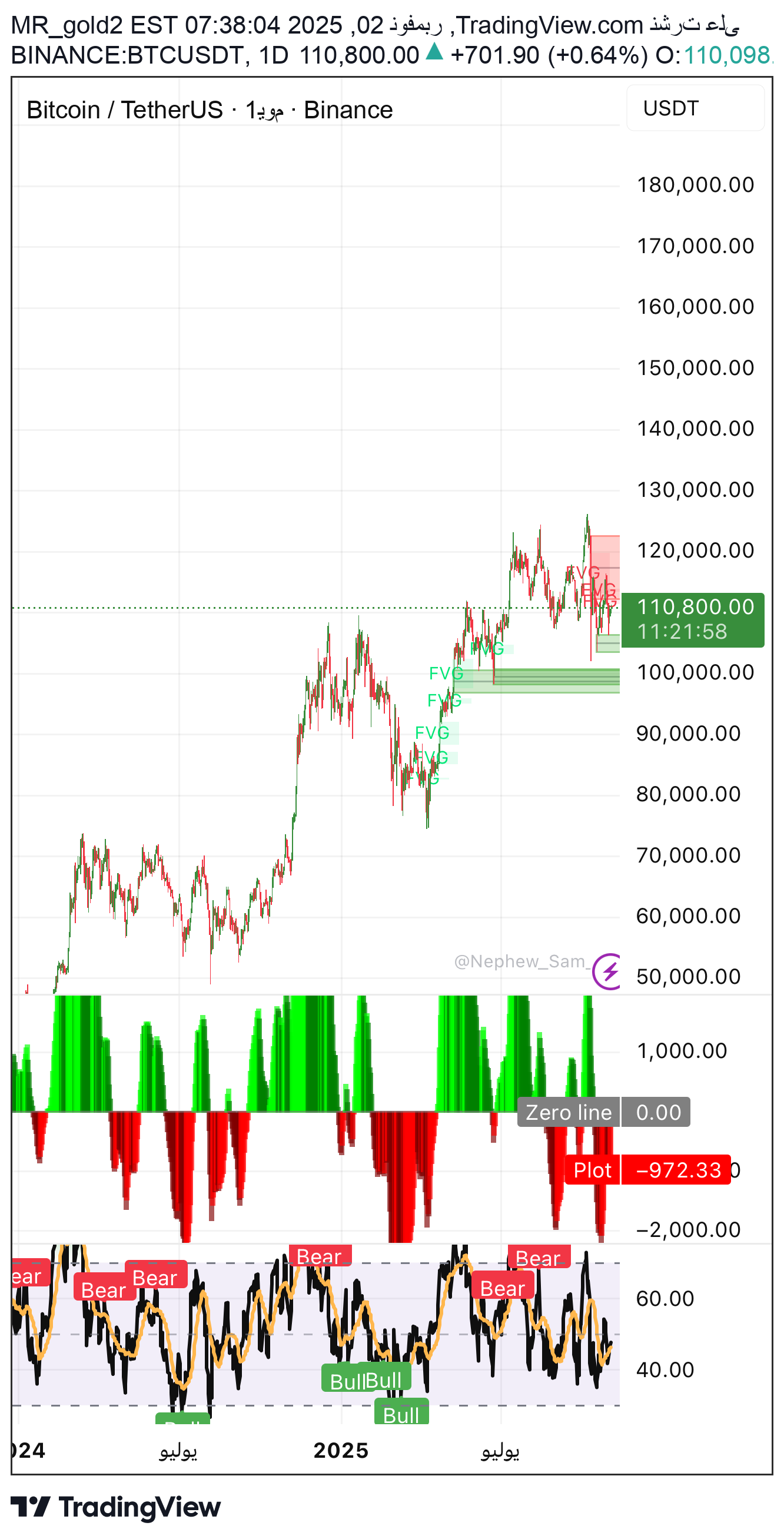

بیتکوین در آستانه انفجار صعودی: تحلیل موجی و اهداف جدید ۱۲۰ هزار دلاری!

Congratulations on your sale deal from 116k to 106-108k What we mentioned in the previous recommendation, do not forget our support with a missile like � General technical analysis Bitcoin shows a strong bounce from an institutional demand zone at 107,000–108,000 after a moderate corrective fall from the 124,000 high. The price is currently in a retest phase of the FVG (Fair Value Gaps) zones, reflecting a temporary balance between buyers and sellers before the next decision. The medium-term trend is still bullish provided it holds above 107,000, while the short trend reflects an upward correction within a side range of 108,000–112,000. 📊 General trend: bullish 📈 Instantaneous momentum: average positivity 📉 Critical resistance: 112,800 – 114,000 🔹 Wave analysis (Elliott Waves) The current wave structure indicates that we are inside the fifth sub-wave (v) of an extended corrective wave. Suggested numbering for the 4-hour frame: (1) 100,000 → 115,000 (2) 115,000 → 107,000 (3) 107,000 → 113,000 (4) 113,000 → 108,000 (5) 108,000 → 120,000 (expected) ️ The fourth wave ended at the 108K area, supported by strong demand, and the start of the fifth wave depends on breaching the 111,500 level. � Fibonacci Time Zones •The third wave took about 36 trading hours. •The fourth corrective wave lasted approximately 28 hours. ⏳ The expected time of the fifth wave = 48-60 hours, meaning that we are about to launch it during the next New York session if the breakthrough is confirmed. 🔹 Digital Analysis (Fibonacci Price Levels) 0.382 109,900 Sub support during debugging 0.5 108,500 Strong institutional support 0.618 107,000 Support key terminator for debugging 🎯 Extension goals for the fifth wave: •1.272 → 113,500 •1.414 → 116,000 •1.618 → 119,000 – 120,000 ⸻ 🔹Fundamental analysis •Institutional flows: Continuing growth in ETFs and OTC operations. •Economic macro: The weakness of the dollar and high expectations of interest cuts in 2025 boost demand for Bitcoin. •Institutional adoption: The continued entry of global banks and large investment platforms. •General analysis: Fundamentals support the continuation of the upward trend, and there are no indications of a long-term reversal. 📈 Fundamentals remain positive even with short corrections. ⸻ 🔹 Price Action •Recent candles show strong price rejection below 108K. •RSI at 55 with a positive slope — supports continued upward momentum. •MACD started with a new positive crossover. •The last 4-hour candle tends to form a Higher Low, which confirms the start of momentum restoration. ⸻ 🔹 Technical models •Double Bottom pattern at 107K → its technical target is 112,800. •A bullish flag pattern is currently forming between 108K and 111K → its technical target is 116K. ⸻ 🔹Digital and harmonic models The Bullish Gartley pattern is formed with high accuracy: •X = 115,000 •A = 107,000 •B = 111,000 •C = 108,200 •D = 107,000 📍 Reflection Zone (PRZ): 107,000 – 108,000 🎯 Possible goals: 1️⃣ 111,500 2️⃣ 113,800 3️⃣ 116,200 ⸻ 🔹 Demand and supply areas 🟩Demand Zones: •107,000 – 108,000 (golden bounce zone) •103,500 – 105,000 (low institutional demand) 🟥Supply Zones: •111,800 – 113,000 (first resistance) •115,500 – 116,500 (temporary sharp resistance) •119,000 – 120,000 (possible area for the end of the fifth wave) ⸻ 🔹 Fixation points and indicators •EMA 50: 109,700 → Active dynamic support •EMA 200: 107,800 → medium-term support •VWAP: Bullish crossover with price •RSI: Positive with a gradual upward trend ⸻ 🔹 Pivot Zone The pivotal area for the 4-hour frame is between 109,600 – 111,200: •Stability above it = continuation of the upward wave towards 116K. •Break below = possible correction to 107,500. ⸻ 🔹 Final recommendation (MrCrypto / Engineer Ihab) 🟢Basic scenario (bullish): •Entry: 108,500 – 109,000 Objectives: •111,800 •113,500 •116,000 •Stop loss: 4-hour close below 107,000 🔴 Alternative scenario (corrective decline): •Breaking 107,000 will lead to a decline towards 105,000 - 103,000 before rising again. Summary of the analysis (Engineer Ihab): Bitcoin is in a medium-term bullish fifth wave, The current rally above 108K represents a strong launching pad towards 115K-120K. Any correction below 107K is a golden opportunity for a long-term re-entry Important note We do not provide you with financial and investment advice Rather, we provide you with scientific and educational content You are the only person responsible for pressing the buy and sell button Analyst Engineer Ihab Sayed Al Thahab channel