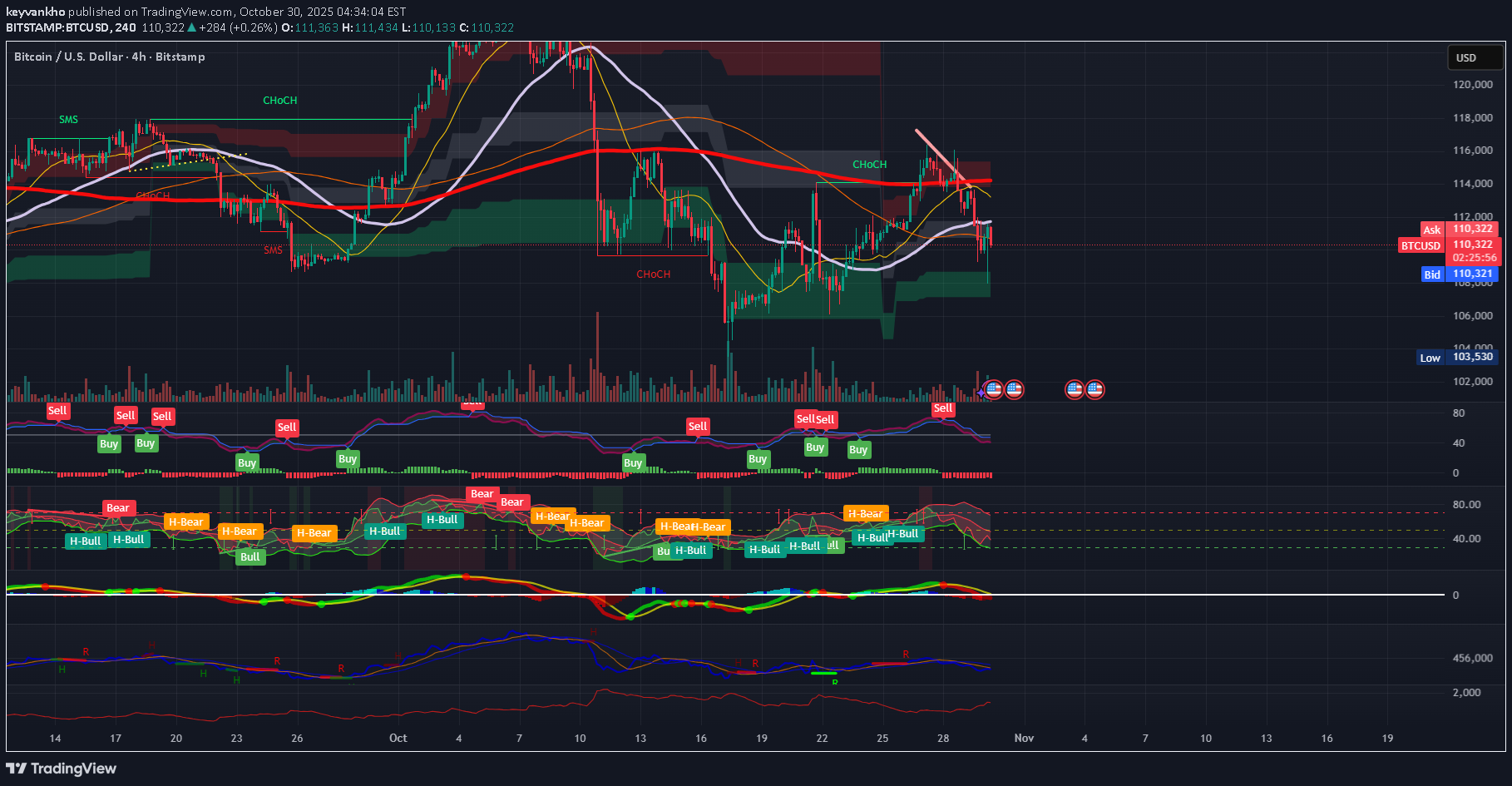

Technical analysis by keyvankho about Symbol BTC on 10/30/2025

keyvankho

تحلیل جامع بیت کوین: نقشه راه نهنگها، لیکوئید شدنها و برنامه معاملاتی صعودی

BTC Price Movement Expectation Short-Term (24–48h) BTC is in a controlled post-liquidity-sweep phase after the flush into the 108K region. The reclaim attempt stalled under 112K resistance, showing that smart money is engineering sideways chop to trap both longs and shorts. Expect shallow retraces and engineered whipsaws as price builds fuel. If price reclaims 111.8K–112.2K with volume, a fast rotation toward 113.5K–115K is likely. Without that reclaim, expect a sweep down toward 109K and possibly 108K support again to shake out late longs before expansion. Short-term bias: Neutral-to-bullish accumulation Targets: 111.8K → 113.5K → 115K Risk: another fast liquidity flush toward 108K before push Medium-Term (1–3 weeks) BTC remains in a controlled re-accumulation zone after the corrective leg. Structure suggests we are building the base for the next expansion leg, but smart money wants maximum liquidation efficiency before allowing trend continuation. As long as price holds above the 105–108K base, expect compression → breakout behavior. The most efficient path remains sideways-up with volatility and unpredictable spikes to exhaust both sides. Medium-term bias: Bullish continuation after base Targets: 117K → 121K → 126K Long-Term (4–12 weeks) Macro remains intact for the next major impulse leg once corrective absorption completes. A push into new ATH zone above 130K remains on track after shakeout, unless a systemic macro event breaks structure. Institutional demand bottom sits lower at 103–105K; if tapped, it accelerates the next parabolic move. Long-term bias: Strong bullish continuation after final liquidity events Targets: 135K → 145K+ Smart money still in accumulation control Liquidation Map & Flow Large short liquidations stack above 112K–113.5K → draw target Liquidity gap above 115K that will trigger a fast wick when reclaimed Long liquidation pool sits below 108K, deeper at 105K MM footprint suggests hunt both sides then expansion Liquidation expectation: Sweep weak lows → build higher base → take shorts above 112–113.5K Whale Map Behavior Whales added below 109K and layered bids toward 105K Aggressive absorption at the wick lows confirms value perception Sell walls at 113–116K designed to slow price, not reject trend Signature resembles accumulation disguised as weakness Whales pushing weak-hand shakeouts before expansion. Trade Plan Primary Setup ( safer reclaim entry ) Entry: Break + hold 112.2K SL: 109.7K TP1: 113.5K TP2: 115.2K TP3: 117.8K+ Aggressive Accumulation Zone Entry zone: 108.5K–107.2K SL: 105.8K TP: 112K → 115K Best play: Fade fear flushes into support, not chase candles. Invalidation The plan invalidates if BTC: Loses 105K on high-volume breakdown OBV + Delta flip into distribution without reclaim attempts 4H volatility expands down inside cloud with no rebound Break below 105K = deeper corrective leg → 98–100K zone before continuation.