Technical analysis by pejman_zwin about Symbol BTC: Buy recommendation (10/27/2025)

pejman_zwin

رالی بیت کوین داغ شد: مراقب این منطقه حساس باشید!

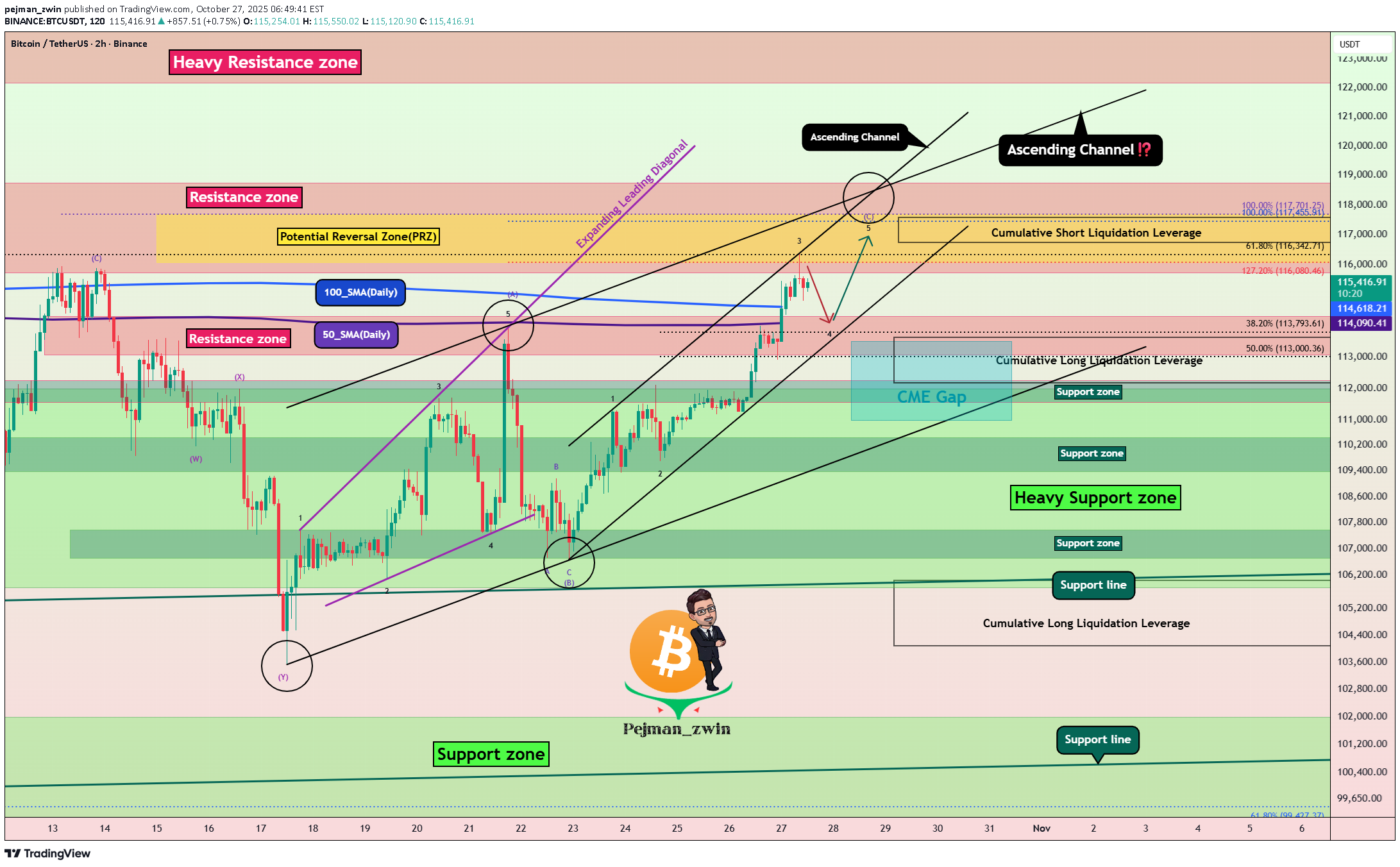

As the new week kicked off, Bitcoin ( BTCUSDT ) started to climb, fueled by a pump in the S&P500 index ( SPX ) and the creation of a gap in the S&P500 index. It seems Bitcoin has successfully broken above the 100_SMA(Daily) and 50_SMA(Daily) , as well as a Resistance zone($114,300-$113,000) . In fact, Bitcoin has also formed a new CME Gap($113,495-$110,990) due to this S&P500 Index -driven surge. Right now, Bitcoin is approaching the next key Resistance zone($118,740-$115,740) , Potential Reversal Zone(PRZ) [$117,700-$116,080] , the Cumulative Short Liquidation Leverage($117,577-$116,731) , and the upper line of an ascending channel . From an Elliott Wave perspective , by breaking this Resistance zone($114,300-$113,000) , Bitcoin has entered a new phase of wave counting. It appears to be completing microwave 4 of the main wave C . Overall, the corrective structure seems to be a Zigzag Correction(ABC/5-3-5) with an expanding leading diagonal in main wave A . I expect that in the coming hours, after a pullback to the broken Resistance zone($114,300-$113,000) and those moving averages , Bitcoin might rise again at least up to the Potential Reversal Zone(PRZ) [$117,700-$116,080] . There's a possibility of forming a larger ascending channel, but since we haven't confirmed a second top, we can't rely on that channel just yet. Note: In general, the crypto market in the past couple of weeks has been heavily influenced by news around U.S.-China tariffs. Any headline can cause Bitcoin and other tokens to swing up or down, so keep an eye on those geopolitical headlines. Cumulative Long Liquidation Leverage: $113,625-$112,175 Cumulative Long Liquidation Leverage: $106,033-$104,090 Note: If Bitcoin falls below the moving averages and the Resistance zone($114,300-$113,000) again, we can expect further declines. Please respect each other's ideas and express them politely if you agree or disagree. Bitcoin Analysis (BTCUSDT), 2-hour time frame. Be sure to follow the updated ideas. Do not forget to put a Stop loss for your positions (For every position you want to open). Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post. Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.Short Position touched Target I opened a long position, but I will close it at the slightest sign of a reversal and wait for Bitcoin's next move. As I expected in yesterday’s analysis, BTC pulled back nicely to the broken Resistance zone($114,300-$113,000) and used the 100_SMA(Daily) and 50_SMA(Daily). However, one key thing to note is that sell order volume at higher levels is pretty heavy, and there's a chance Bitcoin might NOT even reach the Potential Reversal Zone(PRZ) [$117,700-$116,080] before facing resistance. So if you've taken a long position near the lower line of the ascending channel, keep this in mind and stick to your own strategy. This is just a personal analysis. Another point to mention is that although the SPX500 has been hitting new all-time highs as the new week began, BTC has shown a bit less correlation with it in the last day. So if the S&P 500 undergoes a correction, Bitcoin might actually see a sharper pullback, which is something to watch out for as a potential negative factor for Bitcoin. Also, keep in mind that tomorrow some important U.S. economic indices will be released, which could also influence the market. So definitely factor that into your considerations. New Cumulative Short Liquidation Leverage: $116,763-$115,388 New Cumulative Long Liquidation Leverage: $113,331-$112,474 Be sure to follow money managementLong Position touched the target