Technical analysis by artemfedorov about Symbol BTC: Buy recommendation (10/25/2025)

artemfedorov

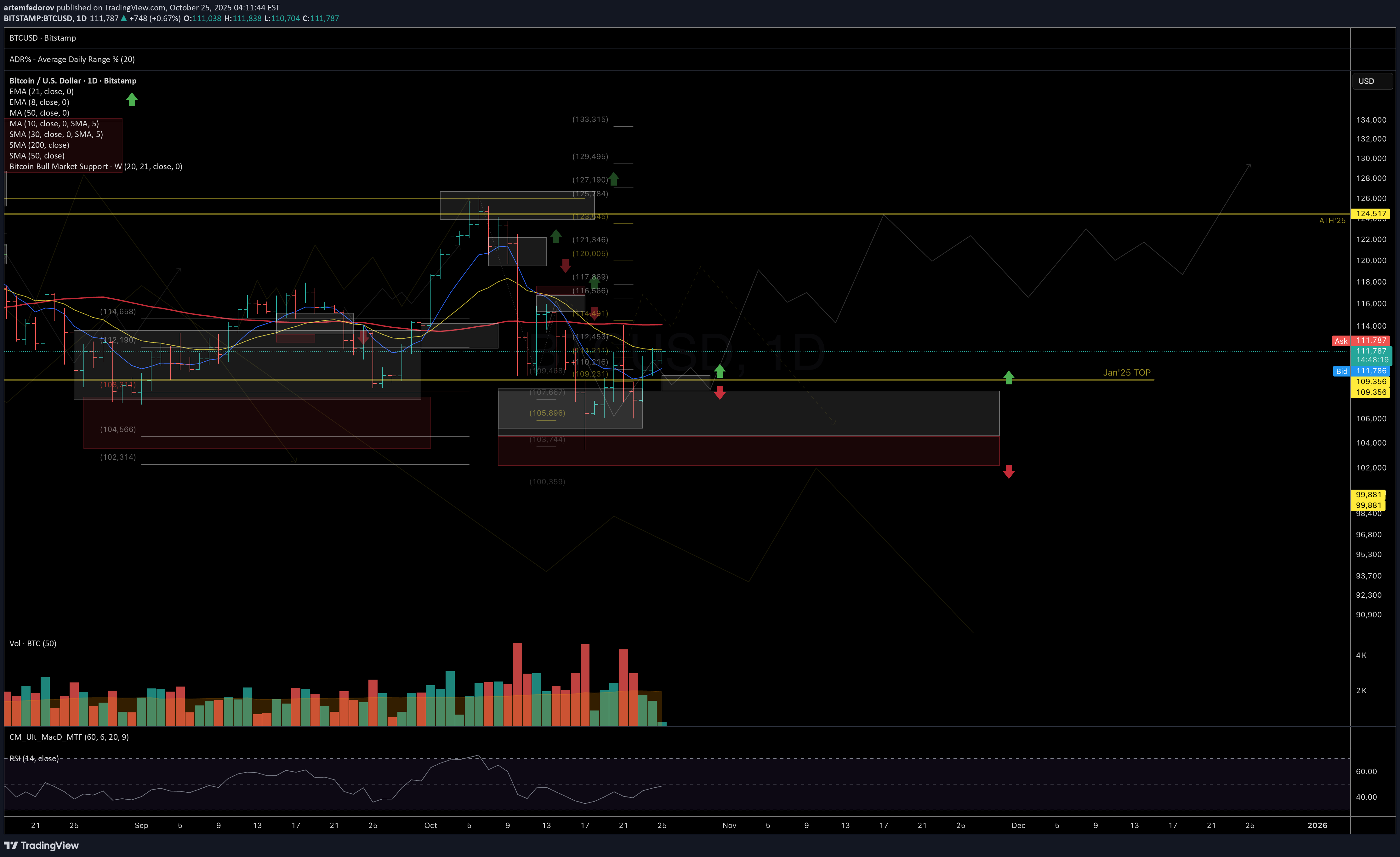

تحلیل هفتگی ارز دیجیتال: آیا بیت کوین به اوج جدید میرسد؟ (سطوح کلیدی)

Price continues to move in line with the main scenario discussed in previous weekly updates. As long as the structure remains constructive and key supports hold, I'll be holding the base hypothesis of correction completion and gradual trend recovery as a prime one. In this scenario, over the coming weeks and into Q4, I’d like to see: • price holding above local support; • breakout and consolidation above the 21-day EMA and 50-day MA; • gradual movement toward next resistance zones — 115–120K, followed by 123K+. Key levels: • Local support: 109–107K • Local resistance: 114–116K, then 120–123.5K • Macro support zone: 102K A breakdown below local support may trigger another retest of the lower boundary of the macro-support zone. If weekly closes occur below 102K, it would notably increase the probability that the current long-term uptrend cycle is ending and a macro-correction phase is beginning. Daily time frame: Weekly: Thank you for your attention — wishing everyone a calm weekend and a productive start to the new week!Today’s price action looks constructive and aligns with the main scenario of resuming uptrend. Key intraday level: support zone 113–111.7k must hold. As long as it does, expecting continuation toward next local resistance in the coming hours/days. Break below 111.7k would increase risk of retesting 106–103k zone. Chart (4h):Quick update on #BTC The local trend still looks constructive: price has broken above the nearest resistance level I mentioned earlier and is now testing it as a support zone. To maintain the bullish scenario, it’s important to hold above $111.7k. In this case, I expect continuation toward $120–125k in the coming days. However, if price fails to hold above $111.7k, a more prolonged correction toward $105–102k becomes likely. Watching how this develops. Updated chart: