Technical analysis by artemfedorov about Symbol BTC on 10/13/2025

artemfedorov

سطوح حیاتی بیت کوین و اتریوم: چه اتفاقی در راه است؟

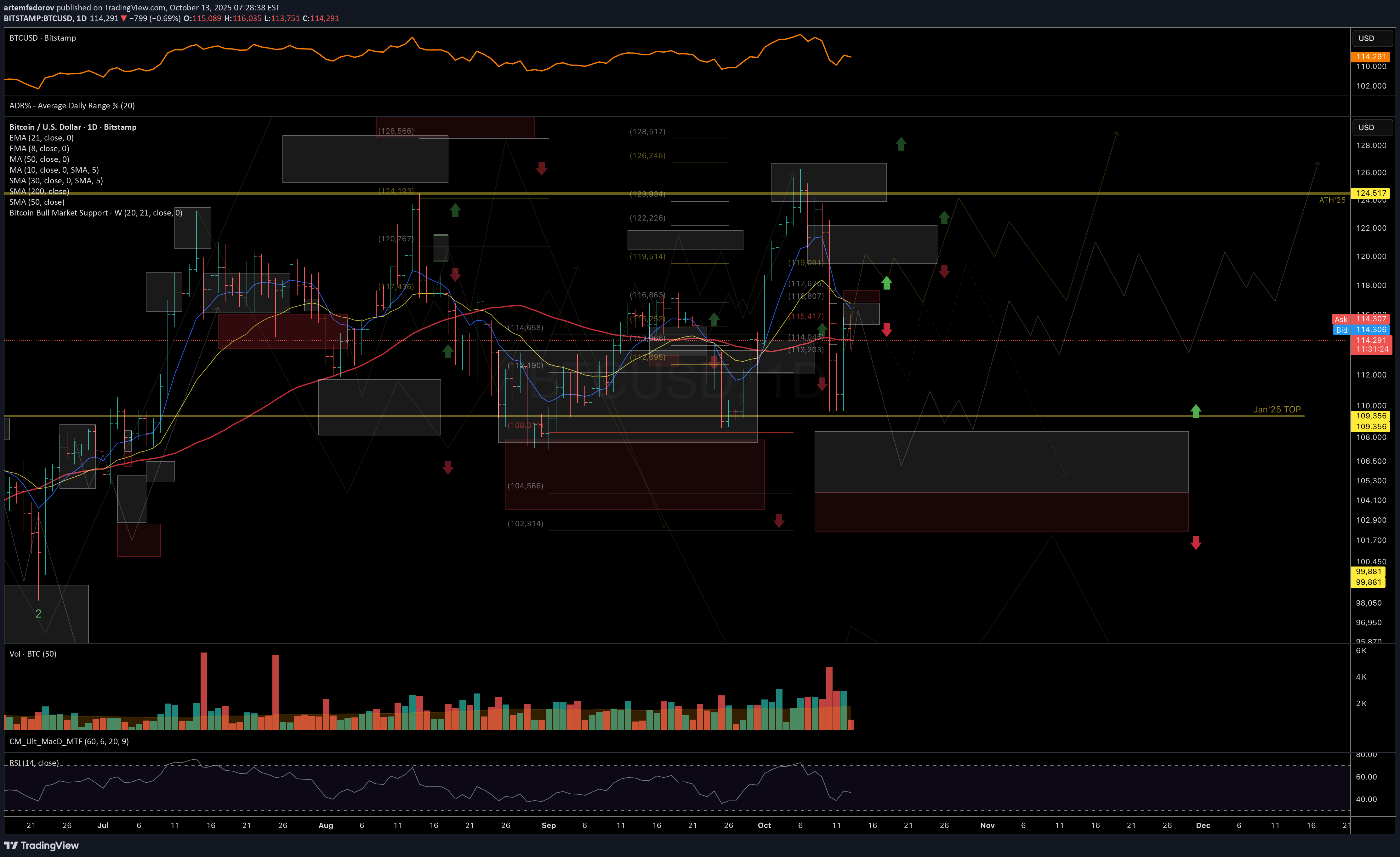

BTC The recovery pattern from the September lows still looks more like a medium-term correction rather than the completion of the broader bullish cycle. As long as the price holds above the macro support zone at 108–102K and does not close below the 50-week moving average for more than two consecutive weeks, I consider the macro uptrend intact and expect the correction to conclude in Q4. However, while Bitcoin remains below 118K, another wave of selling toward the 108K area in the coming weeks cannot be ruled out before a potential new leg higher. Chart (taken on Oct 12): Short-term resistance zone: 115.5–118K Macro support zone: 108–102K ⸻ ETH The price has moved deeper into the macro support area highlighted in earlier reviews and reached key weekly moving averages (20SMA and 21EMA), which have historically provided support to every major growth cycle. On the daily timeframe, as long as the price remains above 3290, the main scenario remains bullish — with potential for new highs in Q4. Ideally, I would like to see ETH hold the 3840–3700 zone during the current recovery attempt and form a constructive consolidation above the 21/50-day moving averages. If assets maintain their macro support zones, I expect Ethereum could once again outperform Bitcoin in the next phase of the uptrend. Chart: Short-term resistance zone: 4180–4360 / 4550 Local support zone: 3960–3700 ⸻ In light of the historic liquidation event we witnessed last week, I’d like to share a quote from one of the veteran traders and original Market Wizards — Peter Brandt: "Greetings crypto traders whose Friday was not a cheerful day. I need to tell you that there will be better tomorrows. While the tunnel may seen dark, there can be bright days in front of you depending upon how you respond to your present circumstances. ... Wealth - real wealth that is secure and lasting - does not come from "bet the farm" speculative bets. Real wealth comes from accepting investing as a marathon, not a sprint. Real wealth comes from controlling risk, not from taking huge gambles. Real wealth comes in the accumulation in small pieces, gained, then protected. I love that the younger generation to which you belong has taken an interest in speculative markets such as crypto and futures. Welcome. This is the arena I have operated in now in the 6th different decade starting in the 1970s. I wiped out several accounts in the early days. These are not fond memories. But I kept at it. For me I learned how to control my risk. What does that mean exactly? Well, for me it means to limit my risk on any given bet to no more than 1% of my total pot. I know that sounds too tame to be meaningful, but if you do not want to go through what you experienced this past week, then perhaps it should be meaningful. It also means that I do not bet any more than 3% of my entire trading capital on the composite of highly correlated bets. I have noticed that some in the crypto space wear as a badge of honor that they can sit through 80% drawdowns. Well, that is NOT a badge of honor. It is a crown of shame. Anyone who thinks lightly of 80% drawdowns will end up rekt at the end of the game. If you doubt me, then stay on your present course and find out. ... So, I encourage you. Take this past week as a serious lesson of investing and of life. Take ownership of your mistakes. Don't blame this past week on some "whale" or manipulator. Own it. And move forward having learned some valuable lesson " ⸻ Thank you for your attention! In times of heightened volatility, please remember - protecting your emotional capital is just as important as protecting your financial one. Stay disciplined, patient, and kind to yourself through market turbulence - it’s part of every trader’s journey toward mastery. Let’s leave the past behind, take the lessons it offered, and focus on the next trade with a clear vision and renewed confidence. Wishing everyone a strong and productive start to the new week!