Technical analysis by Trading-Addicts about Symbol BTC on 9/13/2025

BTCUSD

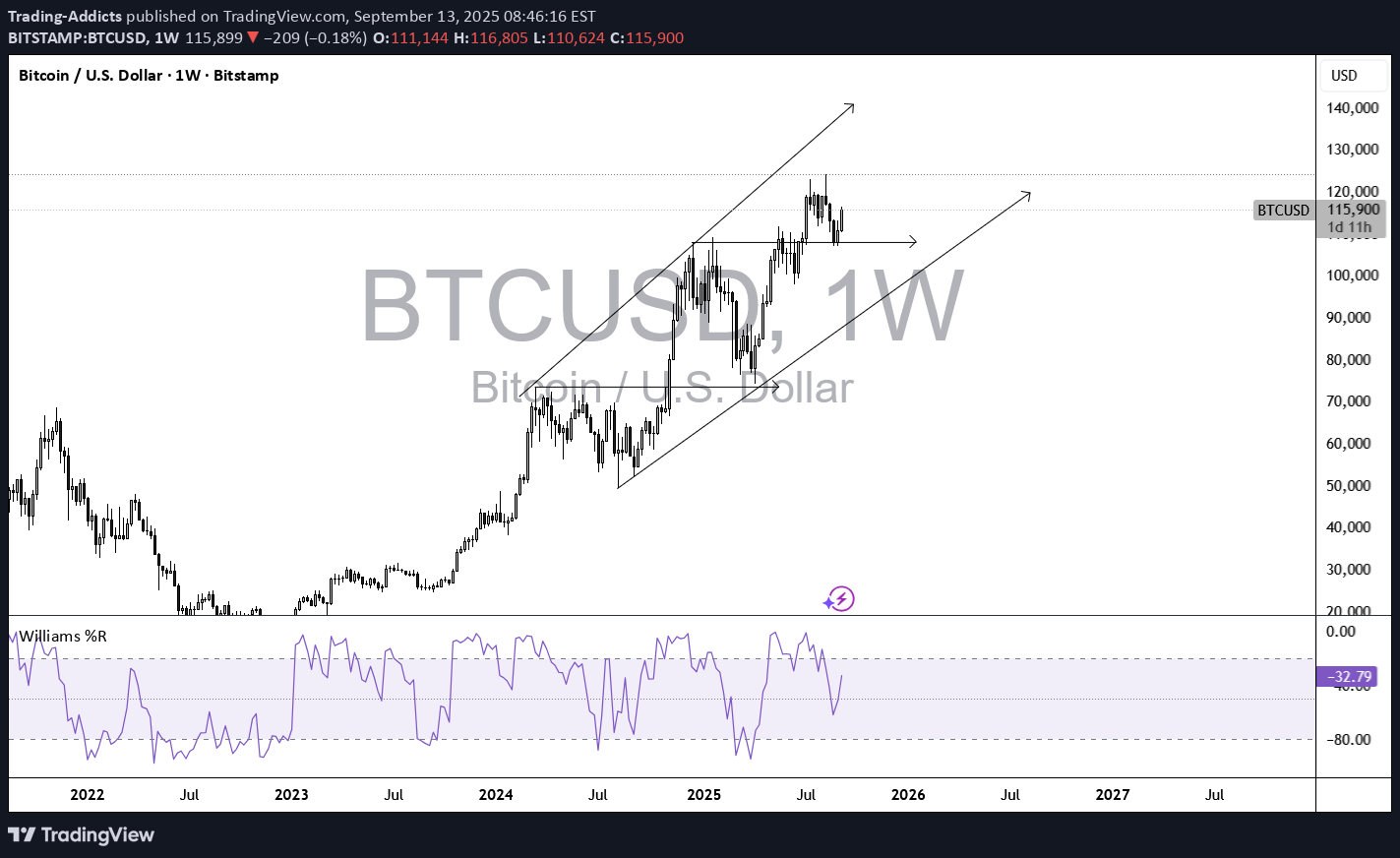

Bullish Arguments for BTC/USD Institutional adoption Bitcoin ETFs and regulated investment vehicles are attracting steady inflows, creating consistent demand. Large asset managers are gradually increasing allocations, giving BTC legitimacy in traditional finance. Macro backdrop (monetary policy) Expectations of Fed rate cuts weaken the dollar and lower bond yields, which tends to benefit alternative assets like BTC. In a low-yield environment, investors search for higher-beta assets, and BTC often rallies. Supply dynamics The halving event earlier this year reduced new supply issuance by 50%. Historically, halvings are followed by multi-month to multi-year bullish cycles, as supply shrinks while demand continues. Digital gold narrative BTC increasingly behaves as a hedge against inflation, fiscal deficits, and currency debasement. Growing central bank debt and fiat skepticism fuel interest in scarce assets. Technical structure BTC remains in a long-term uptrend with higher lows forming. Key resistance levels near recent highs are being tested; a breakout could open the way to new all-time highs. ❌ Bearish Arguments for BTC/USD Regulatory risks Governments could tighten rules on exchanges, wallets, or crypto transactions. Legal or compliance issues around stablecoins, DeFi, or taxation could weigh on sentiment. Liquidity / risk appetite In risk-off markets (stock selloffs, flight to safety), BTC often drops alongside equities. If global risk sentiment deteriorates, BTC may struggle despite long-term fundamentals. Stronger USD / higher yields If US inflation stays sticky and the Fed delays cuts, a stronger USD could hurt BTC. Rising bond yields reduce the appeal of speculative assets. Volatility & profit-taking BTC often sees sharp corrections after big rallies. Profit-taking from institutions and whales can trigger 20-30% retracements even in a bull trend. 🎯 Technical Zones to Watch Support: Around $58K–60K (short-term), deeper support near $52K–55K. Resistance: $68K–70K (recent highs); if broken, $75K+ could open as next psychological target. Trend: As long as BTC holds above $58K, the medium-term structure remains bullish. 📌 Summary Bull case: ETF inflows, halving supply shock, Fed easing expectations, and strong adoption narrative keep BTC in an upward bias. Bear case: Stronger USD, regulatory uncertainty, and profit-taking could trigger sharp but possibly temporary pullbacks. Trade approach: Buy dips into strong support zones, with stops below major swing lows. Upside targets include retests of highs and potential new all-time highs if momentum continues.