Technical analysis by ScottMelker about Symbol BTC on 9/11/2025

ScottMelker

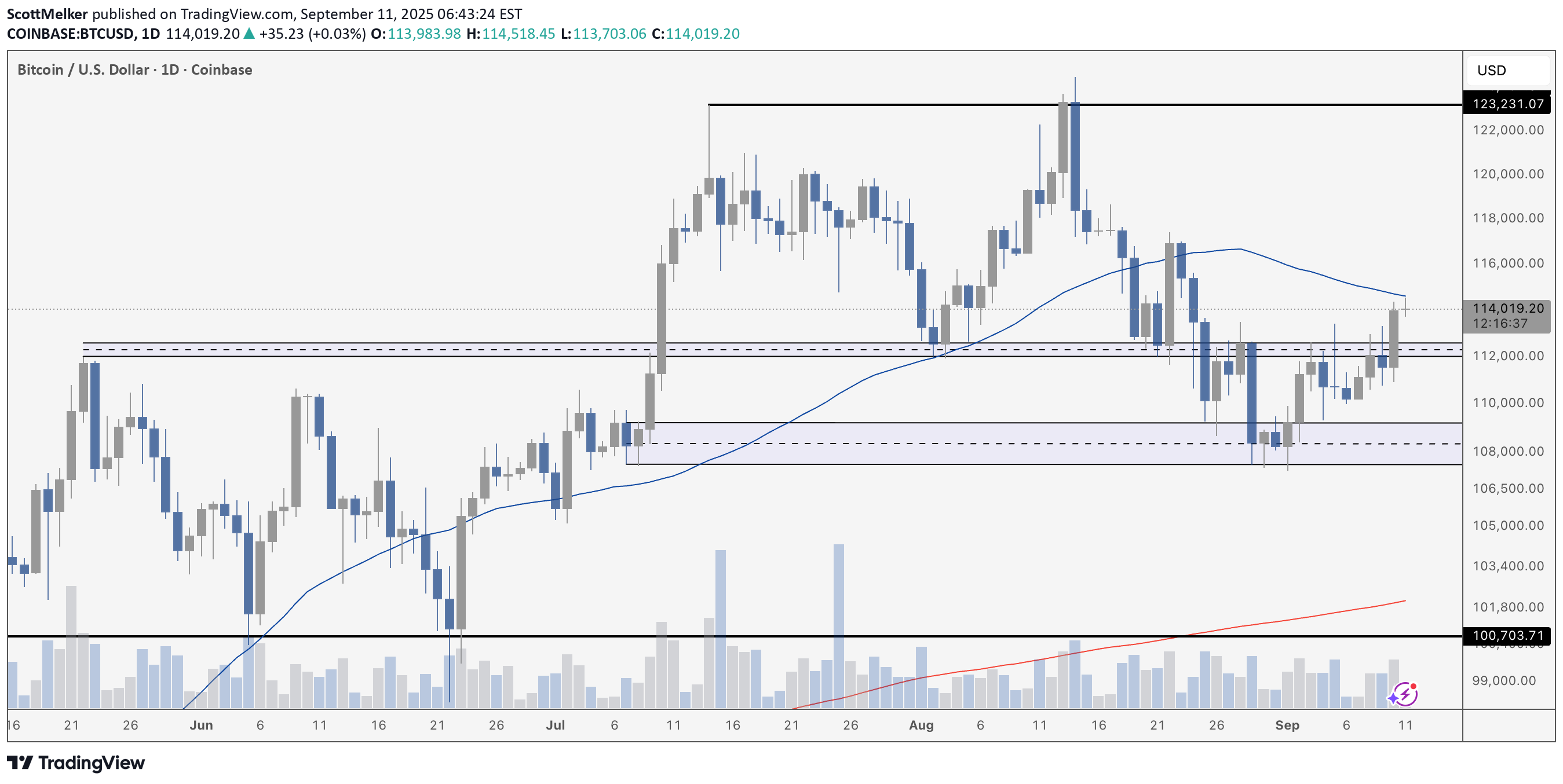

Bitcoin has finally pushed through the 112K resistance zone that capped price for the past few weeks, and yesterday’s daily close at 114K marks a meaningful shift in momentum. This level was critical – it had rejected multiple rallies since mid-August – so reclaiming it on a daily closing basis is an encouraging sign for bulls. That said, the chart still leaves room for caution. Price is now testing the 50-day moving average from below, and this is often where lower highs form in corrective structures. Until Bitcoin can push convincingly above the 117Ks and hold there, the risk remains that this bounce is just part of a broader consolidation. On the downside, the reclaimed 112K zone now becomes key support. A clean retest and hold of that level would flip it into a stronger base for continuation. Below that, the range between 108K–109K remains the last line of defense before a potential drop back toward 100K. In short, breaking above 112K is a clear win, but confirmation requires follow-through. If bulls can maintain momentum through the moving averages and print a higher high above ~117K, it would invalidate the recent series of lower highs and put the 123K range highs back in play. For now, we’re at a pivotal juncture – either Bitcoin builds on this breakout, or it risks another rejection at resistance.