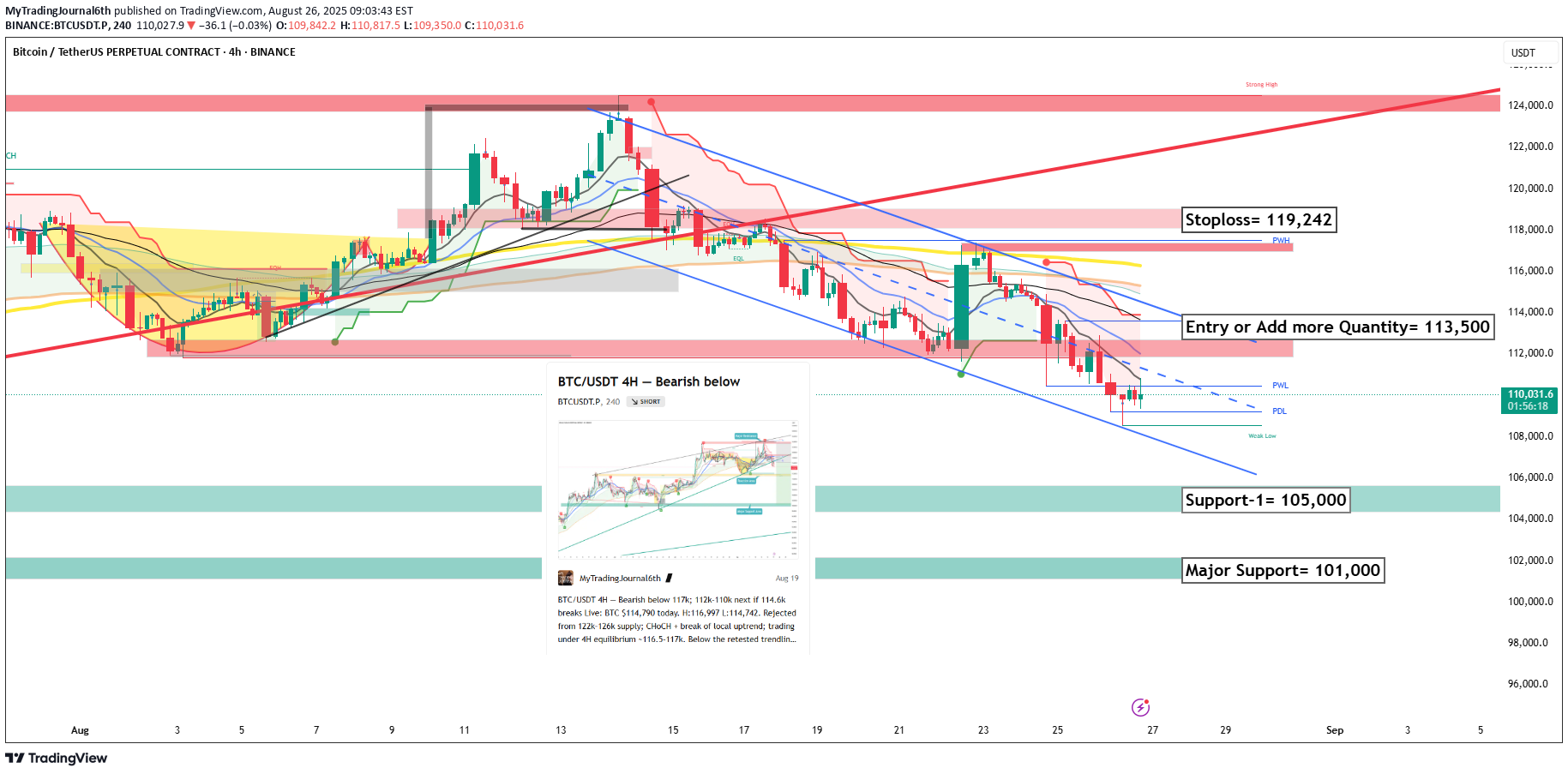

Technical analysis by MyTradingJournal6th about Symbol BTC: Sell recommendation (8/26/2025)

MyTradingJournal6th

Snapshot (26 Aug 2025, 19:25 IST) BTC is holding near $110k after the mid-Aug peak and subsequent bleed. Past 24–72h stayed inside a 4H descending channel; intraday range ~$108.8k–$112.9k. Technical View – 4H descending channel intact; lower highs since mid-Aug. – Supports: $108k first, then $105k; deeper shelf near $101k. – Resistances: $112k–$113.5k supply zone; next cap around $118k. – EMAs (20/50/200) remain bear-stacked; 4H MACD below zero. – Confluence: channel top + MA cluster ≈ $112k–$113.5k. Trade Plan – Short below $113,000 → T1 $105,000, T2 $101,000; SL $119,240; timeframe swing. (For intraday, a 1H close >$111k targets $112.8k; <$109k targets $107.5k.) Invalidation Bearish view invalid if daily close >$119,250 with convincing volume. Big Picture ETF flows just flipped positive, but overall tone is cautious; GDP/PCE this week can push a break from the $110k–$113k pivot. Engage $112k–$113.5k breakout first, or do we sweep $105k before any bounce?