Technical analysis by PHANT0M about Symbol ADA: Buy recommendation (8/18/2025)

PHANT0M

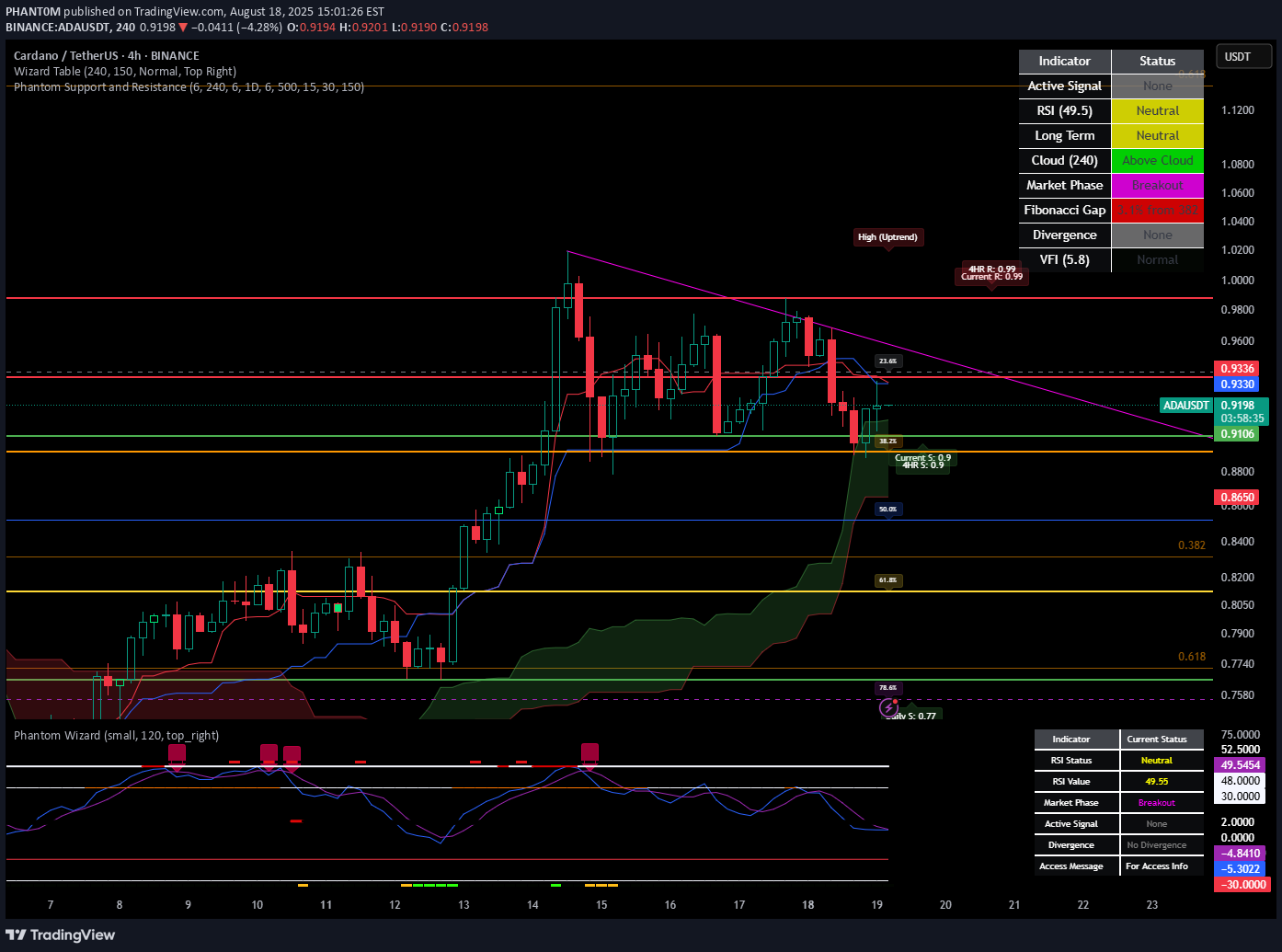

Cardano's Awakening: ADA's Technical Resurgence and Year-End Outlook Executive Summary Cardano (ADA) is showing strong signs of a potential breakout after a prolonged consolidation phase. Currently trading at $0.9183, ADA has established a solid foundation with key support at $0.82-$0.85 and is demonstrating increasing momentum indicators. The recent surge from $0.75 to $0.95+ represents a significant 26% gain that appears to be the beginning of a larger move. Our analysis points to a primary target of **$1.20-$1.30** by year-end, with an aggressive bull case scenario of **$1.50-$1.65** if current momentum accelerates. Technical Analysis Price Structure and Key Levels Cardano has completed a multi-month bottoming pattern and recently broke through several critical resistance levels: 1. **Breakout Confirmation**: ADA decisively broke above the $0.85 resistance zone in early August, which had capped price action since April 2024. 2. **Support Conversion**: The previous resistance at $0.82-$0.85 has now flipped to become strong support, with multiple tests confirming this level. 3. **Higher Highs and Higher Lows**: Since July 2024, ADA has established a clear pattern of higher highs and higher lows, confirming a trend reversal from the previous downtrend. 4. **Volume Confirmation**: The breakout above $0.85 was accompanied by significantly higher trading volume, particularly during the surge to $0.95+ in early August. Ichimoku Cloud Analysis The Ichimoku indicators reveal a strongly bullish setup: 1. **Cloud Breakout**: Price has broken above the Kumo (cloud), with the current price ($0.9183) well above both the Senkou Span A and B lines. 2. **TK Cross**: A bullish Tenkan-sen/Kijun-sen cross occurred in late July, signaling strong momentum. 3. **Future Cloud**: The forward-looking cloud has turned bullish (Senkou Span A above Senkou Span B), suggesting continued upward pressure in the coming weeks. 4. **Price-Kijun Relationship**: Price is maintaining position above the Kijun-sen (base line), which is now acting as dynamic support around $0.89. Oscillator Analysis 1. **RSI**: The daily RSI is currently at 56, showing strength without being overbought. This provides room for further upside before exhaustion. 2. **Oscillator SMA**: The oscillator SMA has crossed above the zero line, confirming the shift to bullish momentum. 3. **VFI (Volume Flow Indicator)**: Shows positive money flow into ADA, supporting the price advance. Market Structure Analysis Historical Context Cardano's price action must be viewed within its historical context: 1. **Previous ATH**: ADA's all-time high of $3.10 from September 2021 represents a significant psychological level. 2. **Retracement Level**: Current price at $0.9183 represents approximately 30% of the all-time high, suggesting substantial recovery potential. 3. **Consolidation Period**: ADA spent most of 2023 and early 2024 in a tight range between $0.24-$0.45 before beginning its current uptrend. Comparative Performance When compared to other major cryptocurrencies: 1. **Relative Strength**: While market leaders have shown exceptional strength, ADA is still in earlier stages of its recovery cycle. 2. **Catch-up Potential**: ADA typically lags in market cycles but often experiences more explosive percentage gains when its momentum fully establishes. 3. **Market Rotation**: There are early signs of capital beginning to rotate from leading assets into "second-tier" assets like ADA, which typically occurs in the middle-to-late stages of bull markets. Price Projections and Targets Based on technical analysis, we've established the following price targets: 1. **Primary Target**: $1.20-$1.30 (30-40% upside from current levels) - This represents the 1.618 Fibonacci extension from the July-August move - Aligns with significant historical resistance from April-May 2022 2. **Aggressive Bull Case**: $1.50-$1.65 (65-80% upside from current levels) - This represents the 2.618 Fibonacci extension - Would require continued strength in the broader crypto market 3. **Support Levels**: - Primary support: $0.82-$0.85 (previous resistance turned support) - Secondary support: $0.75-$0.77 (recent consolidation range) Risk Assessment Several factors could impact this outlook: 1. **Bitcoin Correlation**: ADA maintains a high correlation with Bitcoin. A significant BTC correction could temporarily derail ADA's uptrend. 2. **Technical Resistance**: Multiple resistance levels exist between $1.00-$1.20, which could slow momentum. 3. **Market Sentiment**: The broader crypto market sentiment remains a key variable, with regulatory news potentially causing volatility. 4. **Overbought Conditions**: Short-term overbought readings could trigger pullbacks, though these should be viewed as buying opportunities within the larger trend. Trading Strategy For traders looking to capitalize on ADA's potential: 1. **Entry Points**: - Immediate: Partial positions at current levels ($0.9183) - Optimal: Look for pullbacks to the $0.85-$0.88 support zone - Aggressive: Major pullbacks to $0.82 represent strong buying opportunities 2. **Position Management**: - Stop Loss: Below $0.80 (invalidates the current bullish structure) - Take Profit Levels: Partial profits at $1.10, $1.30, and $1.50 3. **Risk Management**: - Limit position size to 3-5% of portfolio - Consider scaling in on dips rather than deploying full positions at once Conclusion Cardano (ADA) is showing compelling technical strength with its recent breakout above key resistance levels. The completion of a multi-month bottoming pattern, coupled with improving momentum indicators and volume confirmation, suggests ADA is in the early stages of a significant uptrend. Our analysis points to a primary target of $1.20-$1.30, with potential for $1.50-$1.65 in an aggressive bull case scenario. The current price of $0.9183 represents an attractive entry point with a favorable risk-reward ratio, especially for investors with a medium-term horizon. Any pullbacks to the $0.82-$0.85 support zone should be viewed as significant buying opportunities within the context of the larger bullish trend. While not yet showing dominant market leadership, ADA appears poised for a period of outperformance as capital potentially rotates into this asset class. The technical foundation is firmly in place for continued upside through the remainder of 2024.