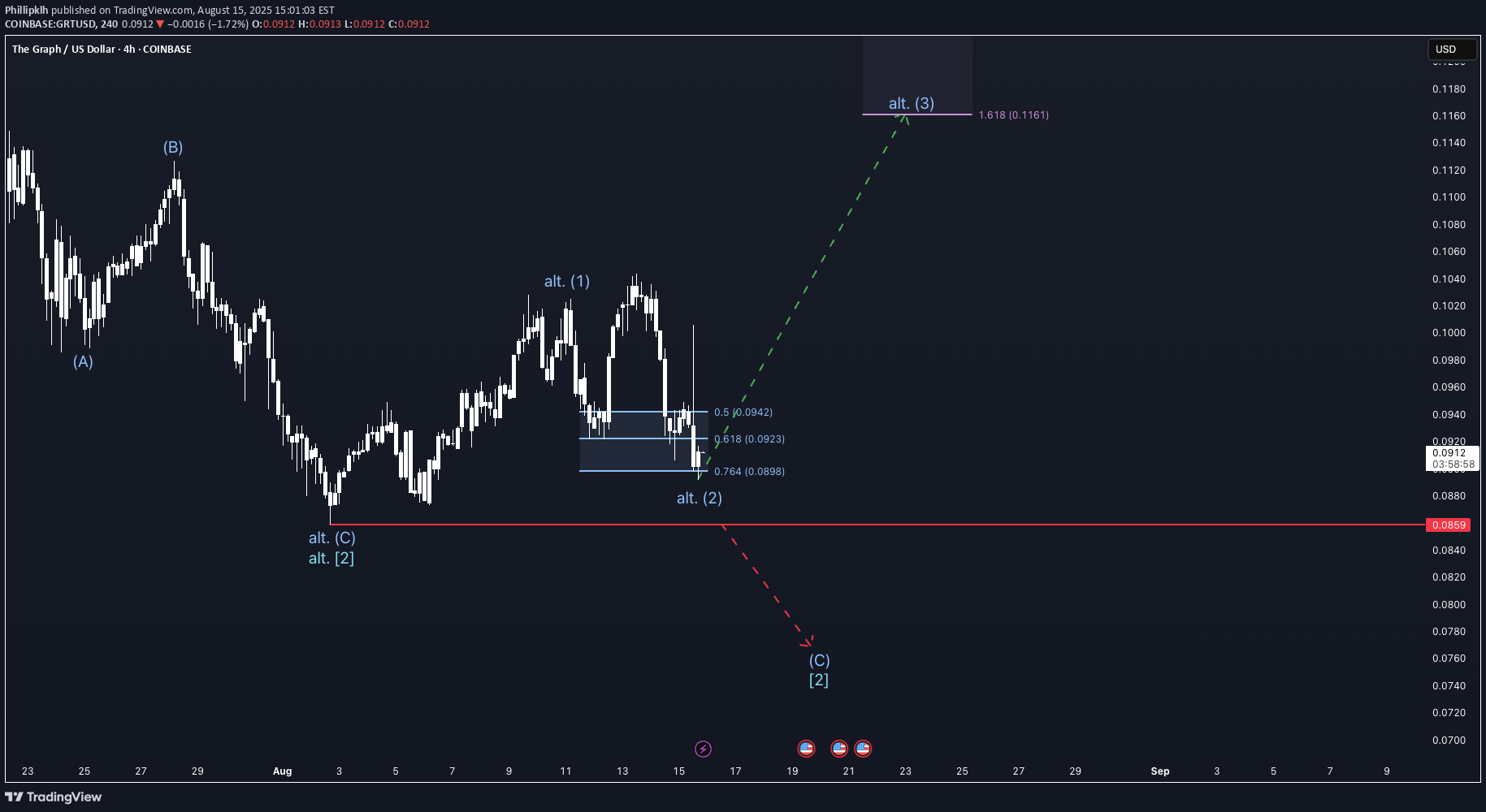

Technical analysis by Phillipklh about Symbol GRT on 8/15/2025

The current chart positions GRT in Intermediate Wave C of Primary Wave 2, implying a bearish continuation within the Elliott Wave framework. However, confidence in this view is low, as the Elliott Wave count is the only factor supporting further downside. All other signals currently point in the opposite direction. Last week’s chart had the primary and alternative scenarios reversed, a shift largely driven by cross-cryptocurrency correlations and the anticipation of deeper corrections. From a liquidity perspective, there is only a notable cluster above the high of the alternative Intermediate Wave 1. The order book likewise shows large orders positioned very close to the current price, a setup that is unlikely to trigger a significant move lower and instead raises the possibility of a liquidity run to the upside. Derivative data further undermines the bearish case. Funding rates have already turned negative, while open interest is declining, indicating capital outflows from GRT and an increase in short positioning. This combination often suggests heightened squeeze risk rather than sustained downside momentum. Given the broader market context, including correlations with other altcoins and Bitcoin, as well as the fact that Bitcoin dominance has yet to drop sufficiently to support a strongly bullish alternative, the outlook remains unclear. I have closed my positions in profit and will remain on the sidelines until price action provides greater clarity. There will always be opportunities to re-enter the market once direction is confirmed.