Technical analysis by Ox_kali about Symbol BTC: Buy recommendation (7/25/2025)

Ox_kali

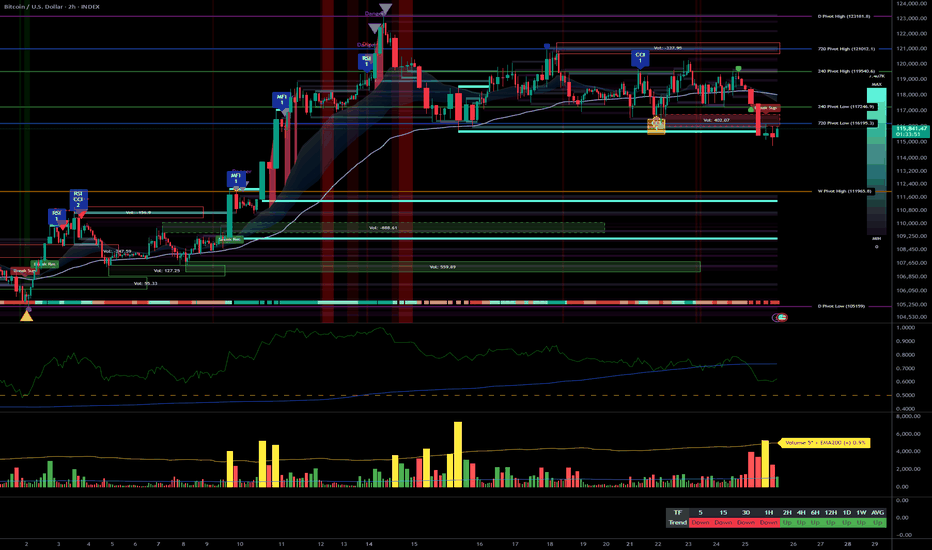

__________________________________________________________________________________ Technical Overview – Summary Points ➤ Bullish momentum across all higher timeframes (1H to 1W) supported by Risk On / Risk Off Indicator (Strong Buy). ➤ Major supports: 116,128 and 111,980 (multi-timeframe pivots). Key resistance at 123,218. ➤ Very high intraday volumes, pointing towards probable capitulation zones. ➤ Multi-timeframe behaviors: Technical rebound anticipated on the 116,128–115,600 zone, caution if 111,980 breaks. __________________________________________________________________________________ Strategic Summary ➤ Global Bias: Bullish confirmed mid/long-term. ➤ Accumulation opportunities on key pullbacks near 116,128 and 111,980. ➤ Risk zone: sustained closes below 111,980 = invalidation of bullish outlook (target 105,100). ➤ Macro catalysts: FOMC meeting (July 29-30), heightened event-risk period. ➤ Action plan: favor entries after FOMC volatility resolution, stop-loss adjusted below 111,980. __________________________________________________________________________________ Multi-Timeframe Analysis Daily (1D) : Compression under 123,218 resistance, primary bullish trend, no extreme signals. 12H : Healthy consolidation under resistance, no euphoria or panic, normal volumes. 6H : Price squeezed between major supports (116,128–111,980), uptrend confirmed. 4H : Institutional volumes on supports, favors technical rebound. 2H : Speculative rebound underway, confirmation needed for short-term bottom. 1H : Strong capitulation signal, record volumes, immediate retest of 116,128 support. 30min : Local oversold status, extreme sentiment, high technical reversal probability. 15min : Phase of panic likely ending, short-term rebound anticipated. Key Indicators: Risk On / Risk Off Indicator: Strong buy on 1D–4H, neutral on 30min and 15min. ISPD DIV: Neutral to Buy (capitulation signaled on 1H+30min). Volumes: Very high at lows = capitulation + potential bottom. MTFTI: Up momentum above 1H, down on lower timeframes (30–5min). __________________________________________________________________________________ Cross Timeframe Synthesis High timeframe alignment confirms bullish bias, supported by buyer volumes. Key zone 116,128–111,980 = multi-timeframe support, tactical focus. Main risk: break of 111,980. __________________________________________________________________________________ Operational synthesis & macro context Bullish bias validated unless breakdown below 111,980. Tactical accumulation window on pullbacks, 1H confirmation needed. Volatility risk increases ahead/during FOMC, dynamic stop management essential. Altcoins fragile: extra caution if BTC triggers Risk Off. Calendar to watch: FOMC (July 29–30), Durable Goods (July 25). __________________________________________________________________________________ On-Chain (Glassnode) : BTC consolidates, no extreme signs; ETH outperforming but caution on alts (elevated leverage). __________________________________________________________________________________ ⏳ *Decision Recap for July 25, 2025, 10:56 CEST:* — BUY ZONE tactical at 116,128–115,600 (BTC), 1H confirmation required. — Stop-loss below 111,980 / Swing target >120,000–123,218. — Risks : Fed announcements, flushes on supports, altcoins at risk. __________________________________________________________________________________