Technical analysis by BitonGroup about Symbol SPYX: Buy recommendation (6/9/2025)

BitonGroup

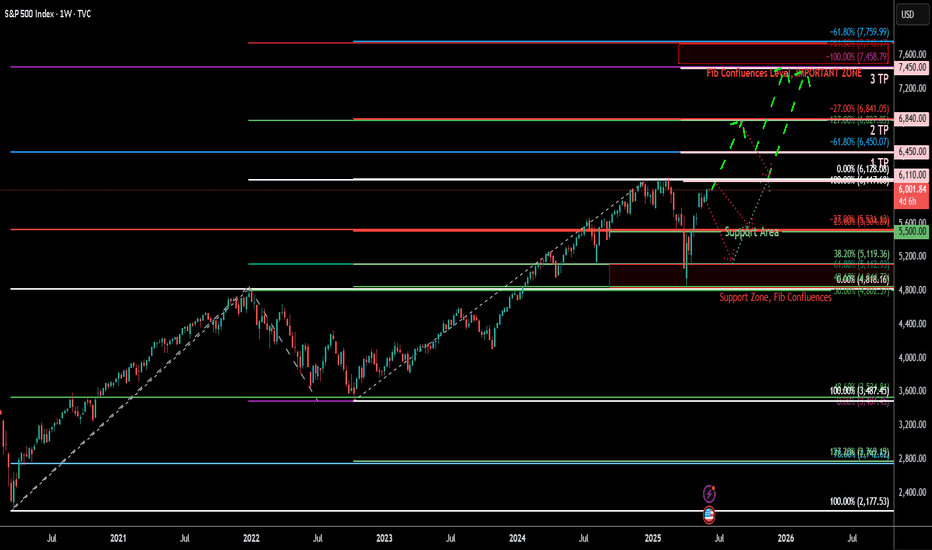

S&P 500 Index (SPX) Weekly TF – 2025

Chart Context: Tools Used: 3 Fibonacci Tools: 1. One **Fibonacci retracement** (from ATH to bottom) 2. Two **Trend-Based Fibonacci Extensions** * Key Levels and Zones: * **Support Zone** (Fib Confluence): \~4,820–5,100 * **Support Area (shallow pullback)**: \~5,500–5,600 * **Resistance & TP Zones:** * TP1: **6,450** (Fib confluence & -61.8%) * TP2: **6,840** (-27%) * TP3: **7,450–7,760** (Major Confluence) Technical Observations: * SPX is approaching a **critical resistance** near previous ATH (\~6,128) with projected upward trajectory. * The **green dashed path** suggests a rally continuation from current \~6,000 levels to TP1 (\~6,450), TP2 (\~6,840), and eventually TP3 (\~7,450–7,760), IF no major macro shock hits. * The **purple dotted path** suggests a potential retracement first to \~5,600 (shallow correction) or deeper into \~5,120 or even 4,820 zone before continuing the bullish rally. * The major support zone around **4,820–5,120** includes key Fib retracement levels (38.2% and 61.8%) from both extensions and historical breakout levels. Fundamental Context: * US economy shows **resilience** amid soft-landing narrative, though inflation remains sticky. * The **Federal Reserve** is expected to cut rates in **Q3–Q4 2025**, boosting equity valuations. * Liquidity expansion and dovish outlook support risk assets, including **equities and crypto**. * However, **AI-driven tech rally** may be overstretched; a correction could follow earnings disappointments or macro surprises (e.g., jobs or CPI shocks). Narrative Bias & Scenarios: **Scenario 1 – Correction Before Rally (Purple Path)** * If SPX faces macro pushback (e.g., high CPI, hawkish Fed), expect retracement to: * 5,600 = Fib -23.6% zone * 5,120–4,820 = Major Fib Confluence Zone * These would act as **accumulation zones**, setting up next leg up toward TP1 and beyond. * **Effect on Gold**: May rise temporarily due to risk-off move. * **Effect on Crypto**: Could stall or correct, especially altcoins. **Scenario 2 – Straight Rally (Green Path)** * If Fed confirms cuts and macro remains soft: * SPX breaks ATH (\~6,128) * Hits TP1 (\~6,450), TP2 (\~6,840) * Eventually reaches confluence at **TP3 (7,450–7,760)** * **Effect on Gold**: May struggle; investor preference for equities. * **Effect on Crypto**: Strong risk-on appetite, altseason continuation. Indicators Used: * 3 Fibonacci levels (retracement + 2 extensions) * Trendlines (macro and local) * Confluence mapping Philosophical/Narrative Layer: This phase of the market resembles a test of collective confidence. Equity markets nearing ATHs while monetary easing begins reflect a fragile optimism. The Fibonacci levels act as narrative checkpoints — psychological as much as mathematical. Will we rally on faith or fall for rebalancing? Bias & Strategy Implication: Bias: Bullish with caution * Strategy: * Await **confirmation breakout >6,128** for fresh long entries * Accumulate on dips in the **5,100–5,500** zone if correction unfolds * Use **TP1, TP2, TP3** as staged exits Related Reference Charts: * BTC.D Analysis – Bearish Bias: * TOTAL:Bullish Bias *TOTAL3 – Bullish Bias: * US10Y Yield – Falling Bias Impact:the First Target Achieved