Technical analysis by Innotrade_AJ about Symbol AVAX: Buy recommendation (7/29/2025)

Innotrade_AJ

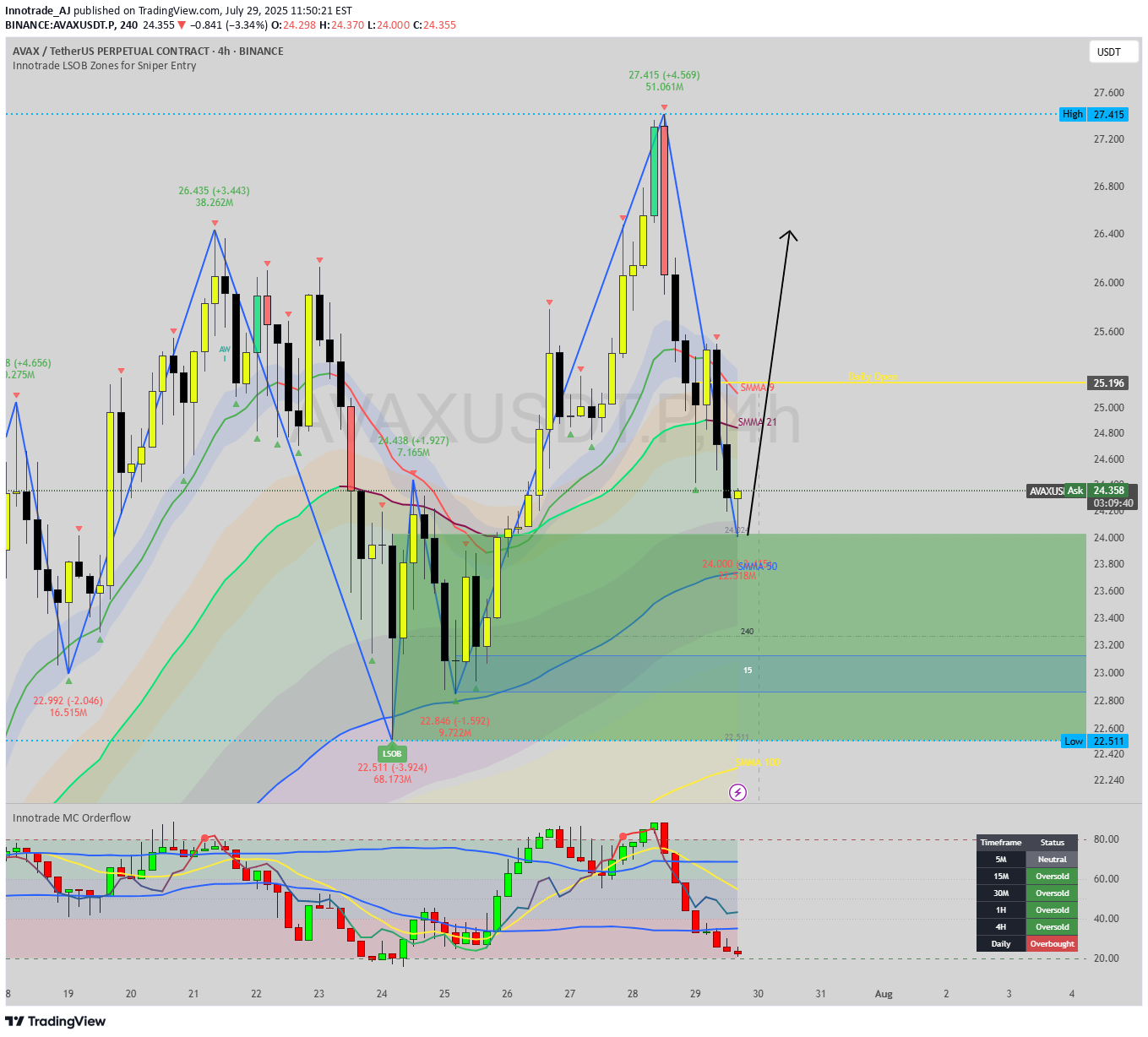

Hello, traders. Today, we're analyzing Avalanche (AVAX), which has undergone a healthy and necessary correction after a powerful impulsive move upwards. Price has now pulled back to a critical decision point that is loaded with a confluence of technical support signals. This analysis will break down, step-by-step, why the current price zone represents a high-probability area for a bullish reversal, potentially kicking off the next major leg up. This is an educational walkthrough demonstrating how to stack technical factors to build a strong trade thesis. The Analysis: Stacking the Technical Confluences A high-probability trade is rarely based on a single signal. It's built on multiple, independent factors all pointing in the same direction. Here is the confluence we are seeing on the AVAX 4H chart: 1. The Bullish Market Structure: First, the context. The overarching trend for AVAX is clearly bullish. Our Zig-Zag indicator confirms a strong pattern of higher highs and higher lows. The current dip is, therefore, considered a corrective pullback within a larger uptrend, meaning we should be looking for buying opportunities, not fighting the trend. 2. The Golden Pocket (Fibonacci Retracement): We've drawn a Fibonacci retracement from the beginning of the last impulsive leg up ( 22.54) Price has now pulled back precisely into the "golden pocket" between the 61.8% and 78.6% levels. This zone is a classic, high-probability area for trend continuation entries, as it often represents a point of equilibrium before the dominant trend resumes. 3. The Bullish LSOB (Liquidity Sweep Order Block): The most significant signal in this area is the large green LSOB zone. This institutional footprint was formed after a sweep of a prior low and represents a major area of buying interest. The fact that the golden pocket lies directly within this LSOB provides a powerful layer of confirmation. Price has now entered this zone, effectively mitigating the imbalance and reaching a key area of demand. 4. Dynamic & Static Support Confluence: Octo MA: The EMA 100 is flowing directly through the LSOB, providing a strong layer of dynamic support. Daily Open: The Daily Open is situated just above, acting as an initial magnet and a potential first target for a bounce from this zone. 5. Momentum Exhaustion (Oscillator Analysis): This is the final, critical piece of the puzzle. Our MC Orderflow oscillator in the sub-chart shows that selling momentum is deeply exhausted, with the lines pushing into the green oversold territory. Critically, the Dashboard confirms this across multiple timeframes (5M, 15M, 30M, 1H, and 4H are all flashing "Oversold"). This is a powerful signal that sellers are losing control and the market is primed for a reversal, providing excellent timing for a potential entry. The Potential Trade Plan Based on this strong confluence, here is a potential trade plan: Entry Zone: The current area between $23.50 and $24.80 (the LSOB / Golden Pocket) is the ideal entry zone. Stop Loss: A logical stop loss can be placed just below the low of the LSOB and the 100% Fibonacci level, around $22.40. This invalidates the entire setup if hit. Potential Targets: Target 1: The Daily Open / 38.2% Fib level at ~$25.40. Target 2: A retest of the recent swing high at $27.41. Target 3 (Extension): If the trend resumes with strength, longer-term targets can be found at the 127.2% or 161.8% Fibonacci extension levels. Conclusion We have a powerful alignment of bullish market structure, a golden pocket retracement, a major institutional LSOB zone, dynamic MA support, and clear momentum exhaustion. This stack of confluences presents a compelling case for a long position on AVAX. Disclaimer: This content is for educational purposes only and does not constitute financial or investment advice. Trading carries a high level of risk. Please do your own research and consult with a professional financial advisor before making any investment decisions. You are solely responsible for any trades you take.AVAX took Support in 15 min LSOB-BOX for a Bullish Setup