Technical analysis by Ox_kali about Symbol BTC on 7/28/2025

Ox_kali

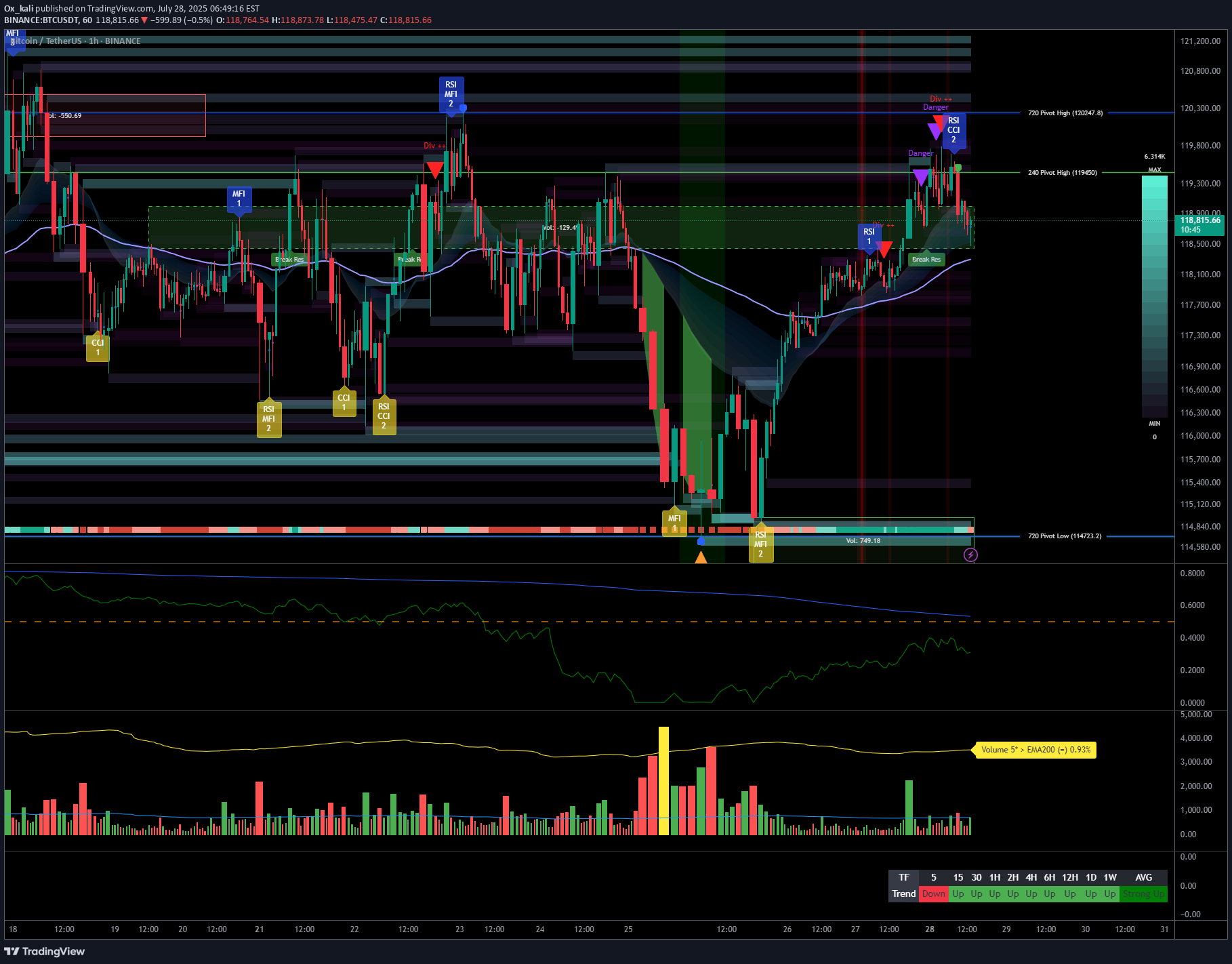

__________________________________________________________________________________ Technical Overview – Summary Points ➤ Sustained bullish momentum on BTCUSDT across all swing timeframes. ➤ Key supports: 116400–117400 (likely rebound), major supports: 105047–114674. ➤ Main resistances: 119000–120000 (short term), major ceiling at 123240 (1D/12H). ➤ Risk On / Risk Off Indicator: "Strong Buy" signal – tech sector leadership confirmed. ➤ Volumes normal to moderately elevated, no excess or behavioral anomaly (ISPD "Neutral"). ➤ No euphoria or capitulation flags; general wait-and-see attitude, FOMC event ahead. __________________________________________________________________________________ Strategic Summary ➤ Strategic bullish bias remains as long as 116400/117400 supports hold. ➤ Opportunity window: buy pullbacks towards 117400–116400 with tight stops; clear invalidation below 115900. ➤ Risks: FOMC-induced volatility, increased leverage on alts, potential capitulation if key support breaks. ➤ Catalysts: FOMC communication, geopolitical context (no immediate threat), background risk-off climate not yet triggered. ➤ Action plan: Prioritize post-event reaction over anticipation; maintain strict technical protection. __________________________________________________________________________________ Multi-Timeframe Analysis 1D: Uptrend confirmed. Price above all major supports. Strong resistance at 123240, key support at 105047, normal volumes, Risk On / Risk Off Indicator "Strong Buy", ISPD "Neutral". 12H: Bullish bias. Resistance cluster 120002–123240. Intermediate supports 114674/111949. Momentum/volume supported, no excesses. 6H: Bullish near range top, supports at 114674/111949, ceiling at 120002–123240. Solid Risk On / Risk Off Indicator. 4H–2H: Up momentum, resistance 119003–120002–123240, supports 116474/117800. Moderate/normal volumes. 1H: Strong uptrend, thick resistance at 119000–120000, immediate supports 117800/116474. Slight volume uptick ahead of FOMC. 30min–15min: Resistance 119003–120000 (~H4 pivot). Intraday support 117400–117800/118200. Both Risk On / Risk Off Indicator and ISPD neutral, normal volumes, bullish as long as 116474 holds. SYNTHESIS: Broad bullish confluence on MTFTI from 1H to 1D/W. Supports at 116474/117400 are key pivots for maintaining bullish swing view. No behavioral alerts or extreme volumes. Consolidation/waiting likely before FOMC release – monitor reactions at pivot zones. __________________________________________________________________________________ Strategic decision & macro Opportunities: Swing bullish scenario favored as long as key supports hold, buy strategic pullbacks, reverse on clear break. Main risk: FOMC volatility, altcoin excesses, possible post-announcement fake moves. Active monitoring essential. Macro/on-chain: No excess, BTC realized cap > $1T; aggressive rotation into alts, high open interest. No capitulation. Major on-chain & technical support aligned at 114500–118000. Action plan: Favor reactivity (post-FOMC), tight stops, progressive take profits at 119500–123240 resistance. No aggressive pre-positioning. __________________________________________________________________________________ Macro catalysts overview FOMC expected: status quo, market sensitive to any Powell tone shift. Global macro: latent risk-off, geopolitical drivers closely watched. BTC stable, no technical disruptor in the immediate term. __________________________________________________________________________________ Final Decision Summary Robust technical setup with a clear bullish bias. Optimal entries on 117400-116400 pullbacks, stops below support, active management needed during FOMC. No on-chain excess; constructive background unless exogenous shock or resistance failure (119000–123240). Stay alert for breakout/reject pivot. __________________________________________________________________________________