Technical analysis by pejman_zwin about Symbol BTC: Buy recommendation (7/22/2025)

pejman_zwin

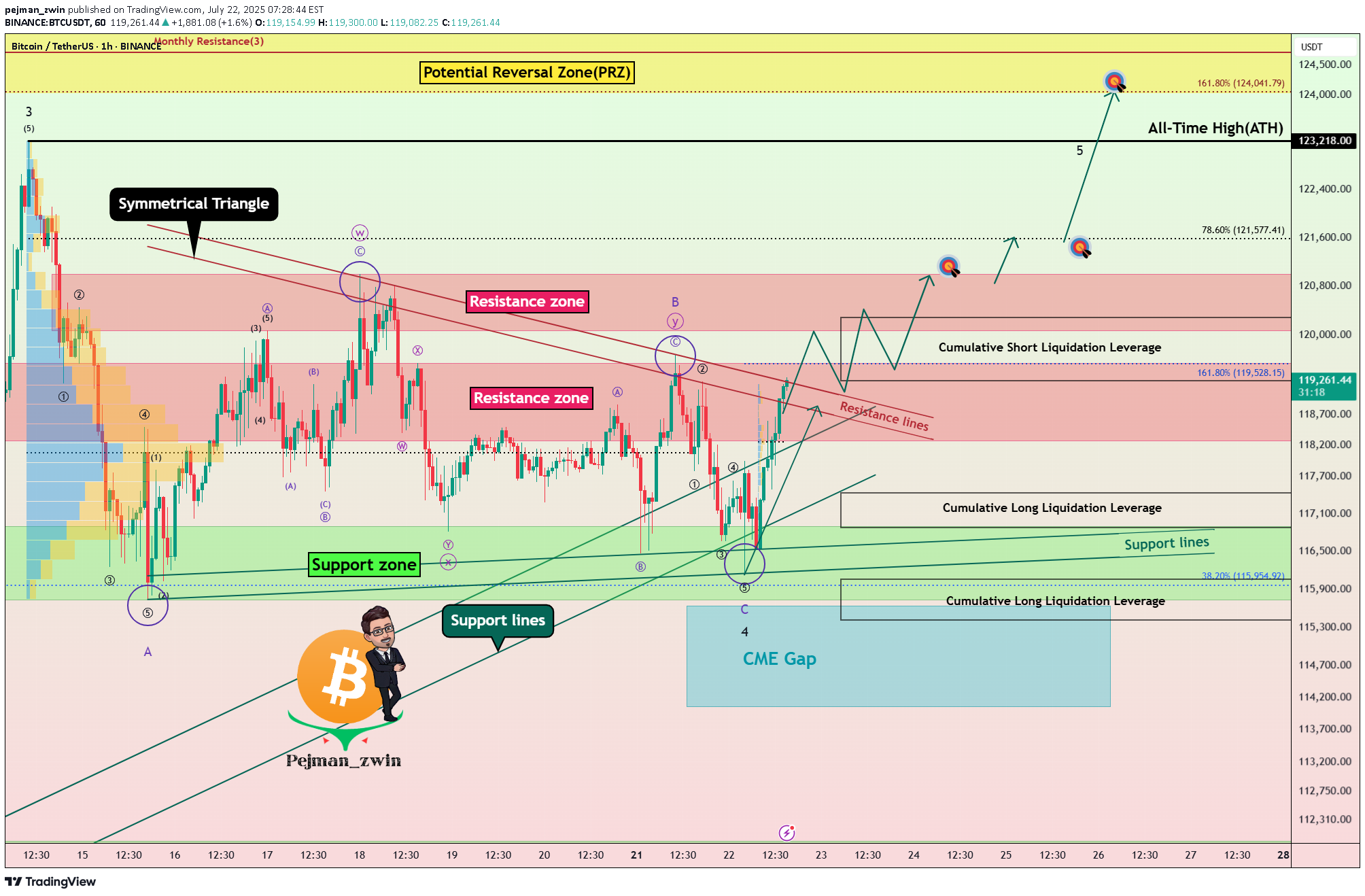

Bitcoin ( BTCUSDT ) has attacked the Support zone($116,900-$115,730) several times over the past week but failed to break through, meaning that buyers are still hoping for a BTC increase or even a new All-Time High(ATH) . Bitcoin has reached a Resistance zone($119,530-$118,270) again and is trying to break the upper lines of the Symmetrical Triangle Pattern . The Cumulative Short Liquidation Leverage($117,255-$116,675) is important and includes high sell orders , so if Bitcoin can break the Resistance zone($119,530-$118,270) and the Resistance lines with high momentum , we can hope for a continuation of the upward trend. Whether or not the Resistance zone($119,530-$118,270) and the Resistance lines break could depend on the tone of Jerome Powell’s speech today . Jerome Powell will speak at the opening of the “ Integrated Review of the Capital Framework for Large Banks ” — the final major appearance before the Federal Reserve enters its pre-meeting blackout period. Market Expectations: The speech is officially about regulatory frameworks (like Basel III), but traders are watching closely for any hints regarding interest rate policy. Even indirect comments could move risk assets like BTC. Rate Cut Signals? With political pressure mounting (including criticism from Trump ) and markets pricing in a potential cut later this year, Powell may adopt a cautious, data-dependent tone emphasizing flexibility in decision-making. -------------------- In terms of Elliott Wave theory , it seems that the wave structure of the main wave 4 correction is over. The main wave 4 has a Zigzag Correction(ABC/5-3-5) , so that the microwave B of the main wave 4 has a Double Three Correction(WXY) . Of course, the breakdown of the Resistance zone($119,530-$118,270) and Resistance lines can confirm the end of the main wave 4 . Also, there is a possibility that the 5th wave will be a truncated wave because the momentum of the main wave 3 is high , and Bitcoin may NOT create a new ATH and the main wave 5 will complete below the main wave 3. I expect Bitcoin to rise to at least the Resistance zone($121,000-$120,070) AFTER breaking the Resistance zone($119,530-$118,270) and Resistance lines . Second Target: $121,620 Third Target: $123,820 Note: Stop Loss(SL)= $117,450 CME Gap: $115,060-$114,947 Cumulative Long Liquidation Leverage: $117,429-$116,878 Cumulative Long Liquidation Leverage: $116,053-$115,411 Please respect each other's ideas and express them politely if you agree or disagree. Bitcoin Analyze (BTCUSDT), 1-hour time frame. Be sure to follow the updated ideas. Do not forget to put a Stop loss for your positions (For every position you want to open). Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post. Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.Powell Opens Fed Conference Without Monetary Policy Comments Key Highlights from Powell’s Speech/Update Jerome Powell opened the Federal Reserve’s Banking Supervision Conference on Tuesday without making any remarks about monetary policy or addressing political pressures from former President Donald Trump. Due to the pre-meeting blackout period, Powell’s comments were brief and highly limited in scope. He focused solely on the importance of gathering feedback and suggestions regarding reforms to the capital framework for large banks, emphasizing that regulatory changes must balance stability and innovation. Additional Remarks from U.S. Treasury Secretary Bessent: “I see no reason for Powell to step down now.” “Nothing tells me he should step down at this point.” These statements come amid recent political discourse questioning Powell’s future at the Fed.It seems that #BTC was affected by the shock from the Richmond Manufacturing Index(Actual:-20/Forecast:-2/Previous-7). Although the Cumulative Short Liquidation Leverage($120,278-$119,259) was an important zone I had mentioned in my analysis. Weak data = potential recession = demand for USD liquidity: When data comes out extremely poor (like -20), markets initially experience a shock, and investors panic. This fear drives them to pull out of risky assets (like Bitcoin) and even non-cash assets (like Gold), seeking safety in liquidity (USD). Trading has become a bit difficult with these fluctuations the past few days, and it's better to open positions in really important areas.Let's open a long position with a Hammer Candlestick Pattern. This pattern formed near the Cumulative Long Liquidation Leverage ($117,429-$116,878).For me, the analysis is still valid, and as I said before, it is a bit difficult to trade in this range($121,000_116,000). Bitcoin can move from the Support lines to the Resistance zone($121,000-$119,500) and fill a new CME Gap($120,795-$120,560). The analysis can be valid until the Support lines and the Support zone($116,900-$115,730) are broken. Cumulative Long Liquidation Leverage: $117,298-$116,559 Cumulative Short Liquidation Leverage: $121,675-$120,488One of the key reasons behind Bitcoin’s decline in the past 24 hours (July 25) could be the reduced likelihood of Jerome Powell being replaced as Chair of the Federal Reserve. In recent days, market participants were speculating that Donald Trump might replace Powell — a scenario that was considered bullish for risk assets like Bitcoin. However, recent reports of a meeting between Trump and Powell, and signs that Powell might not be dismissed, have weakened this fundamental narrative. This meeting may signal a truce or reduced tension between Trump’s team and Powell, which could imply a continuation of current Fed policies. That’s bad news for Bitcoin, as it removes a potential psychological tailwind from the market and dampens speculative sentiment. As a result: Over $500 million in liquidations(Long Positions) occurred Weak inflows into Bitcoin ETFs A stronger U.S. Dollar Index (DXY) And declining gold prices over the past two days all added additional selling pressure on BTC.