Technical analysis by pips1000s about Symbol PAXG: Buy recommendation (6/22/2025)

pips1000s

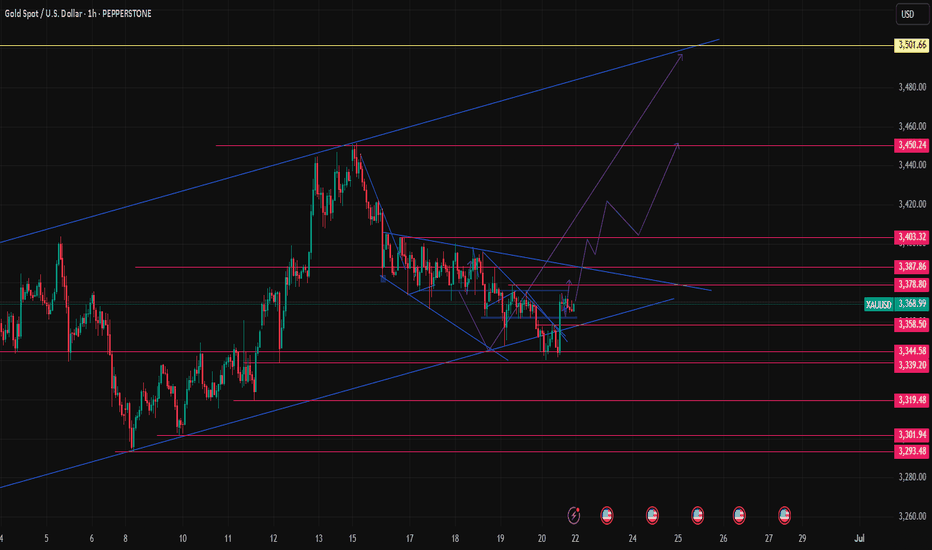

Gold remains in focus this week as both technical breakout signals and global geopolitical tensions align to support a bullish narrative. Here’s an in-depth breakdown of what’s happening on the XAUUSD chart and the key factors influencing price action. 📉 Technical Analysis (1H Timeframe) XAUUSD is currently trading within a bullish ascending channel, forming a falling wedge pattern in the last leg of its pullback. Price recently bounced off the channel’s lower boundary around 3,358–3,365, suggesting renewed buying pressure. Key Technical Zones: 🔹 Support Zone: 3,358 – 3,365 (channel base) 🔹 Wedge Breakout Resistance: 3,378 – 3,387 🔹 Next Resistance Levels: 3,403, 3,450 🔹 Major Target: 3,501 (channel top projection) Bullish wedge breakouts within an up-channel are powerful continuation patterns. A breakout above 3,378 will likely accelerate bullish momentum. 🌍 Geopolitical & Fundamental Factors Gold’s safe-haven appeal remains strong amid rising international risks and a softer U.S. economic outlook. 🔥 Current Drivers: Middle East Conflict: Ongoing military exchanges between Israel and Hezbollah + Red Sea shipping threats. Russia–Ukraine War: Persistent drone attacks and instability in eastern Europe. US Inflation Cooling: May CPI slowed to +0.1% m/m, increasing rate-cut expectations. Fed Policy: FOMC holds steady; dot plot shows 2 cuts likely in 2025 if disinflation persists. Central Bank Demand: Continued global accumulation of gold reserves, especially in Asia and the Middle East. Together, these factors underpin a bullish fundamental case for gold, even if short-term volatility spikes on headlines. 🎯 Trade Setup (Swing Strategy) StrategyLong (Buy) 📍 Entry 1Aggressive: 3,365 – 3,368 (channel base retest) 📍 Entry 2Confirmation: Break & retest above 3,378 (wedge breakout) ⛔ Stop-Loss3,344 (below key swing low and structure) 🎯 TP13,387 🎯 TP23,403 🎯 TP33,450 (strong resistance) 🏁 Extended Target3,501 (channel top projection) ❌ InvalidationClose below 3,339 turns short-term bias bearish 🧠 Risk-Reward: The setup offers a clean 2:1 or better, especially if price breaks 3,378 with momentum. 📌 Final Thoughts Gold remains one of the most technically aligned and fundamentally supported assets in today’s volatile macro landscape. As geopolitical risk persists and Fed dovishness grows, gold may continue to attract safe-haven flows. The wedge breakout inside the rising channel gives bulls an actionable edge with clearly defined levels.