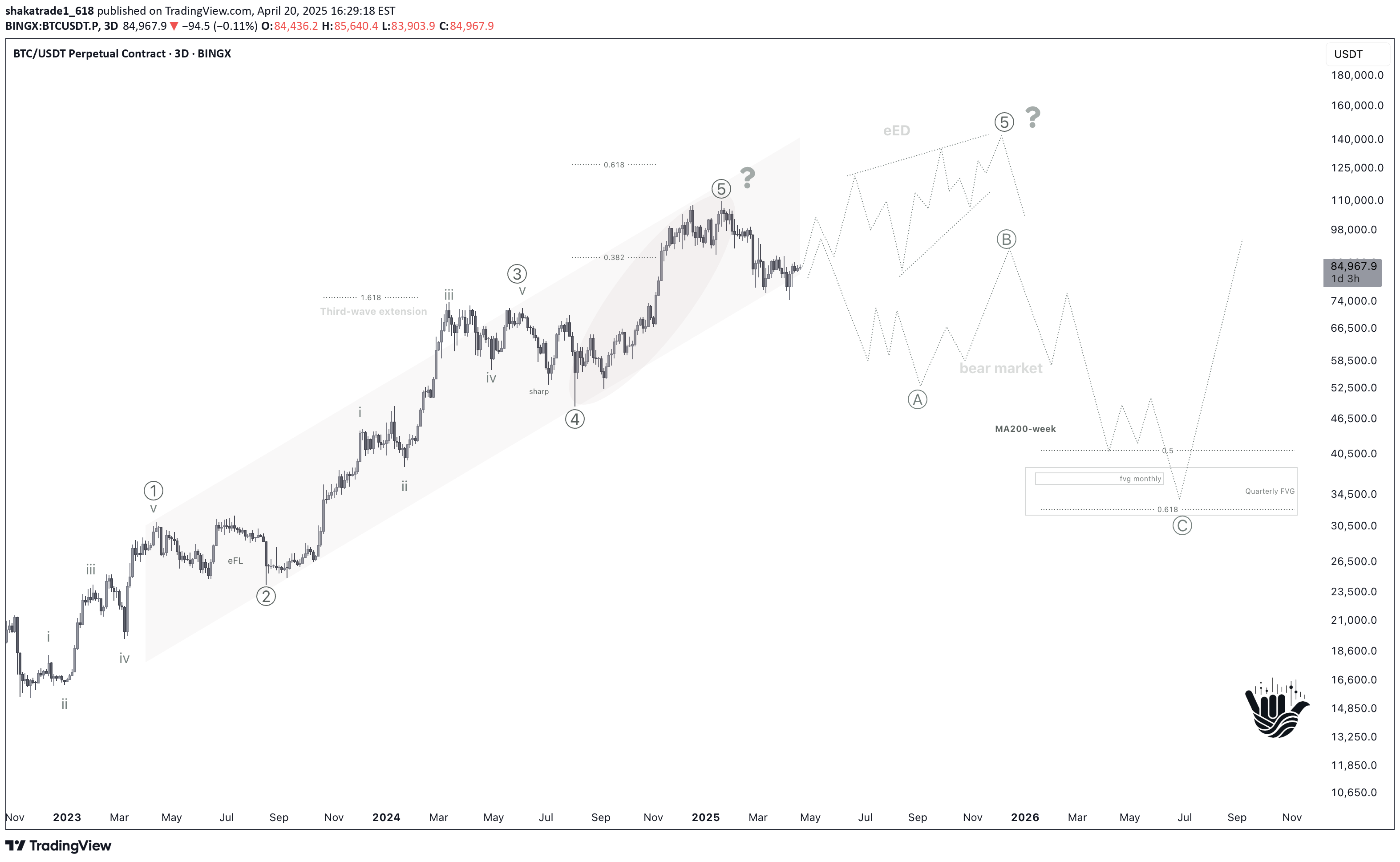

Technical analysis by shakatrade1_618 about Symbol BTC on 4/20/2025

shakatrade1_618

Bitcoin Topped in January? Here’s Why That’s Not Crazy.

The move BTCUSDT BTCUSD BTCUSDT.P from November 2022 looks like a textbook impulse. The third wave extended perfectly to 1.618 of wave one — a classic sign of strength. But here’s the big question: Did the impulse already end in January 2025? If yes, we’re looking at a nearly ideal structure: 🔹 Wave 3 — extended to 1.618 🔹 Wave 5 ≈ Wave 1 (typical after an extended 3rd) 🔹 Fib zone 0.382–0.618 of wave 0–3 — perfectly hit 🔹 Sentiment — peak euphoria in January: BTC in national reserves, mass media hype 🔹 Volume spike — a sign of potential distribution at the top 📌 Possible scenarios: 1️⃣ The impulse is complete, and we’re already in a corrective phase — even if the market doesn’t realize it yet https://www.tradingview.com/chart/BTCUSDT/xGke8M2k-The-bull-rally-to-end-in-December-2024-February-2025/ 2️⃣ A terminal diagonal is forming — ATH hasn’t been printed yet, but we’re likely close 3️⃣ A 5th wave extension — still possible, but less likely given current global liquidity and macro headwinds (trade war environment) 📊 Watch the 200-dayMA: Historically, Bitcoin tends to stay below it for about 2 months during bull cycles. That clock is ticking — the next few weeks may reveal the market’s true direction. 📈 A strong weekly close above $95K would sharply raise the odds of a new ATH. Until then — monitor the local structure and wait for clarity.