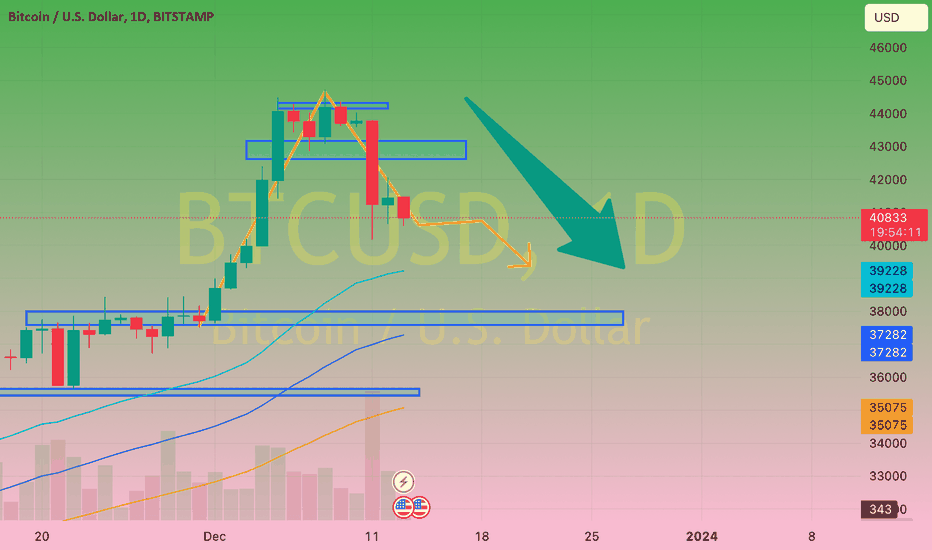

Technical analysis by Gwen_Humuna about Symbol BTC on 12/13/2023

Bitcoin (BTC) is showing weakness ahead of the Federal Open Market Committee (FOMC) meeting scheduled for December 13. Federal Reserve Chairman Jerome Powell is expected to provide an economic forecast summary after the release of the Consumer Price Index (CPI) data, indicating that inflation in the U.S. has decreased to 3.1%, aligning with market expectations. Bitcoin Price Prepares for Increased Volatility Before FOMC Investors have shown caution and reduced risk ahead of the FOMC meeting, evident in a 40% decrease in trading volume over the past 24 hours. After the announcement of the U.S. CPI data for November, the Bitcoin price briefly surged to $42,000 before retracing. Looking ahead, the prevailing view is that the Fed will maintain interest rates at the target range of 5.25-5.50%. In the latest meeting in November, the FOMC kept interest rates steady, as in the September meeting, signaling that rates may remain unchanged in the near future but are still open to change based on economic conditions. The decision to pause interest rate hikes is widely anticipated, providing the Fed with additional time to determine whether the current interest rates effectively curb inflation's impact on economic growth. The range of 5.25% to 5.50% was raised in the July meeting, marking the 11th interest rate hike in the 2022/2023 cycle, all aimed at managing inflation. This explains the observed unease in the Bitcoin price. Implications for Bitcoin Price The increase in interest rates makes investors more cautious, negatively impacting risk-based assets like cryptocurrencies. According to the CME FedWatch tool, there is a 97.1% chance that the Fed will keep the Federal Funds Rate target at 5.25% to 5.50% in the upcoming FOMC meeting, while 2.9% of opinion polls predict a change to 5.50-5.75%.