XRP

XRP

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

toto8771Rank: 161 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 12/12/2025 | |

reazosmanRank: 46 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 12/7/2025 | |

Smarttrader0786Rank: 1170 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 11 hour ago | |

KingPedroFXRank: 2384 | فروش | حد سود: تعیین نشده حد ضرر: تعیین نشده | 6 hour ago | |

MavRich_TradingRank: 2458 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 12/10/2025 |

Price Chart of XRP

سود 3 Months :

خلاصه سیگنالهای XRP

سیگنالهای XRP

Filter

Sort messages by

Trader Type

Time Frame

Rocksorgate

XRP EXITS DESCENDING BROADENING WEDGES

💥 Hey, gonna keep this idea pretty short today since this is mainly a follow up off of yesterday's idea as shown below for reference: 💥 In yesterday's Idea we spoke on how XRP was in a descending broadening wedge and our price target of $1.99, we're waiting on that for confirmation of a bullish reversal though we can see off today's chart that bulls were able to reclaim some ground using the wedge as some technical support to bounce. We can see our 20, 50 EMA's have already converged so it'll be a matter now if whether or not we can avoid falling back within the wedge and reenter our descending channel. 💥 If we manage to break back into our descending channel then I would keep mind of that $1.99 level as it'll play a crucial resistance point until we're above it and even so the next thing will be if we can sustain and regain our 200 EMA to form a bullish crossover else we'll keep facing some volatile activity till the retail market and technical traders get some more bullish confirmation. 💥 Alongside this a big part is sentiment, things are still uneasy as ever. We've still got strong inflows into Bitcoin and positive fundamentals but with macroeconomic concerns and persistent selling pressure, liquidations and Bitcoin trading in this volatile range facing $70k again if it can't break resistance levels, $90k in particular. I would keep these things in mind, we know January has a chance of being a positive month if past-price action proves correct else we may continue to see choppy waters for a few weeks till we get some positive news or some catalyst and better sentiment. 💥 Thanks for tuning in, really appreciate everyone and the words as always, thanks and hope the holidays treat you all well. All the best and happy holidays till next. Best regards, ~ Rock '

On our way to $2.00

Ripple is still making deals and gaining contracts behind the scenes. It would be foolish to sell right now. Especially if you've been holding since $.50 All we need now is to push past the $2.00 then we should see some gains.

xrp/usdt

xrp today has recovered even though japan has risen rates, 19/12 price is recently at 1.9195 Towmorow we will be looking for price to drop down to 1.8577 and from this area we will be looking for price to go back up liquidty is coming back to the market frist area where i see xrp recovring to is 2.0735 !!!

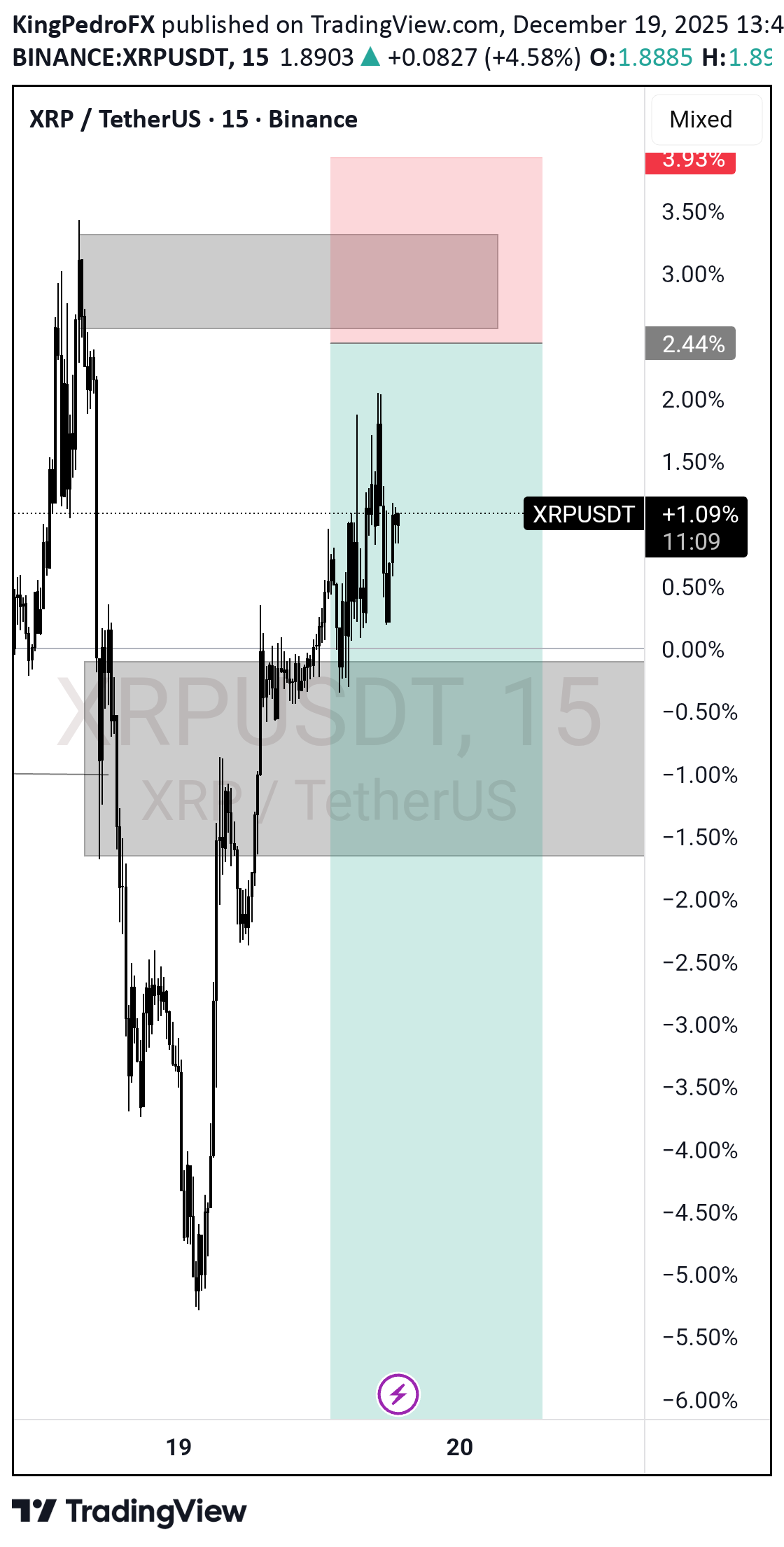

KingPedroFX

Going short in XRPUSD

The trend is down, and I can see a break of structure to the downside. If the price goes back to my POI and gives me confirmation to the downside, I'm in. I will wait for confirmation because i don't want to lose foolishly.

Short then long

we need one more impulse down before we start trading higher imo. lets see how this plays

Smarttrader0786

SMC Trading Strategy ( #XRPUSDT ) Buy Trade Setup.

Hello, TradingView community and my subscribers, please if you like ideas do not forget to support them with your likes and comments, thank you so much and we will start a LONG outlook on #XRPUSDT explained. Price action analysis

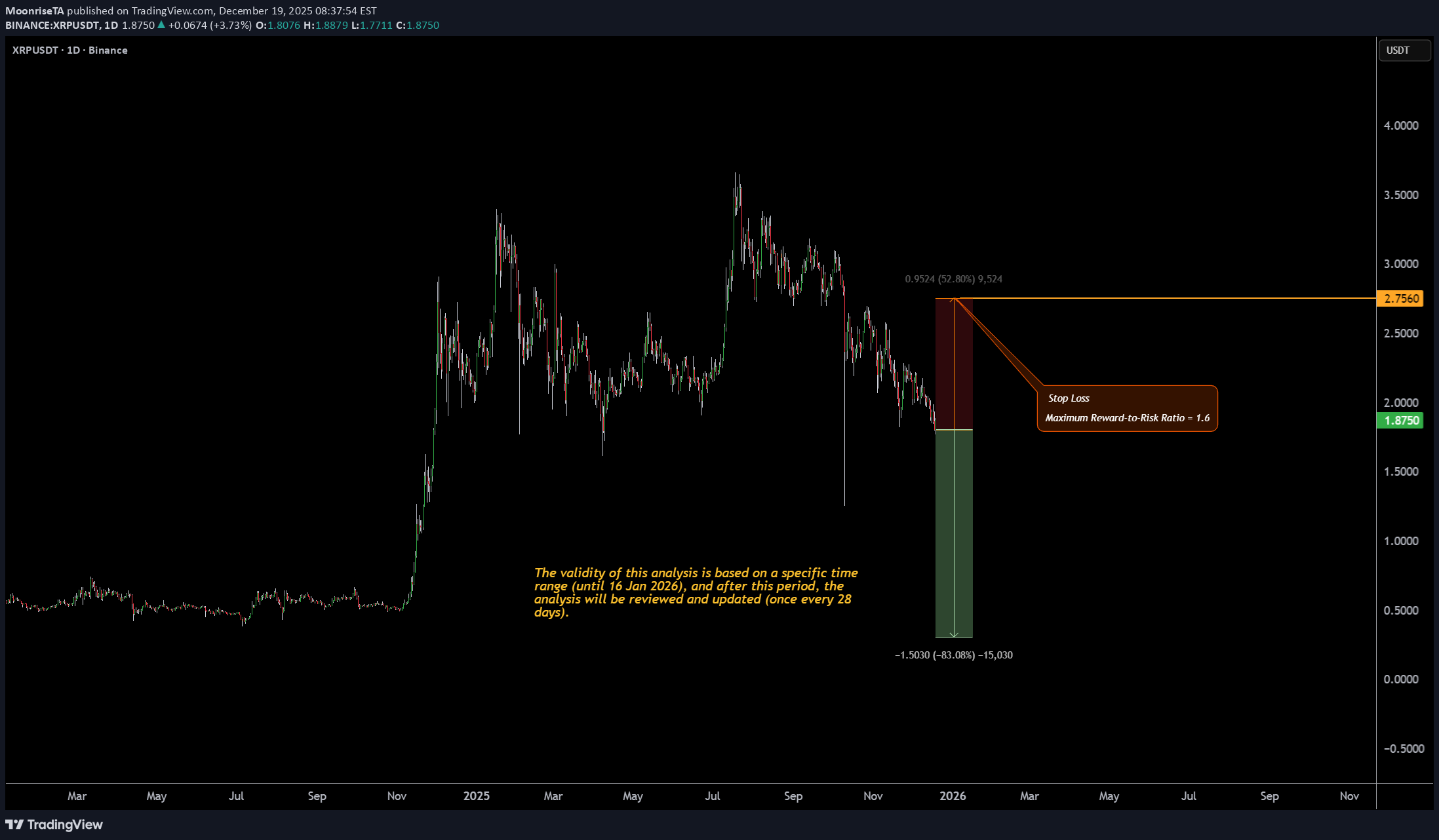

MoonriseTA

Monthly Crypto Analysis: Ripple (XRPUSD) – Issue 112

The analyst expects Ripple’s price to decline by the specified end time, based on quantitative analysis. The take-profit level only highlights the potential price range during this period — it’s optional and not a prediction that the market will necessarily reach it. You don’t need to go all-in or use leverage to trade wisely. Allocating just a portion of your funds helps keep overall risk low and ensures a more sustainable approach. Our strategy is built on institutional portfolio management principles, not the high-risk, all-in trading styles often promoted on social media. Results are evaluated over the entire analysis period, regardless of whether the take-profit level is reached. Next analysis: Monthly Crypto Analysis: Litecoin (LTCUSD) – Issue 113

XRP – Daily Outlook

XRP Army, Price is still trading inside a descending channel, keeping the short-term structure bearish. We recently saw a reaction from daily support, but this move alone is not enough to confirm a reversal. In the past, this support level has shown clean deviations, where price dipped below and quickly reclaimed the level. A similar scenario could play out again, but confirmation is required. Key observation: For any bullish continuation, XRP needs to reclaim the broken support level and hold above it. Without a reclaim, this move remains a relief bounce within a downtrend. I’ll be watching lower timeframes for a potential deviation and reclaim before considering longs. Until then, caution is warranted. Levels to watch: Resistance: reclaimed support + upper channel Support: current daily support zone MrC

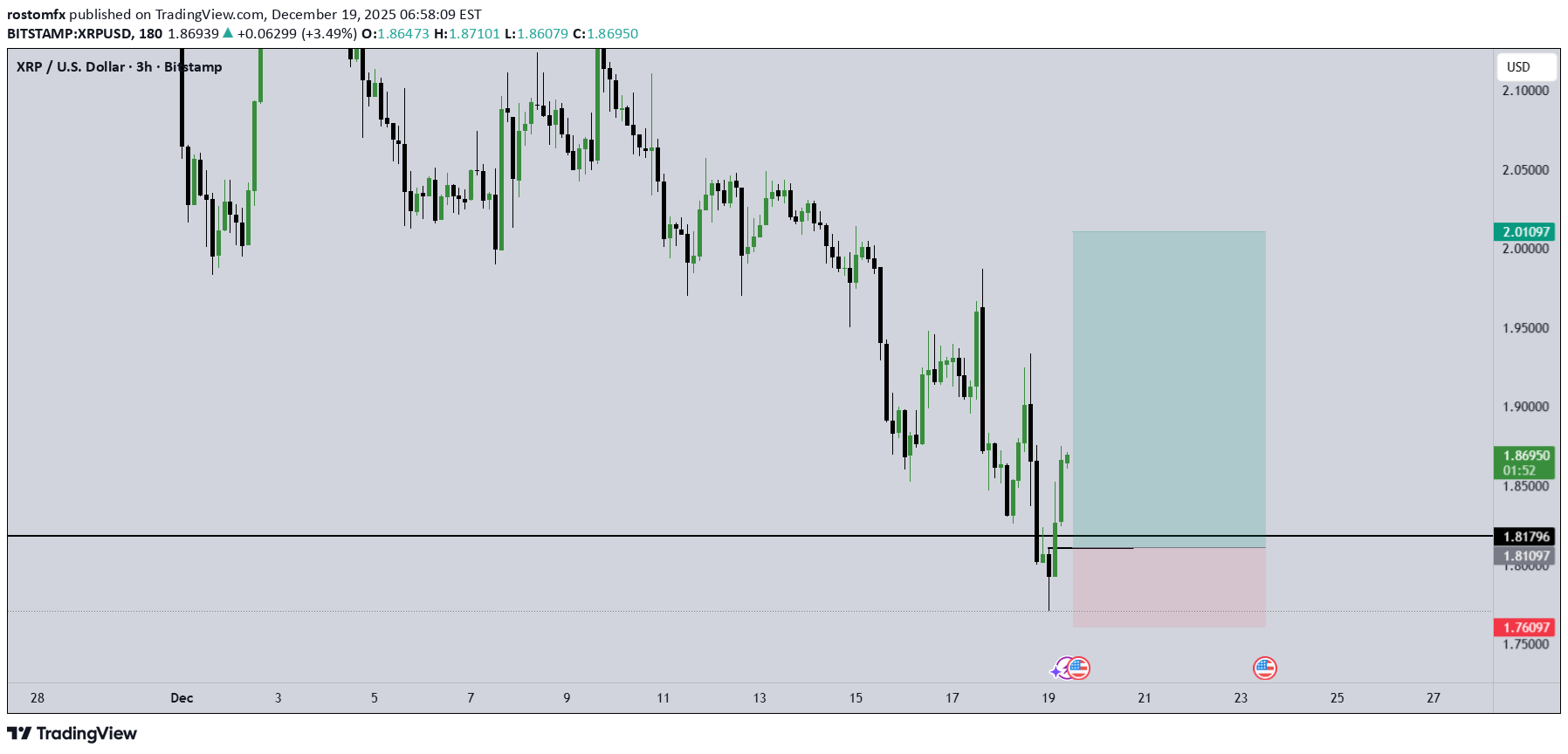

XRPUSD Update

3h Candle hasn't retested my level for the entry and run up so i'll delete the limit and i'll wait for new confirmations. Price is still showing bullish signs so it can also go up without retesting and in that case i'll look for confirmation on the Lower Timeframe. For now i'm monitoring and waiting

تحلیل جدید و حساس XRP: منتظر ورود به موقع برای صعود!

Yesterday price of xrpusd during the news has run up without getting my entry so i deleted the limit and then price came back and created a new lower low. Now has given me another confirmation so i'm waiting patiently for the price to fill my entry and then eventually going up. For the entry to still be valid i need the current 3h candle to touch my entry before the creation of the upcoming 3h candle.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.