SAROS

Saros

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Saros

سود 3 Months :

سیگنالهای Saros

Filter

Sort messages by

Trader Type

Time Frame

dan577

تشکیل موج انفجاری در بازار: آیا کف قیمتی $0.006 نقطه پرش خواهد بود؟

This structure looks interesting: a long (extended) Wave 5 appears to be correcting through an extended Wave A (abc). If the lower boundary of the channel holds, a bounce around $0.006 could initiate Wave B . That move could offer three profit zones, as marked on the chart. Just sharing the plan, not financial advice. Cheers!

SatochiTrader

ساروس آماده انفجار؟ فرصت صعود تا ۰.۴۲ دلار با شکست مقاومت کلیدی!

SAROS/USDT — Range Reversal Forming, Eyeing Breakout Toward $0.30 🚀 SAROS is showing a strong early rebound after testing its range low at $0.203. The price has now reclaimed the mid-range zone near $0.24, indicating buying pressure returning and a potential shift in short-term momentum. The key resistance and confirmation area is found near $0.295 — a breakout above this level could signal the start of a trend reversal, with further upside potential toward $0.42 if volume confirms. 📊 Technical Overview: Range Low Support: $0.203 Range High / Breakout Zone: $0.295 Extended Target: $0.421 Bias: Accumulation → Bullish shift once $0.295 breaks If SAROS maintains this momentum and reclaims the upper range, the structure suggests a strong continuation setup forming for the next leg higher. 📈 Outlook: Building strength inside the range 🎯 Targets: $0.295 → $0.42

BeInCrypto

3 Altcoins That Could Hit All-Time Highs In September

SAROS price is trading at $0.402, holding firmly above the $0.401 support level. This support has remained intact for over a week, indicating strong investor confidence. The stability provides a foundation for SAROS to attempt recovery. The altcoin is only 8.6% away from its all-time high of $0.436. With the 50-day EMA positioned well below current levels, acting as support, SAROS has technical strength. A bounce off $0.401 could allow the token to retest the ATH this week, boosting investor sentiment further. However, risks remain if bullish momentum weakens. SAROS price could slip under $0.401 support and extend losses to $0.377. Such a drop would invalidate the bullish thesis, signaling a potential bearish reversal.

MeeCoin

SAROSUSDT: Weakening Buy Momentum, Bears May Take Control

SAROS has been on an extended rally, but despite the price increase, trading volume has remained very low, making the price vulnerable to manipulation. On August 24th, we witnessed a sharp sell-off that drove the price down by two-thirds within just a few hours. Although market liquidity helped the price recover, I find this behavior unusual. It could be whales testing liquidity, or simply a large investor taking profits. In either case, I will not risk investing in a coin with weak liquidity and strong profit-taking sentiment from holders. If you are currently holding SAROS, I believe this is the time to consider taking profits. This analysis is for reference only and should not be considered financial advice.

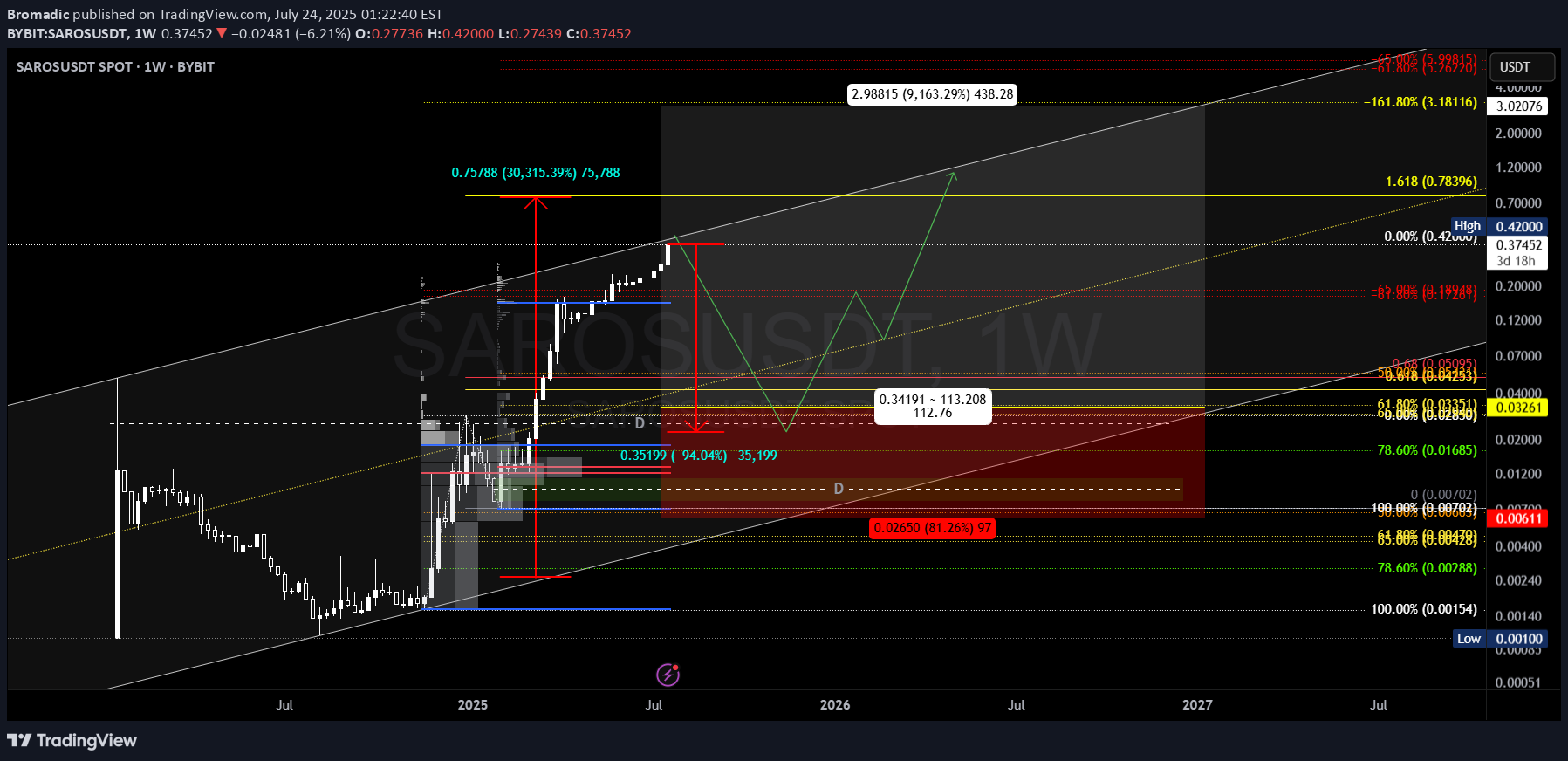

Bromadic

SAROS

As I have said in the past saros have been one of my best investment in crypto! been looking for a proper dip on weekly TF however it just have been pushing higher & higher....... Will be watching the DIP if it comes 90% down from here for a swing long term investment. This is HTF weekly/monthly trade similar to our #XRPMajor update on #Saros here, Understand this is my multiyear swing trade, i am only risking 1% of my PF for this, if you can't understand risk management then just stay away For educational purpose only :) not a financial advisor

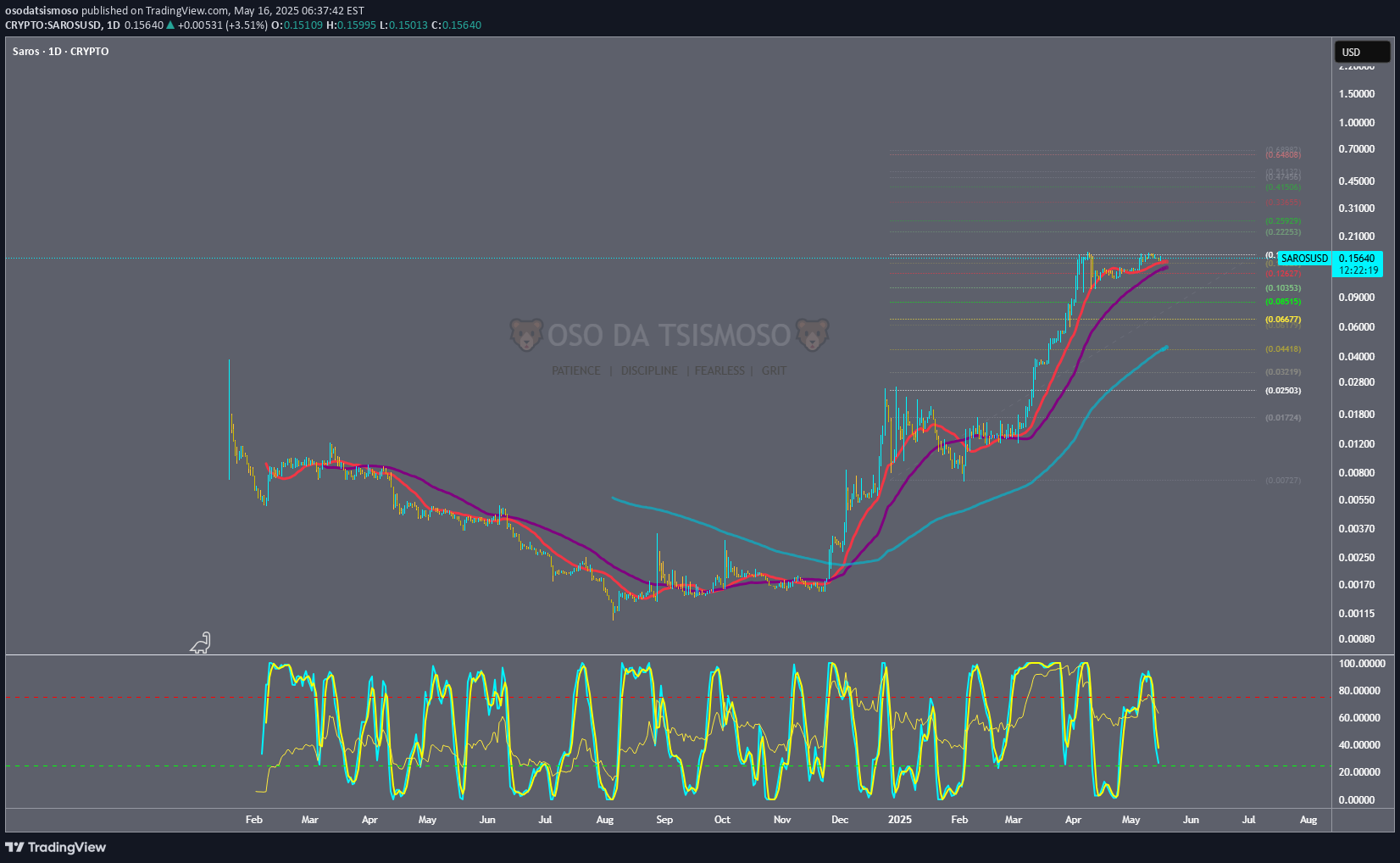

osodatsismoso

ALTCOIN BOOM FOR SAROS 2025-2026 PROPOSAL

Intro & Core Info SAROS ( SAROS ) is a decentralized finance (DeFi) ecosystem built on Solana, focusing on liquidity solutions, decentralized exchange (DEX) aggregation, and cross-chain swaps. It aims to solve fragmented liquidity across Solana-based protocols while offering low fees and near-instant transactions. Think of it as the "Uniswap of Solana," but with ambitions to bridge ecosystems like Ethereum and Cosmos. Recent News []Launched "Saros Super Pool," a concentrated liquidity protocol with $50M TVL in its first week. []Partnered with Jupiter Exchange to integrate Solana’s largest DEX aggregator into Saros’ interface. SAROS price jumped 60% in July, fueled by Solana’s resurgence. Deep Dive Solana’s DeFi TVL has tripled in 2024, and SAROS is riding the wave. The Super Pool launch taps into Solana’s speed to attract yield farmers, while the Jupiter collab positions SAROS as a one-stop trading hub. However, Solana’s history of network outages remains a risk. If SAROS can’t ensure uptime during congestion, users might flock to rivals like Raydium. Latest Tech or Utility Update Update Details Saros deployed "Cross-Chain Swaps" this month, enabling asset transfers between Solana, Ethereum, and Binance Smart Chain via Wormhole bridges. Also introduced "Dynamic Fees," which adjust based on network congestion. Implications Cross-chain swaps could make SAROS a hub for multi-chain traders, but reliance on bridges like Wormhole introduces security risks. Dynamic Fees help retain users during Solana’s traffic spikes, but if fees rise too high, it might negate Solana’s low-cost advantage. Biggest Partner & How Much Was Invested Partnership Spotlight Jupiter Exchange invested $5M in SAROS’ liquidity incentives program, locked for 12 months. Impact Analysis Jupiter’s liquidity dominance on Solana gives SAROS instant access to deep order books. This partnership could funnel Jupiter’s user base into SAROS’ Super Pools, creating a flywheel effect. If successful, SAROS becomes the go-to for Solana yield farming. Most Recent Added Partner & Details New Collaboration Saros partnered with marginfi (Solana lending protocol) to enable leveraged yield farming. No direct investment, but revenue-sharing on margin trading fees for 18 months. Future Prospects Leveraged farming could attract degens and boost TVL, but overcollateralization risks could backfire during market crashes. Short-term, this adds hype; long-term, it tests SAROS’ risk management. Tokenomics Update Token Dynamics []Burned 1.5M SAROS (3% of supply) in July via protocol revenue. []Staking rewards now include 20% of swap fees (up from 10%). DAO voted to extend token vesting for team tokens by 2 years. Deep Analysis Burns + fee-sharing make SAROS more deflationary, but the token’s value hinges on volume. Extended vesting reduces sell pressure, signaling team commitment. However, if trading activity stalls, stakers could dump rewards. Overall Sentiment Analysis Market Behavior Retail traders are FOMO-ing into SAROS (social mentions up 300%), while whales are taking partial profits. Funding rates turned negative on derivatives, suggesting short-term caution. Driving Forces Hype around Solana’s comeback and leveraged farming. Concerns linger about Saros’ ability to scale without Solana-level outages. Deeper Insights Sentiment is overly tied to Solana’s performance. If SOL dips, SAROS could crash harder. But if Solana’s DeFi summer continues, SAROS might outperform. Recent Popular Holders & Their Influence Key Investors []Alameda Research survivor wallet bought 500K $SAROS. []Solana co-founder Raj Gokal praised Saros’ UX in a tweet. Why Follow Them? Alameda’s remnants are known for trading Solana ecosystem gems aggressively. Raj’s endorsement signals insider confidence, which could attract more builders to Saros. Summary & Final Verdict Recap SAROS is Solana’s liquidity aggregator on steroids, combining cross-chain swaps, leveraged farming, and deep Jupiter integration. Its tokenomics are tightening, and Solana’s revival gives it tailwinds. Final Judgment SAROS is a high-beta Solana play . If you’re bullish on SOL’s comeback, this could 3x-5x. But if Solana stumbles, SAROS will bleed harder than blue chips. Considerations []Can Saros’ infrastructure handle Solana’s next congestion crisis? []Will leveraged farming lead to cascading liquidations in a crash? How dependent is SAROS on Jupiter’s continued dominance? If you’re riding the Solana wave, buy the dip. If skeptical about Solana’s reliability, stay clear.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.