SAGA

Saga

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Saga

سود 3 Months :

سیگنالهای Saga

Filter

Sort messages by

Trader Type

Time Frame

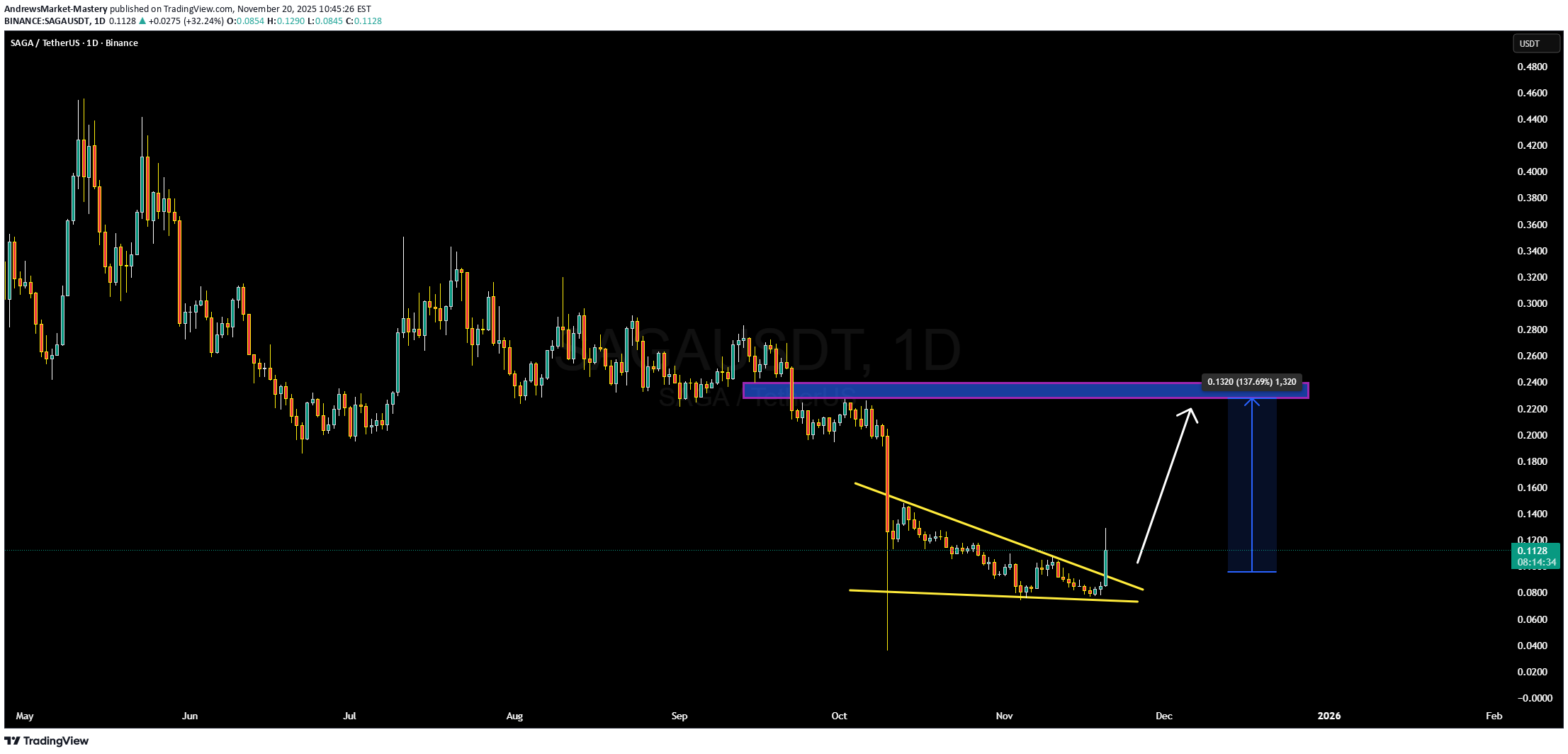

SAGA/USDT - Market Structure

SAGA remains in a persistent downtrend. During the flash crash, price lost its support and is now trading roughly –65% below it. There is a chance this deviation gets filled: — a clear bullish divergence has formed on RSI, — on the weekly RSI, price is sitting at levels that previously produced a ~130% bounce. If you choose to trade this setup, a stop-loss is mandatory. Last time, the stop saved the position from a –90% drawdown. Consider taking most profits in the $0.12–0.19 range.

Risk in Global Events and Geopolitical News

1. Understanding Geopolitical Risk Geopolitical risk is fundamentally tied to countries, governments, conflict, policy, and global relationships. It involves evaluating how political decisions or international disputes may impact economic conditions. Common sources of geopolitical risk include: Wars and military conflicts Terror attacks or large-scale violence Trade wars and tariff disputes Sanctions and diplomatic tensions Elections and political instability Shifts in alliances and treaties Border conflicts Energy supply disruptions Natural disasters with political implications Markets dislike uncertainty, and geopolitical news creates exactly that. Even a small headline can trigger massive market reactions if it suggests potential disruption to economic activity or global trade. 2. Major Categories of Global Event Risks a) Political Instability and Elections Elections, leadership changes, coups, or political protests can quickly impact markets. Investors prefer stable governments, predictable policies, and clear regulatory environments. For example: A surprise election result can shift a country’s economic policy direction. Political unrest can affect tourism, investment, and consumer confidence. Countries with weak institutions often face market sell-offs during instability. b) Wars and Military Conflicts Armed conflicts are among the most severe geopolitical risks. They disrupt trade routes, destroy infrastructure, create inflationary pressures, and affect global commodity markets. Conflicts in key regions like the Middle East can instantly affect global oil prices, while tensions between major powers (like the US, China, or Russia) can shake global markets. c) Trade Wars and Economic Sanctions Modern geopolitical tensions often play out through tariffs, sanctions, and economic restrictions instead of full-scale wars. Examples: US–China trade war caused supply chain disruptions worldwide. Sanctions on Russia affected energy markets and global inflation. Restrictions on semiconductor exports changed technology investments. Trade barriers make goods more expensive, limit production, and reduce GDP growth — all of which increase market volatility. d) Global Health Crises and Pandemics Events like COVID-19 demonstrate how a health crisis can become a global economic shock. Impact areas: Lockdowns disrupt supply chains. Travel and tourism collapse. Labor shortages slow production. Governments increase fiscal spending. Pandemics are rare but extremely high-impact risks. e) Natural Disasters Earthquakes, floods, hurricanes, and climate-related disasters also create geopolitical and economic ripple effects. For example: A major earthquake in Japan affects global automobile and electronics supply chains. Floods in agricultural regions push food prices higher. Climate change policies alter energy markets and industrial investments. f) Currency and Debt Crises A country’s financial instability can also spark global panic. Events include: Sovereign debt defaults Currency devaluation Banking crises Such crises reduce investor confidence, harm trade partners, and can lead to capital flight from emerging markets. 3. How Geopolitical News Impacts Financial Markets a) Stock Markets Equity markets react immediately to global events. Negative geopolitical news often triggers: Market sell-offs Flight to safety (investors move money to safer assets) Increased volatility (VIX index spikes) Sectors directly related to global risk — defense, energy, cyber security — sometimes rise during geopolitical tensions. b) Currency Markets Forex markets are extremely sensitive to geopolitical instability. Safe-haven currencies like USD, JPY, and CHF strengthen. Currencies of unstable or exposed countries weaken. Currency volatility increases trading opportunities but also risk. For example, during conflicts in Europe, the Euro often faces downward pressure. c) Commodity Markets Commodities like crude oil, natural gas, gold, wheat, and metals react sharply to global events. Oil prices rise when conflict threatens supply in the Middle East. Gold becomes a safe-haven during uncertainty. Agricultural prices rise after climate disasters or geopolitical disruptions. d) Bond Markets Government bonds, especially US Treasuries, become highly attractive during geopolitical crises. Investors seek safety and stable returns, causing bond yields to fall as prices rise. 4. Sector-Wise Impact of Geopolitical Risk Energy Sector Among the most sensitive sectors. Conflicts in oil-producing nations cause: Supply disruptions Price spikes Inflation in importing countries Technology Sector Geopolitics affects: Semiconductor supply chains Data security regulations Cyber-security threats Export restrictions on advanced technology Defense & Aerospace Risks and conflicts often boost: Defense budgets Weapon system demand Military research investments Agriculture Weather, climate, political instability, and war all shape global food supply. Sanctions or blockades affect trade routes and prices. 5. How Traders and Investors Manage Geopolitical Risk a) Diversification Holding a variety of assets (stocks, bonds, commodities, currencies) reduces exposure to any single geopolitical event. b) Hedging Strategies Using derivatives like: Options Futures Currency hedges These protect portfolios from sudden market swings. c) Monitoring Global News Professional traders constantly track: Government decisions Diplomatic meetings Conflict zones Major speeches Data releases Timely information is the key to navigating geopolitical risk. d) Investing in Safe Havens During turmoil, traders often shift to: Gold US Treasury bonds Swiss franc Japanese yen Defensive stocks (utilities, healthcare) e) Scenario Analysis Institutions often simulate “what if” scenarios: What if oil supply drops by 20%? What if a conflict intensifies? What if sanctions expand? This helps them prepare in advance. 6. Long-Term Economic Impact of Geopolitical Risks Geopolitical tensions can reshape global economics for decades. Examples include: Redefined trade routes (like India–Middle East–Europe corridor) New energy alliances (shift to renewables) Rise of regional manufacturing (China+1 strategy) Increased defense expenditure worldwide These long-term shifts create opportunities as well as risks. Conclusion Global events and geopolitical news are powerful drivers of market movements, economic decisions, and investor behavior. From wars and elections to trade wars and natural disasters, these events bring both risks and opportunities. Successful traders and businesses understand these dynamics, monitor trends closely, diversify their exposure, and adapt strategies to manage uncertainty. In a world where information travels instantly and economies are deeply interconnected, geopolitical awareness has become essential for anyone involved in markets. Understanding and preparing for these risks not only prevents losses but also allows individuals and institutions to make smarter, more confident decisions in a constantly changing global landscape.

AndrewsMarket-Mastery

سیگنال صعودی SAGA: آیا کفسازی برای جهش بزرگ آغاز شده است؟

SAGA/USDT is developing a classic falling-wedge formation, signaling that downside pressure may be easing and a bullish reversal could be near. The compression in price — with lower highs slowly tightening — suggests that sellers are running out of steam, while buyers may be building a base. Volume behavior is healthy, and a breakout above the wedge’s upper trendline could confirm a reversal and lead to a strong upward leg. On the fundamentals side, SAGA is a Layer-1 blockchain built for on-chain gaming and social applications, with a focus on NFT marketplaces, web3 identity, and low-latency scalability. This aligns well with themes like “play-to-earn”, web3 gaming infrastructure, and multichain social metaverse, which are increasingly popular among developers and investors. Its token, SAGA, is used for staking, governance, and transaction fees in the network, giving it multifaceted utility. Tokenomics also favor a potential breakout: SAGA has a capped or controlled supply with a portion allocated to ecosystem incentives, validator rewards, and community programs. A meaningful share of tokens are locked or vested, reducing active circulation and potentially creating supply-side tailwinds as ecosystem adoption grows. As more developers build on SAGA, staking demand could increase, putting upward pressure on the token. From a trading perspective, the ideal setup would be to wait for a clean breakout above the upper trendline of the wedge, confirmed by a strong volume candle. A retest of that breakout point could offer a favorable entry, while a stop should be placed just below the recent swing low or the lower wedge boundary. If the breakout holds, the risk-reward is very attractive given SAGA’s strong use case and structural setup.

Bithereum_io

تحلیل SAGA: آیا این سقوط در گُوِه نزولی به پایان میرسد؟ اهداف صعودی انفجاری!

#SAGA is moving inside a falling wedge pattern on the daily chart. For the bullish scenario to play out, it must bounce from the wedge support line and break above the pattern. So, wait for a solid breakout before entering this coin. If that happens, the potential targets are: 🎯 $0.1992 🎯 $0.2620 🎯 $0.3564 🎯 $0.4327 🎯 $0.5090 🎯 $0.6176 🎯 $0.7560 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Kapitalist01

راز معامله کوتاه مدت: ورود در 13:44 و خروج در 14:55 (یادداشت شخصی معاملهگر)

It is not investment advice. short term trading note to self. Entering the trade at 13:44 candle Transaction closing at 14:55

Farough7670

سود ۱۸ درصدی در انتظار تریدرها: فرصت طلایی جفت ارز SAGAUSDT!

SAGAUSDT : Our analysis suggests this trading pair has a strong potential for an upside move, targeting a profit of 18%. This presents an excellent short-term opportunity for traders looking to capitalize on the current market momentum.

zainmain

Saga = 2025 version of AAVE?

Back in 2020, very few people paid attention to $LEND. Then it rebranded to AAVE , and in Q4 2020 the real run began: 📈 from $0.40 → $600+ in less than a year. Fast forward to today: •Rebecca (Saga co-founder) just confirmed their DeFi layer is being built with ideas similar to AAVE’s early innovations: 🔹 integrated liquidity across L1s 🔹 on-chain carry trading 🔹 stacked stablecoin yields 🔹 flash loans as inspiration But here’s the kicker 👀 Saga isn’t just DeFi. It’s a general L1 blockchain, meaning the upside isn’t limited to lending/borrowing protocols — the ecosystem can expand way beyond. 💡 History doesn’t repeat, but it rhymes. If AAVE was the DeFi star of 2020, Saga could be setting up as one of the L1 stars of 2025. 👉 Not saying Saga will pull a $600 AAVE move… But with everything being built, can we at least expect a return to its ATH of $8–10? 🤔🔥

Cryptojobs

CryptoNuclear

SAGAUSDT — Descending Triangle: Preparing for a Major Move?

📌 Market Context On the 2D timeframe, SAGA/USDT has been in a prolonged downtrend since late 2024 into early 2025. Recently, price action has formed a descending triangle: consistent lower highs pressing down against a flat demand zone at 0.22–0.24. This structure reflects seller dominance (lower highs) while buyers continue to defend the same support. As price compresses into the apex of the triangle, volatility shrinks — signaling that a major move is imminent, either bullish breakout or bearish breakdown. --- 📊 Technical Structure & Key Levels Key Demand Zone: 0.22 – 0.24 (highlighted in yellow) Next Supports: 0.1835 (previous low), extension toward ~0.135 if breakdown accelerates Stepwise Resistances: 0.3056 → first bullish validation 0.3993 → strong horizontal resistance 0.6508 → measured move confluence from triangle height 1.2263 → higher timeframe resistance 1.6265 → major resistance zone 2.7333 & 3.2828 → ambitious targets if macro bullish cycle resumes Downtrend Line: descending resistance from multi-month highs, currently near 0.26–0.28 --- 🟢 Bullish Scenario Trigger: Breakout above the downtrend line and a 2D close above 0.3056 Confirmation: Increased volume + successful retest turning 0.27–0.305 into support Targets: T1: 0.3993 T2: 0.6508 (measured move projection) T3: 1.2263 if momentum extends further Alternative setup: A fake breakdown below 0.22 followed by a quick reclaim above 0.23–0.24 could trigger a bear trap and squeeze price towards 0.3056/0.3993 Invalidation: Failure above 0.3056 with price falling back under 0.26 --- 🔴 Bearish Scenario Trigger: A decisive 2D close below 0.22 (triangle floor breakdown) Confirmation: Retest into 0.22–0.24 fails, flipping the zone into supply Targets: T1: 0.1835 (prior low) T2: ~0.135 if sellers maintain pressure Invalidation: Price reclaims 0.24–0.26 with sustained strength --- ⚖️ Conclusion The descending triangle on SAGAUSDT is now nearing completion, with price action coiling tightly around the 0.22–0.24 demand zone. Historically, this pattern favors continuation to the downside, but a bullish reversal remains possible if buyers reclaim control with a breakout above 0.3056. In setups like this, traders often prepare for both scenarios instead of guessing direction: React to the confirmed breakout or breakdown Define clear invalidation levels for strict risk management The market is reaching its decision point — the next move could be explosive. #SAGA #SAGAUSDT #CryptoAnalysis #DescendingTriangle #PriceAction #ChartPattern #Breakout #Breakdown #CryptoTrading #SupportResistance #RiskManagement

Bithereum_io

SAGAUSDT 1D

#SAGA is moving inside a symmetrical triangle on the daily chart. Consider buying some #SAGA at the current price and near the support level of $0.2493. In case of a breakout, the potential targets are: 🎯 $0.3206 🎯 $0.3525 🎯 $0.3978 🎯 $0.4556 ⚠️ As always, use a tight stop-loss and apply proper risk management.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.