PRO

Propy

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Propy

سود 3 Months :

سیگنالهای Propy

Filter

Sort messages by

Trader Type

Time Frame

CryptocurrencyBlot

کراکن لیست کرد! رمز ارز جدیدی که همه جا پیچید (و شاید ندیدید)

Kraken slipped this one past the main new listings page that I noticed today.

DrDovetail

You can see here on the daily chart how propy hit the exact target of this 4hr chart inverse head and shoulders pattern of $1.93 and then instantly corrected and has now corrected enough to reset the daily stochrsi indicator just in time for its golden cross. Having price action be this close to the 50 and 200mas at the time of the cross is almost always a good sign that the cross will be sustained and validated as well. If so once price action climbs above the horizontal brown line and flips it to solidified support then the next target should be 2.76. That target then places us above the green trendline which will lead eventually to another breakout validation with an even bigger breakout target but we will focus more on that one once we get there. For now the focus is on breaking above the brown trendline and sustaining the golden cross. *not financial advice*Propy decided t wanted to do a deeper doble bottom pattern nested which simply gives Byers an opportunity to get n lower and thus eventually have much higher percentage gains than if it had decided to go up from where price action was when this chart was originally posted.

jonnieking

After breaking out of a brutal 116D descending channel, PRO looks like it’s about to unleash a god candle on us all 💯Next Targets:150% to local high ~$4235% to previous ATH ~$5.80415% to new ATH ~$8.90With @PropyInc sitting at a measly 100m MC, this micro-cap will absolutely rip when the RWA / Real Estate narrative catches fire with Onchain Summer (Base).

ducky1004kwak

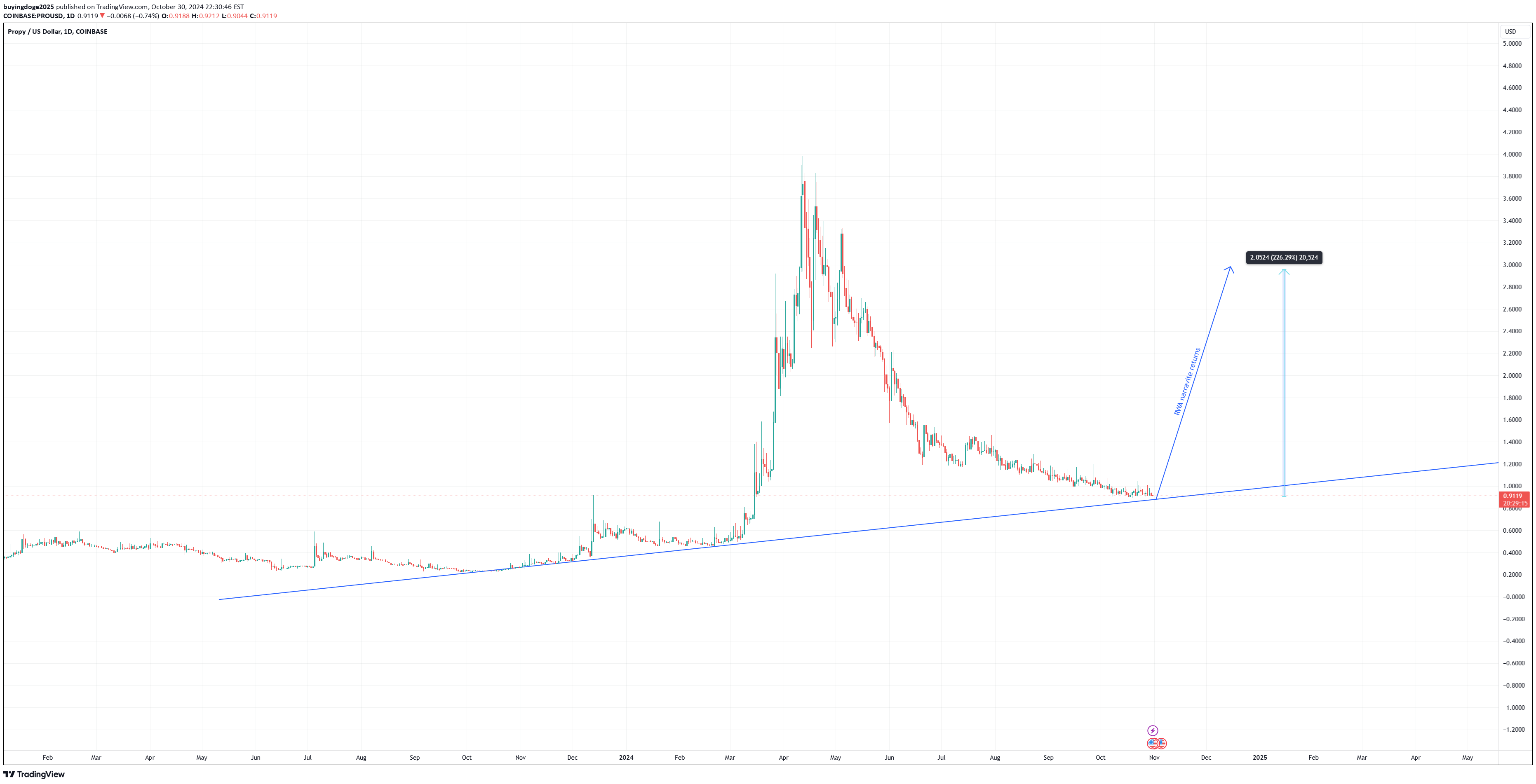

buyingdoge2025

propy PRO has been a dead coin since the top.. no one 50% + pump since.. looks like team/holders all dumping.. if the rwa meta comes back we can see this one spike up in price.. keeping my eyes on this one for Q4 / Q1 high risk low reward atm...dead.. going to 25-45c

jonnieking

Massive breakout underway for Propy as it pushes through its descending wedge on the Daily.Yesterday PRO got its biggest influx of buying volume in 6 months, largely in part to this whale typing 😉Propy has been building the RWA real estate narrative since 2017.It’s a micro-cap sitting at 60m on BASE.Kind of a no-brainer to put in your portfolio here.

thedailyinvestor

PROUSD Current Price: $1.37 Market Cap: $136,847,352 Volume (24h): $2,792,208 Circulating Supply: 100,000,000 PRO Technical Analysis: Support and Resistance: - Support: $1.19 - Resistance: $1.69 Indicators: - EMA: The price is below the 50, 100, and 200 EMA, indicating a bearish trend. The 21 EMA also acts as resistance. - MACD: Bearish, with the MACD line below the signal line and a negative histogram. - RSI: At 46.67, indicating bearish sentiment but not oversold. - OBV: Decreasing volume, aligning with the downward price trend. Trend Analysis: - The price is in a downward channel with lower highs and lower lows. - Watch for a breakout above $1.53 for potential bullish reversal. Volume Analysis: - The 24-hour trading volume increased by 12.86%, but not enough to reverse the bearish trend. Market Sentiment: - Mixed sentiment in the community, with some bullish perspectives looking for a reversal and others bearish due to recent declines. Propy Overview: PROUSD is revolutionizing the real estate industry by integrating Web3 technology, offering a seamless and secure way to buy and sell homes. PROUSD supports transactions via bank transfers, cryptocurrency, and even as NFTs, simplifying the process for agents, buyers, and sellers. Recent Highlights: - All-time High: $6.15 (Jan 05, 2018) - All-time Low: $0.02956 (Mar 12, 2020) - 30-Day Performance: -30.38% Propy's Achievements: - Processed $4 Billion in transactions - Collaborations with leading real estate companies like Compass, eXp, The Agency, Redfin, KW, Remax, and others. - Recognized for integrating blockchain technology to facilitate cross-border real estate transactions. Join the Future of Real Estate with Propy: - Experience faster, simpler, and more secure transactions with Propy's integrated escrow and title company. - Become a Crypto Certified agent and handle cryptocurrency and NFT transactions effortlessly. Community Insight: - PROUSD is gaining traction among venture capitalists and high-net-worth individuals. - The platform is recognized for its potential to transform the real estate industry by addressing longstanding challenges. Conclusion: PROUSD is currently in a bearish trend with key support at $1.19. Indicators support the bearish sentiment. Traders should watch for price action around the $1.32 support level and any break above the $1.53 resistance level for potential reversal. Stay informed and leverage Propy's innovative technology to stay ahead in the real estate market. For more details and to join the Propy revolution, visit Propy's Website .

Triangle_Traders

jonnieking

$PRO Bull Penant Break-Out Imminent Propy forming its next Bull Penant on the Daily Nearly Bottomed out on the Stoch RSI Target is $10 on the 4.236 Fib $172m market cap *RWA GEM*

StarShip

Let the stampede begin, too the moon we go! Deeds OnChain is now live, death to all rent seeking no value added middle men. As a former title closer with in Chicago, I was ground zero with the f__ckery in 08. Read the primer on RWA and then hit the go button!I got stopped out Then fell asleep on the bottom Now we are going to 4.50 before we pull back

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.